Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The multi-layer ceramic capacitor (MLCC) market attained a value of USD 10.70 Billion in 2025. The market is expected to grow at a CAGR of 5.00% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 17.43 Billion.

The rising prominence of electric vehicles is driving the multi-layer ceramic capacitor (MLCC) market due to the higher requirement for high-voltage and high-reliability capacitors. As per BloombergNEF's Electric Vehicles Outlook, the global passenger EV sales are estimated to hit almost 22 million in 2025, depicting a 25% jump from 2024. ADAS technologies, such as LiDAR, radar, and electronic braking systems demand stable, low-ESR capacitors with AEC-Q200 qualifications. Infotainment systems, increasingly featuring high-resolution displays and connectivity modules, also rely on MLCCs for power regulation, EMI suppression, and signal integrity, further propelling demand in the automotive electronics landscape.

Strict environmental regulations are favouring the growth of the MLCC industry. Producers are largely adopting green materials as well as sustainable manufacturing processes, especially in automotive and consumer electronics markets. In response to global mandates, manufacturers are phasing out hazardous substances, such as lead and adopting recyclable packaging. For instance, in June 2022, TDK pioneered a closed-loop recycling system for PET films utilised in MLCC manufacturing. As the demand for greener EVs grows, renewable energy systems, and energy-efficient devices, MLCCs are becoming a preferred component.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5%

Value in USD Billion

2026-2035

*this image is indicative*

The rollout of 5G infrastructure and exponential growth of IoT devices are fuelling the multi-layer ceramic capacitor (MLCC) industry revenue. In May 2022, Kyocera invested USD 111 million to build a new MLCC plant in Japan, boosting capacity for 5G, ADAS, and EV demands. Meanwhile, the proliferation of IoT devices demands compact, reliable MLCCs for power decoupling and noise suppression. As 5G and IoT technologies expand into smart cities, autonomous vehicles, and healthcare, the need for specialized MLCCs with enhanced durability and miniaturization accelerates market growth globally.

Demand for ultra-compact, high-capacitance MLCCs is surging as modern electronics prioritize smaller form factors. Smartphones, wearables, AR/VR headsets, and IoT sensors require more functionality within tighter spaces, pushing manufacturers to develop MLCCs with higher capacitance in miniature sizes. In May 2025, KYOCERA AVX unveiled its industry-first 47 µF X5R MLCC in 0402-inch size using advanced dielectrics to cater to smartphones, wearables, and AI devices. As integration deepens, compact MLCCs play a crucial role in power delivery, decoupling, and filtering in next-gen consumer and industrial electronics.

Leading players are investing in research & development for new dielectrics, miniaturized packages, and production automation, adding to the MLCC market share. Companies are pioneering advancements in ultra-compact MLCCs with higher capacitance and stability for use in smartphones, EVs, and 5G equipment. In September 2023, TDK introduced new low-resistance soft termination MLCCs, up to 22 µF in 3216 and 47 µF in 3225 sizes for offering automotive-grade reliability with reduced ESR. These innovations help firms meet rising demand while lowering costs and staying competitive globally.

Smart factories and industrial automation use sensors, motor drives, and communication systems requiring high-frequency switching supported by MLCC arrays. These capacitors ensure precise power management, noise reduction, and signal integrity in complex IIoT networks. As per the Society of Operations Engineers (SOE), 80% of United Kingdom manufacturers were confident in 2024 that Industry 4.0 would be a reality in businesses by 2025. With such Industry 4.0 advances, MLCCs enable real-time data processing and reliable control in robotics, automated assembly lines, and predictive maintenance systems.

The multi-layer ceramic capacitor (MLCC) market share is expanding with higher incursion into system in package (SiP) assemblies and modules for reducing external component count and enhancing thermal management. SiP solutions are increasingly adopted in smartphones, wearables, and IoT devices, where space optimization and electrical performance are critical. MLCCs also enable miniaturization without compromising power integrity, signal filtering, or stability. For instance, in March 2024, AGEO unveiled its CE series embedded MLCCs, specifically designed for integration within system substrates, targeting compact, high‑frequency electronics.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Multi-layer Ceramic Capacitor (MLCC) Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Equipment Type

Key Insight: In the MLCC market, the Class segment is valued for its high stability, low losses, and minimal capacitance change over temperature. NP0 (C0G) capacitors offer near-zero temperature coefficient, making them ideal for RF modules in smartphones. In January 2025, TDK Corporation introduced the industry's first 10nF, 1,250V multilayer ceramic capacitors in a 3225 package, featuring C0G (Class I) dielectric characteristics. Meanwhile P100 provides a positive temperature coefficient, useful in timing circuits and specialized analog applications. These MLCCs are critical in environments requiring thermal and frequency stability, where performance consistency is non-negotiable despite fluctuating conditions.

