Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global robotic vacuum cleaner market was valued at approximately USD 6.96 Billion in 2025 and is projected to expand at a CAGR of 23.80% in the forecast period of 2026-2035, reaching USD 58.86 Billion by 2035.

This growth is primarily driven by the increasing demand for efficient cleaning solutions and the growing adoption of smart home technology. As the technology behind robotic vacuum cleaners evolves, more consumers are incorporating these devices into their daily lives. The market’s growth is also fuelled by advancements in sensor and navigation technology, improving the performance and functionality of robotic vacuum cleaners. Continued innovation will ensure the market’s strong growth trajectory in the coming years.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

23.8%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The robotic vacuum cleaner market has witnessed a significant rise in adoption, particularly following the COVID-19 pandemic. With increased awareness about hygiene, the demand for efficient cleaning solutions has surged, leading to a higher usage of robotic vacuum cleaners. These devices are not only designed for cleaning but also for disinfection, addressing concerns about cleanliness in homes and offices. The COVID-19 crisis accelerated the adoption of robotic vacuum cleaners, as consumers sought more automated and effective ways to maintain their environments. The usage of these vacuum cleaners for everyday cleaning and disinfection continues to grow, further boosting market potential.

The robotic vacuum cleaner market has experienced significant growth, driven by the increased demand for automated cleaning solutions. Following COVID-19, consumers have become more focused on maintaining clean environments, leading to a rise in the popularity of robotic vacuum cleaners. These devices offer an efficient, hands-free cleaning experience, meeting the evolving needs of modern households. As more consumers adopt robotic vacuum cleaners, the market continues to expand, with innovation and technological advancements contributing to its continued growth. The trend towards automated cleaning is expected to keep driving the market forward in the coming years.

The robotic vacuum cleaner market is experiencing remarkable growth, driven by the increasing adoption of robots in everyday cleaning tasks. As consumers seek more efficient, automated cleaning solutions, robotic vacuum cleaners have become a popular choice. These robots offer a hands-free cleaning experience, making them highly desirable for busy households and individuals seeking convenience. The market for robotic vacuum cleaners is expanding rapidly as technology continues to improve, allowing for more advanced features and enhanced performance. With continuous innovation, the growth of this market is expected to accelerate, further solidifying robots as a mainstay in modern cleaning solutions.

The robotic vacuum cleaner market is experiencing significant market growth, driven by increased adoption of autonomous vacuum cleaners and rising demand for convenient vacuum cleaning solutions. As consumers prioritise hygiene and cleanliness in their homes, robotic vacuum cleaners have become essential for maintaining tidy spaces with minimal effort. These devices are particularly popular in smart homes, where smart home technology enhances the efficiency of vacuum cleaners. With advancements in technology, robotic vacuum cleaners offer improved performance, contributing to their growing popularity. The demand for these vacuum cleaners continues to rise, as consumers seek effortless, automated solutions for maintaining their homes’ cleanliness and hygiene.

The robotic vacuum cleaner market is witnessing rapid growth, driven by the increasing demand for smart and efficient cleaning solutions. Consumers are increasingly opting for robotic vacuum cleaners equipped with advanced technology, such as artificial intelligence and voice assistance, which enhance performance and convenience. These vacuum cleaners offer improved battery life and reduced charge time, making them more efficient for daily cleaning tasks. As robotic vacuum cleaners become more capable, their popularity continues to rise. The market is expected to see further growth, as consumers seek out innovative cleaning solutions that save time and effort. With advanced technologies constantly improving, robotic vacuum cleaners are poised to become an integral part of modern homes.

The robotic vacuum cleaner market is experiencing strong market growth, driven by increased adoption of these devices for efficient cleaning. Robotic vacuum cleaners are equipped with advanced sensors that enhance their performance, making them more effective in cleaning various surfaces. However, the market faces a restraint due to the presence of counterfeit products, which may affect consumer trust and increase the cost of genuine units. Additionally, regular maintenance of these devices can be a concern for some users. Despite these challenges, the market continues to expand, with increasing demand for innovative and reliable robotic vacuum cleaners.

