Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The United States compounding pharmacies market was valued at USD 7.44 Billion in 2025 driven by the increasing prevalence of chronic diseases across the region. It is expected to grow at a CAGR of 6.30% during the forecast period of 2026-2035 and attain a market value of USD 13.71 Billion by 2035. The market growth is also driven by the rising emphasis on providing treatment alternatives for diseases like cancer to the patients.

Base Year

Historical Period

Forecast Period

The market is expected to grow due to rising immunization awareness, government initiatives, and advancements in mRNA technology, improving vaccine efficacy and expanding protection against emerging infectious diseases.

Increasing investments in domestic vaccine manufacturing aim to reduce reliance on global supply chains, ensuring quicker responses to outbreaks while stabilizing production costs and enhancing national health security.

Personalized vaccines, including cancer immunotherapies and mRNA-based treatments, are gaining momentum, with ongoing research driving innovation and expanding the market beyond infectious diseases to targeted, patient-specific therapies.

Compound Annual Growth Rate

6.3%

Value in USD Billion

2026-2035

*this image is indicative*

Compounding pharmacies create customised medications tailored to individual patient needs. They prepare drugs in specific dosages, formulations, or combinations not available commercially, benefiting patients with allergies, dosage restrictions, or unique medical requirements. These pharmacies serve hospitals, clinics, and individual patients, ensuring personalised treatment. Regulated by the U.S. Food and Drug Administration (FDA) and state boards, they follow strict safety and quality standards. With increasing demand for personalised medicine, compounding pharmacies play a crucial role in modern healthcare, offering solutions for niche medical conditions and improving patient care and treatment outcomes.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Investment in Technology-Enabled Pharmacies to Strengthen Market Expansion

The market is witnessing growth due to increasing demand for customised medications and the expansion of telemedicine services. For instance, in November 2023, Precision Compounding Pharmacy, a technology-enabled compounding pharmacy specialising in telemedicine prescriptions, secured seed investment from Right Side Capital Management, a technology startup investment firm. This funding enables Precision Compounding Pharmacy to enhance its services, broaden its patient reach, and drive industry innovation. The investment is expected to accelerate market growth by improving pharmacy accessibility, integrating advanced digital healthcare solutions, and fostering the development of personalised medication solutions to meet evolving patient needs.

Infrastructure Expansion to Drive United States Compounding Pharmacies Market Demand

The rising demand for specialty medications and advancements in pharmaceutical technology are key drivers of growth in the U.S. compounding pharmacies market. For instance, in September 2021, Empower Pharmacy, an FDA-registered outsourcing facility, inaugurated a USD 55 million, 86,000-square-foot facility in Houston, making it one of the largest and most advanced compounding pharmacies in North America. This expansion improves access to affordable and innovative pharmaceutical solutions while setting new industry benchmarks. The facility is expected to boost market growth by increasing production capacity, enhancing efficiency, and ensuring greater availability of high-quality compounded medications in the forecast period.

The market is witnessing several trends and developments to improve the current scenario. Some of the notable trends are as follows:

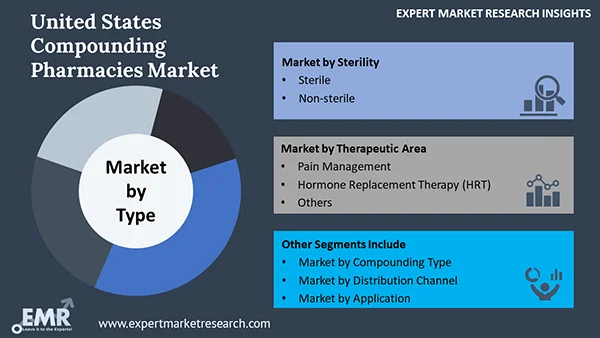

United States Compounding Pharmacies Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Market Breakup by Pharmacy Type

Market Breakup by Compounding Type

Market Breakup by Sterility

Market Breakup by Therapeutic Area

Market Breakup by Applications

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Oral Medication to Lead the Segment by Product Type

Oral medications dominate the market due to high patient preference, ease of administration, and widespread use in chronic disease management. These formulations offer personalised dosages, allergen-free compositions, and flavour customisation, enhancing patient adherence. The increasing prevalence of conditions such as hormone imbalances and pain disorders is driving demand. Additionally, pharmaceutical shortages and regulatory approvals for compounded oral medications are boosting their adoption. With ongoing advancements in compounding techniques and an expanding customer base, this segment is expected to maintain its leadership, contributing significantly to the market’s overall growth during the forecast period.

