Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global trisodium phosphate market attained a value of USD 3.57 Billion in 2025 and is projected to expand at a CAGR of 5.00% through 2035. The market is further expected to achieve USD 5.82 Billion by 2035. Rapid industrial expansion in Asia Pacific, coupled with surging demand for processed foods and stricter wastewater-treatment norms, is driving adoption.

The market witnesses several leading chemical manufacturers to expand their production capacity of high-purity food-grade TSP. The increase in processed food manufacturing has created a new level of demand in North America and Asia Pacific. For example, Aditya Birla Chemicals announced the opening of a manufacturing and research and development facility in Texas, United States in June 2024, for USD 50 million to supply various grades of trisodium phosphate. The company is also investing in expanding its capacity to meet the growing demand for reliable emulsifiers and pH regulators to help preserve the quality of food products, accelerating the overall trisodium phosphate market growth.

Simultaneously, there is a pronounced shift toward technical-grade TSP formulations tailored for industrial cleaning, metal treatment, and wastewater handling. TSP’s alkaline nature and water-solubility make it a cost-effective choice for degreasing, surface prep, and water chemistry control. Manufacturers are capitalizing on this by launching specialized TSP grades optimized for effluent treatment and heavy-duty cleaning, thereby broadening the trisodium phosphate market opportunities. For example, Innophos offers a low-dust technical-grade TSP specifically for aluminum and steel pre-treatment lines used by automotive sector.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5%

Value in USD Billion

2026-2035

*this image is indicative*

Growing demand for processed and convenience foods is structurally lifting consumption of food-grade trisodium phosphate as a multifunctional emulsifier, buffer, and moisture-retention agent. Brand owners are looking for batch-to-batch stability and clean, easily auditable additive supply chains. Government actions, such as the United States FDA’s endorsement of TSP in school lunches enhances cereal quality and reinforces trisodium phosphate market stability. Leading TSP suppliers are, therefore, qualifying new plants under HACCP and FSSC 22000, targeting co-development partnerships with multinational processors scaling regional recipe platforms.

In order to comply with state regulations that limit phosphorus discharge to approximately 1 mg/L from both industrial and municipal sources, manufacturers of technical-grade trisodium phosphate must implement stringent treatment process controls and achieve rigorous monitoring standards. As of January 2025, EU Member States have revised their wastewater standards as part of Urban Wastewater Treatment Directive, impacting the overall demand in the trisodium phosphate market. Additionally, the EPA's rules restricting the use of phosphorus in detergents as part of the Clean Water Act seek to prevent eutrophication and preserve our aquatic ecosystems.

Evolving detergent regulations are compelling chemical formulators to rethink how, where, and how much trisodium phosphate they deploy. Most of the major manufacturers of cleaning chemicals would not be able to eliminate the use of TSP completely, because they are now shifting their use towards cleaning products that are specifically used in commercial and industrial environments, where high levels of alkalinity and soil-degreasing properties are required. For example, a new alkaline formula developed by Kitten Enterprises in January 2024 contains TSP as an ingredient to provide an effective cleaning solution for hard surfaces, such as floors, walls, and ceilings. These changing trends in the trisodium phosphate market are causing many manufacturers to innovate and create products containing low levels of dust and phosphate, delivered through encapsulation techniques that will provide effective degreasing in foodservice, transportation, and machining applications.

Asia Pacific’s rapid expansion in processed food manufacturing is another structural growth engine that is accelerating demand in the trisodium phosphate market. Growth in this region is backed by national programs for food-processing infrastructure and export promotion. Snack, frozen meal, and ready-to-cook brands in India, China, and Southeast Asia increasingly rely on food-grade TSP to stabilize textures, protect color, and tolerate complex cold-chain journeys. For example, the World Food India 2025 organized by MoFPI, is designed to position India as a “Global Food Hub,” inviting global investment, partnerships, and export-oriented growth. This indicates renewed institutional support, and likely growth in food-processing capacity, which in turn can drive demand for functional food-additive chemicals such as TSP.

