Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America packaging automation market size attained a value of USD 21.39 Billion in 2025. The market is expected to grow at a CAGR of 5.20% between 2026 and 2035, reaching almost USD 35.51 Billion by 2035.

Base Year

Historical Period

Forecast Period

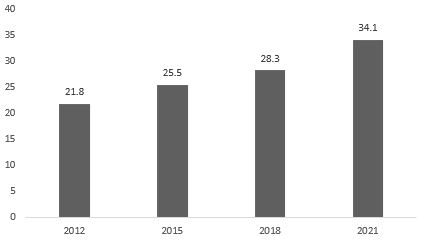

Between 2012 and 2021, pharmaceutical sales in Canada rose by 56.4% to USD 34.1 billion, driving the North America packaging automation market growth.

Automation packaging gained traction in the industry due to benefits like flexibility, high quality, safety enhancements, cost reduction, and waste minimisation.

As per data from the U.S. Department of Commerce, and Bureau of the Census’s Annual Survey of Manufacturers, food and beverages manufacturing facilities accounted for 16.8% of sales and 15.4% of total employees among all U.S. manufacturing plants in 2021, thus fueling the North America packaging automation market.

Compound Annual Growth Rate

5.2%

Value in USD Billion

2026-2035

*this image is indicative*

Packaging automation refers to the utilisation of automated machinery, techniques, and advancements to perform diverse tasks associated with product packaging. The primary goal of packaging automation is to coordinate and optimise packaging processes, ultimately enhancing worker efficiency at a cost-effective rate for businesses.

Packaging automation is widely utilised in industries like food and beverage, pharmaceuticals, cosmetics, and consumer goods for enhancing productivity, cost-effectiveness, product safety, and shelf life, aiding the North America packaging automation market growth. It also reduces labour, and waste, improves precision, scalability, and usability, and maintains quality control.

From 2012 to 2021, as per the Patented Medicine Prices Review Board Canada, the total pharmaceutical sales value in Canada surged by 56.4% to USD 34.1 billion, propelling growth in North America packaging automation market in the pharmaceutical industry.

CANADIAN MANUFACTURER'S SALES OF MEDICINE FROM 2012-2021 (SALES IN $ BILLIONS)

The North America packaging automation market growth is boosted by growing demand for packed products, increasing e-commerce platforms, technological advancements, and innovative packaging.

| Date | Company | Announcement |

| February 2024 | Bell’s Brewery | Invested over USD 2 million in packaging automation to boost the production capacity of its variety packs |

| January 2024 | Materne North America | Slashed packaging expenses with Arkestro, streamlined procurement, and strengthened supplier relationships, facilitating future expansion |

| November 2023 | Amcor | Introduced AmFiber™ Performance Paper packaging in North America, part of its AmFiber range. This packaging, endorsed by How2Recycle®, meets repulpability standards, improving sustainability |

| June 2023 | Boox | Collaborated with ReturnBear, Canada's package-free returns service, to expand its offerings in Canada, striving to reduce e-commerce's environmental footprint by 70% |

| Trends | Impact |

| Growing demand for packed products | Surge in packaged food demand in the food and beverage sector due to lifestyle shifts, urbanisation, and increasing incomes, necessitates packaging machinery with features such as vacuum and modified atmosphere packaging. |

| Increasing e-commerce platforms | Growth of e-commerce sector spurs demand for packaging machinery, with a need for packaging that is protective and easy to open. Automation guarantees speed, reliability, and cost-effectiveness. |

| Technological advancements | Automation increases speed, cuts manual labour, and reduces errors, propelling North America packaging automation market expansion. IoT integration enables predictive maintenance and real-time monitoring, enhancing efficiency and smart factory connectivity. Robotics optimise sorting and placement, while ML and AI innovations offer enhanced customization and operational efficiency. |

| Innovative packaging | Packaging entices consumers visually, reflecting the brand's identity. The rise in demand for multi-packs and compact, eco-friendly packaging aligns with consumer preferences, aided by automated processes. |

As per the North America packaging automation market analysis, the demand for automated machinery is on the rise as it enhances efficiency and productivity in manufacturing across various industries. Manufacturers are increasingly adopting automation to streamline packaging processes, reduce labour time, and cut overall costs.

