Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global software-defined networking (SDN) market size attained a value of USD 30.08 Billion in 2025. The industry is expected to grow at a CAGR of 19.00% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 171.30 Billion.

The software-defined networking technology is a network management strategy that allows dynamic and programmatically effective network setup to enhance network performance and tracking, making it more like cloud computing than traditional network management.

The incumbent IT substructure is under pressure to configure systems while complying with standards and norms robustly. SDN is rising as one of the most promising and lucrative networking technologies capable of enabling virtualisation and innovation of the network, addressing most of the ongoing networking issues, which in turn has resulted in favourable software-defined networking (SDN) market outlook.

Moreover, the increasing demand for cloud services, data center consolidation, network virtualisation, and mobility are factors driving software-defined networking (SDN) market growth. The adoption of SDN can help enterprises reduce operational and capital expenditures, improve network agility and flexibility, and support emerging technologies such as Internet of Things (IoT), artificial intelligence (AI), and 5G.

Base Year

Historical Period

Forecast Period

According to software-defined networking (SDN) market statistics, the SDN market is expected to reach over USD 60 billion by 2028.

With a market share of 31.19 percent in November 2023, Google Drive was the market leader for file sharing software. Dropbox, based in San Francisco, came in second with a share of 18.61 percent.

With over 300 locations, California has the highest concentration of data centres in the United States.

Compound Annual Growth Rate

19%

Value in USD Billion

2026-2035

*this image is indicative*

Cloud computing requires responsive and scalable network infrastructure that can support dynamic workloads and high data traffic. SDN enables cloud service providers to optimise network performance, reduce operational costs, and enhance data security. Amazon Web Services is investing billions in Asia-Pacific cloud regions (Australia, Taiwan), aiming to support growing AI workloads. This expansion underscores the need for responsive SDN systems to manage dynamic network traffic, thus boosting the demand of the software-defined networking (SDN) market.

5G and IoT are expected to generate massive amounts of data and increase network complexity and heterogeneity. SDN can facilitate the management of diverse network resources and devices and enable faster service delivery. As modern networks become more heterogeneous and data-intensive, traditional networking approaches struggle to keep pace with the complexity and scale. SDN, by separating the control and data planes, offers centralized network management, programmability, and flexibility—making it a critical solution for managing next-generation network demands.

Network automation and programmability can improve network efficiency, reduce human errors, and manual interventions. software-defined networking (SDN) market allows network operators to configure, monitor, and control network behaviour through software applications. Across the enterprise and cloud sectors, AI and ML integration continues to transform SDN, automating tasks like traffic analysis, anomaly detection, and predictive optimization—enabling networks to self-adjust for improved performance and reduced manual intervention. Meanwhile, 5G and edge computing deployments are amplifying SDN’s importance.

SD-WAN is a subset of SDN that applies SDN principles to wide area networks (WANs), which connect geographically dispersed locations and enterprises. SD-WAN can offer cost-effective, secure, and high-performance connectivity across multiple WAN links and service providers. This has become increasingly critical as organizations adopt cloud-native applications and support remote workforces. Asia-Pacific is witnessing some of the fastest adoption rates in the software-defined networking (SDN) market, driven by expanding IT infrastructure, the rollout of 5G, and widespread digital transformation across enterprises.

SDN environments often involve integration with various virtualized and cloud-based systems, which increases complexity and potential exposure to threats such as Distributed Denial of Service (DDoS) attacks, man-in-the-middle attacks, and unauthorized access. As networks become more programmable and automated, the risk of misconfigurations and insider threats also rises. These challenges are compelling organizations to invest in advanced security solutions tailored for SDN, such as dynamic threat detection, real-time analytics, and AI-driven policy enforcement.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Software-Defined Networking (SDN) Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insight: Open SDN, driven by open-source controllers like OpenDaylight and ONOS, is gaining traction for its ability to offer high customizability and vendor-neutral frameworks. It is especially relevant to organizations looking to reduce costs and avoid vendor lock-in. Adoption is strong in academic, research, and government sectors, as well as enterprises seeking greater control over network infrastructure and more rapid innovation through open standards.