| Global Robotic Vacuum Cleaner Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 6.96 |

| Market Size 2035 | USD Billion | 58.86 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 23.80% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 27.4% |

| CAGR 2026-2035 - Market by Country | China | 26.3% |

| CAGR 2026-2035 - Market by Country | UK | 21.8% |

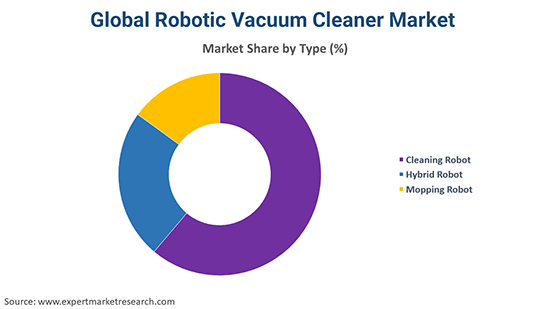

| CAGR 2026-2035 - Market by Type | Hybrid Robot | 26.7% |

| CAGR 2026-2035 - Market by Distribution Channel | Online | 26.2% |

| Market Share by Country 2025 | Germany | 4.4% |

Floor vacuum cleaners are essential in the global robotic vacuum cleaner market, offering efficient and time-saving solutions for residential and commercial spaces. They clean various floor types, from carpets to hard floors, with minimal human intervention. With smart sensors and powerful suction, these vacuum cleaners ensure thorough cleaning, improving indoor air quality while saving time and effort for consumers.

Pool vacuum cleaners in the global robotic vacuum cleaner market simplify pool maintenance by automatically removing dirt, debris, and leaves. These autonomous devices save time and reduce the effort required for cleaning large pools. They efficiently clean pool floors and walls, offering consistent performance, reducing water contamination, and improving water quality, all while conserving energy and enhancing convenience for pool owners.

Cleaning robots have revolutionised the global robotic vacuum cleaner market by providing hands-free cleaning for homes and businesses. Equipped with sensors and advanced navigation technology, they can autonomously clean various surfaces, including carpets, tiles, and hardwood. These robots save consumers time and effort while ensuring a high level of cleanliness, offering convenience and flexibility through features like scheduling and remote control.

Hybrid robots combine the functionality of both vacuuming and mopping, offering versatile cleaning solutions in the global robotic vacuum cleaner market. These devices save time and energy by performing both tasks simultaneously, ensuring a more thorough clean. With advanced sensors and smart technology, hybrid robots effectively clean different floor types, offering consumers a comprehensive solution for maintaining a pristine home with minimal effort.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

In the residential sector, robotic vacuum cleaners offer convenience and efficiency, saving homeowners time and effort. They provide thorough cleaning with minimal supervision, navigating around furniture and tight spaces. Many models come with smart features, such as scheduling and remote control, ensuring a clean home while reducing the physical effort required for daily cleaning tasks.

For commercial spaces, robotic vacuum cleaners enhance cleaning efficiency and reduce labour costs. They can cover large areas with minimal human intervention, ensuring consistent cleanliness in offices, hotels, and retail spaces. With advanced sensors and long battery life, they can operate autonomously, offering a cost-effective solution for businesses looking to maintain a clean environment while saving time and resources.

In industrial settings, robotic vacuum cleaners provide powerful cleaning capabilities to tackle heavy-duty dirt and debris. They help maintain a clean and safe working environment, reducing the risk of accidents and improving productivity. These machines can operate in large, complex spaces with minimal supervision, offering both efficiency and reliability. Their automation reduces the need for manual cleaning, improving overall operational efficiency.

Offline sales in the global robotic vacuum cleaner market offer consumers a hands-on shopping experience, allowing them to see, touch, and test the product before making a purchase. Retail stores provide the advantage of personalised assistance from knowledgeable staff, who can help answer questions and offer expert advice. Immediate availability for purchase and in-person product demonstrations makes offline shopping convenient for customers seeking instant satisfaction. Additionally, physical stores often offer warranties, return policies, and after-sales services that can give buyers confidence and peace of mind when investing in a robotic vacuum cleaner.

Online sales in the global robotic vacuum cleaner market offer the convenience of shopping from home, providing customers access to a wide selection of brands and models. Consumers can compare prices, read detailed product reviews, and explore advanced features in a hassle-free environment. Online platforms often offer discounts, exclusive deals, and promotional offers, which may not be available in physical stores. With home delivery options, customers can conveniently receive their robotic vacuum cleaners without leaving their homes. Moreover, the ability to track shipments and access customer service online enhances the overall shopping experience.