With its advantages including enhanced flexibility, high product quality, safety improvements, cost reduction, and waste minimisation, automation is gaining significant traction in manufacturing, presenting growth opportunities for market players.

"North America Packaging Automation Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Market Breakup by Offering

Market Breakup by Function

Market Breakup by Product Type

Market Breakup by End Use

Market Breakup by Country

Automated packagers hold a considerable position in the North America packaging automation market, primarily due to their enhanced speed and efficiency

Automated packaging systems decrease the need for manual labour, and they offer precision by utilising only the necessary amount of material for each order, thereby significantly reducing waste.

Packaging robots enhance production efficiency, handling larger product quantities simultaneously, with higher uptimes than manual labour, and reducing costs effectively.

The food and beverage sector led the North America packaging automation market growth due to the growing demand requiring high-speed, efficient packaging solutions to accommodate increasing consumption rates

Packaging machinery aids food and beverage makers in enhancing productivity and quality to meet strict hygiene standards and regulatory requirements with advanced features.

Asper the North America packaging automation market report, healthcare and pharmaceutical packaging safeguards drugs from physical and biological degradation, including protection from light, water, and sensitive substances, meeting information dissemination standards.

Market players are implementing technologies to enhance procurement processes and strengthen connections with suppliers, paving the way for future growth.

| Company | Year Founded | Headquarters | Services |

| Rockwell Automation Inc. | 1903 | Wisconsin, United States | Connected enterprise solutions, discrete control, drive systems, information solutions, support for machine and equipment builders, migration solutions, process solutions, motion solutions, connected and maintenance services, safety solutions, and sustainable production initiatives. |

| ABB Ltd. | 1988 | Zurich, Switzerland | Global engineering enterprise dedicated to catalysing the evolution of society and industry towards a more efficient and sustainable future. Integration of software with its electrification, robotics, automation, and motion offerings. |

| Emerson Electric Co. | 1890 | Missouri, United States | Measurement and analytical instrumentation, industrial valves, process control software and systems, fluid control devices, pneumatic solutions, electrical distribution equipment, and various other offerings. |

| Mitsubishi Electric Corporation | 1921 | Tokyo, Japan | Production and distribution of electrical and electronic goods and systems utilised across diverse fields and applications. |

Other key players in the North America packaging automation market report are Siemens AG, ATS Corp., JLS Automation, Dover Corporation (DESTACO), Harpak-ULMA Packaging, LLC, Massman Companies, Inc., and others.

The United States leads the packaging automation market in North America, driven by factors like cost efficiency and supply chain optimisation. The regional market is growing due to the extensive adoption of automated systems for various packaging tasks.

According to information from the U.S. Department of Commerce, Bureau of the Census’s Annual Survey of Manufactures, food and beverages manufacturing facilities represented 16.8 per cent of sales and 15.4 per cent of total employees among all U.S. manufacturing plants in 2021, consequently increasing the North America packaging automation market share.

In Canada, the demand for automated solutions is rising across various industries to enhance efficiency and cut operating expenses. Managing large order volumes manually is challenging, making automated technologies essential for streamlining packaging processes.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the packaging automation market in North America attained a value of nearly USD 21.39 Billion.

The market is projected to grow at a CAGR of 5.20% between 2026 and 2035.

The packaging automation market is expected to reach USD 35.51 Billion in 2035.

The market is being driven by demand for packed products, increasing e-commerce platforms, technological advancements, and innovative packaging.

The packaging automation market is categorised according to its offerings, which include solutions such as filling, labeling, palletizing, wrapping, capping, case packaging, bagging, and other services like consulting, installation and training, as well as support and maintenance.

Key players in the industry are Rockwell Automation Inc., Mitsubishi Electric Corp, ABB Ltd., Emerson Electric Co., Siemens AG, ATS Corp., JLS Automation, Dover Corporation (DESTACO), Harpak-ULMA Packaging, LLC, Massman Companies, Inc., and others.

Based on the product type, the packaging automation market is divided into automated packagers, packaging robots and automated conveyor and sortation systems.

The major regional markets include the United States of America and Canada.

Based on the end use, the market is divided into e-commerce and logistics, healthcare and pharmaceuticals, food, and beverage, automotive, aerospace and defence, and others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Offering |

|

| Breakup by Function |

|

| Breakup by Product Type |

|

| Breakup by End Use |

|

| Breakup by Country |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share