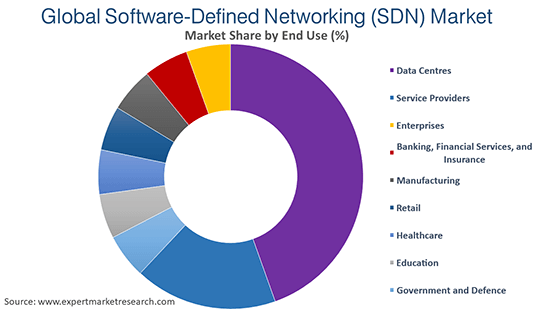

Market Breakup by End Use

Key Insight: The data centre segment accounted for the largest software-defined networking (SDN) market share in the historical period and is expected to maintain its dominance over the forecast period. Data centres are one of the major end-users of SDN, as they require efficient network management, scalability, flexibility, and security. SDN enables data centre operators to optimise their network resources, automate network provisioning and configuration, reduce operational costs, and enhance performance. The growing adoption of cloud computing, big data analytics, and artificial intelligence (AI) in various industries is driving the demand for SDN in data centres.

Market Breakup by Region

Key Insight: North American region accounts for a significant software-defined networking (SDN) market share due to the presence of major players such as Cisco, VMware, IBM, and Juniper Networks, along with the high adoption of cloud computing, big data analytics, and Internet of Things (IoT) among various industries. The U.S. Department of Defense alone invested more than USD 1.3 billion in software-centric networking projects, forging demand for secure, programmable fabrics in classified environments. Start-up density around Silicon Valley, Austin, and Toronto accelerates controller innovation, while open-source stewardship by the Linux Foundation fosters multivendor interoperability.

SDN via API and Overlay Occupy a Large Share in the Market

SDN via API is widely adopted by enterprises leveraging existing hardware while integrating programmable features. This model allows for gradual SDN implementation without overhauling the entire network architecture. It is particularly useful for telecom providers and large-scale enterprises that require centralized control while maintaining interoperability with legacy systems. Its relevance is growing due to the need for flexible, scalable networks supporting IoT and cloud computing, thereby supporting the growth of the software-defined networking (SDN) market.

SDN via overlay is popular in data centers and cloud environments, where virtual networks are layered over physical infrastructure. This approach enables rapid provisioning, multi-tenancy, and network abstraction, making it ideal for service providers and cloud-native businesses. Its growth is being fueled by demand for agile networking solutions in virtualized environments, especially where physical network changes are cost-prohibitive or complex.

Rising Adoption of SDN in BFSI and Manufacturing Sectors Driving Market Growth

The BFSI sector is another key end-user in the SDN market, as it requires high-speed, reliable, and secure network connectivity to support its operations. SDN helps BFSI institutions to improve their network security, comply with regulatory standards, and fulfil customer expectations. SDN also enables BFSI institutions to offer innovative services and products, such as mobile banking, online banking, digital payments, and fintech solutions. As per the software-defined networking (SDN) market report, the BFSI segment will register a high CAGR in the future due to the increasing digitisation and transformation of the banking industry.

The manufacturing sector is also adopting SDN solutions to enhance its network performance, productivity, and competitiveness. SDN enables manufacturers to integrate their network infrastructure with their industrial systems, such as production lines, machines, sensors, and robots. SDN also facilitates the implementation of Industry 4.0 concepts, such as smart factories, internet of things (IoT), and edge computing, which require dynamic and scalable network connectivity.

Asia Pacific Leads SDN Growth While MEA Shows Emerging Potential

Asia Pacific is expected to be the fastest-growing software-defined networking (SDN) market during the forecast period, due to the increasing demand for bandwidth, mobility, and cloud services among the emerging economies such as China, India, Japan, and South Korea. The region is also witnessing a rapid growth of data centres, telecom operators, and cloud service providers, which are driving the adoption of SDN solutions to optimise their network performance and reduce operational costs.

