Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global ultra-high molecular weight polyethylene market attained a value of USD 2.00 Billion in 2025 and is projected to expand at a CAGR of 10.00% through 2035. The market is further expected to achieve USD 5.19 Billion by 2035. Growing defense procurement budgets are accelerating UHMWPE adoption in lightweight armor systems, as militaries prioritize soldier mobility, fuel efficiency, and lifecycle durability over traditional ballistic materials.

Industrial conveyor and bulk material handling applications are boosting demand in the ultra-high molecular weight polyethylene market as they demand abrasion resistance and reduced downtime. Food processing plants are replacing metal liners to meet hygiene audits. On the other hand, orthopedic device manufacturers are increasing purchases of cross-linked UHMWPE to reduce revision surgeries. Such factors emphasize reliability over cost. Procurement teams are favoring suppliers with testing documentation and long-term supply assurances.

Buyers are increasingly locking in multi-year supply agreements to reduce qualification risk and exposure to supply volatility. This ultra-high molecular weight polyethylene market trend indicates that UHMWPE has moved into core material specifications, with demand driven by long-term program stability rather than experimental adoption or short-cycle substitution behavior. In April 2025, Peijia Medical Technology Co., Ltd. announced the research and development achievements of polymer heart valves using ultra-high molecular weight polyethylene (UHMWPE) and thermoplastic polyurethane (TPU) from the Biomedical business of dsm-firmenich.

The ultra-high molecular weight polyethylene market is further evolving around application-specific engineering instead of volume expansion alone. Medical implant producers are demanding oxidation-resistant and vitamin-E stabilized grades to extend implant life beyond several years. At the same time, defense suppliers are shifting from aramid blends toward lighter polyethylene laminates. Companies are redesigning product portfolios around tensile strength, consistency, and creep resistance. For example, Graphene reinforced ultra high molecular weight polyethylene with improved tensile strength and creep resistance properties in December 2025. Margin expansion is now linked to performance guarantees instead of polymer tonnage shipped.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

10%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Ultra-High Molecular Weight Polyethylene Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 2.00 |

| Market Size 2035 | USD Billion | 5.19 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 10.00% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 11.5% |

| CAGR 2026-2035 - Market by Country | India | 13.2% |

| CAGR 2026-2035 - Market by Country | China | 11.0% |

| CAGR 2026-2035 - Market by Form | Sheets | 11.7% |

| CAGR 2026-2035 - Market by End Use | Healthcare and Medical | 11.4% |

| Market Share by Country 2025 | France | 3.0% |

UHMWPE is increasingly becoming central to next-generation armor systems as defense agencies are prioritizing lighter personal protection. This reduces fatigue and improves mobility. NATO-aligned procurement programs are also increasing funding for lightweight composite armor platforms, accelerating the ultra-high molecular weight polyethylene market value. UHMWPE laminates replaced steel inserts in several infantry systems. Companies like Honeywell International are expanding Spectra Shield programs for military contracts. In January 2025, Dyneema unveiled groundbreaking hard ballistic product innovations, enabling a 45% weight reduction in protective armor systems.

Orthopedic OEMs are redesigning implants around longevity metrics. UHMWPE with antioxidant stabilization has now become a standard requirement for knee and hip replacements. Regulatory agencies in the United States are emphasizing post-implant wear performance, however, revision surgery costs remain high. Producers investing in cleanroom-grade resin and traceability systems gain preferred supplier status, propelling growth in the ultra-high molecular weight polyethylene market. In February 2023, Honeywell announced the addition of a new ultra-fine denier fiber to its Spectra Medical Grade (MG) BIO fiber portfolio.

UHMWPE is replacing steel in marine mooring lines and offshore lifting applications. They offer weight reduction that improves safety and corrosion resistance that lowers maintenance costs. Rope and cable manufacturers are securing long-term UHMWPE supply, while product consistency matters more than resin price. Suppliers offering certified marine grades are winning contracts, influencing the overall ultra-high molecular weight polyethylene market dynamics. For example, Trelleborg offers FQ1000 ultra-high molecular weight polyethylene (UHMW-PE), that is ideal for facing steel fender panels and other heavy-duty marine applications.

Bulk handling industries are shifting toward UHMWPE liners and guides. Mining and cement operators report downtime reductions after replacement. Government safety audits are encouraging low-friction materials. Fabricators prefer machinable UHMWPE slabs, while producers that supply near-net shapes gain advantage, accelerating demand in the ultra-high molecular weight polyethylene market. For example, MKSM, a new bridge bearing sliding material, combines and surpasses the positive properties of the UHMWPE semi-finished product and PTFE.