Self-driven robotic vacuum cleaners offer significant advantages in the global market by operating autonomously, requiring minimal user intervention. They are equipped with advanced sensors and smart navigation technology, allowing them to map and clean homes efficiently. These vacuum cleaners can adjust to various floor types, ensuring a thorough clean while avoiding obstacles. With features like scheduled cleaning and automatic recharging, self-driven models save time and provide users with a hassle-free, efficient cleaning solution for their homes.

Remote-controlled robotic vacuum cleaners offer enhanced control and convenience for consumers in the global market. These devices allow users to direct the vacuum cleaner remotely, guiding it to specific areas or cleaning spots that need attention. With the ability to control cleaning schedules, speeds, and settings, users can customise their cleaning experience. Remote-controlled models are ideal for those who want more direct involvement in the cleaning process, ensuring flexibility and targeted cleaning while maintaining efficiency.

The Asia Pacific region benefits from the global robotic vacuum cleaner market due to its large, tech-savvy consumer base and increasing urbanisation. As disposable incomes rise, consumers are seeking convenient, time-saving home appliances like robotic vacuum cleaners. The region's rapid adoption of smart home technology further supports demand. Additionally, with many households having smaller living spaces, robotic vacuum cleaners are ideal for maintaining cleanliness in compact environments, driving growth in both residential and commercial sectors.

In North America, the global robotic vacuum cleaner market benefits from a high level of technological adoption and consumer interest in smart home devices. With a focus on convenience and efficiency, robotic vacuum cleaners are in high demand, particularly in busy households and businesses. The region's growing interest in automation and eco-friendly solutions also contributes to the market's expansion. With access to advanced features like AI and voice control, consumers in North America are driving innovation and increasing market growth.

Europe benefits from the global robotic vacuum cleaner market through a strong emphasis on home automation and sustainability. With a growing number of smart homes and eco-conscious consumers, the demand for robotic vacuum cleaners continues to rise. These devices offer convenience, efficiency, and energy savings, aligning with European preferences for high-quality, environmentally friendly products. Additionally, many European countries face high labour costs, encouraging businesses and consumers to invest in automated cleaning solutions, further boosting market growth in the region.

Latin America benefits from the global robotic vacuum cleaner market as more consumers look for time-saving, efficient cleaning solutions. With an emerging middle class and rising disposable incomes, demand for household appliances like robotic vacuum cleaners is growing. These devices offer increased convenience in both residential and commercial spaces, reducing manual labour. As urbanisation continues, particularly in larger cities, robotic vacuum cleaners become essential for keeping homes and businesses clean with minimal effort, driving market growth in the region.

In Central and South America, the global robotic vacuum cleaner market benefits from the increasing adoption of modern technology in households and businesses. As disposable incomes rise, more consumers are investing in automated solutions for cleaning, valuing the convenience and efficiency these devices offer. Robotic vacuum cleaners are particularly beneficial in urban areas where space is limited, helping to maintain cleanliness with minimal time and effort. The growth of the middle class and a greater interest in smart home technology further supports the market's expansion.

The Middle East and Africa benefit from the global robotic vacuum cleaner market through growing urbanisation, rising disposable incomes, and a demand for time-saving technologies. In both residential and commercial sectors, robotic vacuum cleaners are gaining popularity due to their ability to provide efficient and automated cleaning solutions. The region’s increasing adoption of smart home devices further drives market growth, as consumers seek convenient and effective ways to maintain cleanliness. Additionally, the development of infrastructure and improving access to technology enhance the market’s expansion in the region.

| CAGR 2026-2035 - Market by | Country |

| China | 26.3% |

| UK | 21.8% |

| USA | 21.2% |

| Germany | 19.6% |

| Japan | 16.4% |

| Canada | XX% |

| France | XX% |

| Italy | XX% |

| India | XX% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

The robotic vacuum cleaner market is experiencing growth due to increasing consumer demand for efficient cleaning solutions. Competitive pressures are driving brands to diversify their product lines, incorporating innovative technologies. Key developments, including advancements in artificial intelligence and sensors, are enhancing performance. Companies are also pursuing strategic initiatives to stay ahead, meeting evolving needs and offering superior robotic vacuum cleaners.

