Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America food safety testing market reached USD 10.95 Billion in 2025. The market is expected to grow at a CAGR of 6.30% between 2026 and 2035, reaching almost USD 20.17 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6.3%

Value in USD Billion

2026-2035

*this image is indicative*

| North America Food Safety Testing Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 10.95 |

| Market Size 2035 | USD Billion | 20.17 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 6.30% |

| CAGR 2026-2035 - Market by Region | United States | 7.0% |

| CAGR 2026-2035 - Market by Region | Canada | 5.7% |

| CAGR 2026-2035 - Market by Test | Allergen Testing | 7.2% |

| CAGR 2026-2035 - Market by End Use | Meat, Poultry, and Seafood Products | 7.1% |

| Market Share by Region | United States | 89.6% |

Food safety and quality pose significant concerns for the food manufacturing, retail, and hospitality sectors. Hygiene and quality impact productivity, with both intentional and unintentional adulteration becoming increasingly sophisticated. Testing labs play a vital role in detecting these adulterants.

As per the North America food safety testing market dynamics and trends, the primary function of food safety labs is to test for adulterants, pathogens, pesticide residues, heavy metals, microbial contaminants, unauthorized additives, colours, and antibiotics in food. Without such testing, producers cannot guarantee the absence of harmful substances, emphasizing the critical importance of food safety.

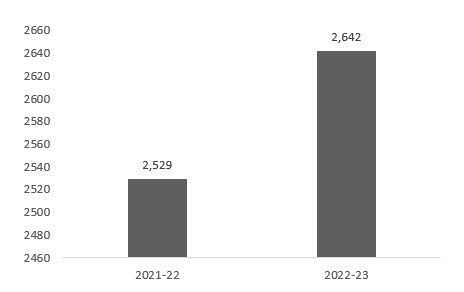

NUMBER OF FOOD SAFETY INVESTIGATIONS IN CANADA

Rapid testing techniques, allergen identification, remote monitoring, and food safety testing kits contribute to the growth of North America food safety testing market.

The North America food safety testing demand benefits from advancements such as PCR and immunological assays, enabling rapid and accurate identification of pathogens like E. coli and Salmonella. This reduces testing durations from days to hours, enhancing outbreak response and overall food safety standards.

Market developments are attributed to the rising occurrence of food allergies, precise detection techniques for allergens like gluten, nuts, and shellfish are essential. These advancements bolster the market by ensuring accurate food labelling, thus protecting consumer health.

The North America food safety testing industry benefits from the integration of IoT devices and sensors, facilitating ongoing, real-time monitoring of essential variables such as temperature, humidity, and pH levels. This proactive strategy helps prevent spoilage, minimize food waste, and lower the chances of contamination.

The increasing availability of portable and user-friendly testing kits allows for on-site testing in a range of environments, including farms, restaurants, and food processing facilities. These kits provide quick results, enabling stakeholders to address concerns and maintain strict safety protocols promptly.

Whole genome sequencing of pathogens is a crucial trend in North America food safety testing market which aids in precise identification and monitoring during outbreaks, providing insights into bacterial genetics for targeted interventions and enhanced treatment strategies.

Advanced algorithms analyse extensive datasets to predict potential hazards in food production, improving risk assessment, and decision-making processes, and fostering a proactive approach to food safety.

As per the North America food testing industry analysis, in 2023, the USDA's food safety and inspection service inspected 161 million livestock, 9.8 billion poultry carcasses, 304 million pounds of catfish, and 2.7 billion pounds of egg products. According to the USDA, the Food Safety, and Inspection Service in 2023, safeguarded public health through inspections of 161 million livestock and 9.8 billion poultry carcasses. About 304 million pounds of catfish and 2.7 billion pounds of liquid, frozen, and dried egg products were examined.