UHMWPE producers are regionalizing operations to reduce logistics risk at a significant level. It also supports faster customer trials. In the United States, advanced material investments qualify for industrial grants. Suppliers are securing multi-year offtake agreements. The ultra-high molecular weight polyethylene market rewards operational reliability, while product innovation strategies now include supply reliability as a feature. In September 2024, materials firm Braskem received USD 50 million in funding from the United States Department of Energy's Office of Manufacturing and Energy Supply Chains.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Ultra-High Molecular Weight Polyethylene Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

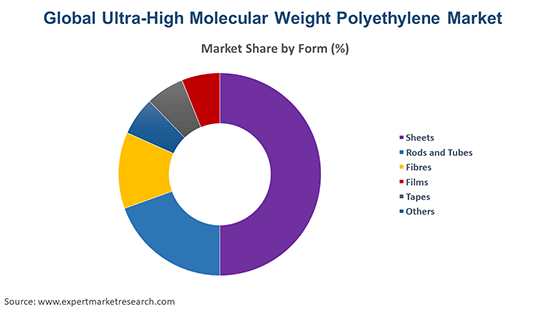

Market Breakup by Form

Key Insight: Sheets largely contribute to the ultra-high molecular weight polyethylene market value due to machining flexibility and industrial replacement demand. Rods and tubes serve precision wear parts, while fibers grow at a relatively faster pace in terms of market share, supported by defense and marine uses. Films support barrier and lining applications. In March 2023, DSM Biomedical introduced ISCC-certified Bio-based Dyneema Purity fiber, enabling renewable UHMWPE options for medical devices. Tapes enable lightweight reinforcement systems.

Market Breakup by Application

Key Insight: Medical prosthetics drive consistent volume, while membranes and filtration rely on chemical stability. Battery use grows its shares in the ultra-high molecular weight polyethylene market revenue from electrification demand. Additives use UHMWPE for lubrication and wear reduction, while other applications include seals and liners. Each application prioritizes different properties. Such diversity protects the market from single industry growth trends.

Market Breakup by End Use

Key Insight: Healthcare leads demand due to its regulated stability and long-term procurement cycles. Aerospace prioritizes UHMWPE for weight reduction benefits, while defense growth is driven by ongoing modernization programs. Mechanical equipment manufacturers use UHMWPE extensively for wear-resistant components, and the food and beverage sector relies on the material to meet strict hygiene and safety compliance requirements. Additional demand comes from marine and mining applications, where durability and low-friction performance are critical. Each end use considered in the ultra-high molecular weight polyethylene market report defines its own performance metrics.

Market Breakup by Region

Key Insight: The ultra-high molecular weight polyethylene market in North America leads through defense and healthcare, while Europe emphasizes sustainability and precision engineering. Asia Pacific’s market growth is supported by manufacturing expansion. Latin America adopts UHMWPE in mining and food processing. Middle East and Africa use UHMWPE in infrastructure and energy.

By form, sheets dominate the market due to machinability, wear resistance, and industrial replacement cycles

Sheets account for the largest share in the ultra-high molecular weight polyethylene market revenue due to their adaptability across industrial and medical machining needs. Fabricators prefer sheets because their thickness tolerances remain stable under repeated stress. Mining and bulk handling plants replace steel liners with UHMWPE sheets to reduce downtime. Medical OEMs machine sheets into implant components for hips and knees. For example, the new Dyneema Woven Composites, launched in April 2025, doubles down on the core durability, strength, abrasion resistance, and dimensional stability of Dyneema fiber.

UHMWPE fibers are rapidly gaining popularity due to defense and marine applications. Lightweight strength is becoming a key factor in performance as the trend switches away from heavier aramid blends. Fiber-based UHMWPE laminates benefit more flexible armor without compromising strength. Apart from armor capabilities, offshore wind farm installations along with marine rope applications are moving towards heavier utilization of UHMWPE fibers. In these types of operations, resistance to corrosion as well as weight savings can create more attractive business models. In this environment, producers must focus on the consistency of filaments as well as the strength of the materials.

By application, medical grade registers a substantial share of the market driven by implant longevity requirements and hospital procurement

Medical grade UHMWPE dominates the market due to implant durability requirements. The requirement for revision surgery reduction is doubling the need for oxidation resistance, with an emphasis on longer lifetimes that has increased the need for longer-lasting UHMPE materials. The need for full traceability of materials and clean room processing has significant implications for the medical OEM industry, where there is an increased need to fulfill stringent quality requirements. The focus of the procurement process has now shifted from the cost of the resin used to the performance of the resin. Medical applications create stable, ultra-high molecular weight polyethylene market value. In November 2025, Borouge launched the first Made-in-UAE healthcare Low-Density Polyethylene solution.

UHMWPE application in batteries is rising through separators and insulation components. Lithium battery manufacturers demand chemical resistance, where thermal stability is critical. UHMWPE membranes help reduce short-circuit risk in battery systems, prompting increased experimentation across electric vehicle supply chains. Producers are actively customizing membrane porosity and thickness to meet evolving battery performance requirements.