Product innovation is upgrading TSP beyond its commodity status as suppliers seek higher-margin, specification-driven niche categories to penetrate. Leading producers are engineering low-dust, free-flowing granules and pre-blended TSP formulations tailored for metal pretreatment, coil-coating lines, and high-output food plants, propelling the trisodium phosphate market scope. For example, Aarti Phosphates lists both anhydrous and hydrated/crystal forms of TSP, with detailed assay/purity, pH, impurity levels (e.g. Fe, SO₄, Cl), enabling users to choose between “technical/industrial grade” and “pure/pharma/food-grade.” Similarly, Hemadri Chemicals markets TSP in multiple grades both industrial, food, technical, and multiple physical forms (crystals, powder, granular). EU REACH registration, United States OSHA expectations, and government green-procurement policies for institutional cleaners are nudging buyers toward well-documented, third-party-audited chemistries.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Trisodium Phosphate Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

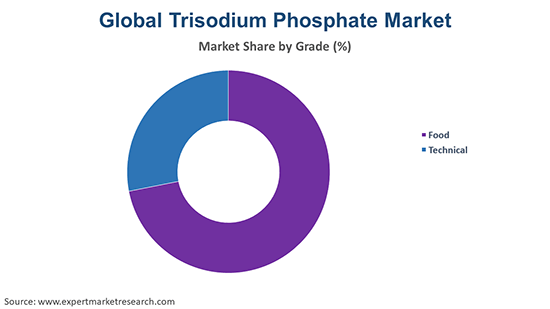

Market Breakup by Grade

Key Insight: The global trisodium phosphate market dynamics are increasingly shaped by how buyers balance technical certainty with regulatory and brand expectations. Technical grades remain the dominant category for detergents, metal cleaning, and water-treatment chemistries, where engineers value consistent alkalinity, low dust, and compatibility with automated dosing equipment. Food-grade material is chosen by R&D teams for its ability to stabilize texture, color, and yield in complex formulations while still meeting retailer and export-market compliance requirements.

Market Breakup by Application

Key Insight: Research indicates that buyers map trisodium phosphate usage to clearly defined process outcomes rather than treating it as a generic commodity, creating trisodium phosphate market opportunities. Food additive customers deploy TSP for texture, yield, and pH control in tightly specified formulations. Detergent and cleaner formulators value its powerful alkalinity for heavy-duty degreasing and hygiene programs. Metal treatment shops use TSP in surface-preparation and conversion steps to stabilize coating adhesion and corrosion performance. Water-softener manufacturers integrate TSP where hardness control and pipe conditioning are needed.

Breakup by Region

Key Insight: Regional trisodium phosphate demand patterns reflect distinct industrial and policy priorities. The North American market is driven by a well-established food, beverage, and institutional cleaning sector, alongside strict wastewater and workplace safety regulations that reinforce steady TSP consumption. Europe prioritizes compliance with phosphate-restriction policies, limiting TSP to high-spec industrial, food, and specialized technical uses. Asia Pacific blends rapid processed-food expansion with dense manufacturing zones, enabling suppliers to scale production and diversify portfolios. Latin America reflects balanced demand across agribusiness, beverages, and construction-linked cleaning applications. In the Middle East and Africa, growing investments in water treatment, infrastructure, and food processing increasingly position TSP as a key enabler of broader industrial development.

Technical grade TSP dominates the market by a substantial margin, driven by industrial cleaning demand

Technical grade trisodium phosphate dominates the market due to its widespread use in industrial cleaners, detergents, metal cleaning agents, and water treatment formulations. These sectors require high levels of alkalinity and sequestering ability for use in heavy-duty application environments. Some of the larger suppliers of TSP, including Aditya Birla Chemicals, Wengfu, and Yuntianhua, are working on optimizing the manufacturing routes and particle engineering to produce Low-Dust, Flowable Grades that are compatible with automated dosing systems.

As per the trisodium phosphate market report, food grade trisodium phosphate is emerging as the fastest-growing grade, witnessing strong momentum in bakery, meat, dairy, and convenience foods. Food-grade phosphates are often required as emulsifiers and regulators of acidity, moisturizers, and other forms of enhancement in processed meats, cheeses and frozen prepared foods. In July 2025 Bangladesh Agricultural Development Corporation (BADC), Ministry of Agriculture in Bangladesh, entered into an agreement with a Malaysian company for importing both TSP and DAP Fertilizer.

Food additive applications lead the global industry, underpinned by stability needs in processing

Food additive applications remain the dominant demand center for trisodium phosphate, aligned with the strong role of phosphates across processed food categories. Food and beverage applications already contribute the largest single share of TSP market revenue, reflecting its role as a texture builder, yield improver, and pH buffer in meat, seafood, bakery, and dairy processing. Through TSP, a number of overseas and contract manufacturers guarantee superior slicing, cooking, and freezing performance across multiple locations.

