Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America light detection and ranging (LiDAR) market size was valued at USD 795.83 Million in 2025. It is projected to grow at a CAGR of 11.10% between 2026 and 2035, reaching a value of USD 2280.14 Million by 2035.

Base Year

Historical Period

Forecast Period

Civil engineering, agriculture, forestry, archaeology, and related end-user services are pushing the North America light detection and ranging (LiDAR) market.

The U.S. Department of State revealed a significant increase, with defense items and services through the Foreign Military Sales system surging to $80.9 billion, boosting LiDAR market expansion.

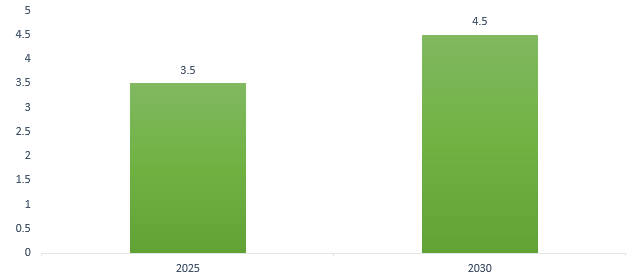

The number of autonomous vehicles in the United States are projected to grow at a CAGR of 5.77% between 2025-2030.

Canada - boasting a local production worth around USD74,598 million, significantly contributes to the LiDAR market growth, particularly in GPS and navigation systems.

Compound Annual Growth Rate

11.1%

Value in USD Million

2026-2035

*this image is indicative*

LiDAR is a remote sensing method called light detection and ranging that uses pulsed laser light to measure distances to the Earth. It is used to create precise three-dimensional details of ground elevation and surface features of the Earth.

A laser scanner, an inertial navigation system (ins), and a global positioning system (GPS) receiver are often found in a lidar system. Helicopters and small aircraft are used as platforms to collect lidar data over large areas.

Topographic and bathymetric lidar are the two main varieties. While bathymetric lidar measures the height of riverbeds and seafloors using green light that can penetrate water, topographic lidar maps the land using a near-infrared laser.

Advancements in the management of land and forestry, space exploration, survey and mapping, and the automotive sector are enhancing developments in the North America light detection and ranging (LiDAR) market.

LiDAR technology is employed in forestry for assessing canopy vertical structures and density, offering valuable data for environmental impact assessment, land management, and fire prevention planning. Its applications include precision forestry, forest mapping, biodiversity studies, pollution modeling, and aiding carbon absorption estimations.

NASA utilises LiDAR for the secure landing of lunar vehicles on other planets. The navigation doppler lidar (NDL) offers accurate altitude, speed, and direction data to Astrobotic’s Peregrine lander's guidance, navigation, and control (GNC) subsystem, ensuring a safe lunar surface landing.

North America light detection and ranging (LiDAR) market growth can further be attributed to the use of LiDAR in exact mapping and digital elevation model creation for geographic information systems (GIS) and improving accuracy in civil and commercial surveying. This laser scanning system, with integrated IMU, GNSS receiver, or SLAM algorithm, ensures precise georeferencing of each point in the resulting point cloud.

LiDAR-equipped vehicles capture data on road features, enhancing autonomous navigation by detecting road markings, signs, pedestrians, and obstacles. Autonomous or self-driving vehicles, as defined by the National Highway Traffic Safety Administration (NHTSA), operate without direct driver input for steering, acceleration, and braking. The driver is not required to constantly monitor the road during self-driving mode.

NUMBER OF SELF-DRIVING VEHICLES ON U.S ROADS, IN MILLION

LiDAR technology produces precise three-dimensional digital farm models, enabling accurate natural resource maps. It captures landscape-influenced variations in soil, moisture, and microclimate, facilitating observation and measurement of slope, aspect, and elevation differences.

Drones with LiDAR offer aerial views for inspecting challenging industrial assets, reducing maintenance costs. LiDAR aids in optimising solar panel placement for harnessing renewable energy, thus aiding the light detection and ranging (LiDAR) market in North America. Additionally, LiDAR enables robots to map and navigate surroundings, teaching autonomous systems to gauge distances from objects in their environment.