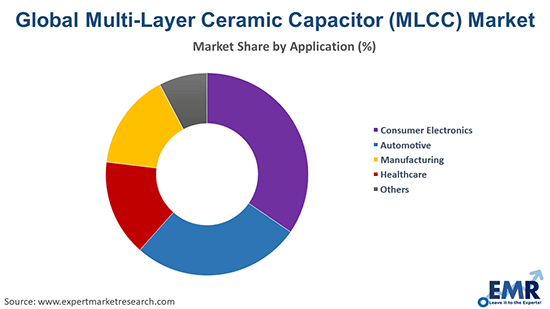

Market Breakup by Application

Key Insight: The consumer electronics segment dominates the MLCC market, accounting for the highest volume of consumption globally. Devices including smartphones, tablets, laptops, gaming consoles, and wearables each require hundreds to thousands of MLCCs per unit. For instance, China's smartphone industry recovery boosted MLCC demand, with Murata receiving orders worth 410.5 billion yen from January to March 2024. The increasing demand for high-performance, compact devices with advanced features drives the miniaturization and volume use of MLCCs, driving the segment growth.

Market Breakup by Region

Key Insight: North America holds a significant share in the multi-layer ceramic capacitor (MLCC) market, largely driven by its robust electronics and automotive industries. As per ACEA’s Economic and Market Report, North America manufactured 11.4 million cars in 2024. The United States is a major hub for advanced electronic devices, 5G infrastructure, and defense equipment, which utilize MLCCs extensively for miniaturization and high-frequency stability. Moreover, the growing demand for electric vehicles has bolstered the use of MLCCs in battery management systems and infotainment units.

Class 2 MLCCs to Gain Popularity

The class 2 multi-layer ceramic capacitor (MLCC) industry is growing due to high capacitance per volume and cost-effectiveness. X7R is the most widely used as it is ideal for power supplies, smartphones, and automotive electronic control units. In February 2025, Samsung Electro‑Mechanics launched the CL55B105KEU6PN#, a 1 µF X7R MLCC in 2220 size rated 250 V, mass-produced to support high-reliability automotive functions. X5R, is favoured in compact electronics, such as wearables and tablets due to its higher capacitance in smaller sizes. Lesser-used types, including Z5U and X7S are applied in non-critical filtering and decoupling tasks where cost is a priority over precision, such as LED drivers and low-end consumer devices.

Surging MLCC Applications in Automotive & Manufacturing

The automotive segment is the fastest-growing multi-layer ceramic capacitor (MLCC) market due to the accelerating shift toward electric vehicles and advanced driver-assistance systems. MLCCs are essential in EV powertrains, battery management systems, infotainment, and safety modules, requiring high reliability and resistance to harsh conditions. Automotive-grade MLCCs, particularly Class I dielectrics, are in high demand for stability and longevity. OEMs drive MLCC adoption through their electrification strategies. Regulatory pushes for emissions reduction and vehicle automation further expand this market’s importance.

The manufacturing sector, particularly in industrial automation and robotics, is driving the industry share. As smart factory adoption grows, with Industry 4.0 and IIoT technologies, MLCCs become critical in supporting high frequency switching and precision control. In February 2024, Izumo Murata Manufacturing began constructing a new MLCC plant set to open in 2026 to respond to the surging MLCC demand from automation, AI servers, IIoT, and smart manufacturing applications The demand is also growing steadily due to increasing investments in automation and digitization across the logistics, packaging, and process industries.

Rising MLCC Adoption in Europe & Asia Pacific

Europe is strengthening the multi-layer ceramic capacitor (MLCC) industry value, benefitting from a technologically advanced automotive sector, particularly in Germany, France, and the United Kingdom. The push for EV adoption and green energy solutions has accelerated MLCC usage in electric drivetrains, ADAS, and renewable energy systems. Major automotive OEMs are increasingly integrating MLCCs into their vehicles for improved efficiency and reliability. Strong R&D investment and regulatory support for low-emission technologies further make Europe a steadily growing and highly lucrative segment in the global market.

