Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global space launch services market attained a value of USD 22.28 Billion in 2025 and is projected to expand at a CAGR of 15.30% through 2035. The market is further expected to achieve USD 92.51 Billion by 2035. Rising multi-orbit constellation programs from defense and Earth-observation agencies are accelerating demand for mission-flexible launch services, pushing companies to develop rapid-response boosters and reusable propulsion modules to secure long-term institutional contracts.

The global market is witnessing a decisive shift as companies compete to commercialize reusable heavy-lift capabilities at scale. In August 2025, SpaceX confirmed that Starship completed a successful integrated flight test that validated its next-generation heat-shield tiles and ascent-descent stability systems, a milestone closely watched by satellite operators planning multi-ton GEO constellations. This space launch services market trend is motivating launch providers to redesign propulsion systems, avionics stacks, and turnaround workflows to achieve a more predictable cost-to-orbit profile.

Vendors are also focusing on differentiated service models. Companies like Rocket Lab are expanding into vertically integrated launch-plus-satellite-platform offerings, enabling operators to deploy, manage, and scale constellations without relying on multiple vendors. In December 2024, Aerospace Manufacturing announced the completion of new vertical platforms aimed at improving efficiency and decreasing costs for upcoming Artemis missions, redefining the space launch services market dynamics. Meanwhile, Blue Origin continues to refine BE-4 engine performance for higher thrust efficiency, aiming to capture government and commercial payload segments where reliability is a strict procurement requirement. These moves signal a broader competitive pattern where propulsion innovation and rapid reusability are becoming core purchase drivers for institutional customers.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

15.3%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Space Launch Services Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 22.28 |

| Market Size 2035 | USD Billion | 92.51 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 15.30% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 17.6% |

| CAGR 2026-2035 - Market by Country | India | 20.2% |

| CAGR 2026-2035 - Market by Country | Australia | 18.7% |

| CAGR 2026-2035 - Market by Payload | Satellite | 17.3% |

| CAGR 2026-2035 - Market by End User | Government and Military | 16.8% |

| Market Share by Country 2025 | India | 3.8% |

Government defense agencies are accelerating multi-orbit satellite deployments, pushing launch providers to scale capacity and reliability. The United States Space Force’s 2024 authorization for rapid-launch procurement under the Tactically Responsive Space (TacRS) framework has already encouraged companies like Firefly Aerospace and SpaceX to test fast-turnaround launch procedures, catering to the rising demand in the space launch services market. For example, in October 2025, the Indian Space Research Organisation (ISRO) announced that the company is poised to launch the CMS-03 military communication satellite, also designated as GSAT-7R. Meanwhile, NATO is expanding its multi-orbit surveillance architecture, demanding flexible LEO-to-MEO insertion capabilities.

The rise of commercial broadband and Earth-observation constellations is reshaping how launch vendors plan fleet availability and payload accommodations. Operators like Amazon’s Project Kuiper and OneWeb are securing multi-year launch block deals, forcing companies to diversify rockets across different thrust classes. In November 2025, SEOPS, an American mission services provider, purchased a Spectrum launch from Isar Aerospace to broaden launch options for its customers. Similar momentum is seen in Asia, where Japanese and Korean firms are adopting shared-launch strategies to reduce per-kilogram costs. This space launch services market trend toward bulk launch contracts is encouraging vendors to invest in advanced payload fairings, restartable upper stages, and higher-frequency launch operations.

Launch reusability is now at the center of market competition, driven by operators’ need to cut mission costs while scaling fleet deployment cycles. In September 2025, SpaceX announced that the company plans to launch a new version of its Starship rocket by 2026. The updated model, Starship Version 3, will be fully reusable and capable of delivering over 100 metric tons of payload to orbit. Blue Origin’s New Glenn is also approaching its first commercial flights, backed by BE-4 engines designed for multiple reuse cycles. Government incentives, such as NASA’s funding for Commercial Lunar Payload Services (CLPS), are accelerating these technologies, creating new space launch services market opportunities.

Countries are modernizing launchpads, assembly complexes, and safety corridors to attract commercial launch tenants. The European Space Agency’s upgrades to the Guiana Space Centre for Ariane 6, including automated cryogenic fueling and digital range safety systems, are expanding multi-provider launch availability, driving the space launch services market value. India is also enhancing commercial access through NSIL’s expanded dedicated-launch slots and the upcoming second launch complex at Sriharikota tailored for private missions. These infrastructure expansions are enabling higher launch frequency, shortened ground cycles, and diversified orbital windows.

