Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global sapphire glass market value reached around USD 849.46 Million in 2025 due to rising demand for consumer electronics. High-end smartphones like the Apple iPhone use sapphire glass for their screens due to its exceptional scratch resistance. Additionally, technological advancements in manufacturing processes have made sapphire glass more cost-effective and widely available. As a result, the industry is expected to grow at a CAGR of 6.20% during the forecast period of 2026-2035 to attain a value of USD 1550.20 Million by 2035. Product’s expanding use in sectors such as defense and aerospace is expected to further broaden the market's appeal.

Base Year

Historical Period

Forecast Period

Sapphire glass, with a Mohs hardness of 9, is renowned for being the second hardest gemstone after diamond. This exceptional hardness makes it an ideal material for various industries seeking durable and hard-to-crack products. For example, sapphire glass is extensively used in high-end consumer electronics, including smartwatches, where it protects screens from scratches and impacts.

The rising production and sales of smartphones, tablets, and wearables significantly propel the sapphire glass demand. As major brands like Apple and Samsung increasingly adopt sapphire glass in their devices, the market is expected to witness robust growth.

Regionally, the Asia Pacific holds the largest share of the sapphire glass market due to the robust consumer electronics manufacturing capabilities in countries such as China, Japan, and South Korea. With China’s government initiatives aimed at boosting local production capabilities by 25% over the next two years and India’s new state-of-the-art glass processing facilities, the region is poised for significant growth in sapphire glass production and application across various sectors.

Compound Annual Growth Rate

6.2%

Value in USD Million

2026-2035

*this image is indicative*

| Global Sapphire Glass Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical Period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | 849.46 |

| Market Size 2035 | USD Million | 1550.20 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 6.20% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 7.4% |

| CAGR 2026-2035 - Market by Country | India | 7.8% |

| CAGR 2026-2035 - Market by Country | China | 7.3% |

| CAGR 2026-2035 - Market by Raw Material | High Grade Transparency Sapphire Glass | 6.7% |

| CAGR 2026-2035 - Market by Application | Watches | 7.1% |

| Market Share by Country 2025 | Canada | 3.2% |

Sapphire glass is a synthetically manufactured transparent crystal and one of the hardest substances after diamonds. It has high durability, brilliance, and resistance against abrasions and chemicals. The durable property of sapphire glass makes it ideal for the manufacturing of consumer electronic devices that use digital output displays, such as smartphones, tablets, and laptops. It also features high resistance to thermal shock with a melting point of 2030 degrees Celsius, along with a compressive strength of 2000 mega Pascals, which makes it more robust than any stainless steel. Besides, it is also used in the production of watches, bulletproof glass, windows of armoured vehicles, and visors or screens in military body armour suits. These favourable properties of sapphire glass have contributed to sapphire glass demand growth.

Sapphire glass offers good thermal conductivity, high tensile strength, and enhanced optical transparency to a wide range of wavelengths. Sapphire glass has applications in various end-use industries such as ballistic and defence applications. It is also utilised in the manufacturing of bulletproof glass, missile domes, electro-optic and FLIR windows, infrared windows, transparent armour, countermeasure systems, and targeting system components. Moreover, it can also be employed in laser hair removal systems, endoscope lenses, and surgical blades. Increasing adoption of these devices in the medical and healthcare industries is further propelling the growth of the sapphire glass market over the forecast period.

Also, the booming electronics industry is further witnessing an increased utilisation of sapphire glass for the manufacturing of LED screens in various devices such as televisions, mobile phones, laptops, and computer sets. Moreover, the product is being widely adopted in volatile industrial environments that experience harsh conditions, which is prompting the industry players to manufacture more versatile products, such as sapphire glass windows.

Expanding applications in the automotive industries, advancements in production technologies, and increasing demand in consumer electronics are the key trends propelling the market growth.