March 2025

iRobot launched eight new Roomba models, marking its largest product release. These models introduced lidar navigation and mapping, a feature previously used by competitors. The new range includes vacuum mops with auto-empty docks and dual spinning mopping pads. iRobot revamped the design and added suction power specs, reflecting its strategic response to increasing competition.

January 2025

At CES 2025, Roborock unveiled its AI-powered Saros Series, including the Saros Z70, Saros 10, and Saros 10R. These models feature advanced AI, powerful suction, and innovative designs like the foldable OmniGrip arm. The Z70 is notable for its obstacle-removal capabilities, while the 10R offers powerful suction and smart navigation at a lower cost.

January 2025

At CES 2025, Samsung revealed the Ballie AI, a spherical household robot developed over five years. Designed for home use, it offers features like voice control, smart home integration, and autonomous movement with advanced sensors. Ballie also provides entertainment, fitness support, and pet engagement, positioning itself as a competitor to Amazon’s Astro.

September 2024

Xiaomi announced seven new AIoT products, including the Xiaomi Robot Vacuum X20 Max, X20 Pro, Xiaomi TV Max 100 2025, TV Max 85 2025, Xiaomi Buds 5, Smart Band 9, and the updated Watch 2. These devices aim to enhance home living, personal health, and entertainment with advanced, practical technology.

March 2022

Panasonic launched a powerful tank-type vacuum cleaner in India, designed for the Jammu and Kashmir market. The MC-YL633 model features a 2000W motor, an 18-litre dust tank, and an anti-bacterial filter. It offers high suction, efficient cleaning, and improved air quality, catering to households and commercial spaces.

The robotic vacuum cleaner market has experienced significant revenue growth, driven by evolving industry trends and increasing consumer demand. The market is segmented based on type, application, distribution channel, and region, providing opportunities across global, regional, and country levels. Sub-segments such as residential and commercial applications are emerging, allowing businesses to tap into diverse opportunities. With advancements in technology, the market is poised for further expansion, driven by innovative features and rising demand for efficient cleaning solutions.

Type Outlook (Revenue, Billion, 2026-2035)

Distribution Channel Outlook (Revenue, Billion, 2026-2035)

Operation Outlook (Revenue, Billion, 2026-2035)

Application Outlook (Revenue, Billion, 2026-2035)

Region Outlook (Revenue, Billion, 2026-2035)

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global robotic vacuum cleaner market reached a value of USD 6.96 Billion in 2025.

The market is projected to grow at a CAGR of nearly 23.80% in the forecast period of 2026-2035.

The market is estimated to reach a value of about USD 58.86 Billion by 2035.

Key factors driving market growth include changing lifestyles, higher disposable income, a growing working population, increased purchasing power, and ease of use.

The rising preference of consumers for smart and innovative electrical appliances and advancements in robotic vacuum cleaner technology are expected to be the key trends guiding the growth of the market.

North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa are the leading regions in the market.

The leading types of robotic vacuum cleaner in the market are cleaning robot, hybrid robot, mopping robot, floor vacuum cleaner, and pool vacuum cleaner.

The significant distribution channels for the market are online and offline.

The major operation segments of robotic vacuum cleaners in the market are self-driven and remote-controlled.

The significant applications in the market are commercial, industrial and residential.

The key players in the robotic vacuum cleaner market include iRobot Corporation, Beijing Roborock Technology Co., Ltd., Ecovacs Robotics Co., Ltd., Anker Innovations Limited Technology Co., Ltd., Panasonic Corporation, LG Electronics, Inc., Xiaomi Corporation, SharkNinja Operating LLC, Neato Robotics, Inc., Cecotec Innovaciones S.L., Samsung Electronics Co., Ltd., and Dyson Ltd., among others.

Asia Pacific dominated the robotic vacuum cleaner market. This can be attributed to innovation in the product offerings within the region, along with consumers' willingness to spend on added value and innovative products that simplify daily life.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Distribution Channel |

|

| Breakup by Operation |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share