Launch companies are increasingly adopting vertical integration to control costs, improve reliability, and offer bundled satellite deployment solutions. Rocket Lab’s shift from pure launch services to integrated spacecraft manufacturing, as announced in April 2025, backed by its Photon satellite bus and in-house components line, has attracted customers seeking simplified mission logistics. Similarly, Relativity Space is expanding its 3D-printed engine program to tighten supply chain cycles and reduce component variability. Supportive regulatory frameworks like the United States CHIPS and Science Act are pushing companies to develop domestic propulsion, avionics, and materials capabilities. This trend in the space launch services market is creating a competitive environment where fully integrated launch-plus-spacecraft ecosystems become a key selector for government and commercial customers.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

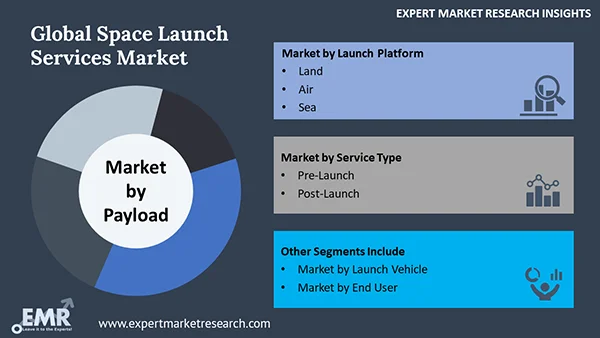

The EMR’s report titled “Global Space Launch Services Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Payload

Key Insight: Satellites currently dominate the space launch services market dynamics due to commercial constellations and government programs. Human spacecraft are gaining momentum due to crewed missions and tourism. Cargo flights support logistics and orbital platforms, while testing probes serve technology demonstration needs and stratollites offer persistent near-space services. Providers that offer tailored mission integration packages, flexible insertion profiles, and end-to-end logistics are preferred across payload classes, since they reduce program risk and simplify customer contracting.

Market Breakup by Launch Platform

Key Insight: Launch platforms including land, air and sea, each offer distinct operational advantages. Land is the baseline for heavy lift and government missions. Air-launch provides responsive, mobile payload insertion and reduced ground infrastructure. Sea platforms offer equatorial flexibility and reduced range constraints, broadening the space launch services market scope. Customers pick platforms based on orbit, regulatory environment, and cadence needs. Providers are investing in platform-specific technologies such as automated pad operations for land, airborne booster release systems for air-launch, and marine integration modules for sea to improve reliability and reduce schedule slips.

Market Breakup by Service Type

Key Insight: Service types include pre-launch and post-launch offerings. Pre-launch focuses on integration and environmental certification whereas post-launch covers commissioning, in-orbit ops and follow-up support. Companies that can guarantee mission success with validated pre-launch testing and provide continued post-launch operational support are winning strategic contracts. This lifecycle approach increases customer retention and opens recurring revenue opportunities through telemetry services, anomaly resolution SLAs, and rapid-replacement launch guarantees for constellation clients.

Market Breakup by Launch Vehicle

Key Insight: As per the space launch services market report, launch vehicles split into small and heavy classes. Small launchers dominate the market by enabling dedicated, responsive missions for small satellites and tactical payloads. Heavy vehicles serve large GEO payloads, human missions and deep-space cargo. Customer choice depends on orbital destination, volume, and timeline. Small vehicles offer flexibility and speed, heavy vehicles provide capacity and single-launch economics.

Market Breakup by End User

Key Insight: End users include government/military and commercial entities. Governments require assured access, security compliance and long-term procurement models. Commercial operators demand cost-efficiency, cadence, and integrated launch-plus-ops services. The commercial sector is expanding its share in the space launch services market with constellation rollouts and private crew missions, while government spending remains steadier but high-value.

Market Breakup by Region

Key Insight: North America leads the space launch services market with private-capital and mature infrastructure. Europe focuses on reliable institutional launchers and cooperative programs. Asia Pacific is rapidly expanding manufacturing and launch capacity. Latin America and MEA are developing launch capabilities with selective national investments. Launch providers that create regional partnerships and offer multi-site launch options are improving resilience and meeting global customer demands for schedule diversity and supply-chain redundancy.

By payload, satellite missions account for the largest share of the market due to massive constellation and commercial demand

Satellites continue to be the core payload type, powering commercial broadband, Earth observation, and government communications. Launch providers are optimizing fairing volumes, adapter dispensers, and rideshare architectures to meet multiclient satellite manifests while preserving schedule flexibility. In November 2025, NASA, SpaceX launched United States-European satellite to monitor ocean and atmospheric information to improve hurricane forecasts, help protect infrastructure, and benefit commercial activities, such as shipping. The economics of constellations favor frequent, predictable lift at scale, so vendors are developing modular payload interfaces, standardized dispensers and rapid integration flow charts to shave days from vehicle processing.