Advancements in manufacturing technologies are making sapphire glass more accessible and cost-effective. Innovations like the Kyropoulos and Czochralski methods have improved production efficiency, leading to a 20% increase in yield rates for sapphire crystal growth in recent years. These improvements allow manufacturers to produce larger and thinner sapphire substrates, catering to a wider range of applications, such as optical devices and automotive displays. For example, GT Advanced Technologies reported a significant reduction in production costs, enabling them to supply sapphire glass for various industries, thus broadening their client base and resulting in increased sapphire glass market revenue.

The aerospace and defense sectors are increasingly adopting sapphire glass for applications requiring high durability and performance under extreme conditions. In 2024, the use of sapphire glass in aerospace components is expected to grow by 20%, with an estimated 1,200 units using sapphire windows in aircraft and sensor protection systems. The U.S. Air Force has begun integrating sapphire glass into advanced aircraft sensors, after knowing its capability to withstand harsh environments. Furthermore, contracts have been awarded for developing missile guidance systems that use sapphire windows, highlighting its critical role in defense applications.

Recent advancements in manufacturing technologies are making sapphire glass more accessible and cost-effective. In 2024, it is anticipated that production efficiency will allow manufacturers to produce larger sapphire wafers with less waste. For instance, II-VI Optical Systems has implemented a new production line capable of creating wafers up to 300 mm in diameter, compared to the previous maximum of 200 mm. This improvement not only lowers production costs but also enhances the quality of the final products, increase sapphire glass market appeal across various industries.

The market is witnessing significant growth driven by its application in consumer electronics, particularly in smartphones, smartwatches, and other wearable devices due to its superior durability and scratch resistance. In 2024, it is projected that approximately 65% of premium smartphones (around 450 million units) will feature sapphire glass displays, up from 50% (about 350 million units) in 2023. Companies like Apple are expanding their use of sapphire glass; for example, the latest iPhone models are expected to incorporate sapphire glass on camera lenses. This trend in the sapphire glass market has led a broader industry shift as many smartphone manufacturers are now exploring sapphire glass for display covers as well.

Sapphire glass is finding new applications beyond electronics, particularly in industries like healthcare, aerospace, and automotive. In healthcare, its high thermal resistance and durability have led to its use in over 50% of advanced medical imaging devices and surgical instruments. Similarly, in the automotive sector, the integration of sapphire glass in lighting solutions and dashboard displays is gaining traction. As per industry reports, 15% increase in adoption of sapphire glass is expected over the next few years. As the market evolves, manufacturers are likely to invest in research and development to create new products, enhancing their competitiveness and expanding their sapphire glass market share.

Furthermore, in 2024, it is estimated that 35% of new sapphire glass products (approximately 700 million units) will be marketed as eco-friendly. For instance, Kyocera Corporation has announced initiatives aimed at reducing carbon emissions during production by 30%, targeting a reduction from 100 tons to 70 tons per year by implementing renewable energy sources.

One significant opportunity lies in the automotive sector, where the demand for advanced lighting solutions and durable vehicle displays is rising. For instance, with the automotive industry's push towards electric vehicles, manufacturers are exploring sapphire glass for headlamps and touch displays, projected to account for a 25% increase in sapphire glass usage by 2025, translating to a production of estimated 2 million units of sapphire components annually. Furthermore, the burgeoning market for smart and luxury wearables continues to drive sapphire glass market opportunities. Companies like Garmin and TAG Heuer are using sapphire glass in their premium products, with TAG Heuer reporting that over 70% of its watch models feature sapphire glass. Additionally, the healthcare industry is increasingly adopting sapphire glass for medical devices, including surgical instruments and imaging equipment, where its biocompatibility and scratch resistance are critical. Overall, these sectors indicate a robust growth trajectory for the market.

One major restraint is the high production cost associated with sapphire glass compared to conventional glass materials. The manufacturing processes, such as the Czochralski and Kyropoulos method, require significant energy consumption and precision, leading to costs that can be up to three times higher than those for standard glass. For example, a standard tempered glass cover may cost around USD 0.50 to USD 1.00 per unit, while a sapphire glass cover ranges from USD 3.00 to USD 5.00 per unit. This can impact sapphire glass demand forecast in affordable consumer electronics.

