Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The plywood market size USD 52.27 Billion in 2025. The industry is expected to grow at a CAGR of 5.00% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 85.14 Billion. Digital platforms are impacting distribution and sales in the plywood market by enabling manufacturers to reach wider markets efficiently. Online marketplaces and direct-to-consumer channels are facilitating easier access to product information, reviews, and competitive pricing. Companies are strengthening their online presence by leveraging digital marketing and virtual catalogues. As per industry reports, the B2C e-commerce revenue worldwide is estimated to reach USD 5.5 trillion by 2027. This e-commerce growth is supporting plywood sales, especially for specialized and custom products.

Structural-grade and marine plywood are gaining popularity in specialized applications, such as infrastructure, shipbuilding, and automotive interiors. Supporting with an instance, In October 2024, Supersede introduced the world's first 1:1 marine-grade plywood replacement to expand its application to modular homes, RVs, and trailers. The resistance of marine plywood to moisture and fungal attacks is making it essential in coastal and wet environments. Infrastructure development projects are further requiring structural plywood for load-bearing applications, boosting product demand. Digital campaigns are contributing to the plywood industry for expanding brand visibility, targeting niche audiences, and driving measurable sales growth. These campaigns are highly targeted, allowing brands to showcase specific plywood grades based on regional preferences. Influencer partnerships and video content are helping to demonstrate real-world applications. In March 2024, Greenlam Industries launched its new MikasaPly campaign to offer more flexibility in choosing quality plywood in a crowded market, further driving product demand.

Base Year

Historical Period

Forecast Period

The Australian residential building sector experienced a 19.4% growth in January 2024, reaching USD 7.14 billion, providing positive momentum for the global plywood market. This growth, according to the Australian Bureau of Statistics, highlights the rising demand for construction materials like plywood in residential projects.

Saudi Arabia's construction industry, which houses 138,114 companies, as per the Ministry of Municipal and Rural Affairs, is an emerging market for plywood. As the sector expands, it drives demand for high-quality plywood, contributing to growth in global plywood consumption for commercial and residential buildings.

The U.S. construction sector, employing 8 million people and generating USD 2.1 trillion annually, according to the Construction Association, is a significant player in the global plywood market. The substantial investment in infrastructure and housing directly influences the demand for plywood, particularly for framing, flooring, and finishes.

Compound Annual Growth Rate

5%

Value in USD Billion

2026-2035

*this image is indicative*

Sustainability is gaining traction in the plywood market with increasing consumer preference for eco-friendly plywood made from certified wood and agroforestry sources. Several firms are introducing FSC-certified products to reduce environmental impacts. For instance, in October 2023, Amulya Mica launched its EO Plywood with E0 certification, reflecting its commitment to sustainability and quality. Governments are also promoting sustainable forestry to curb deforestation.

Technological innovations in plywood manufacturing, such as water-resistant adhesives and fire-retardant coatings for expanding applications are driving the plywood market expansion. In July 2022, prominent plywood brand Durbi initiated calibrated plywood manufacturing using an advanced technology to meet the evolving demands of the furniture and modular kitchen industries. Such advancements are enabling plywood to compete with alternative materials, strengthening market position in furniture and flooring segments.

Modular construction is influencing the plywood market outlook due to its cost efficiency and speed offered in prefabricated panels and workstations. The lightweight and strong properties of plywood are facilitating easy handling and transport. Thus, several companies are innovating in plywood tailored for modular construction. For instance, in June 2022, DURO launched DURO PLUS, India's first ready-to-use plywood and board product ideal for jointless applications in modular construction.

The rising efforts by manufacturers on forging partnerships with distributors, designers, and technology providers to enhance product offerings is catalysing the plywood market expansion. In May 2025, Atlantic Plywood partnered with wood coatings firm Sayerlack® Innovative Wood Solutions to enhance its product range and offer Sayerlack’s advanced wood coating solutions.

Such alliances are enabling innovation, customized solutions, and faster market penetration. Joint ventures are also helping companies to enter new geographic regions and share research costs while strengthening their competitive advantage.