The space launch services market report indicates human spacecraft launches to be the fastest-growing high-profile category as commercial crew transport and space tourism mature. Governments and private firms are commissioning crew-rated capsules and dedicated human-rated launch windows, requiring enhanced safety margins, abort systems, and crew medical support infrastructure. Launch service providers working on crewed missions must invest in redundant avionics, certified life-support interfaces and extensive ground-crew training programs.

By launch platform, land launches register the largest market share because of established infrastructure and regulatory clarity

Land-based launch facilities, driven by well-established range infrastructure, regulatory processes, and ground support ecosystems, significantly boost growth in the space launch services market. Fixed pads allow large-scale propellant handling, heavy-lift integrations, and established safety corridors. These are critical for government and commercial heavy launches. Operators are upgrading land facilities with automated cryogenic systems, mobile integration gantries, and digital range telemetry to shorten turnaround.

Sea-based launch platforms, including autonomous sea-ports and decommissioned-ship barges, are gaining ground because they offer flexible downrange safety windows and equatorial launch advantages for certain orbits. Sea platforms reduce national regulatory friction for cross-border launches and enable tailored launch azimuths that improve payload insertion efficiency. In October 2025, China's private rocket company Orienspace set a new milestone by launching three satellites from a floating barge in the Yellow Sea. Providers like Sea Launch pioneers and new maritime concepts are capitalizing on mobile range concepts to serve high-frequency commercial customers who want off-grid launch opportunities.

By service type, pre-launch services dominate the market for integration, testing, and mission assurance needs

Pre-launch services secure the biggest market revenue share because mission assurance, mechanical and electrical integration, and environmental testing are critical to mission success. Pre-launch offerings include payload integration, environmental stress screening, vibration and acoustic testing, and final telemetry checks. These are services that are often outsourced to specialized facilities. Providers that offer accelerated integration bays, standardized separation systems, and digital mission simulations reduce risk and shorten time-to-launch.

Post-launch services are expanding their shares in the space launch services market revenue as operators demand end-to-end mission lifecycle support, such as on-orbit commissioning, de-orbit planning, and in-space servicing coordination. Companies are offering subscription-based telemetry monitoring, anomaly resolution contracts, and rapid-response replacement launches. For providers, post-launch offerings create recurring revenue and deeper client relationships but require investments in ground-segment analytics, operations centers and cross-provider API integration for telemetry and command interfaces.

By launch vehicle, small launch vehicles dominate for responsive, low-cost dedicated LEO access

Small launch vehicles accounted for the largest share of the market due to the proliferation of small satellites and the demand for dedicated, responsive LEO access. Small launchers offer rapid manifesting, simplified integration and lower per-mission scheduling complexity, appealing to constellations, universities and tactical government payloads. Providers are optimizing modular payload dispensers and standardized interfaces to maximize manifest flexibility and payload share economics.

Heavy launch vehicles are experiencing significant growth in the space launch services market for institutional and deep-space missions as demand rises for large GEO satellites, crewed missions, and lunar gateway logistics. In November 2025, Blue Origin launched its huge New Glenn rocket with a pair of NASA spacecraft destined for Mars. Heavy-lift providers are focusing on reusability and rapid refurbishment to reduce per-kg costs and increase cadence. The market’s growth is tied to government deep-space ambitions and large commercial GEO constellations that require single-launch delivery.

By end user, government and military lead the market since they sponsor large strategic programs

Government and military end users dominate due to national security, navigation, and science programs that require assured access, high reliability and bespoke payload accommodations. These users procure launch services via long-term contracts and national procurement channels with strict certification, safety and assurance requirements. Launch providers competing for government work invest in hardened vehicle architectures, secure telemetry, and compliance frameworks. Military procurement often includes rapid-response clauses, on-call launch windows and stricter range safety hardware, creating high technical barriers for entrants.

Factors like broadband constellations, Earth-observation startups, and venture-backed space firms scaling satellite fleets are driving the commercial consumer group’s impact in the space launch services market value. Commercial customers prioritize cost-per-kilogram, predictable cadence, and flexible insertion options. They are adopting multi-launch block purchases, service-level agreements, and bundled mission services that include integration and post-launch operations.

