Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The US cold storage market size reached around USD 19.58 Billion in 2025. The market is projected to grow at a CAGR of 4.30% between 2026 and 2035 to reach nearly USD 29.83 Billion by 2035.

Base Year

Historical Period

Forecast Period

Advanced technology adoption and efforts to preserve temperature-sensitive products propel the United States cold storage market growth.

The rise of connected and high-capacity refrigerated transport boosts the expansion of the market.

Increased health concerns and stringent quality standards drive demand for high-quality manufacturing, further stimulating market growth.

Compound Annual Growth Rate

4.3%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Cold storage refers to a special facility that is often computer-controlled for the warehousing of perishable or other sensitive goods like food, medicines, and artwork, at a particular temperature. These facilities are crucial in the supply chain of various industries, especially food and pharmaceuticals, to preserve the quality and extend the shelf life of products.

The rising adoption and availability of advanced technology in the United States and the increasing efforts of manufacturers to preserve temperature-sensitive products from tampering or staling, especially food items, are driving the United States cold storage market growth. The development of such facilities provides high efficiency and reliability, which is expected to aid the market growth in the forecast period.

The increasing popularity of connected trucks, high-cube refrigerated trailers, and vehicles that offer cross-product transportation is expected to drive the demand for cold storage transportation services in the coming years. The rise in health concerns among consumers, coupled with the implementation of stringent quality standards, is resulting in the increased demand for quality product manufacturing, providing further impetus to the United States cold storage market growth.

The market is growing due to increased online grocery shopping; technological advancements; a focus on sustainability; and rising investments in cold chain infrastructure development

Consumers are increasingly turning towards online platforms for their grocery needs, necessitating more cold storage space to preserve perishable goods.

Automation technologies, such as robotic storage and retrieval systems, are being increasingly adopted to enhance efficiency, reduce labour costs, and improve inventory management.

Regulations regarding food safety, energy efficiency, and environmental impact are becoming stricter, pushing companies to invest in modern, compliant facilities.

Governments and major players are increasingly investing in the development of logistical infrastructure and the upgradation of existing infrastructure.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“United States Cold Storage Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Warehouse Type

Market Breakup by Construction Type

Market Breakup by Temperature Type

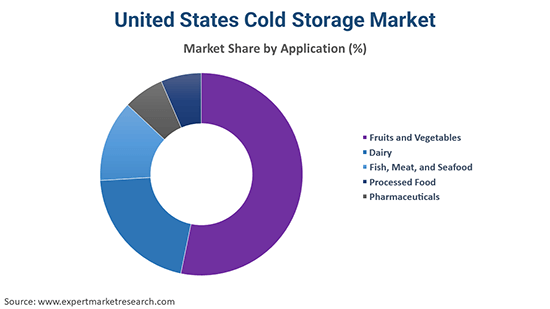

Market Breakup by Application

The increasing demand for exotic vegetables, fruits, meats, and certain dairy products has substantially enhanced the market expansion

According to the United States cold storage market analysis, to accommodate the growing variety of perishable goods, cold storage operators are expanding their facilities to include frozen storage facilities. For instance, Americold has invested USD 35 million to build and operate a state of the art, temperature controlled, cold-storage facility, in collaboration with RSA Cold Chain and DP World. The construction is expected to be completed in the first quarter of 2025 and the facility will accommodate 40,000 pallet positions.

Americold's recent initiative is focused on establishing a cutting-edge cold storage facility, designed to optimize the cold chain process. This development is aimed at enhancing the company's ability to assist its clients in efficiently distributing food and other products globally.

Pharmaceuticals, fish, meat, seafood, and dairy foods often have unique storage needs in terms of temperature and humidity controls. This has led to the development of more sophisticated and versatile cold storage facilities capable of maintaining a range of specific conditions to ensure the quality and freshness of diverse products.

Frozen storage is expected to account for a significant portion of the United States cold storage market share

Frozen storage is essential for a wide range of products, including meats, seafood, frozen meals, certain dairy products like ice cream, and some fruits and vegetables. The ability of freezing to extend the shelf life of products for a considerable duration without significant loss of quality makes it a preferred method for long-term storage. The typical temperature for frozen storage is around -18°C (0°F) or lower.

Moreover, chilled storage facilities are increasing rapidly as food distribution networks become more complex and globalised. This is to ensure the timely and efficient movement of perishable goods across the country.

Some major players are integrating innovative technologies to enhance their cold storage capabilities

Americold Logistics LLC is one of the leading companies in temperature-controlled warehousing, providing comprehensive supply chain solutions. Its expansive network ensures efficient storage and distribution of perishable goods across various industries, leveraging advanced technology.

Agro Merchant Group LLC specialises in cold storage and logistics, offering tailored solutions for perishable commodities. Its global presence, with state-of-the-art facilities, underscores its commitment to quality and food safety in the supply chain.

Renowned for its customised supply chain services, Burris Logistics, Inc. excels in cold storage and freight management. Its client-centric approach, coupled with cutting-edge technology, makes it a go-to partner for diverse cold chain needs.

As one of the largest refrigerated warehousing companies globally, Lineage Logistics Holdings, LLC, innovates in cold storage solutions. The company is the owner of a large network of advanced facilities and logistics.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the United States cold storage market are United States Cold Storage, Inc., and Wabash National Corporation, among others.

Storage facility companies around the world are increasingly focused on the development of advanced facilities and the upgradation of existing facilities. ASRS and IoT are some of the major technological updates as they aid in automating the handling and storage of products. The sensors in IoT devices track temperature, humidity, and other environmental factors, ensuring optimal conditions for preserving the quality of perishable goods, and ultimately reducing human intervention.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market attained a value of nearly USD 19.58 Billion.

The market is assessed to grow at a CAGR of 4.30% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 29.83 Billion by 2035.

The major industry drivers include the high efficiency and reliability of cold storages, increasing popularity of connected trucks and vehicles, rise in health concerns among consumers, implementation of stringent quality standards, and increased demand for quality product manufacturing.

The key trends driving the market include the rising adoption and availability of advanced technologies and increasing efforts of manufacturers to preserve temperature-sensitive products from tampering or staling.

Based on warehouse types, the United States cold storage industry can be segmented into private and semi-private and public.

By construction type, the market is divided into bulk storage, production stores, and ports.

The categories of temperature are chilled and frozen.

On the basis of application, the market is divided into fruits and vegetables, dairy, fish, meat, and seafood, processed food, and pharmaceuticals.

The major players in the market are Americold Logistics LLC, Agro Merchant Group LLC, Burris Logistics, Inc., Lineage Logistics Holdings, LLC, United States Cold Storage, Inc., and Wabash National Corporation, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Warehouse Type |

|

| Breakup by Construction Type |

|

| Breakup by Temperature Type |

|

| Breakup by Application |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share