The rapid rate of global urban population is fuelling the demand for efficient building materials, adding to the plywood market development. According to industry reports, 68% of the world population is estimated to live in urban areas by 2050. Smart city projects emphasize sustainable, lightweight, and modular materials to reduce construction time and environmental impact. Countries investing in smart infrastructure are further driving plywood consumption in housing, offices, and transportation hubs.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Plywood Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

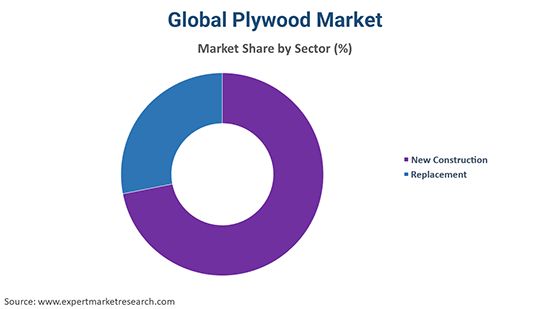

Market Breakup by Sector

Key Insight: The new construction segment leads the plywood market with continuous growth in commercial, residential, and infrastructure projects. As per industry reports, the total annual spending on construction in the United States touched USD 2.2 trillion in 2024. Large-scale urban housing developments as well as office complexes are extensively using plywood for internal partitions and furniture. This can be attributed to the expanding urbanization and infrastructure investments. The rising adaptability to modern construction techniques, including modular and prefabricated structures is further fuelling growth in this segment.

Market Breakup by End Use

Key Insight: The residential segment dominates the plywood market with rising housing demands and urbanization. Plywood is widely used for furniture, flooring, doors, and interior panelling in homes. The segment benefits from government housing schemes and increasing disposable incomes, boosting renovation and new construction activities. In September 2024, Portugal's government introduced a new spending package of 2 billion euros for building nearly 33,000 homes by 2030. The preference for aesthetically appealing and long-lasting materials are also enhancing plywood’s popularity amongst homeowners.

Market Breakup by Grade

Key Insight: The MR Grade segment of the plywood market is witnessing high demand in residential and commercial interiors, mainly in India. This plywood is widely used in furniture, wardrobes, and wall panelling. In budget apartments and mass housing projects, MR Grade plywood is preferred for kitchen cabinets and bedroom furniture due to its affordability and decent performance in low-humidity conditions. Balance of cost and functionality are further making MR grade a dominant choice for medium-scale interior work.

Market Breakup by Wood Type

Key Insight: Softwood plywood market value is increasing with its extensive usage in construction, packaging, and industrial applications. Made primarily from coniferous trees, softwood plywood is favoured for its lightweight nature, affordability, and structural strength. In May 2025, Finnish manufacturer Koskisen unveiled Zero ThinPly, a softwood plywood product made entirely from bio-based materials for aligning with the surging demand for eco-friendly building materials. Such instances are making soft plywood a go-to option for high-volume projects to render aesthetic finish and superior performance.

Market Breakup by Application

Key Insight: The furniture segment leads the plywood market due to higher utilization in residential, commercial, and office furnishings. With its ease of shaping, durability, and cost-effectiveness, plywood is largely favoured in wardrobes, kitchen cabinets, beds, tables, and office desks. Catering to this trend, in June 2023, Duroply launched Techply, India’s first ready-to-use and customizable plywood with a veneer-like finish for direct furniture use. In India and Southeast Asia, plywood-based furniture is preferred over metal or plastic alternatives, making this segment the most dominant.

Market Breakup by Region

Key Insight: North America plywood market value is driven by advanced construction, remodelling, and furniture industries, mainly in the United States and Canada. The rise in prefabricated housing and green building initiatives are bolstering the demand for sustainable plywood products. For instance, in April 2025, The United States Green Building Council unveiled an enhanced LEED rating system for offering broader standards for sustainable building practices. Furthermore, the increasing investments in infrastructure renovation in urban areas and the growing DIY culture are supporting continued growth of plywood use in flooring, cabinetry, and panelling.