By region, North America secures the leading market position owing to private-capital, mature supply chains, and demand

North America holds the dominant position in the market owing to abundant private capital, mature supply chains, and dense clusters of launch firms, suppliers and research institutions. The United States regulatory environment and government procurement programs have catalyzed private launch growth, and key infrastructure across Florida, California and Alaska supports a range of orbital inclinations. North American providers are leading in reusable-vehicle development, high-frequency small-launch operations, and integrated launch-plus-satellite offerings.

Growth of the space launch services market in Asia Pacific, strengthened by China, India, Japan, and South Korea, is accelerating both governmental space programs and commercial launch ventures. Strong manufacturing ecosystems, increasing domestic satellite demand and supportive policies are driving investments in launch complexes, vehicle development, and downstream integration services. Regional players are advancing reusable technologies and small-launch capabilities to serve local constellations and export launch services.

| CAGR 2026-2035 - Market by | Country |

| India | 20.2% |

| Australia | 18.7% |

| China | 16.9% |

| UK | 14.0% |

| USA | 13.6% |

| Canada | XX% |

| Germany | XX% |

| France | 12.0% |

| Italy | XX% |

| Japan | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

The market is entering a phase where commercial innovation overlaps heavily with national security and scientific ambition, compelling space launch service companies to sharpen their technical and operational strategies. Launch providers are prioritizing reusable propulsion cycles, modular upper stages, autonomous flight safety systems, and rapid-integration payload bays to cut both turnaround time and per-mission risk.

Another major area of focus is vertically integrated launch ecosystems, where firms own the manufacturing lines, propulsion IP, launch sites, and downstream data services, to secure profit pools beyond the rocket itself. Emerging opportunities appear in on-orbit servicing, micro-constellation replenishment, high-cadence small-payload flights, and government-backed deep-space logistics programs. Space launch services market players that align with sovereign space programs, secure regulatory clearances early, and maintain aggressive testing pipelines are best positioned to win long-term multi-launch agreements in this fast-moving market.

Airbus SE, established in 1970 and headquartered in Leiden, Netherlands, strengthens the market with its ArianeGroup joint venture and advanced satellite integration services. The firm focuses on reusability trials, cryogenic propulsion optimization, and digitally controlled avionics that lower mission error margins.

Antrix Corporation Limited, founded in 1992 and based in Bengaluru, India, serves as ISRO’s commercial arm and is expanding its role by packaging mission design, satellite integration, and launch brokerage services. The company’s primary focus lies in commercializing India’s emerging small-satellite launch capabilities and supporting reusable test-bed programs.

Space Exploration Technologies Corp., founded in 2002 and headquartered in California, United States, remains one of the most disruptive players with its fully reusable Falcon and in-testing Starship systems. SpaceX targets ultra-rapid launch cadence, heavy-lift deep-space missions, and global broadband satellite placement.

Lockheed Martin Corporation, founded in 1995 and headquartered in Bethesda, Maryland, contributes through advanced upper-stage engines, precision guidance systems, and integration support for government and defense missions. The firm is heavily invested in hypersonic-ready launch architectures, smart avionics health monitoring, and classified mission payload protection.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other prominent players in the market include The Boeing Company, among others.

Unlock the latest insights with our space launch services market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 22.28 Billion.

The market is projected to grow at a CAGR of 15.30% between 2026 and 2035.

Stakeholders are investing in reusable propulsion, forming sovereign-program alliances, expanding automated integration lines, adopting digital twins for mission planning, and securing long-term supply partners to stabilize hardware flow and accelerate high-cadence launches.

The key trends guiding the market include technological advancements and innovations, the development of digital satellite connectivity infrastructure, and increasing government expenditure on space exploration.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The major segments based on payloads of space launch services considered in the market report are satellite, human spacecraft, cargo, testing probes, and stratollite.

The significant launch platforms considered in the market report are land, air, and sea.

Pre-launch and post-launch are the various service types included in the market report.

The different launch vehicles considered in the market report include small launch vehicle and heavy launch vehicle.

The major end users of space launch services are commercial and government and military.

The key players in the market include Airbus SE, Antrix Corporation Limited, Space Exploration Technologies Corp. (SpaceX), Lockheed Martin Corporation, and The Boeing Company, among others.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 92.51 Billion by 2035.

Companies struggle with regulatory delays, tight launch windows, cost overruns, reusable hardware fatigue, and supply-chain instability, while meeting increasingly complex payload requirements for governments, defense agencies, and high-density commercial constellations.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Payload |

|

| Breakup by Launch Platform |

|

| Breakup by Service Type |

|

| Breakup by Launch Vehicle |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share