Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Saudi Arabia construction equipment market size attained a value of USD 1.52 Billion in 2025. The market is further expected to grow at a CAGR of 4.30% between 2026 and 2035 to reach a value of almost USD 2.32 Billion by 2035.

Base Year

Historical Period

Forecast Period

As per the Ministry of Municipal and Rural Affairs analysis, 138,114 construction sector companies operate in the country.

The Ministry of Industry and Mineral Resources predicted that higher investment in mining, will yield a USD 47 billion GDP and employment by 219,000.

Currently, 71,500 kilometres of road infrastructure exist in Saudi Arabia.

Compound Annual Growth Rate

4.3%

Value in USD Billion

2026-2035

*this image is indicative*

Construction equipment encompasses machinery, tools, and apparatus intended for utilisation in construction tasks. This category includes excavators, cranes, loaders, and dump trucks, among other devices, which carry out various construction functions such as excavation, digging, levelling, and hauling.

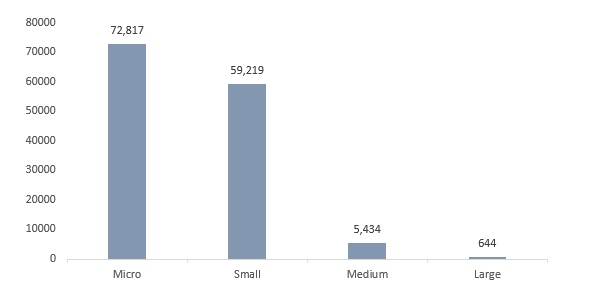

Saudi Arabia's Vision 2030 initiative is geared towards facilitating access to affordable housing for underserved communities. Consequently, the demand for construction equipment in Saudi Arabia is bolstered by a growing emphasis on improving the efficiency, productivity, and cost-effectiveness of residential construction endeavours. According to a sector analysis conducted by the Ministry of Municipal and Rural Affairs (MOMRA), 138,114 companies are operating within the construction sector which is boosting the construction equipment market in Saudi Arabia.

CATEGORY-WISE DISTRIBUTION OF COMPANIES IN CONSTRUCTION SECTOR

The Saudi Arabia construction equipment market growth is enhanced by infrastructure development, cutting-edge equipment and automated machinery, and rising investment in the mining sector.

Saudi Arabia's Vision 2030, including the National Transformation Program, aims to enhance infrastructure and foster a conducive environment for all sectors- public, private, and non-profit, elevating demand for construction equipment. In 2023, the nation ranked 34th in the infrastructure field in the Global Competitiveness Report.

Advanced equipment and automated machinery, coupled with technologies such as the Internet of Things (IoT), are increasingly being embraced. These innovations enable real-time data collection, minimise downtime, cut operational expenses, and enhance construction efficiency, propelling the Saudi Arabia construction equipment market growth.

Heightened investment in the mining sector aims to excavate metals and minerals, projecting a sector GDP impact of USD 47 billion and the creation of 219,000 jobs. Additionally, it will develop remote regions, generating 40,000 jobs by 2030, according to the Ministry of Industry and Mineral Resource, consequently increasing the utilisation of construction equipment.

Innovations such as telematics, automation, robotics, and advanced vision systems are poised to augment construction machinery capabilities and enhance operational efficiency, potentially driving demand for construction equipment in the forecast period.

Infrastructure development involves various commercial and residential projects such as constructing complexes, offices, and societies, alongside expanding airports, roads, and ports. This development is fuelled by rapid urbanisation, prompting increased government spending on infrastructure for dams, bridges, metro stations, and more. Such activities are vital for enhancing connectivity and fostering sustainable growth, consequently driving up demand for construction equipment.

Moreover, there has been significant growth in the tourism sector, marked by considerable infrastructure construction in Makkah, Madinah, Riyadh, and Jeddah to cater to the increasing influx of tourists, boosting the construction equipment market in Saudi Arabia.

Saudi Arabia Construction Equipment Market Report and Forecast 2026-2035offers a detailed analysis of the market based on the following segments:

Market Breakup by Machinery Type

Market Breakup by Propulsion Type

Market Breakup by End-Use

Material handling machinery holds a considerable portion of the Saudi Arabia construction equipment market share, driven by demand for cranes and other equipment for heavy lifting and material transport.

