Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global polybutylene adipate terephthalate (PBAT) market was volumed at 463.01 KMT in 2025. The industry is expected to grow at a CAGR of 13.70% during the forecast period of 2026-2035 to attain a volume of 1671.84 KMT by 2035.

Base Year

Historical Period

Forecast Period

According to the United Nations, 75% of plastic produced since 1950 ended up as waste, leading to increased demand for PBAT due to its environmentally friendly characteristics.

PIAI reports rapid growth of 22-25% annually in India's packaging sector, making it a preferred destination for the industry, and boosting the global polybutylene adipate terephthalate (PBAT) market growth.

PBAT's versatility and eco-friendliness cater to packaging, agriculture, and disposables, making it a promising option for sustainable materials globally.

Compound Annual Growth Rate

13.7%

Value in KMT

2026-2035

*this image is indicative*

Polybutylene adipate terephthalate (PBAT) is a notable biodegradable and compostable polymer, garnering attention for its eco-friendly characteristics and wide-ranging applications. Derived from butylene glycol, adipic acid, and terephthalic acid, PBAT offers exceptional biodegradability and mechanical strength, making it a viable substitute for traditional plastics. Its compostable properties enable decomposition into natural elements, diminishing environmental harm.

As per the global polybutylene adipate terephthalate (PBAT) market, it serves various sectors, including packaging, agriculture, and disposables, aligning with global sustainability. Its versatility, eco-friendliness, and functional properties position PBAT as a promising contender in the pursuit of greener materials.

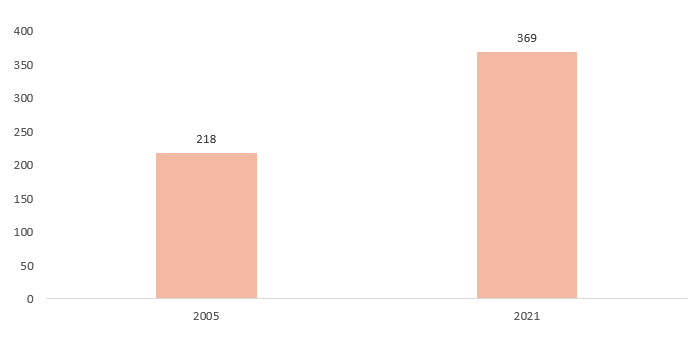

Global plastic trade involves various plastic products, from toys to electronics, and raw materials like fossil fuels, including waste shipment. UN states that 75% of plastic produced since 1950 becomes waste. This boosts the demand for PBAT for its eco-friendly features.

GLOBAL EXPORTS OF PLASTICS OR GOODS MADE FROM PLASTIC FROM 2005 TO 2021, IN MILLION METRIC TONS

The global polybutylene adipate terephthalate (PBAT) market growth is driven by end-user demand, diverse positive attributes, cost-effectiveness, and government initiatives.

The rising acceptance of polybutylene adipate terephthalate (PBAT) in various industries such as packaging, agriculture, medical research, and consumer goods is projected to fuel polybutylene adipate terephthalate (PBAT) market development. PBAT's adaptability extends to consumer goods, athletic equipment, coatings, electronics, and beyond.

PBAT boasts various benefits such as high melting points, flexibility, and adaptability for blending with other biodegradable polymers. Rising awareness of waste disposal and the increasing adoption of biodegradable products are fuelling the growth of the PBAT market.

Recent technological advancements have enhanced both the properties and cost-effectiveness of PBAT through ongoing research and development efforts. Improved polymer blending and compounding techniques have led to enhanced performance and processability, expanding PBAT's application potential and market acceptance.

Governments worldwide are implementing stringent regulations to reduce plastic waste and promote biodegradable materials, thereby impacting the polybutylene adipate terephthalate (PBAT) market outlook. Measures such as banning single-use plastics and promoting compostable packaging create a favourable market environment for PBAT and other biodegradable polymers, aligning with efforts to enhance sustainability in various industries.

The global rise of the circular economy aims to reduce waste by encouraging material reuse and recycling. PBAT, compostable and recyclable, aligns with this approach, reducing reliance on fossil fuel-derived plastics for a more sustainable resource economy.

The packaging sector is a major user of PBAT, driven by the rising demand for eco-friendly packaging solutions. PBAT's biodegradability and composability meet this demand, making it ideal for various packaging needs, including food, disposable bags, and films.