"North America Light Detection and Ranging (LiDAR) Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Range

Market Breakup by Component

Market Breakup by Application

Market Breakup by End User

Market Breakup by Country

Based on components, laser scanners dominate the North America light detection and ranging (LiDAR) market share due to their use in engineering and medical applications

Laser scanners utilise non-contact, infrared technology to rapidly capture millions of data points, creating detailed 3D images for crime scene documentation, accident reconstruction, fire analysis, and forensic investigations. They also play a vital role in engineering, maintenance, and medical applications, providing precise measurements for body shape and surface area.

The Global Positioning System (GPS) is a U.S.-owned utility delivering positioning, navigation, and timing services through its space, control, and user segments. Initially a military project, it's now widely used in vehicles, aircraft, ships, submarines, trains, and the space shuttle.

A navigation device is a tool equipped with the ability to identify our present location and enable us to establish our` intended destination.

Defence and aerospace is anticipated to drive the North America light detection and ranging (LiDAR) market growth due to its ability to navigate and map

In the 1960s, the United States initially created LiDAR for military purposes in defense and aerospace. Militaries employ LiDAR for diverse defence applications, including battlefield mapping, line-of-sight determination, mine countermeasures, and autonomous navigation for military vehicles.

LiDAR, a valuable tool for civil engineers, offers diverse applications in project management. By utilizing a Digital Elevation Model (DEM), LiDAR swiftly provides topographical insights, aiding in planning by revealing terrain features like slopes. Additionally, it excels in ecological surveys and is effective for tunnel data capture.

As per the North America light detection and ranging (LiDAR) market report, LiDAR finds extensive use in forestry, providing crucial data for assessing canopy structures, managing land, and planning fire prevention. NASA relies on Navigation Doppler Lidar (NDL) to ensure secure lunar vehicle landings, offering precise altitude, speed, and direction data.

In geographic information systems (GIS), LiDAR aids in accurate mapping and digital elevation model creation. Additionally, LiDAR-equipped vehicles enhance autonomous navigation by detecting road features for safer self-driving experiences.

Aerial LiDAR holds the majority of North America's light detection and ranging (LiDAR) market share, based on type, since it excels in capturing images and collecting data from an elevated perspective

It is a mapping and surveying technology conducted from the air, employing GPS-monitored aerial drones or UAVs, which are large drones equipped with onboard positional and sensory capabilities. Following post-flight production processes, the obtained LiDAR-mapped data is utilized to determine the precise elevation and geospatial location of features on the Earth's surface.

Terrestrial LiDAR is a ground-based, active imaging technique that swiftly captures detailed, three-dimensional point clouds of object surfaces using laser range finding. Mobile LiDAR, on the other hand, is a mobile mapping system utilizing a scanner attached to a vehicle to gather dense, accurate, and feature-rich data while in motion on the road.

Based on application, North America's light detection and ranging (LiDAR) market is dominated by corridor mapping

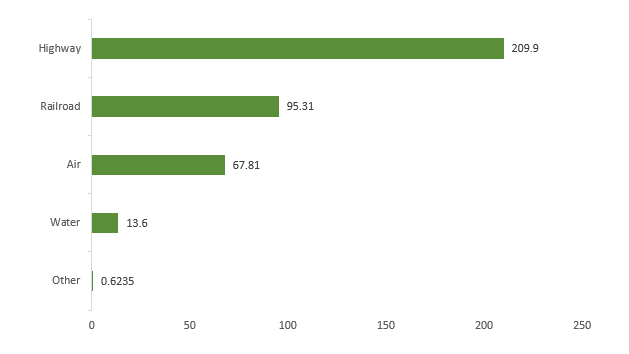

A helicopter-mounted LiDAR sensor is commonly employed to map corridors by flying at lower altitudes, ensuring the collection of precise and dense data for various types of corridors such as highways, railways, or oil and gas pipelines. During the fiscal year 2020, $209.9 billion was allocated from the government budget for transportation, specifically directed to the development and maintenance of highways.