Plywood to Gain Traction in Replacement

The replacement segment in the plywood industry caters to renovation, repair, and maintenance needs. Replacement remains significant as businesses and homeowners are working on upgrading and restoring the old structures. This segment also benefits from sustainability trends, where recycled plywood and eco-friendly variants are preferred, offering multiple growth opportunities to the market players. In March 2024, Rushil Decor expanded its presence in eco-friendly plywood by using agroforestry-sourced wood to promote sustainability in modern infrastructure applications, driving segment growth.

Thriving Plywood Adoption in the Commercial Sector

The commercial plywood market has a profound role in office buildings, retail spaces, hotels, and institutional structures. With its strength, fire resistance, and ease of installation, plywood is valued for commercial interiors, such as partitions, counters, and false ceilings. Most IT parks and co-working spaces are using plywood for modular workstations and conference rooms. The segment is also growing with expanding business infrastructure and hospitality sectors. Supporting with industry reports, the office leasing demand in India jumped by 11% year-over-year to reach 3.44 million sqm in H2 2024.

BWR Grade & Fire Resistant Grade Plywood to Record Preference

BWR grade plywood market is growing due to its suitability for semi-wet areas like kitchens and bathrooms. Homeowners and carpenters largely opt for BWR plywood for modular kitchen cabinets and outdoor furniture exposed to intermittent moisture. Brands, such as CenturyPly and Greenply are offering BWR-grade options tailored for Indian climates where monsoon humidity is a concern. This plywood further offers a longer lifespan and better resistance to delamination, making it a popular option in both residential and commercial segments.

The fire resistant grade segment of the plywood industry is gaining importance due to the surge in high-rise buildings, hotels, hospitals, and commercial infrastructure along with the increasing fire safety regulations. For instance, in October 2024, the state of Maharashtra in India implemented stringent fire safety regulations for buildings vulnerable to man-made disasters. Moreover, this plywood grade is treated with fire-retardant chemicals and is engineered to delay the spread of flames. Rising urban safety awareness is expected to fuel increased demand for fire-resistant grade plywood across residential, commercial, and institutional segments.

Increasing Prominence of Hardwood Plywood

The demand for hardwood plywood is gaining momentum due to higher usage in furniture, cabinetry, decorative panels, and interiors where finish, durability, and strength are essential. Hardwood plywood is denser and offers superior resistance to wear and impact, making it ideal for premium home and office furniture. Driven by these benefits, in July 2024, Indian manufacturer AP Wood launched AP Wood Carb Plywood, a health-conscious hardwood plywood product for interior applications. In countries, such as Europe and India, hardwood plywood is highly preferred by custom furniture makers and luxury interiors.

Rising Plywood Application in Flooring & Construction & Packaging

The plywood market share is growing from the flooring & construction segment as it plays a vital role in subflooring, wall sheathing, and formwork in concrete casting. In commercial and residential projects, plywood offers high tensile strength and resistance to warping. Additionally, the rise in smart and sustainable buildings is pushing the demand for engineered plywood for ensuring consistency and minimal waste. With increased infrastructure investments, this segment further holds strong growth potential.

The packaging segment is attaining traction in the plywood industry with growing uses for creating crates, pallets, and boxes to transport heavy or sensitive items. Exporters are relying on plywood packaging for shipping across long distances, especially when dealing with fragile or valuable goods. For instance, in January 2025, Gulmohar Packtech unveiled OSB Ply for catering to export and long-haul shipping. The rise in e-commerce and international trade is also spurring the demand for durable and eco-friendly packaging solutions.

Surging Plywood Demand in Europe & Asia Pacific

Europe records a prominent share in the plywood market, largely driven by the commitment to eco-friendly construction materials and stricter regulations for promoting sustainable forestry. Germany, France, and the United Kingdom are witnessing increased usage of certified plywood in both commercial and residential construction. Investments in production modernization to reflect the growing regional focus on efficiency and sustainability are helping to align with Europe’s broader goals for low-emission building materials and energy-efficient architecture.