The market revenue in Asia Pacific is driven by its massive electronics manufacturing ecosystem, with China, Japan, South Korea, and Taiwan leading production and consumption. As per Taiwan’s Ministry of Economic Affairs, the production in the country’s electronic components industry surged 19.52% year-on-year in 2024. The widespread use of MLCCs in smartphones, consumer electronics, and computing devices contributes heavily to market volume. Furthermore, rapid urbanization and rising demand for EVs in China and India amplify MLCC adoption, making Asia Pacific the most dominant segment in the market.

Key players operating in the multi-layer ceramic capacitor (MLCC) market are employing several key strategies to stay competitive and capitalize on market growth. Leading manufacturers invest heavily in capacity expansion to meet rising demand from sectors, such as consumer electronics and automotive. These firms prioritize technological innovation by developing smaller, higher-capacitance, and more reliable capacitors tailored for emerging applications including 5G, electric vehicles, and IoT devices. Additionally, many players are adopting sustainability initiatives to comply with regulations and meet growing environmental expectations.

Product diversification is another focus, offering a wide range of dielectric types and specialized automotive-grade MLCCs to address diverse customer needs. Strategic partnerships, mergers, and acquisitions help companies expand market reach, strengthen research & development, and optimize supply chains. Geographic expansion, especially in Asia-Pacific regions like China and Japan, allows firms to leverage cost efficiencies and be closer to major customers. Together, these strategies enable MLCC manufacturers to navigate competitive pressures and evolving technological demands effectively.

Founded in 1992 and headquartered in Taipei, Taiwan, Darfon Electronics specializes in electronic components including MLCCs. Darfon gained recognition for integrating innovative manufacturing technologies, improving product reliability, and expanding its global footprint in automotive and consumer electronics sectors, emphasizing quality and sustainability.

Established in 1919 and based in Florida, the United States, Kemet Corporation is a leading manufacturer of capacitors. The firm is known for pioneering advanced capacitor materials and design, contributing significantly to electronics miniaturization and performance, serving industries from aerospace to automotive with cutting-edge, high-reliability components.

Kyocera, founded in 1959 with headquarters in Kyoto, Japan, excels in electronic components and ceramics. Renowned for continuous innovation in MLCC technology, Kyocera emphasizes miniaturization, high capacitance, and thermal stability, supporting diverse markets, such as telecommunications and automotive with sustainable manufacturing practices.

Murata, founded in 1944 and headquartered in Kyoto, Japan, leads the MLCC market globally. Murata has pioneered breakthroughs in capacitor technology, including high-density and multilayer designs, enabling advancements in mobile devices, automotive electronics, and IoT, while maintaining a strong focus on environmental responsibility.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the multi-layer ceramic capacitor (MLCC) market include Samsung Electro-Mechanics Co., Ltd., and Taiyo Yuden Co., Ltd., among others.

Download your free sample report now to explore the latest multi-layer ceramic capacitor (MLCC) market trends 2026. Gain valuable insights on market size, growth drivers, and competitive strategies shaping the industry’s future. Stay ahead in this rapidly evolving sector with Expert Market Research’s detailed analysis and forecasts.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 10.70 Billion.

The market is projected to grow at a CAGR of 5.00% between 2026 and 2035.

The key strategies driving the market include the miniaturization for compact electronics, expanding automotive-grade product lines, enhancing high-frequency and high-capacitance performance, investing in production automation, and strategic partnerships. Companies also focus on regional expansion, R&D for new dielectric materials, and aligning with trends in EVs, 5G, AI, and Industry 4.0.

The key trends guiding the growth of the market include the increased adoption of multi-layer ceramic capacitors for IoT applications, their use in the manufacture of smart LCD and LED televisions, and growing research and development activities.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Class and Class 2 are the major equipment types of multi-layer ceramic capacitor (MLCC) in the market. Class is subdivided by type into NP0 (C0G), and P100, among others such as N33 and N75, while Class 2 is subcategorised by type into X7R, and X5R, among others such as Z5U and X7S.

The significant applications of the product in the global multi-layer ceramic capacitor (MLCC) market include consumer electronics, automotive, manufacturing, and healthcare, among others.

The key players in the market report include Darfon Electronics Corp., Kemet Corporation, Kyocera Corporation, Murata Manufacturing Co., Ltd., Samsung Electro-Mechanics Co., Ltd., and Taiyo Yuden Co., Ltd., among others.

The consumer electronics segment dominates the market, accounting for the highest volume of consumption globally.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Equipment Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share