Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global SCADA market was valued at USD 25.68 Billion in 2025. The industry is expected to grow at a CAGR of 6.00% during the forecast period of 2026-2035 to reach a value of USD 45.99 Billion by 2035.

The Supervisory Control and Data Acquisition (SCADA) market is undergoing massive evolution as industrial digitisation deepens across critical infrastructure. From predictive maintenance to remote diagnostics, SCADA systems are now being tailored with edge intelligence, adaptive protocols, and cybersecurity-first frameworks. The global market is being reshaped by Industry 4.0 initiatives and regulatory compliance pressures and power grid vulnerabilities. For example, the U.S. Department of Energy allocated USD 70 million in 2024 for grid modernisation which also included SCADA-integrated microgrid projects. Meanwhile, India’s National Smart Grid Mission continues to deploy SCADA systems.

The SCADA market growth is supported by accelerated automation in sectors like utilities, energy, and manufacturing. A key development has been Europe's push for interoperable SCADA software under the Horizon Europe programme, supporting open-source platforms for water and wastewater monitoring.

As OT-IT convergence tightens, SCADA architectures are being redesigned for compatibility with digital twins and IoT ecosystems. Emerging players in the SCADA market are also entering niche segments such as low-power systems for remote mining applications. With governments encouraging secure-by-design infrastructure, market participants are compelled to embed multi-layer encryption and anomaly detection into even basic SCADA modules.

Base Year

Historical Period

Forecast Period

According to the United States Department of Energy, modernizing grid infrastructure, including SCADA systems, supports an annual investment of USD 18 billion in smarter energy networks. An upgrade of SCADA systems would allow utilities to improve real-time monitoring, predictive maintenance, and energy efficiency, enhance grid resilience, and reduce downtime, thus boosting the SCADA market growth.

The growing adoption of cloud-based SCADA systems is the main driver in the market, as they are able to provide remote monitoring, real-time data access, and scalability. These systems enable businesses to manage multiple sites from a central location, reduce infrastructure costs, and enhance flexibility, leading to wider SCADA adoption across industries like energy, manufacturing, and utilities.

Energy, manufacturing, and utility industries need real-time information to improve their operational effectiveness and decision-making. Actionable insights into operations from SCADA systems enable businesses to optimize processes, reduce time spent on downtime, and improve both safety and performance. Hence, the SCADA market is growing with the demands for operational efficiency.

Compound Annual Growth Rate

6%

Value in USD Billion

2026-2035

*this image is indicative*

AI integration into SCADA is revolutionising industrial plant maintenance. Predictive algorithms embedded in SCADA dashboards now forecast equipment failures before they occur. Recently, Red Hat, Inc. announced that Siemens has enhanced the availability, performance, and security posture of mission-critical applications at its Amberg production facility by utilising Red Hat OpenShift, which involves SCADA features. Governments are boosting this particular SCADA market trend. For instance, Germany’s "Industrie 4.0" platform incentivises predictive analytics. These systems not only reduce maintenance costs but also reduce safety incidents. In oil fields, AI-powered SCADA predicts pipeline corrosion patterns, mitigating major spills. This AI feature has become a procurement priority for utilities and manufacturing plants seeking reduced unplanned downtimes and real-time operational efficiency without human intervention.

Cyberattacks on operational technologies are pushing SCADA vendors to embed zero-trust models. The United States CISA released updated SCADA-specific security guidelines that mandate encrypted communication, multifactor authentication, and role-based accessibility. Schneider Electric introduced a zero-trust-ready SCADA suite that auto-isolates compromised nodes. SCADA networks are now being increasingly integrated into cloud-based or hybrid systems, making endpoint security non-negotiable. Real-time packet inspection and anomaly mapping are increasingly built into the SCADA platform rather than as add-ons.

Edge SCADA is enabling near-instantaneous data processing in geographically isolated environments. Companies in the SCADA market like Emerson are deploying modular edge kits at remote oil rigs and hydropower dams, reducing latency by a significant extent. This is crucial in places like Canada’s Yukon or India’s Ladakh, where connectivity is patchy. Edge SCADA systems also come with in-built local analytics, allowing plants to function autonomously during network outages.

Containerised SCADA environments are gaining popularity due to their ease of deployment and scaling, boosting the overall SCADA market development. Companies like Rockwell Automation are launching virtual SCADA modules hosted via Red Hat OpenShift. These setups simplify software patching, version control, and horizontal scaling. As more SCADA environments are moved to hybrid clouds, virtualisation ensures faster recovery and seamless integration with DevOps pipelines. EU-funded initiatives are piloting containerised SCADA in municipal water systems to lower operational overheads.