Additionally, the brittleness of sapphire glass poses challenges in terms of fragility during manufacturing and transportation, resulting in higher waste rates. Furthermore, the emergence of alternative materials, such as Gorilla Glass and other advanced composites, offers comparable durability at a lower cost, which can deter manufacturers from investing in sapphire glass.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Sapphire Glass Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Application

Market Breakup by Region

| CAGR 2026-2035 - Market by | Region |

| Asia Pacific | 7.4% |

| Middle East and Africa | 6.9% |

| Latin America | 6.5% |

| North America | 6.1% |

| Europe | 5.7% |

Market Insights by Type

High-grade transparency sapphire glass is widely used in applications requiring exceptional optical clarity and high durability, such as luxury watches, optical components, and high-end smartphones. For example, Apple uses high-grade sapphire glass in its Apple Watch models to enhance screen durability and scratch resistance. The segment is also gaining traction in defense and medical equipment, as these industries demand robust materials for optical lenses and protective covers. According to sapphire glass industry analysis, this segment is growing at a CAGR of 6.7%, driven by rising demand in aerospace and semiconductor manufacturing.

| CAGR 2026-2035 - Market by | Raw Material |

| High Grade Transparency Sapphire Glass | 6.7% |

| General Transparency Sapphire Glass | XX% |

In contrast, general transparency sapphire glass is typically employed in industries where the highest level of clarity is not critical, but durability and scratch resistance are still required. This type of sapphire glass finds applications in consumer electronics, such as smartphone camera lenses and biometric scanners. Companies like Huawei and Xiaomi uses general transparency sapphire glass in their camera lenses for added protection. Thus, general transparency sapphire glass demand is growing due to the rising use of sapphire glass in everyday consumer gadgets and automotive displays.

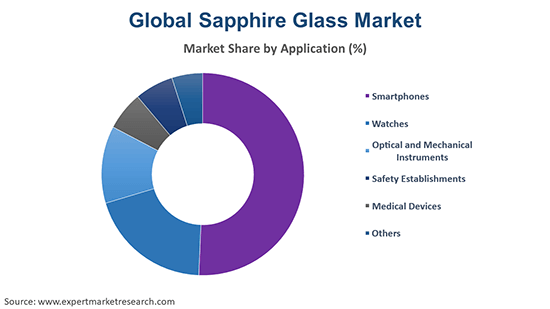

Market Insights by Application

Sapphire glass is extensively used in luxury watches for its scratch-resistant properties and aesthetic appeal. According to sapphire glass market overview, this segment has seen a steady growth rate in historic period and is anticipated to continue growing at a CAGR% of 7.1% in the forecast period. Rising disposable incomes of working and business class in regions like APAC, NA, and Europe have allowed them to afford and purchase high-end watches, like those offered by Apple, Rolex, Omega, Cavalli, and Guess, among others. Some of these brands, namely, Rolex and Omega widely use sapphire glass for the premium watch models.

| CAGR 2026-2035 - Market by | Application |

| Watches | 7.1% |

| Smartphones | 6.6% |

| Medical Devices | 6.4% |

| Optical and Mechanical Instruments | XX% |

| Safety Establishments | XX% |

| Others | XX% |

The smartphone segment is one of the largest markets for sapphire glass, primarily due to its use in high-end devices. Sapphire glass is favoured for its heat and scratch resistance, making it ideal for screens and camera lenses. Over the forecast period, the smartphone segment is expected to grow at a CAGR of 6.6% as several leading smartphone brands (Apple, Xiomi, Samsung, etc.) are planning to incorporate sapphire glass in more affordable models, indicating a potential increase in sapphire glass market share. Moreover, according to a report from the U.S. Department of Commerce, the demand for sapphire glass in smartphones is expected to rise by 15% annually, further improving segment’s growth.

