Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The United States contract packaging market was valued at USD 93.33 Billion in 2025. The market is estimated to grow at a CAGR of 11.70% during 2026-2035 to reach a value of USD 282.20 Billion by 2035.

Base Year

Historical Period

Forecast Period

In 2023, the USA’s agriculture, food, and related sectors accounted for 5.6% of the country’s GDP.

The majority of food and beverages manufacturing plants are located in California with 6,301 units, followed by Texas (2,782), indicating potential opportunities for contract packaging services in these regions.

The expansion of start-ups seeking contract packaging service solutions is a notable trend in the market. In 2023, nearly 5.5 million businesses were launched in the United States.

Compound Annual Growth Rate

11.7%

Value in USD Billion

2026-2035

*this image is indicative*

According to 2024 data, the United States boasts 13,106 electronics and electrical equipment facilities in operation with an annual average sales of USD 1.8 trillion. Among these manufacturers, 56% of companies are major exporters, especially for the international markets, and 29% of the companies produce for the U.S. market only.

California has the largest number of semiconductor manufacturers with 34 facilities, followed by Arizona with 28 facilities, and Texas with 17 facilities. In July 2022, the U.S. government passed the CHIPS Act of 2022 to strengthen domestic semiconductor manufacturing, design, and research.

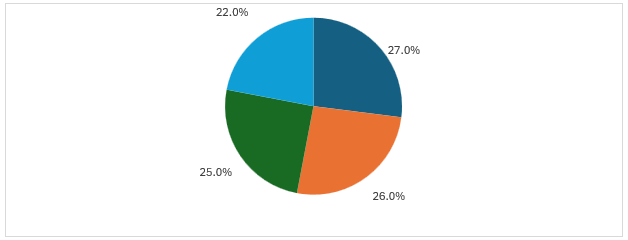

Figure: Electronic Manufacturing by Region in the U.S., 2024

Food and beverage companies are increasingly demanding biodegradable packaging to enhance sustainability, which is further increasing the United States contract packaging market value.

In 2022, the expenditure on food accounted for 12.8% of U.S. households’ spending, an increase from 12.4% compared to 2021.

The U.S. frozen food market is expanding due to the popularity of online grocery sites such as Walmart.com, Amazon Fresh, Instacart, and others. By 2024, the U.S. grocery eCommerce market is predicted to reach USD 76.2 billion.

In May 2023, Amcor and Tyson Foods teamed up to create sustainable packaging for consumer products to reduce pollution. The new packaging is made of Amcor‘s AmPrima recycle ready forming/non-forming flexible film and offers up to a 70% reduction in carbon footprint over conventional packaging.

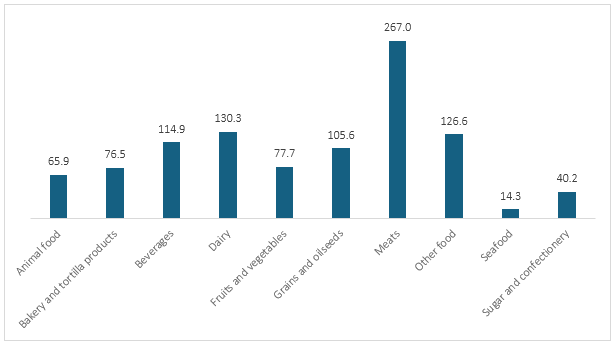

Figure: Components of food and beverage manufacturing: sales, value of shipments, or revenue by industry, 2021 (USD Billion)

Rising pharmaceutical production, demand for electronics, and advancement in contract packaging technology are the key trends impacting the United States contract packaging market demand positively

In the pharmaceutical sector, contract packaging companies provide a variety of services specifically designed to meet packaging requirements, including high-volume commercial solutions for both primary and secondary packaging. In 2022, the USA accounted for around 45% of the global pharmaceutical market and 22% of global production.

Electronic devices feature intricate designs and delicate components, necessitating specialised packaging for protection and efficiency. The USA’s semiconductor manufacturing is driven by the CHIPS and Science Act of 2022, which provides USD 52.7 billion for American semiconductor research, development, manufacturing, and workforce development. Currently, the USA hosts around 13,106 electronics and electrical equipment facilities. Around 56% of the electronics manufacturers export their products.

Owing to rising sustainability concerns, contract packagers can strengthen their market position by selecting biodegradable, recyclable, or materials made from sustainable sources. By adopting a minimalist approach to packaging in the United States contract packaging market, businesses can create packaging that is tailored to the exact dimensions of the product, eliminating excess space and materials and lowering transportation costs.

The integration of AI into contract packaging systems enables predictive maintenance. AI models analyse data from machinery to forecast potential failures and maintenance needs. This allows companies to perform maintenance before issues arise, avoiding unexpected downtime.

Contract packaging is gaining importance in food and beverage and supplement/ pharmaceutical sectors in the United States, due to the improved efficiency, consistency, and innovation provided by them. The expansion of the food and beverage sector in the US is supporting the United States contract packaging market growth. In 2023, more than 1,000 new food and beverage products were launched in the United States through contract manufacturing. This makes up over 10% of all new products in the CPG category.

Pharmaceutical companies are actively moving away from in-house packaging to contract packaging, as it is a cost-effective method to launch drugs without sacrificing packaging quality. Furthermore, the presence of stringent regulations such as the Drug Supply Chain Security Act (DSCSA) for drug serialisation is pushing companies to adopt contract packaging to meet the quality requirements. On an average, the FDA approves an average of 20 to 30 new drugs every year, representing a strong pharmaceutical sector in the United States.