Global Polybutylene Adipate Terephthalate (PBAT) Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Technology

Market Breakup by Application

Market Breakup by Distribution Channels

Market Breakup by Region

The extrusion technology is propelling the polybutylene adipate terephthalate (PBAT) market growth

PBAT's transparent and biodegradable properties make it suitable for injection and extrusion processes. Injection moulding compresses polymer granules under high pressure and heat to create the desired shape. Extrusion moulding deforms material under pressure and passes it through a die to shape it.

Based on application, the global polybutylene adipate terephthalate (PBAT) market share is led by flexible packaging

The flexible packaging sector is experiencing notable growth because PBAT offers a lower carbon footprint compared to petroleum-based alternatives. Furthermore, the expanding fast-food industry is driving demand for biodegradable plastic bags.

Similarly, the film sector is growing steadily, spurred by environmental concerns and government efforts to reduce soil pollutants. PBAT coatings are employed to waterproof object surfaces.

Asia Pacific, particularly China and India, represents the largest and fastest-growing economies within polybutylene adipate terephthalate (PBAT) market. Factors such as industrialisation, urbanisation, and environmental awareness drive the adoption of eco-friendly materials like PBAT.

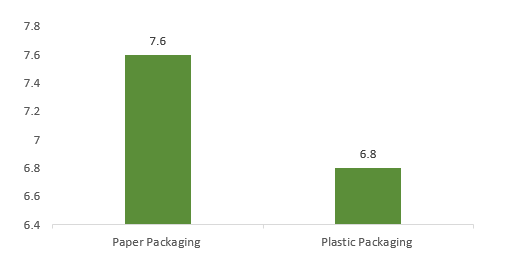

According to the Packaging Industry Association of India (PIAI), the packaging sector is experiencing rapid growth in India, expanding at a rate of 22-25% annually, making the country an increasingly favoured destination for the packaging industry and driving the growth of the PBAT market.

INDIA PACKAGING MARKET GROWTH, 2023, IN MILLION TONS

Moreover, industry expansion is observed in regions like North America and Europe due to heightened awareness of plastic pollution and the availability of sustainable alternatives.

The companies are building several plants to produce huge amounts of PBAT to stay ahead in the market.

BASF SE was established in 1865 and based in Germany, is a leading European multinational corporation and the world's foremost chemical manufacturer. Its operations span six segments, including Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care, and Agricultural Solutions, with a primary emphasis on sustainability, innovation, and digitization.

Reliance Industries Ltd was founded in 1957 and is based in India. From the exploration and extraction of oil and gas to the production of petroleum derivatives, polyester goods, plastics, chemicals, synthetic textiles, and fabrics.

LG CHEM Ltd, founded in 1947 and headquartered in South Korea, is a key player in the global automotive industry, supplying batteries for electric and hybrid vehicles to numerous automakers across the United States, Europe, and China. Additionally, LG Chem collaborates on battery development initiatives and also specializes in electronic components such as polarizers for liquid crystal display panels.

An Phat Holdings, established in 2002, is a Vietnamese firm specialising in the plastics sector, providing services such as research, manufacturing, and advancement of biodegradable and eco-conscious materials and goods.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other global polybutylene adipate terephthalate (PBAT) market key players are Xinjiang Blue Ridge Tunhe Sci.&Tech. Co., Ltd, Henan Longdu Torise Biomaterials Co., Ltd, Ningbo Changhong Polymer Scientific and Technical Inc., SKC, and GYC Group, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global market for PBAT resin attained a volume of nearly 463.01 KMT.

The market is projected to grow at a CAGR of 13.70% between 2026 and 2035.

The revenue generated from the market is expected to reach 1671.84 KMT in 2035.

The PBAT market is growing due to its ability to offer cost-effectiveness and rising government initiatives.

Based on technology, the polybutylene adipate terephthalate (PBAT) market is divided into extrusion and injection.

Key players in the industry are BASF SE, Xinjiang Blue Ridge Tunhe Sci.&Tech. Co., Ltd, Henan Longdu Torise Biomaterials Co., Ltd, LG Chem Ltd, Ningbo Changhong Polymer Scientific and Technical Inc., SKC, GYC Group, Reliance Industries Ltd, and An Phat Holdings, among others.

Based on application, the market is divided into flexible packaging (plastic bags), film, coating, and others.

The various types of distribution channels are divided into direct and indirect.

The market is broken down into region North America, Europe, Asia Pacific, Latin America, Middle East, and Africa.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Technology |

|

| Breakup by Application |

|

| Breakup by Distribution Channels |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Price Analysis |

|

| Competitive Landscape |

|

| Companies Covered |

|

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share