The medical device industry also relies on sapphire glass for its use in equipment such as surgical tools and diagnostic instruments. The product offers high durability and biocompatibility, which is why it is used in endoscopes. According to sapphire glass market report, the use for sapphire glass in medical applications is expected to grow by 6.4% annually, driven by innovations in medical technology, increasing demand for high-performance materials, and ability of sapphire glass to provide a clear view while offering resistant to scratches and chemicals.

North America Sapphire Glass Market Trends

North America is one of the leading markets for sapphire glass, driven by technological advancements and high consumer demand for durable materials in electronics and luxury goods. The regional market is projected to grow at a CAGR of 6.1% annually till the year 2032, largely due to increased applications of sapphire in smartphones and medical devices. Companies like Apple and Corning Inc. are key players in the North American sapphire glass market, and they are investing in advanced sapphire glass manufacturing technologies. Moreover, the United States and Canadian market for sapphire glass is expected to grow at robust CAGR of 6.0% and 3.2%, respectively, demonstrating market’s potential.

| CAGR 2026-2035 - Market by | Country |

| India | 7.8% |

| China | 7.3% |

| Mexico | 6.3% |

| USA | 6.0% |

| UK | 5.9% |

| Canada | XX% |

| Germany | XX% |

| France | XX% |

| Italy | XX% |

| Japan | XX% |

| Australia | 5.5% |

| Saudi Arabia | XX% |

| Brazil | XX% |

Asia Pacific Sapphire Glass Market Drivers

The market for sapphire glass in Asia Pacific is expected to grow at a CAGR of 7.4% from 2024 to 2032, with India and China growing at a CAGR of 7.8% and 7.3%. This growth can be attributed to the rising smartphone penetration and demand for luxury goods in these countries. Moreover, in January 2024, recent government initiatives in China to promote high-tech industries were announced, which include investments in sapphire glass manufacturing. The Chinese government aims to boost local production capabilities by 25% within the next two years, particularly for smartphones. Similarly, in India, Sapphire Tuff (a glass manufacturing company) unveiled a state-of-the-art glass processing plant in Pune in January 2024 to enhance the production of high-quality sapphire glass solutions. Manufacturers like Kyocera and Shenzhen KSTAR Science and Technology Co., Ltd. are also expanding their glass production capacities.

| Market Share by | Country |

| Canada | 3.2% |

| USA | XX% |

| UK | XX% |

Europe Sapphire Glass Market Opportunities

The European market is projected to grow at a CAGR of 5.7% over the next few years, driven by increasing demand for high-quality luxury watches, optical devices, and safety equipment. In EU, the United Kingdom leads the market share and is anticipated to grow at a CAGR of 5.9% annually till 2032. Renowned brands such as Swatch Group and Richemont use sapphire glass extensively in their watch models, contributing to the region's sapphire glass market expansion. Moreover, in March 2023, a consortium of European manufacturers announced a collaborative effort to innovate in sapphire glass production techniques, aiming to enhance sustainability in the manufacturing process. This initiative is expected to reduce the carbon footprint of sapphire glass production by 15% over the next five years.

Middle East and Africa Sapphire Glass Market Growth

The Middle East and Africa region represents a niche market for sapphire glass and is expected to grow at a CAGR of 6.9% through 2032, largely influenced by rising demand in the construction and automotive sectors. Sapphire glass is increasingly being used in safety eyewear and protective gear offered by companies like Alcon and Luxottica. Moreover, the UAE government is focused on increasing the use of high-tech materials in construction and defence sector. This has also led to funding for research and development in sapphire glass technologies.