The demand for SDN in Middle East and Africa region is expected to show moderate growth. Even if the awareness and adoption of SDN solutions are low compared to other regions, the growing investments in digital transformation, smart cities, and e-commerce sectors are creating opportunities for the SDN vendors to expand their presence and offer customised solutions to meet the specific needs of the regional customers.

Major SDN vendors are aggressively integrating AI, automation, and open interfaces into their solutions, enabling more flexible, programmable networks. They are forming strategic alliances and acquiring niche players to accelerate innovation and expand their portfolios. These efforts aim to attract cloud operators, telcos, and large enterprises migrating toward software-defined architectures that demand agility, visibility, and centralized management.

Simultaneously, companies are enhancing hardware–software synergy by adopting open APIs, supporting hybrid deployments, and emphasizing interoperability. They are investing heavily in research and development to drive advanced use cases in AI workloads, edge computing, and SASE. This positions SDN providers as key enablers of digital transformation and future network infrastructures.

Arista focuses on high-performance data center and cloud networking, integrating SDN through its EOS operating system and open architecture. The company champions standards like VXLAN and NV GRE, collaborates across ecosystems, and positions Ethernet as essential for AI-ready infrastructure. Recognized for strong execution and AI-forward strategies, Arista continues expanding its reach in hyperscaler and enterprise segments.

Cisco leads in programmable networking by offering SDN-enabled switches, routers, and controllers, strengthened by strategic partnerships and acquisitions. It emphasizes hybrid cloud, AI-ready fabrics, and SASE, serving enterprise and service provider clients globally. Cisco leverages deep expertise in networking, security, and collaboration to support customers navigating digital transformation and evolving network demands.

Huawei holds a strong position in SD-WAN and SDN through its comprehensive networking portfolio and extensive global reach. Backed by a vision-centric strategy, Huawei focuses on edge-to-cloud SDN deployments, particularly in emerging markets. It continues investing in R&D to advance programmable networking solutions amid geopolitical challenges and shifting competitive dynamics.

Juniper emphasizes AI-driven SD-WAN/SDN innovation, integrating Mist AI across wired, wireless, and SDN platforms. Its Contrail SDN offers orchestration and network automation, while strategic expansions through acquisitions and partnerships aim to bolster enterprise and service-provider offerings. Its vision-ready, AI-enhanced network architectures support scalability and operational intelligence.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the global software-defined networking (SDN) market include VMware, Inc., and Extreme Networks, Inc., among others.

Unlock the latest insights with our Global Software-Defined Networking (SDN) Market Report 2026. Understand key trends, growth drivers, and competitive dynamics shaping the SDN landscape. Download your free sample report or contact our experts for customized market intelligence and strategic guidance. Stay ahead in the evolving world of network virtualization and digital transformation!

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 30.08 Billion.

The market is projected to grow at a CAGR of 19.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 171.30 Billion by 2035.

Key strategies driving the market include accelerating network virtualization for scalability, integrating AI/ML for intelligent automation, embracing 5G and cloud-native architectures, enhancing security via centralized control, and delivering hybrid deployment models for cost-efficient, flexible, and agile network operations.

Key trends aiding market expansion include the availability of network customisation options, increasing cybersecurity threats and challenges, and the growing technological advancements.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Open SDN, SDN via API, and SDN via overlay are the major types of software-defined networking (SDN) available in the market.

The significant end use segments in the market include data centres, service providers, enterprises, banking, financial services and insurance, manufacturing, retail, healthcare, education, and government and defence.

SDN contrasts with conventional networking methods by introducing a software-based control mechanism that replaces the fixed functionality of hardware-based network devices. Compared to conventional networking methods, SDN offers network administrators the ability to centrally manage and configure network devices via software commands, leading to increased efficiency.

The key players in the market report include Arista Networks, Inc., Cisco Systems, Inc., HUAWEI Technologies Co., Ltd., Juniper Networks, Inc., VMware, Inc., and Extreme Networks, Inc., among others.

The data centre segment accounts for the largest market share due to the growing adoption of cloud computing, big data analytics, and artificial intelligence in various industries.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share