Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global polystyrene (PS) market attained a volume of 20.05 MMT in 2025. The industry is expected to grow at a CAGR of 1.90% during the forecast period of 2026-2035 to reach a volume of 24.20 MMT by 2035.

The polystyrene market is undergoing structural change, powered by the growing demand from packaging and electronics and regional policy interventions. Governments are also encouraging manufacturers to develop higher-efficiency blends and recycling-integrated processes. Under the Union Budget 2025-26 the government allocated Rs. 1,61,965 crore (USD 18.7 billion) to the Ministry of Chemicals and Fertilizers, which includes incentives for clean processing of synthetic polymers, including high-impact polystyrene (HIPS). This initiative is aimed at boosting local manufacturing resilience. Meanwhile, Europe’s Green Deal has added regulatory frameworks for achieving circular economy goals, creating downstream demand for modular and recyclable PS-based products.

South Korea’s Ministry of Environment, on the other hand, partnered with leading petrochemical firms like SK Chemicals to co-develop energy-efficient polymerisation reactors for extruded polystyrene (XPS). These offer significant energy savings and reduce styrene residue as well. From smart labelling in food-grade containers to fire-retardant insulation foam with embedded IoT sensors in construction, the polystyrene’s functionality is being redefined.

Digitised supply chains are also transforming how PS raw materials are sourced and tracked, boosting the polystyrene market dynamics. Companies like TotalEnergies and INEOS Styrolution are piloting blockchain-enabled logistics for waste polystyrene reverse logistics, bridging the gap between producer responsibility and ethical considerations of their brands. As regulations tighten, firms that innovate beyond compliance are poised to capture greater market shares during the forecast period.

Base Year

Historical Period

Forecast Period

Polystyrene foam is used for take-out containers, trays, and clamshells for fast food, prepared foods, and ready-to-eat meals due to its lightweight nature, insulating properties, and cost-effectiveness. In 2020, the combined foodservice and food retail industries sold approximately USD 1.8 trillion worth of food. With the growth of food retailing, the use of polystyrene in frozen food packaging and meat trays due to its ability to provide insulation and impact resistance during storage and transportation is increasing.

The rising use of polystyrene as an insulation material in the construction of cold chain facilities is driving the polystyrene market development. Hence, the increasing development of temperature-controlled storage solutions is surging the demand for polystyrene-based insulation. For instance, in January 2024, A.P. Moller – Maersk broke ground for its Cold Store facility at Mehsana, Gujarat, to offer temperature-controlled storage solutions for perishable frozen processed food items.

Polystyrene is widely used in the automotive sector, especially in interior parts such as door panels, seats, dashboard padding, and headliners, to improve fuel efficiency and reduce carbon emissions. In 2022, 85.4 million motor vehicles were manufactured around the world. As the number of manufactured vehicles increases, the demand for polystyrene for acoustic insulation, thermal insulation, and protective cushioning in automotive interiors is rising.

Compound Annual Growth Rate

1.9%

Value in MMT

2026-2035

*this image is indicative*

The global push for circularity has moved beyond recyclability to digital accountability. Companies in the polystyrene market like INEOS Styrolution and Recycling Technologies have announced pilot programme in the United Kingdom that embeds QR-coded traceability in recycled PS streams. This allows full lifecycle tracking for food-grade applications, a crucial step in meeting EFSA and FDA safety standards. Moreover, with the EU mandating 30% recycled content in single-use plastics by 2030, these digital tools are creating value-added loops. Smart traceability also helps manufacturers secure green funding and carbon credits.

XPS-based insulation has emerged as a city-grade solution amid rising urban temperatures and energy cost volatility, boosting the overall polystyrene market opportunities. Recently, Singapore’s Building and Construction Authority have encouraged the adoption of PS-based smart insulation panels fitted with embedded thermal sensors. These panels adjust R-value properties dynamically, making structures more energy-efficient without major retrofits. Asia-Pacific governments are subsidising such innovations under green city infrastructure missions. Lightweight, fire-rated, and moisture-resistant properties of PS foams make them ideal for high-density applications. This push is also aligned with UN Habitat’s Sustainable Cities Programme, which promotes low-carbon materials in new urban construction.

Polystyrene has found extensive applications in rapid prototyping and tooling through 3D-printed moulds using high-clarity GPPS and HIPS blends. BASF partnered with SEEN AG to co-engineer solutions in 3D printing along the entire value chain of additive manufacturing, accelerating the scope of the polystyrene market expansion. These PS-based resins offer precision, lower material cost, and ease of post-processing. The U.S. Department of Energy’s Advanced Materials Initiative has supported similar projects, where lightweight PS variants are used in wind turbine prototype tooling.