SCADA-as-a-Service is emerging as a disruptor, particularly among mid-tier manufacturers and utilities. Cloud-native SCADA platforms like Inductive Automation’s Ignition Cloud Edition allow users to scale licenses flexibly and access real-time plant data via browser or app. These SaaS models are gaining traction in the Asia Pacific, with Japan’s Ministry of Economy launching cloud SCADA pilots in wastewater facilities. The shift removes upfront infrastructure costs and simplifies integration with third-party AI tools. Subscription-based SCADA also offers regular security patching and auto-updates, making it a preferred option in cyber-sensitive applications like pharmaceuticals.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global SCADA Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Component

Key Insight: All component categories are experiencing specialised advancements. PLCs dominate the SCADA market due to their modular design and reliability. RTUs are preferred in remote locations for telemetry and control. HMI is gaining traction via intelligent visualisation features. Communication systems are integrating LoRaWAN and 5G for better field connectivity. Each component is being optimised for specific industry demands, be it cybersecurity, remote access, or predictive analytics.

Market Breakup by Application

Key Insight: Software has gained popularity in the SCADA market, for they enable scalability and remote operability. Hardware like PLCs and RTUs continue to be foundational while being enhanced with digital overlays. Services are becoming crucial for seamless integration, cybersecurity, and workforce training. The synergy between these elements determines the system’s robustness and agility.

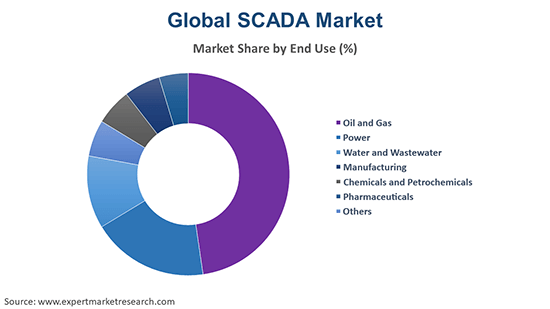

Market Breakup by End Use

Key Insight: The power segment currently dominates the SCADA market due to safety and uptime needs. Water utilities are rapidly growing their market shares with digitalisation mandates. The manufacturing segment uses SCADA for process optimisation and quality control. Chemicals and pharmaceuticals adopt SCADA to meet compliance and traceability requirements. Others, like mining or transportation, deploy SCADA for asset visibility. Each end-use case comes with unique integration, latency, and analytics challenges, which vendors are addressing with tailored offerings and vertical-specific modules.

Market Breakup by Region

Key Insight: North America leads the global SCADA market which technology advancements and policy support. Europe focuses on sustainability and interoperability. Asia Pacific surges on infrastructure growth and government support. Latin America and the Middle East are integrating SCADA in energy and water sectors to counter inefficiencies. Africa, while underserved, is witnessing donor-supported SCADA pilots projects for water utilities. Each region is aligning SCADA deployments with its unique socio-economic goals, making regional strategies crucial for vendor success.

By Component, Programmable Logic Controllers (PLC) Register a Significant Share of the Market

Programmable Logic Controllers (PLC) continue to hold the dominant share of the SCADA market revenue due to their reliability and compatibility with legacy systems. They are extensively used across energy, water, and industrial automation for real-time process control. Modern PLCs now support MQTT and OPC UA, enabling smoother IoT integration. ABB and Mitsubishi Electric have launched PLCs embedded with diagnostic feedback loops and integrated edge processing capabilities. Their versatility makes them indispensable in hybrid architectures.

Human Machine Interface (HMI) panels are transitioning from static dashboards to intelligent interfaces with drag-and-drop configurability, real-time alerts, and voice control, boosting the SCADA market opportunities. The demand is surging due to user-centric SCADA deployments in smart factories and energy monitoring stations. Startups are innovating with gesture-enabled HMIs and augmented reality overlays. These interfaces offer a simplified UX for complex data, driving faster operator response.

By Architecture, the Software Segment Accounts for the Major Share of the Market

Software systems are dominating the global SCADA industry revenue as customisation and interoperability become critical for businesses. Modern SCADA software now integrates AI modules, KPI dashboards, and asset management suites. Vendors like Seimens are developing low-code interfaces and unified HMI-SCADA platforms to simplify operations. For instance, AVEVA’s System Platform is being widely adopted for its model-driven architecture and real-time contextualisation. Software has also become central to cybersecurity, with behavioural anomaly detection and digital signature tracking becoming a critical necessity.

Services are largely contributing to the accelerated SCADA demand due to the complexity of deployment and maintenance. From custom integration to lifecycle management, businesses increasingly rely on vendors for technical support and cybersecurity audits. Predictive maintenance-as-a-service and cloud migration services are particularly in demand. Vendors are also offering training modules and 24/7 managed services.

By End Use, the Power Segment Occupies a Substantial Share of the Market

The power sector dominates the market with massive SCADA adoption due to its need for real-time grid monitoring, fault detection, and automated load balancing. Utilities globally are integrating SCADA with renewable energy systems for dynamic grid optimisation. For example, the United States National Grid deployed an upgraded SCADA network to balance distributed energy inputs. Advanced Distribution Management Systems (ADMS) now run over SCADA frameworks to manage microgrids and DERs. As blackout risks rise and EV charging loads surge, companies are deploying SCADA for scenario simulation and remote rectification.