Forklifts facilitate the efficient storage, retrieval, and arrangement of goods, playing a vital role in transporting heavy construction materials and equipment. Telescopic handlers are utilised on construction sites to elevate heavy construction materials to higher floors or areas that are otherwise difficult to reach.

As per the Saudi Arabia construction equipment market analysis, earth-moving machinery, like dump trucks, finds wide application in heavy-duty tasks such as mining, quarrying, excavation, roadwork, and demolition. Excavators, popular in this category, boast components including a bucket, arm, rotating cab, and movable tracks, enabling diverse functions like trenching, hole digging, and waste removal.

Concrete and road construction machinery, like concrete mixers, pavers, and construction pumps, enhance processes traditionally reliant on manual labour.

Internal combustion engines (ICE) are predominant in the Saudi Arabia construction equipment market, primarily due to their high-power output and excellent mobility characteristics.

The integration of electric propulsion in construction equipment contributes to sustainability efforts, offering enhanced manoeuvrability and increased redundancy. Additionally, it delivers environmental advantages by reducing fuel consumption and emissions.

LNG serves as a cost-effective and environmentally sustainable alternative to oil-based systems for businesses prioritizing cost efficiency and sustainability.

Construction and infrastructure sectors lead the developments in the Saudi Arabia construction equipment market, driven by the objectives outlined in the Vision 2023 initiative of the kingdom.

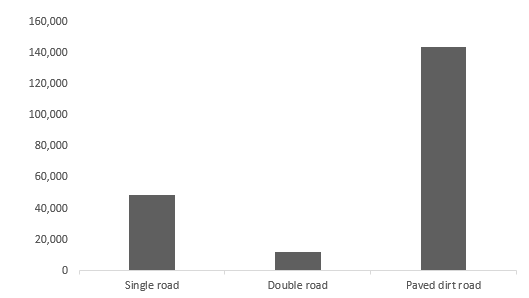

As per the Ministry of Transportation, 71,500 kilometres of roads currently exists in Saudi Arabia, that are designed to meet international standards, linking major cities, and allowing for potential expansion to accommodate anticipated heavy traffic.

DEVELOPING ROADS IN SAUDI ARABIA, 2023, IN KM

The competitiveness in Saudi Arabia construction equipment market arises from growing tourism, technological advancement, infrastructure development, and the growing oil and gas sector.

AB Volvo was established in 1927 and headquartered in Gothenburg, Sweden, and is a multinational producer of construction machinery. Additionally, the company manufactures a variety of vehicles, including buses, trucks, as well as industrial and marine engines, among other products.

Caterpillar Inc. was founded in 1925 and is a construction equipment corporation headquartered in Texas, USA. The company’s range of offerings encompasses engines, excavators, dozers, backhoe loaders, generators, and various other products.

Sumitomo Construction Machinery Co. Ltd. Was established in 1968 and is headquartered in China. The company specializes in the development and production of hydraulic excavators, road paving machines, and road rollers.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the Saudi Arabia construction equipment market report include CNH Industrial N.V., Komatsu Middle East, Doosan Corporation, Manitowoc Company Inc., Kobelco Construction Machinery Co, Ltd, and Xuzhou Construction Machinery Group Co., Ltd., among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The construction equipment market is projected to grow at a CAGR of 4.30% between 2026 and 2035.

The revenue generated from the market is expected to reach USD 2.32 Billion in 2035.

The key factors driving the market are infrastructure development, rising investment in the mining sector, and technological advancements.

Based on the machinery the market is bifurcated into earth-moving machinery, material handling machinery, and concrete and road construction machinery.

Based on propulsion the construction equipment market it is bifurcated into ICE, electric, and CNG/LNG.

Based on end-use, the market it is divided into oil and gas, construction and infrastructure, manufacturing, and mining, among others.

Key players in the market are AB Volvo, Hitachi Construction Machinery Middle East Corporation, Caterpillar Inc., Sumitomo Construction Machinery Co., Ltd., CNH Industrial N.V., Komatsu Middle East, Doosan Corporation, Manitowoc Company Inc., Kobelco Construction Machinery Co., Ltd among others.

Construction equipment serves an essential role in the construction industry due to its ability to deliver the required power, speed, and accuracy, enabling the completion of intricate tasks safely and efficiently.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Machinery Type |

|

| Breakup by Propulsion Type |

|

| Breakup by End-Use |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share