Healthcare end uses dominate the market due to regulated demand and revision surgery reduction focus

Healthcare remains the dominant end-use segment because of its regulated demand profile. Suppliers also witness consistent demand from aging populations of many countries. This compensates for a constant requirement for high-quality medical-grade UHMWPE materials from hospitals that want to improve outcomes of surgical procedures by maintaining long-lasting implants.

Defense demand is also boosting the overall ultra-high molecular weight polyethylene market expansion due to lightweight armor priorities. Mobility matters more than bulk protection in this particular sector as UHMWPE composites reduce soldier fatigue. Suppliers must meet certification standards, even though governments benefit them with modernization budgets. For example, Avient’s Dyneema fiber and UD materials, launched in September 2024, deliver inherent water/oil repellency without PFAS, meeting rising demand for safer, sustainable ballistic protection products.

North America secures the leading market position due to defense contracts and domestic polymer manufacturing

The ultra-high molecular weight polyethylene market in North America dominates due to defense spending and medical manufacturing. The domestic incentives for polymers are supporting capacity expansion, incentivizing producers to develop production capacity in the region. Local sourcing for hospitals, as well as domestic security agencies requiring local production for security purposes, supports infrastructure development, enhancing competitiveness for local producers. The OEMs are engaging in close collaborations, offering a positive impact on long-term planning. In February 2025, Nexeo Plastics and Shell Polymers inked an agreement to distribute polyethylene grades in North America.

Asia Pacific is growing at the fastest pace due to battery and electronics manufacturing. Medical device manufacturing is growing in the region. Regional OEMs are reportedly experimenting with the latest applications of UHMPE. Suppliers are enhancing their quality management to comply more stringently. Export-oriented producers continue to spur volume growth. In defense, adoption speed is growing, but the sector favors suppliers with high scalability potential.

| CAGR 2026-2035 - Market by | Country |

| India | 13.2% |

| China | 11.0% |

| UK | 9.1% |

| USA | 8.9% |

| Germany | 8.2% |

| Canada | XX% |

| France | XX% |

| Italy | XX% |

| Japan | 6.9% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Ultra-high molecular weight polyethylene companies compete on material reliability rather than pricing pressure. Medical and defense programs anchor revenues and protect margins. Product roadmaps are built around specific use cases. Many suppliers are adding machining support and co-development teams. Capacity additions remain selective due to qualification risk.

Innovation priorities among ultra-high molecular weight polyethylene market players include oxidation control, improved laminate stacking, and easier secondary processing. Battery and marine applications are opening new opportunities to scale. Regional manufacturing footprints are becoming strategic assets. Local supply reduces audit risk and delivery delays. Long approval cycles limit customer switching, which indirectly benefits established suppliers. New entrants struggle with capital intensity and compliance demands.

Celanese Corporation was established in 1918 and is headquartered in Irving, Texas, United States. The company supplies UHMWPE grades for medical and industrial use. It focuses on downstream partnerships. Celanese supports OEM machining requirements and emphasizes material consistency.

LyondellBasell was established in 2002 and is headquartered in Netherlands. The company focuses on polymer innovation. The company’s UHMWPE offerings target industrial wear and specialty applications. It leverages global production scale and prioritizes process efficiency, and its reach supports supply reliability.

DSM was founded in 1902 and is headquartered in Netherlands. The company is known for Dyneema fibers. It focuses on defense marine and industrial protection. DSM invests in lightweight material innovation and its products support high-margin applications.

Founded in the year 2005 with its head office located in Tokyo, Japan, Mitsubishi Chemical supplies UHMWPE for industrial and medical uses. The company emphasizes material purity, while its Asian manufacturing facilities support battery growth. The company focuses on advanced processing technologies.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Asahi Kasei Advance Corporation, among others.

Unlock the latest insights with our ultra-high molecular weight polyethylene market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 10.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 5.19 Billion by 2035.

Manufacturers are investing in application-specific grades expanding downstream partnerships securing multi-year contracts regionalizing production enhancing certification readiness and aligning R&D with OEM qualification timelines.

The key trends guiding the market include the growing applications of ultra-high molecular weight polyethylene in diverse end-use sectors, the surging number of hip and knee replacement surgeries, and the growing demand for medical-grade ultra-high molecular weight polyethylene.

The market is broken down into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

The market is broken down into sheets, rods and tubes, fibres, films, and tapes, and others.

The various applications of ultra-high molecular weight polyethylene are medical grade and prosthetics, membranes, filtration, batteries, and additives, among others.

Based on end use, the market is divided into healthcare and medical, aerospace, defence and military, mechanical equipment, food and beverages, and others.

The key players in the market include Celanese Corporation, LyondellBasell Industries Holdings B.V., Koninklijke DSM N.V., Mitsubishi Chemical Holdings Group, and Asahi Kasei Advance Corporation, among others.

In 2025, the market reached an approximate value of USD 2.00 Billion.

High capital requirements regulatory certifications long qualification cycles limited suppliers and performance consistency demands restrict new entrants and slow rapid capacity scaling across emerging applications.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Form |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share