Detergents and cleaners observe accelerated growth in the trisodium phosphate market, particularly boosted by institutional, foodservice, and industrial hygiene programs. While many countries have restricted phosphates in household detergents, regulations are simultaneously raising expectations for cleanliness in hospitals, schools, factories, and quick-service restaurants.

Asia Pacific secures the leading position in the market, anchored by growing food industries

Currently Asia Pacific dominates the global trisodium phosphate market due to its scale in the food processing, construction, and manufacturing sectors. As a result, the expanding processed and frozen food sectors of the economy are holding up demand for food-grade TSP in categories such as meat, fish, bakery products and convenience goods. Large textile, metal and electronics industries located in China, India and Southeast Asia rely on using technical-grade TSP for cleaning, treating surfaces and water management.

The trisodium phosphate market in the Middle East and Africa is rapidly evolving into one of the fastest-growing regional clusters, driven by water infrastructure, construction, and food security agendas. Governments across the Gulf and North Africa are investing heavily in desalination, wastewater reuse, and industrial effluent control, which raises demand for reliable alkaline and cleaning chemistries in treatment plants, pipelines, and distribution networks. Petrochemical complexes, metal-fabrication hubs, and large commercial kitchens use technical-grade TSP for degreasing, surface preparation, and hygiene programs.

Prominent trisodium phosphate market players are centering their focus on developing higher-value, specification-driven products. They are consequently investing in purity upgrades, granular performance improvements, and digitally traceable packaging. Rather than competing purely on price, players are focusing on engineered TSP grades for processed foods, wastewater treatment, and metal-finishing applications where consistency, low-contaminant profiles, and superior solubility directly reduce operational downtime for clients.

Asia Pacific’s expanding food-processing sector and the rise of industrial cleaning automation are creating opportunities for trisodium phosphate companies who are able to deliver low-dust granules, anhydrous food-grade TSP, and tailored blends that match dosing systems in high-throughput facilities. Another opportunity lies in partnering with supply-chain compliance teams with QR-coded drum traceability, audit-ready documentation, and REACH-compliant formulations.

Recochem Inc., established in 1951 and headquartered in Montreal, Canada, serves the market through engineered cleaning and maintenance solutions focused on industrial and institutional applications. The company emphasizes product quality assurance, consistency, and global availability with traceable packaging suitable for automated sanitation workflows.

Founded in 2009 and headquartered in Lianyungang, China, Jiangsu Kolod Food Ingredients Co., Ltd., caters to the trisodium phosphate industry with high-purity food-grade phosphates across multiple certifications and global regulatory frameworks. The company focuses on specialty textures, moisture management, and freeze-thaw stability to support large-scale frozen food processors, dairy manufacturers, and RTE brands.

FBC Industries, Inc., established in 1983 and headquartered in the United States, supports the TSP market through pH-control and food-additive solutions designed for beverage, bakery, and snack producers. The company offers tailored formulations and just-in-time supply programs to ensure stable input quality for high-volume production lines.

Aarti Phosphates, founded in 1994 and headquartered in Gujarat, India, serves the market with multi-grade TSP portfolios covering industrial, food, and water-treatment applications. It is known for granular and anhydrous forms optimized for automated dosing and low-dust factory environments, giving industrial plants improved worker safety and material handling performance.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Hefei TNJ Chemical Industry Co., Ltd., among others.

Unlock the latest insights with our trisodium phosphate market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 5.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to attain around USD 5.82 Billion by 2035.

Key strategies driving the market include expanding application-specific TSP grades, forming OEM partnerships, integrating digital batch traceability, optimizing logistics near mega-plants, and investing in regulatory-compliant formulations to secure multi-year contracts and higher-margin segments.

The key trends aiding the market growth include advancements in the food processing sector and the rising demand for trisodium phosphate from developing countries.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading grades of trisodium phosphate in the market are food and technical.

The significant applications of trisodium phosphate include food additive, detergents and cleaners, metal treatment, and water softener, among others.

The key players in the market include Recochem Inc., Jiangsu Kolod Food Ingredients Co., Ltd., FBC Industries, Inc., Aarti Phosphates, and Hefei TNJ Chemical Industry Co., Ltd., among others.

In 2025, the market reached an approximate value of USD 3.57 Billion.

Tough pricing pressure, fluctuating phosphate rock costs, tightening wastewater and food-safety regulations, and the need for globally synchronized documentation and batch traceability challenge manufacturers striving to differentiate beyond commodity supply.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Grade |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share