Asia Pacific plywood market is poised for growth with the increased construction activity and industrial development in China, India, and Vietnam. Rising urbanization, infrastructure projects, and affordable housing initiatives are other major growth drivers. Supporting with industry reports, the urban population of Asia is estimated to surge to 3.5 billion by 2050. Additionally, cost-effective manufacturing capabilities are making Asia Pacific a key supplier of low-cost plywood globally.

Key players operating in the plywood market are deploying measures that revolve around innovation, expansion, and sustainability. These companies are focusing on product innovations by introducing fire-retardant, water-resistant, and eco-friendly plywood variants to meet the changing consumer demands and regulatory standards. Geographic expansion is allowing these firms to invest in emerging markets to tap into rising construction and infrastructure development. To strengthen market position, players are engaging in strategic partnerships, mergers, and acquisitions to enhance production capacity and distribution networks.

Branding and customization are also playing a leads role with companies delivering tailor-made solutions for commercial, residential, and industrial applications. Additionally, there is a strong emphasis on supply chain optimization along with the higher adoption of digital tools for inventory management, logistics, and customer engagement. Sustainability is driving many firms to invest in certified wood sourcing and low-emission adhesives to appeal to environmentally conscious consumers and comply with global standards. Collectively, these strategies are improving market reach, product quality, and operational efficiency.

Georgia-Pacific LLC, founded in 1927 and headquartered in Atlanta, the United States, offers a wide range of products, including plywood, and oriented strand board among other wood-based construction materials. The company also manufactures tissue, packaging, and building products for residential, commercial, and industrial applications.

PotlatchDeltic Corporation, founded in 1903 and headquartered in Spokane, the United States, specializes in timberland ownership and wood products manufacturing. This company’s product portfolio includes plywood, lumber, and engineered wood, serving residential and commercial construction sectors.

Weyerhaeuser Company, founded in 1900 and headquartered in Seattle, the United States, owns extensive timberlands to produce wood products such as plywood, lumber, and engineered wood. Weyerhaeuser plays a key role in sustainable forestry and supplies materials to builders, manufacturers, and retailers across North America and beyond.

Boise Cascade, founded in 1957 and headquartered in Boise, the United States, manufactures engineered wood products, plywood, and lumber while operating a large distribution network. Boise Cascade supplies materials for new construction, remodelling, and industrial applications, serving both wholesalers and retailers across the country.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the plywood market are UPM-Kymmene Corporation, Sveza, Austal plywoods private limited, Eksons corporation berhad, Latvijas fineries AS, Metas wood, and Potlatch Deltic corporation, among others.

Download your free sample of the plywood market report today to explore key plywood market trends 2026, forecast data, and competitive insights. Stay ahead in the rapidly evolving plywood industry with expert analysis on market drivers, innovations, and sustainability. Don’t miss this opportunity to gain a strategic advantage and make data-backed decisions for your business growth. Get your copy now!

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 52.27 Billion.

The market is projected to grow at a CAGR of 5.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach around USD 85.14 Billion by 2035.

The key strategies driving the market include sustainability adoption, product innovation, expansion into emerging markets, strategic partnerships, and digital marketing. Companies are focusing on enhancing product customization, eco-friendly materials, and improving supply chain efficiency to meet rising demand and regulatory standards, ensuring competitive advantage and long-term growth.

The eco-friendly strategies of the manufacturers and increasing construction activities are expected to be key trends guiding the growth of the market.

The major regions in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The new construction and replacement are the sectors in the market.

Based on end use, the market is divided into residential and commercial.

The key players in the market report include Georgia-Pacific LLC, PotlatchDeltic Corporation, Weyerhaeuser Company, Boise Cascade, UPM-Kymmene Corporation, Sveza, Austal plywoods private limited, Eksons corporation berhad, Latvijas fineries AS, Metas wood, and Potlatch Deltic corporation, among others.

Asia Pacific held the dominant share of the market.

The MR grade dominated the market.

According to the report, softwood type acquired the largest market share.

The residential segment dominates the market with rising housing demands and urbanization.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Sector |

|

| Breakup by End Use |

|

| Breakup by Grade |

|

| Breakup by Wood Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share