Start-ups are developing cost-effective manufacturing processes to lower production costs and enhance yield, making sapphire glass more competitive against alternative materials, such as gorilla glass. Additionally, start-ups are exploring niche applications in sectors like automotive, healthcare, and luxury consumer electronics, leveraging the material's many properties. Some are also investing in research and development to create advanced coatings and enhancements, such as anti-reflective and self-cleaning surfaces, to meet specific industry demands. Some start-ups that have worked towards sapphire glass market development are:

Sapphire Glass Technologies, Inc., established in 2015 and based in Texas, United States, focuses on the production of high-quality sapphire glass products for consumer electronics and optical markets. The company aims to meet the increasing demand for durable, scratch-resistant materials in smart devices, wearables, and specialty optical applications. It has experienced a 200% increase in revenue year-over-year since its founding and has secured contracts with major electronics manufacturers like Samsung and Sony. Their production capacity has expanded to over 500,000 square inches of sapphire glass substrates annually, which has significantly impacted sapphire glass industry revenue.

Crystal IS, Inc., founded in 2006 and headquartered in New York, United States, specialises in the development and manufacturing of advanced ultraviolet (UV) light-emitting diode (LED) technology and sapphire substrates. The company focuses on providing custom sapphire substrate fabrication, UV-LED solutions for water and air disinfection, and technical support for integrating UV technology into existing systems. The company has achieved over USD 30 million in funding to expand its UV-LED technology. The company’s products have been used in over 150 installations worldwide for municipal water treatment and industrial applications.

Sapphire glass market outlook seems to be positive as companies like Apple and Samsung are leveraging sapphire glass in their premium devices, such as the Apple Watch; manufacturers like GT Advanced Technologies are expanding their production capacities to meet the growing demand from various sectors, including consumer electronics and automotive industries; and organisations such as Kyocera are investing in cutting-edge manufacturing processes to lower production costs and improve the quality of sapphire glass. They are also exploring partnerships with tech firms to integrate sapphire glass into new applications. This enables them to offer competitive pricing while maintaining high standards. The luxury watch segment is another focus for market players.

KYOCERA Corporation, founded in 1959 and based in Kyoto, Japan, is a Japanese multinational specialising in ceramics and electronics. Initially established as Kyoto Ceramic Company, it has diversified its offerings to include solar power systems, telecommunications equipment, and electronic components.

Rayotek Scientific Inc., another key player in sapphire glass market, was founded in 1992 and is headquartered in California, United States. Initially established as a research and development firm, it is now a full-service manufacturer specialising in precision sapphire, glass, fused quartz, and fused silica products for aerospace, defense, and telecommunications industries.

Rubicon Technology Inc. (acquired by Specialty Optical Systems, Inc) was founded in 2002 and based in Illinois, United States. It is a semiconductor materials and device manufacturing company that produces monocrystalline sapphire products, which are essential for LED lighting and consumer electronics like smartphone camera lens covers.

SCHOTT North America, Inc. is a subsidiary of SCHOTT AG, which was founded in 1884. Based in Pennsylvania, United States, the company is a leader in speciality glass and glass-ceramics. The company produces optical components and packaging solutions for healthcare, electronics, and automotive industries.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other sapphire glass market players include Monocrystal, Precision Sapphire Technologies, Ltd, STC, Saint Gobain SA, Crystran Ltd., and Crystalwise Technology Inc., among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 849.46 Million.

The sapphire glass market is assessed to grow at a CAGR of 6.20% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 1550.20 Million by 2035.

The major drivers of the market are rising disposable incomes, thriving electronics industry, and growing demand from medical and healthcare sectors.

The rising adoption of sapphire glass in volatile industrial environments that experience harsh conditions and increasing use in the manufacture of LED screens for televisions, mobile phones, laptops, and computers, are major trends of the market.

The major regions in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

General transparency sapphire glass and high grade transparency sapphire glass are the various types of sapphire glass in the market.

Smartphones, watches, optical and mechanical instruments, safety establishments, and medical devices, among others, are the various applications of sapphire glass in the market.

The key players in the global sapphire glass market are KYOCERA Corporation, Rayotek Scientific Inc., Rubicon Technology Inc., Monocrystal, SCHOTT North America, Inc., Precision Sapphire Technologies, Ltd, STC, Saint Gobain SA, Crystran Ltd., and Crystalwise Technology Inc., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share