GOVERNMENT FUNDS ALLOCATED TO TRANSPORTATION AND INFRASTRUCTURE, IN 2020,

IN $ BILLION

Additionally, LiDAR holds significant importance in Advanced Driver Assistance Systems (ADAS), playing a crucial role in applications like adaptive cruise control, blind-spot detection, pedestrian detection, and any scenario that demands object detection and mapping around a vehicle. This increases the North America light detection and ranging (LiDAR) market growth.

LiDAR enhances safety and boosts exploration and drilling efficiency in infrastructure and mining. In environmental contexts, it estimates carbon stocks and gauges flood risks, erosion, and wildlife habitat suitability. Invaluable for engineers, it captures precise topographic data, including terrain elevation and existing infrastructure details.

Aerospace and defence sectors are pushing revenue-generating opportunities for the LiDAR manufacturers in the United States

The U.S. Department of State reported that the overall worth of defense items and services transferred, along with security cooperation activities conducted through the Foreign Military Sales system, reached $80.9 billion in FY2023. This marks a notable surge of 55.9%, rising from $51.9 billion in FY2022, consequently fueling growth in the LiDAR market.

According to the International Trade Administration, Canada’s local automotive production is valued at approximately US$74,598 million. This substantial production plays a pivotal role in the expansion of the LiDAR market, especially in applications such as GPS and navigation systems.

The competitive landscape is characterized by the growing number of partnerships, collaborations, and focus on improving customer satisfaction in North America light detection and ranging (LiDAR) market.

Hexagon AB was established in 1992 and is based in Sweden and offers sensor, software, and autonomous solutions like metrology systems with sensors, CAD, and CAM software. Their products cater to diverse sectors, including construction, mining, agriculture, aerospace, automotive, defense, and manufacturing. They also have applications in satellite positioning, data capture, and GIS software for creating 3D models and maps.

Teledyne Technologies Inc. was established in 1960 and is based in the United States and offers technologies that sense, transmit, and analyze information for key industrial sectors. These include aerospace, defense, factory automation, environmental monitoring, electronics, oceanographic research, energy, medical imaging, and pharmaceutical research.

Luminar Technologies, Inc. was established in 2012 and is based in the United States. It specializes in creating vision-centric lidar and machine perception solutions, with a primary focus on advancing technology for autonomous vehicles.

Ouster Inc. (formerly Velodyne Lidar, Inc.) was established in 2015 and is based in the United States. It designs Lidar sensors suitable for high-resolution, long-range applications in autonomous vehicles, robotics, and mapping. These sensors are known for their cost-effectiveness and reliability across various use cases.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the North America light detection and ranging (LiDAR) market report are DENSO Corporation, Trimble Inc., Quanergy Systems, Inc., SICK AG, LeddarTech Inc., RIEGL USA, Inc and others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the North America light detection and ranging (LiDAR) market reached an approximate value of USD 795.83 Million.

The market is expected to grow at a CAGR of 11.10% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach USD 2280.14 Million by 2035.

Key trends aiding market expansion are the management of land and forestry, space exploration, survey and mapping, and the automotive sector government initiatives, innovations, and increasing research and development (R&D) activities by key players.

The key components prevalent in the market are- Laser Scanners, Navigation Systems, GPS, and others.

The LiDAR available in the market are- Terrestrial, Aerial, and Mobile.

Key players in the industry are Hexagon AB, Teledyne Technologies Inc., DENSO Corporation, Luminar Technologies, Inc., Ouster Inc., Quanergy Systems, Inc., SICK AG, LeddarTech Inc., RIEGL USA, Inc, and others.

The United States holds a majority in the LiDAR market.

LiDAR is commonly employed to inspect the Earth's surface, gather data about ground features, generate a digital replica of an object, or capture various geospatial information.

LiDAR, or light detection and ranging, operates by emitting laser light from a transmitter, reflecting it off objects, and using the system receiver to measure the time of flight for creating a distance map.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Range |

|

| Breakup by Component |

|

| Breakup by Application |

|

| Breakup by End User |

|

| Breakup by Country |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share