Food safety regulations have created an opportunity for value-added polystyrene packaging. These are targeted at ready-to-eat meals and sushi containers. The innovation responds to rising consumer demand for germ-resistant packaging, especially in post-pandemic Asia. Regulatory approvals from the Japanese Ministry of Health have boosted commercial uptake. Retail chains have already reported a significant drop in spoilage. As a result, polystyrene manufacturers are ramping up production of antimicrobial-grade variants, while foodservice distributors increasingly prefer polystyrene due to its insulation, cost-efficiency, and extended shelf-life performance.

The electric vehicle (EV) industry is reshaping plastics selection for internal components, and HIPS is gaining from this major shift, accelerating the overall polystyrene demand. Companies like LG Chem are working with automakers to develop polystyrene-blended internal battery casings that are both heat-resistant and structurally sound. Moreover, in 2025, the South Korean government allocated over USD 800 million in developing materials technologies, specifically targeting lightweight, recyclable plastics. HIPS, with its blend of impact strength and ease of moulding, is ideal for cable insulation and battery enclosures.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Polystyrene Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

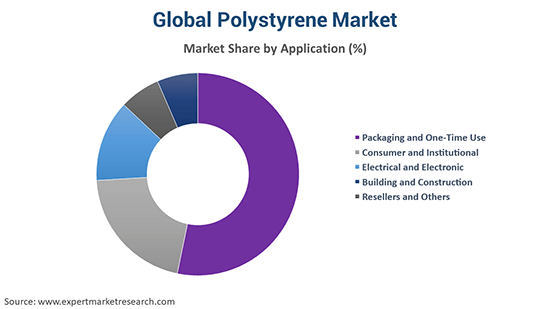

Market Breakup by Application

Key Insight: All five application segments, considered in the polystyrene market report, including packaging, electrical & electronic, consumer & institutional, construction, and resellers, are evolving with new functional mandates. Packaging leads the market due to hygiene innovations and traceability features, while the electrical and electronic segment grows via smart enclosures. In construction, fire-rated PS foams are driving demand amid rising energy mandates. Consumer products like personal grooming kits are witnessing rapid PS consumption due to its mouldability and finish. Meanwhile, the resellers segment shows traction through regional repurposing of post-industrial PS waste into DIY products.

Market Breakup by Region

Key Insight: Asia Pacific, Middle East-Africa, North America, Europe, and Latin America each show distinct momentum drivers, contributing to the overall demand in the polystyrene market. Asia Pacific leads the market via R&D localisation and recycling infrastructure. Middle East-Africa focuses on polymer diversification under government strategies. Europe remains innovation-forward, driven by regulation and advanced recovery systems. North America is growing with the rising packaging demand and extensive automotive PS applications. Latin America, especially Brazil, is testing eco-friendly PS manufacturing under regional carbon credit frameworks. Each region is pushing the material beyond traditional applications, using targeted funding, partnerships, and policy tools to embed polystyrene in future-ready supply chains.

By Application, Packaging and One-Time Use Accounts for the Majority Share of the Market

Packaging dominates the polystyrene market due to its superior insulation, lightweight nature, and cost-effectiveness. However, recent shifts in functionality have amplified its dominance. Companies like Huhtamaki and Genpak are shifting from plain foam trays to develop tamper-evident, multi-layered PS packaging, which are especially used in food delivery and pharmaceutical kits. These designs, now equipped with RFID seals, improve logistics transparency and compliance.

Polystyrene’s thermal insulation and low dielectric properties make it a go-to polymer in the electrical and electronics segment. The polystyrene market growth is further propelled by this synthetic polymer’s integration into smart device enclosures and sensor hubs. In China, the “Green Electrification” subsidy under the 14th Five-Year Plan boosted demand for lightweight, non-conductive housing components, favouring high-impact polystyrene.

By Region, Asia Pacific Clocks the Leading Position of the Market

Asia Pacific commands the largest share of the polystyrene market revenue owing to manufacturing hubs in China, India, and South Korea. The regional growth is driven by innovations and public-private initiatives. In 2025, the Indian government's "Plastic Parks" scheme prompted the localisation of PS component clusters supply chains. Meanwhile, South Korea is investing in circular polymers and chemical recycling hubs. Companies like Formosa and Chi Mei are developing new copolymer PS blends with tailored physical properties for specific climate conditions.