503B Compounding Pharmacies to Witness United States Compounding Pharmacies Market Growth for Segmentation by Pharmacy Type

503B compounding pharmacies are leading due to their large-scale production capabilities and regulatory compliance with the U.S. Food and Drug Administration (FDA). These pharmacies cater to hospitals, clinics, and healthcare facilities, ensuring high-quality, pre-prepared compounded medications. Rising demand for sterile drugs, regulatory crackdowns on traditional compounding, and increased outsourcing by healthcare providers are driving segment growth. Additionally, 503B pharmacies support drug shortages by providing essential medications in bulk. As healthcare institutions prioritise safety and efficiency, the segment is set for substantial expansion, strengthening its contribution to the compounding pharmacies market over the forecast period.

Pharmaceutical Dosage Alteration to Dominate the Segment by Compounding Type

Pharmaceutical dosage alteration (PDA) holds the largest market share due to its role in personalising drug formulations for specific patient needs. This type of compounding enables tailored dosages, alternative drug delivery methods, and allergen-free medication options, enhancing patient compliance. The rising geriatric population and paediatric requirements for customised dosages are major drivers of this segment. Additionally, PDA supports patients with swallowing difficulties or absorption issues, boosting its demand. The continued need for patient-specific treatment solutions, alongside technological advancements in drug formulation, is expected to drive further market growth in this segment.

Sterile Compounded Medications to Hold Significant United States Compounding Pharmacies Market Value for Segmentation by Sterility

Sterile compounded medications dominate the market due to their critical role in hospital settings, surgical procedures, and intravenous therapies. Rising demand for sterile injectables, ophthalmic solutions, and parenteral nutrition supports the segment’s growth. Regulatory guidelines ensuring sterility, patient safety, and increasing FDA oversight further drive adoption. The expansion of 503B outsourcing facilities, advancements in sterile compounding technology, and increasing demand for contamination-free medications contribute to the segment’s prominence. With an ongoing emphasis on infection control and regulatory compliance, sterile compounding is poised to sustain market dominance and significantly impact future growth.

Hormone Replacement Therapy to Lead the United States Compounding Pharmacies Market Segmentation by Therapeutic Area

Hormone replacement therapy (HRT) holds the largest market share due to increasing demand for personalised treatments in managing hormonal imbalances, menopause, and andropause. Rising awareness about bioidentical hormone therapy and its benefits over standard treatments is boosting adoption. As per the analysis by Expert Market Research, the global hormone replacement therapy market value is projected to grow at a CAGR of 6.90% during the forecast period 2025-2034. Compounded HRT provides tailored dosages, ensuring patient-specific care. The growing ageing population and the increasing prevalence of thyroid and adrenal disorders further fuel market expansion. As healthcare providers and patients seek safer, more effective hormone therapies, this segment will continue to be a key driver of the compounding pharmacies market in the U.S.

Adults to Lead the Applications Segment

The adult population segment leads the compounding pharmacies market due to high demand for personalised medications in chronic disease management. Adults require custom formulations for hormone therapy, dermatology, pain management, and nutritional supplementation. The growing prevalence of lifestyle-related disorders and the increasing preference for tailored treatments over commercial alternatives drive segment expansion. Additionally, shortages of specific medications and regulatory changes promoting compounded alternatives further support growth. With rising healthcare awareness and continued innovation in drug customisation, the adult segment is expected to drive substantial market value in the coming years.

The market is expanding due to growing demand for personalised medicine, an ageing population, and advancements in healthcare infrastructure. The South dominates due to a high prevalence of chronic diseases, while the West, particularly California, is witnessing rapid growth driven by advanced healthcare facilities. The Midwest benefits from rising hospital partnerships, whereas the Northeast’s stringent regulations and high healthcare spending ensure steady expansion.