The water and wastewater segment is modernising with SCADA to handle ageing infrastructure, leak detection, and real-time quality monitoring. Post-pandemic recovery funds in the European Union and United States have been channelled into digital water infrastructure, accelerating the SCADA market growth. Smart sensors tied can now measure turbidity, pH, and chemical dosing remotely. Cities like Singapore and Amsterdam are piloting SCADA-linked AI models for predicting water demand and preventing overflows. The push towards smart water grids is making SCADA indispensable in ensuring compliance, sustainability, and 24/7 operational visibility.

By Region, North America Holds the Leading Position in the Market

North America dominates the global SCADA market owing to its advanced infrastructure, regulatory frameworks, and heavy investments in industrial cybersecurity. Government initiatives like the Smart Grid Investment Grant and infrastructure law-backed funding have catalysed SCADA deployments in power and water sectors. Canada’s push for decentralised energy also fuels demand for modular SCADA solutions. Vendor innovation in cloud-native and mobile-first SCADA interfaces further boosts market maturity in this region.

The explosive growth of the Asia Pacific SCADA market is driven by industrial automation in China, India, and Southeast Asia. Urbanisation, smart city rollouts, and national digitalisation agendas are making SCADA increasingly popular. India’s National Smart Cities Mission and China’s Made in China 2025 initiative both prioritise SCADA as foundational technology. Japanese and South Korean firms are embedding SCADA in advanced robotics and semiconductor fabs. The region's cost-sensitive market is also giving rise to open-source SCADA and pay-as-you-go models, democratising access and spurring local innovation.

The SCADA market players like Siemens, Schneider Electric, Emerson, and Honeywell are diversifying portfolios through partnerships with AI firms and cloud providers. The market is seeing increased investment in secure-by-design architecture, real-time visualisation, and edge deployments. Startups are disrupting with modular, open-source platforms targeting underserved regions. Strategic areas include predictive maintenance, SCADA virtualisation, and cybersecurity compliance.

Government contracts remain a vital revenue stream for SCADA companies, particularly in utilities and transport. M&As are rising, as key players acquire niche firms for analytics or cloud-native SCADA capabilities. Vendor focus is shifting towards delivering holistic operational intelligence over mere control systems. AI integration, zero-trust security, edge deployments, SCADA-as-a-Service, and containerisation are redefining system architecture and operational efficiency, offering scalable, secure, and remote-ready control for modern industrial landscape.

Founded in 1890, Emerson Electric Co is an American company that designs and manufactures goods for a number of sectors, including industrial, commercial, and consumer, among others. Commercial, residential solutions and automation solutions are the major business platforms of the company. Moreover, the company actively invests in innovation and research to advance its automation solutions, industrial software solutions, and environmentally sustainable technologies through Emerson Venture.

Founded in 1836, and based in France, Schneider Electric is a leading player in digital transformation of management and energy automation. The company aims to integrate leading energy and process technologies to realise the sustainability and full efficiency.

Founded in 1987, Siemens AG is a global company headquartered in Munich, Germany, with operations throughout the globe. The company focuses on transport, infrastructure, and advanced healthcare. The company owns a majority stake in Siemens Healthineers and a minority stake in Siemens Energy.

The General Electric Company (GE) is a global American corporation with headquarters in Boston, Massachusetts. The company offers its services and products in the power, aviation, healthcare, and renewable energy sectors. Its technology is used by 90% of power transmission facilities and about one-third of overall power is created by the company. The company, along with its partners, powers the largest base of about 38,000 commercial aircraft engines.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market are ABB Ltd. and Rockwell Automation, Inc., among others. among others.

Explore the latest trends shaping the SCADA Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on SCADA Market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the SCADA market reached an approximate value of USD 25.68 Billion.

The market is projected to grow at a CAGR of 6.00% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 45.99 Billion by 2035.

Key strategies driving the market include customising SCADA for verticals, investing in AI-driven modules, training OT-IT teams, partnering with cybersecurity firms, and offering modular pricing to penetrate emerging markets while meeting compliance requirements.

The growing use of the system in the rising grid automation ventures in emerging economies is the major trend expected to drive the market growth.

The major regions in the market are North America, the Asia Pacific, Europe, Latin America, and the Middle East and Africa.

The major components in the market are programmable logic controller (PLC), remote terminal units (RTU), human machine interface (HMI), and communication systems, among others.

The various architecture segments considered in the market report are hardware, software, and services.

The several end uses of SCADA are oil and gas, power, water and wastewater, manufacturing, chemicals and petrochemicals, and pharmaceuticals, among others.

The major players in the market are ABB Ltd., Emerson Electric Co, Schneider Electric, Rockwell Automation, Inc., Siemens AG, and General Electric Company, among others.

The key challenges are legacy system integration, evolving cyber threats, and shortage of skilled technicians make SCADA modernisation complex.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Component |

|

| Breakup by Architecture |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share