Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global trade credit insurance market value reached USD 13.06 Billion in 2025. The market is expected to grow at a CAGR of 8.60% between 2026 and 2035, reaching almost USD 29.80 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

8.6%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Trade Credit Insurance Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 13.06 |

| Market Size 2035 | USD Billion | 29.80 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 8.60% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 10.8% |

| CAGR 2026-2035 - Market by Country | India | 11.3% |

| CAGR 2026-2035 - Market by Country | Canada | 10.0% |

| CAGR 2026-2035 - Market by Component | Product | 10.8% |

| CAGR 2026-2035 - Market by Industry Vertical | Food and Beverages | 9.8% |

Trade credit insurance protects against the risk of not being paid for goods or services, helping to manage the risks involved in buying and selling. It is purchased to reduce losses from insolvency, bankruptcy, or late payments, providing a safety net for manufacturers, traders, and service providers. This insurance is commonly provided to credit card users for a modest monthly fee on their outstanding balance, contributing to the trade credit insurance industry growth.It is used in both domestic and international trade, offering coverage for entire transactions or specific deals. This insurance is commonly utilized across various industries such as food, IT, telecommunications, healthcare, energy, and automotive sectors.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Trade credit insurance is adapting to address risks associated with the complexities of international trade, geopolitical tensions, and regulatory changes, all within the context of expanding and globalized supply chains. This evolution is driving demand in the trade credit insurance market.

By utilising advanced data analytics tools, insurers can conduct more precise risk assessments. This data-driven approach enhances the accuracy of underwriting, enables competitive pricing, and ensures comprehensive coverage.

According to the World Trade Organization, In Q4 2023, global trade in commercial services surged by 9% year-on-year, reflecting robust growth across key sectors. Goods-related services increased by 8%, and other commercial services grew by 9%. Regionally, the growth of the trade credit insurance market is expanding, with Asia spearheading this growth due to a 15% rise in imports, fuelled by increasing demand for commercial services. Europe followed with an 11% increase, highlighting substantial growth. Export growth varied across regions, with Asia leading at 11%, followed by Europe at 8%, and North America at 7%.

In Q4 2023, global merchandise trade volume increased by 0.3% quarter-on-quarter, marking a notable recovery from the 1.7% decline in Q4 2022. Regional import growth exhibited diverse trends, with Asia leading the way with a 2.0% increase, indicative of strong economic activity and demand. North America saw a 0.5% increase in imports, indicating stable trade dynamics according to the World Trade Organization, which is contributing to the growth of the trade credit insurance industry revenue.

As per the Government of India Department of Commerce, in April-May 2024, India’s total trade (merchandise and services) saw substantial growth. Exports increased to USD 133.61 billion, up from USD 122.35 billion in the same period in 2023, showcasing robust year-on-year growth. Merchandise exports rose to USD 73.12 billion from USD 69.57 billion, while merchandise imports climbed to USD 116.01 billion compared to USD 106.54 billion, indicating a solid increase in trade volume. Services exports experienced significant growth, reaching USD 60.49 billion, up from USD 52.77 billion. Imports in services rose to USD 33.91 billion from USD 29.84 billion, highlighting robust demand in the services sector and further driving the growth in trade credit insurance market revenue.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Global Trade Credit Insurance Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Component

Market Breakup by Enterprise Size

Market Breakup by Coverages

Market Breakup by Industry Vertical

Market Breakup by Application

Market Breakup by Region

| CAGR 2026-2035 - Market by | Country |

| India | 11.3% |

| Canada | 10.0% |

| China | 9.5% |

| USA | 8.7% |

| Australia | 7.3% |

| Japan | 6.4% |

| UK | XX% |

| Germany | XX% |

| France | XX% |

| Italy | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

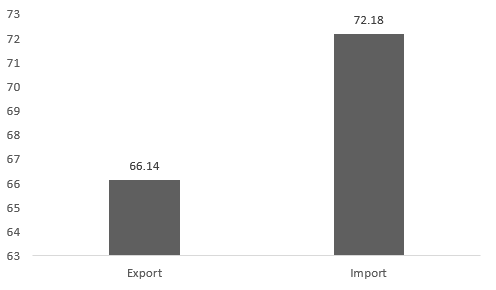

OVERALL TRADE (MERCHANDISE AND SERVICES), IN 2023, IN USD BILLION

Trade credit insurance shields businesses from non-payment risks such as customer insolvency, ensuring stable cash flow, enhancing credit control, supporting international growth, and offering a competitive advantage through favourable credit terms, all of which contribute to increased trade credit insurance demand growth.

Services include expert risk assessment, streamlined claims handling, adaptable policies, market insights, and financial stability, enhancing operational efficiency and reducing financial uncertainties in global trade.

The companies provide a diverse array of insurance options including property-casualty, life insurance, retirement products, and various financial services tailored for both commercial enterprises and individual clients.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market was estimated to be valued at USD 13.06 Billion in 2025.

The global Trade credit insurance market is assessed to grow at a CAGR of 8.60% between 2026 and 2035.

The revenue generated from the trade credit insurance market is expected to reach USD 29.80 Billion in 2035.

Digital transformation, rising demand, tailored solutions, and the integration of ESG factors are driving the trade credit insurance market growth.

Based on the components, the market is divided into products and services.

The competitive landscape consists of American International Group, Inc., Aon plc, Atradius N.V., Credendo, Allianz Trade, QBE Insurance Group Ltd., Zurich Insurance Company Ltd, Coface, Chubb Group Holdings Inc., and Great American Insurance Company among others.

Based on the coverages, the trade credit insurance market is divided into whole turnover coverage and single buyer coverage.

The market is broken down into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Component |

|

| Breakup by Enterprise Size |

|

| Breakup by Coverages |

|

| Breakup by Industry Vertical |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share