As per Canada's Government, the Canadian Food Inspection Agency conducts roughly 2,845 food safety investigations annually, boosting market growth. The total number of investigations in 2019-20 was 3222 and this number fell to 2569 between 2020-21. Between 2021-22 the total number of investigations was 2529 and in 2022-23 this number rose to 2642, which contributes to the growth of the North America food safety testing industry.

North America Food Safety Testing Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Test

Market Breakup by Technology

Market Breakup by Application

Market Breakup by Country

| CAGR 2026-2035 - Market by | Country |

| United States | 7.0% |

| Canada | 5.7% |

Allergen testing contributes to market growth by ensuring the precise identification and measurement of allergenic components

In food safety procedures, allergen testing identifies and quantifies allergenic components such as gluten, nuts, and shellfish, thereby preventing allergic reactions in those who are sensitive.

As per the North America food safety testing market analysis, microbiological testing identifies harmful pathogens such as E. coli, Salmonella, and Listeria in food products, ensuring adherence to safety standards and reducing the occurrence of foodborne illnesses.

Based on technology, the market share is led by rapid technology since it facilitates immediate responses to prevent tainted products from reaching consumers

Traditional techniques in the food safety testing market in North America provide established methods to detect pathogens and contaminants, ensuring compliance with safety standards. These methods offer reliability and accuracy, crucial for maintaining consumer trust and health.

Rapid technology in food safety testing provides swift results, allowing immediate actions to prevent contaminated products from reaching consumers. This technology enhances efficiency, reduces testing times, and decreases the risk of foodborne illnesses and product recalls.

Market players are driving the North America food safety testing market growth by operating across various industries, ensuring compliance with standards of quality, safety, and sustainability.

SGS S.A., established in 1878 and headquartered in Geneva, Switzerland, is a renowned company specializing in inspection, verification, testing, and certification services. It operates worldwide across diverse sectors, ensuring adherence to standards of quality, safety, and sustainability.

ALS Ltd., is a global leader in testing, inspection, and certification services. With operations spanning more than 65 countries, it provides analytical solutions for industries including mining, environmental sciences, and food safety, emphasizing precision and compliance with regulations.

Eurofins Scientific SE, established in 1987 and located in Luxembourg, is a leading multinational life sciences corporation in North America food safety testing industry. It offers a comprehensive range of analytical testing services, particularly focusing on food, pharmaceutical, and environmental testing to maintain high safety and quality standards.

Bureau Veritas S.A., founded in 1828 and based in Paris, France, is a distinguished provider of testing, inspection, and certification solutions. The company excels in improving safety, quality, and sustainability across sectors such as oil and gas, construction, and consumer products.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players are Intertek Group Plc, Neogen Corp., TUV SUD AG, Labs & Technological Services AGQ S.L., and RL Food Testing Laboratory, Inc., among others.

The United States leads in food testing due to strict regulations and consumer awareness. The US and Canada enforce rigorous safety policies, driving demand for advanced testing methods like PCR and immunoassays to ensure the safety of various food items and contributing to North America food safety testing industry expansion.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market was estimated to be valued at USD 10.95 Billion in 2025.

The market is projected to grow at a CAGR of 6.30% between 2026 and 2035.

The revenue generated from the market is expected to reach USD 20.17 Billion in 2035.

Rapid testing techniques, allergen identification, remote monitoring, and food safety testing kits contribute to the food safety testing market growth.

The food safety testing market is categorised according to its test, which includes allergen testing, microbiological testing, genetically modified organism (GMO) testing, chemical and nutritional testing, residues and contamination testing and others.

The key market players are SGS S.A., Bureau Veritas S.A., Eurofins Scientific SE, ALS Ltd., Intertek Group Plc, Neogen Corp., TUV SUD AG, Labs & Technological Services AGQ S.L., and RL Food Testing Laboratory, Inc. among others.

Based on the technology, the food safety testing market is divided into traditional and rapid.

The market is broken down into the United States of America and Canada.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Test |

|

| Breakup by Technology |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share