Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The titanium dioxide market size attained a volume of around 5.22 MMT in 2025. The market is estimated to grow at a CAGR of 3.00% during the forecast period of 2026-2035 to reach a volume of 7.02 MMT by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

3%

Value in MMT

2026-2035

*this image is indicative*

The titanium dioxide industry is growing as a result of the increasing demand for titanium dioxide (TiO2) from end-user industries. In recent years, developing countries have seen an increase in the demand for lightweight cars. The automotive industry is displaying a positive trend in developed regions like North America and Western Europe leading to a surge in demand for titanium dioxide.

As per the titanium dioxide market report, the automotive industry's sustained growth, particularly with regard to lightweight vehicles, is anticipated to enhance demand for titanium dioxide. The growing use of paints and coatings has significantly contributed to this trend as polycarbonate is very compatible with coatings created with TiO2. Due to the rise in the demand for lightweight cars with improved fuel efficiency over the past few years, which has also boosted product consumption, the automotive industry has experienced rising demand, contributing to the titanium dioxide global market.

Titanium dioxide (TiO2) is a commonly used pigment throughout the cosmetics market since it offers a high colour context, higher intensity and brightness, helps absorb oils released from the skin, and protects the skin from ultraviolet rays. Additionally, titanium dioxide is widely used in pigments that find application in diverse products like paints, paper, plastics, and printing inks, among others, further influencing the titanium dioxide market price.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Titanium dioxide, a white inorganic compound, is generally derived from minerals like ilmenite, rutile, and anatase. Due to its luminous, non-toxic, and non-reactive properties, it finds application in a wide range of products, particularly as a vivid colourant to increase the whiteness and brightness of various substances.

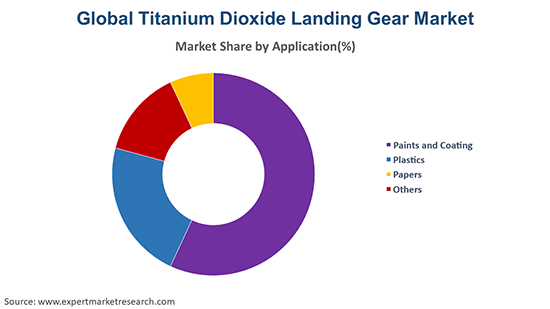

Market Breakup by Application

According to the titanium dioxide industry analysis, paints and coatings remains the largest application sector for titanium dioxide, while its demand in the plastics market is increasing steadily due to the excellent refractive qualities of titanium dioxide.

Market Breakup by Region

The robust growth of the paints and coatings sector, especially in the emerging economies, is one of the key titanium dioxide market trends. Further, the properties of the substance make it a favourable choice for use as a pigment, which aids the market growth. It is also known as ‘the perfect white’ owing to its powerful, whitening qualities, making it a popular choice for use as a pigment. The increasing urbanisation and rise in per capita income, particularly in the developing economies, is aiding the global titanium dioxide market. This directly impacts the automobile and construction sectors, which, in turn, will drive the demand for titanium dioxide further. Rising disposable incomes is resulting in an increase in infrastructure activities, which is further adding to the higher demand for the paints and coatings variants, which is the largest application sector for titanium dioxide, thus, increasing the titanium dioxide market share.

Moreover, the increased demand for titanium dioxide from the plastic and packaging industry is providing further impetus to the titanium dioxide TiO2 market. The refractive properties of titanium dioxide allow it to absorb or scatter UV rays, thus, making it favourable for use in Masterbatches, flexible packaging, and food-grade packaging, thus, aiding the market growth.

The Asia Pacific is a leading region in the global titanium dioxide market, with the other significant markets comprising of Europe and North America. The North America titanium dioxide market is emerging as a significant regional market due to the increase in automotive and other applications of titanium dioxide. While North America is the net exporter of titanium dioxide it also imports a significant volume of low-quality titanium dioxide from the Asia Pacific. The Europe titanium dioxide market has been witnessing steady growth over the years, and also exports high quality titanium dioxide to the Asia Pacific to fulfil the emerging region’s increasing demands. Another key exporter to the Asia Pacific, particularly countries such as India and China, is Australia, offering immense opportunities to the Australia titanium dioxide market.

The EMR report provides a detailed analysis of the following major players in the global titanium dioxide market, covering their competitive landscape, capacity, and recent developments like mergers, acquisitions and investments, expansions of capacity, and plant turnarounds:

The report provides a further assessment of the titanium dioxide market by carrying out SWOT and Porter’s five forces analysis.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global market for titanium dioxide attained a volume of around 5.22 MMT.

The market is projected to grow at a CAGR of 3.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a volume of around 7.02 MMT by 2035.

The major drivers of the market are growing paints and coatings sector, rapid urbanisation, increasing population, and surging infrastructure activities.

The key trends guiding the market growth include the rising disposable incomes and increasing demand for plastics and papers.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific, with the Asia Pacific accounting for the largest share in the market.

Paints and coating, plastics, and papers, among others, are the leading applications of the product in the market.

The major players in the market are The Chemours Company LLC, Venator Materials PLC, KRONOS Worldwide, Inc., Tronox Holdings PLC, LB Group Co Ltd, Shandong Doguide Group Co., Ltd, Nanjing Titanium Dioxide Chemical Co., Ltd., and Ningbo Xinfu Titanium Dioxide Co., Ltd, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Trade Data Analysis |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share