Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global testing and commissioning market attained a value of USD 235.39 Billion in 2025. The market is further expected to grow in the forecast period of 2026-2035 at a CAGR of 4.80% to reach USD 376.18 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4.8%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Testing and Commissioning Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 235.39 |

| Market Size 2035 | USD Billion | 376.18 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.80% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 6.2% |

| CAGR 2026-2035 - Market by Country | India | 7.1% |

| CAGR 2026-2035 - Market by Country | China | 6.0% |

| CAGR 2026-2035 - Market by Sourcing Type | Outsourcing | 5.3% |

| CAGR 2026-2035 - Market by End Use | Life Sciences | 5.5% |

| Market Share by Country 2025 | Germany | 7.5% |

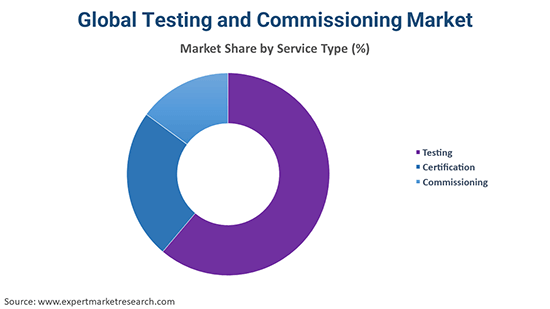

Based on service type, testing is the most popular service type on account of the rising concerns about the overall quality of the product. On the basis of commissioning type, the initial commissioning accounted for the majority of the market share, representing the largest segment. Presently, the inhouse segment is the most preferred sourcing type. However, outsourcing is also gaining traction among end-users.

The construction sector represented the leading end-use segment in 2020. The services are employed in this sector to ensure that all systems and components of a construction project meet the operational requirements of the concerned authorities.

Regionally, Europe represents the largest market, accounting for the majority of the market share. The regional market is driven by the increasing focus on the maintenance and monitoring of the conductive production environment and supply chain to safeguard the quality and safety of the products manufactured in the region.

Testing and commissioning refer to a set of procedures, which are conducted to ensure that the infrastructure, services, and products meet with the mandated regulations and standards in terms of quality as well as safety. These processes include on-site or laboratory testing, data consistency verification, documentary checks, management process audits, and inspections across the complete supply chain. Moreover, testing and commission can be carried out on behalf of either private or public authorities, and these procedures are required throughout the supply chain.

Based on the service type, the global testing and commissioning market is divided into:

On the basis of commissioning type, the industry can be divided into:

The testing and commissioning market can be broadly categorised, on the basis of sourcing type, into:

On the basis of end-use, the global testing and commissioning market is segregated into:

Based on the service region, the global testing and commissioning market is divided into:

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

| CAGR 2026-2035 - Market by | Sourcing Type |

| Outsourcing | 5.3% |

| Inhouse | XX% |

| CAGR 2026-2035 - Market by | End Use |

| Life Sciences | 5.5% |

| Consumer Products | 5.1% |

| Construction | XX% |

| Industrial | XX% |

| Oil and Gas | XX% |

| Others | XX% |

| CAGR 2026-2035 - Market by | Region |

| Asia Pacific | 6.2% |

| Europe | 3.7% |

| North America | XX% |

| Latin America | XX% |

| Middle East and Africa | XX% |

Since the globalization of trade has led to the emergence of complex supply chains impacting the product quality, the requirement for improved testing, and commissioning processes is increasing. Owing to the aforementioned factors, the global testing and commissioning market is expected to propel over the coming years.

| 2025 Market Share by | Country |

| Germany | 7.5% |

| USA | XX% |

| Canada | XX% |

Due to stringent regulations, several major companies are outsourcing inspection and testing, reducing the high costs of in-house testing. The industry has the potential to grow at a rapid pace in the developing regions due to increasing exports compliant with western standards and the imposition of new rules and standards in the infrastructure. The introduction of new and revised regulations has driven a significant shift from a voluntary-based risk management approach to mandatory testing services. Moreover, retro-commissioning has also aided the testing and commissioning market as it assists in identifying problems in existing buildings and reducing waste energy, thereby saving energy costs for the owners. The increased adoption of testing and commissioning procedures across various end-use industries is estimated to foster the industry growth in the coming years.

The report gives a detailed analysis of the following key players in the global testing and commissioning market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis.

| CAGR 2026-2035 - Market by | Country |

| India | 7.1% |

| China | 6.0% |

| UK | 4.4% |

| Australia | 4.2% |

| Japan | 3.7% |

| USA | XX% |

| Canada | XX% |

| Germany | 3.5% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

| France | 3.4% |

| Italy | 3.0% |

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global testing and commissioning market reached a value of USD 235.39 Billion in 2025.

The market is projected to grow at a CAGR of nearly 4.80% in the forecast period of 2026-2035.

The market is estimated to reach a value of about USD 376.18 Billion by 2035.

The major drivers of the market include rising disposable incomes, globalisation of trade growing construction sector, and the rising adoption of testing and commissioning services across the end-use industries, especially in developing nations.

Outsourcing of testing and commissioning and increasing focus on maintenance and monitoring of production environments and supply chains are the key trends of the market.

North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa are the leading regions in the market.

Testing, certification, and commissioning are the various service types in the market.

The leading commissioning types in the market are initial commissioning, retro commissioning, and monitor-based commissioning.

Inhouse and outsourcing are the leading sourcing types in the market.

The various end uses of testing and commissioning in the market are construction, industrial, consumer products, life sciences, oil and gas, food and agriculture, marine and offshore, transport and aerospace, energy and power, and chemicals, among others.

The leading players in the global testing and commissioning market are Intertek Group plc, SGS SA, Dekra SE, and TÜV SÜD, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Service Type |

|

| Breakup by Commissioning Type |

|

| Breakup by Sourcing Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share