The Middle East and Africa polystyrene market is rapidly growing due to the diversification programmes like Saudi Arabia’s Vision 2030 and Egypt Vision 2030. Companies like Aramco, SABIC and TotalEnergies are investing in polystyrene upcycling technologies. UAE-based petrochemical firms are also piloting solvent-free PS expansion techniques, aiming for green building certification compatibility. Government grants for polymer innovation labs are improving accessibility to advanced PS processing across sub-Saharan economies.

Leading polystyrene market players like TotalEnergies and INEOS Styrolution are focusing on closed-loop models, investing in chemical recycling partnerships and blockchain-traced logistics. A notable shift is also seen in modular PS grades. BASF is co-developing re-processable blends suited for multi-industry needs. Start-ups in Europe and Japan are entering the market with micro-foaming technology and solventless expansion methods, tackling long-standing emissions issues. M&A activity is targeting firms with circular patents or regulatory-cleared antimicrobial compounds.

Most of the polystyrene companies are finding opportunities in adaptive licensing models, licensing functionalised PS blends for niche markets like medical packaging or noise-absorbing composites. Circular traceability, smart insulation, additive manufacturing, antimicrobial packaging, and electrification-grade HIPS are key trends redefining polystyrene’s role beyond packaging with smart, sustainable, and regulation-aligned material innovation. Players who align innovation with downstream compliance, particularly for ESG reporting, are becoming preferred vendors.

INEOS Styrolution Group GmbH, established in 2011 and headquartered in Frankfurt am Main, Germany, is a company that provides Styrenic applications for products across different sectors, including electronics, automotive, construction, packaging, healthcare, and sports and leisure, among others. The firm operates 17 production sites in nine countries and employs around 3,000 individuals.

Americas Styrenic LLC, headquartered in Texas, United States, and founded in 2008, is a prominent integrated producer of polystyrene and styrene monomer. The company is a joint venture equally owned by Trinseo LLC and Chevron Phillips Chemical Company LP. It is also a founding member of the Polystyrene Recycling Alliance (PSRA) and is a leading United States producer of certified recycled polystyrene.

CHIMEI Corporation, founded in 1960 and headquartered in Tainan City, Taiwan, is a prominent performance materials provider. The company is engaged in the designing and manufacturing of advanced polymer materials, specialty chemicals, and synthetic rubber.

Versalis S.p.A., founded in 2012 and headquartered in Milanese, Italy, is the chemical division of Eni. The company is committed to a circular chemical industry to create value for stakeholders and contribute to sustainability.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market are PS Japan Corporation, Shanghai SECCO Petrochemical Company Limited, Versalis S.p.A., Supreme Petrochem Ltd, and Trinseo PLC, among others.

Explore the latest trends shaping the Polystyrene Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on Polystyrene Market Trends 2026.

High Impact Polystyrene Hips Procurement Intelligence Report

United States Expandable Polystyrene (EPS) Market

General-Purpose Polystyrene (GPPS) Market

Polystyrene Procurement Intelligence Report

Brazil Polystyrene Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the polystyrene market reached an approximate volume of 20.05 MMT.

The market is projected to grow at a CAGR of 1.90% between 2026 and 2035.

Key strategies driving the market include investing in traceability tech, developing antimicrobial and smart-grade PS, forming public-private partnerships, and piloting solvent-free processes while aligning R&D with region-specific ESG mandates and digital compliance protocols.

The growing usage of high-impact polystyrene and general-purpose polystyrene in consumer electronics and increasing application of expanded polystyrene for insulation and construction purposes are the key trends propelling the market growth.

The major regions in the market are North America, Europe, Asia Pacific, Latin America, and Middle East and Africa with Asia Pacific accounting for the largest share in the market.

The major applications in the global polystyrene market are packaging and one-time use, consumer and institutional, electrical and electronic, building and construction, and resellers, among others.

The major players in the market are INEOS Styrolution Group GmbH, Total S.A., Americas Styrenic LLC, CHIMEI Corporation, PS Japan Corporation, Shanghai SECCO Petrochemical Company Limited, Versalis S.p.A., Supreme Petrochem Ltd, and Trinseo PLC, among others.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around 24.20 MMT by 2035.

The key challenges are regulatory uncertainty, high recycling costs, and public pressure over microplastics. Achieving traceability, fire resistance, and recyclability within cost margins remains a significant R&D and supply chain challenge.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share