However, President Trump’s new tariff regime poses challenges by increasing costs for imported active pharmaceutical ingredients (APIs). Rising prices may affect affordability in the South, while California’s already high healthcare costs could further escalate. The Midwest might face supply chain disruptions, and the Northeast could experience reduced profit margins, potentially limiting market growth.

The key features of the market report comprise funding and investment analysis and strategic initiatives by the leading players. The major companies in the market are as follows:

Headquartered in Deerfield, Illinois, Walgreen Co. was established in 1901 and is a leading pharmacy chain in the U.S. Its compounding pharmacy division provides personalised medications tailored to patient needs, including hormone replacement therapy, dermatological treatments, and pain management solutions. The company integrates advanced pharmaceutical technologies to ensure precision and quality. With a vast nationwide presence, Walgreens offers both retail and mail-order compounding services, ensuring accessibility and convenience. Its commitment to innovation and regulatory compliance has positioned it as a trusted provider in the U.S. compounding pharmacy market.

Founded to enhance personalised patient care, US Drug Mart is a key player in the market. Headquartered in Texas, the pharmacy specialises in custom-formulated medications for pain management, dermatology, hormone therapy, and paediatrics. It focuses on high-quality, patient-specific prescriptions unavailable in mass-produced pharmaceuticals. US Drug Mart ensures stringent quality control and follows industry standards to provide safe, effective medications. With a strong commitment to customer service and innovation, the company continues to expand its presence, catering to diverse healthcare needs across the United States.

Compounding Pharmacy of America, headquartered in Knoxville, Tennessee, is a trusted provider of customised medications. Established to offer patient-specific formulations, it serves various healthcare segments, including pain management, dermatology, veterinary medicine, and hormone therapy. The company ensures pharmaceutical-grade ingredients and stringent safety protocols to meet industry standards. It also provides nationwide shipping, making compounded medications accessible across the U.S. By leveraging modern compounding techniques and regulatory compliance, the pharmacy continues to enhance its service offerings, catering to physicians, clinics, and individual patients seeking specialised medication solutions.

Triad Compounding Pharmacy, based in Cary, North Carolina, is a specialised provider of compounded medications tailored to individual patient needs. It offers formulations for dermatology, hormone therapy, paediatrics, and veterinary medicine. The pharmacy is known for its commitment to high-quality ingredients, rigorous safety standards, and personalised patient care. Triad works closely with healthcare providers to develop precise medication solutions that are not available in standard pharmaceutical offerings. With a focus on innovation and compliance, the company continues to expand its services, addressing complex medical requirements in the U.S. compounding pharmacy market.

Founded in 2017 and headquartered in Berkeley, California, Valor Compounding Pharmacy, Inc. is a growing player in the U.S. compounding pharmacy market. It specialises in providing customised medications for mental health, hormone replacement therapy, pain management, and dermatology. The pharmacy prioritises precision, compliance, and efficiency, leveraging advanced compounding technologies to enhance formulation accuracy. Valor serves patients, healthcare providers, and research institutions across multiple states, offering reliable and timely medication solutions. Its focus on innovation and customer-centric service makes it a distinguished name in the evolving compounding pharmacy sector.

Empower Pharmacy, headquartered in Houston, Texas, is a leading compounding pharmacy established in 2009. It specialises in sterile and non-sterile compounded medications for hormone replacement therapy, weight management, dermatology, and wellness treatments. The company operates advanced pharmaceutical manufacturing facilities, ensuring compliance with FDA and USP guidelines. Empower Pharmacy serves a broad clientele, including physicians, clinics, and telemedicine providers, delivering high-quality, customised medications across the U.S. With a strong emphasis on technological integration and operational excellence, it continues to expand its market presence and set benchmarks in the compounding pharmacy industry.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Pharmacy Type |

|

| Breakup by Compounding Type |

|

| Breakup by Sterility |

|

| Breakup by Therapeutic Area |

|

| Breakup by Applications |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 1,999

USD 1,799

tax inclusive*

Single User License

One User

USD 3,099

USD 2,789

tax inclusive*

Five User License

Five User

USD 4,599

USD 3,909

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share