“United States Contract Packaging Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Packaging Type

Market Breakup by Material

Market Breakup by End Use

Market Breakup by Region

Based on packaging type, primary packaging accounts for a significant share of the market

Primary packaging materials include flexible pouches, glass bottles, paperboard boxes, and blister packs. The United States food and beverage manufacturing industry is comprised of a large base of 75,000 US-based organisations with 41,000 processing plants that support the market for contract packaging.

Companies offering contract packaging are actively advancing their secondary packaging through smart packaging and augmented reality technologies. It is recorded that smart components in the packaging can raise adherence by 23% through various types of reminders, customised to each user.

Furthermore, developments are being carried out in secondary packaging sector supporting the market growth. For instance, In May 2024, Sharp, a global leader in contract packaging, clinical supply services and small-scale sterile manufacturing announced its plans to expand its Macungie, PA site to increase its production capacity for sterile injectables secondary packaging.

Based on material, plastic is a major contributor to the United States contract packaging market revenue

Single-use plastic beverage containers are used to sell an increasing variety of drinks from bottled water and juices to sports drinks, and other non-carbonated beverages. The US beverage industry has been performing consistently over the years. In fact, the beverage industry constituted USD 63.2 billion in terms of value added in 2021. Considering the large opportunity in the market, Refresco acquired California based VBC Bottling – a family owned business that provides co-packing services in April 2024.

The combination of consumer demand, regulatory changes, and corporate sustainability goals are pushing companies to adopt paper-based solutions. Paper packaging is increasingly utilised to package fast food, fresh food, and frozen foods. Moreover, based on industry reports, 60 to 70% of the consumers in the USA are willing to pay more for sustainable packaging. Major companies like Amazon, Chick-fil-A, and JDE Peet's are making significant moves towards sustainability by reducing plastic usage and switching to paper packaging.

Players in the market differentiate themselves through packaging quality, pricing, timely delivery, performance, and providing technical assistance to customers.

Silgan is a prominent manufacturer specialising in dispensing and speciality closures, as well as steel, aluminum, and custom-designed plastic containers. The company operates in the contract packaging sector through its subsidiary, Silgan Unicep, a speciality contract manufacturer and developer (SCMD) solutions provider. Contract packaging solutions offered by the company include HLX, PreciseDose™ Proprietary Unit-Dose, MicroDose Proprietary Unit-Dose, Twist-Tip™ Proprietary Unit-Dose, Standard Blow-Fill-Seal, Custom Unit-Dose Packaging, Form Fill Seal Pouch, Tube Filling, and Syringe Filling.

Sonic Packaging is a dedicated custom contract packaging provider specialising in single-use, metered dose delivery systems. With a comprehensive suite of services, Sonic Packaging designs, qualifies, produces, develops, and fills both primary and secondary packaging solutions tailored to meet the specific needs of its clients while adhering to regulatory standards. Contract packaging solutions offered by the company include applicators, blister packaging and filling, bottle filling, and pouches.

MattPak is a contract packaging company that manufactures water-soluble liquid and powder pods, along with single-use sachets for granular flowing powders. The company emphasises product safety and quality, maintaining strict process controls to ensure that its finished goods consistently meet or exceed customer standards. The company’s contract packaging solutions include sachets/ single packs, water soluble packaging, and display packaging.

Bell-Carter Packaging offers a wide range of solutions for primary and secondary food handling, supporting various packaging and re-packaging projects that cater to seasonal, short-term, and long-term production needs. Bell-Carter Packaging operates across three strategic locations in the United States: Modesto, Phoenix, and Portland. The company’s contract packaging solutions include Ingredient Blending, Bulk Bag Filling, and Flexible Pouch Filling, among others.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the United States contract packaging market are Reed-Lane, Inc., Multi-Pack Solutions LLC, Aaron Thomas Company, Inc., Sharp Services, LLC, Pharma Tech Industries, and Summit Packaging Solutions, among others.

Far West is expected to hold a significant share of the market owing to an expanding manufacturing sector. Washington state has over 6,400 manufacturing companies including 577 in Spokane County in 2023. Colorado is home to 29 semiconductor establishments. A significant manufacturing sector provides opportunities for contract packaging by allowing companies to reduce costs and access advanced technologies. Some of the key contract packaging companies are States Logistics Services Inc and Brown Packaging etc.

In the Southeast region, Georgia has 80 establishments producing pharmaceuticals, while Florida has 574. Pharmaceutical manufacturing in the region offers opportunities for contract packaging as it allows companies to focus on core activities. In March 2024, SMC Ltd, acquired end-to-end fill/finish facility in Charlotte. This enabled SMC to provide a wider portfolio of services including secondary packaging.

The expansion of the personal care and cosmetic sector in the Mideast region is supporting the market growth. In July 2023, JP Packaging, LLC, a contract packaging company, acquired Toll Pack in Lehighton and enhanced its capabilities in catering to the personal care, cosmetic, household and nutritional sectors.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The United States market for contract packaging attained a value of USD 93.33 Billion in 2025.

The market is estimated to grow at a CAGR of 11.70% during 2026-2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 282.20 Billion by 2035.

The factors driving the market growth include the rising preference for sustainable contract packaging solutions, rising demand for pharmaceuticals due to rising chronic diseases, and an expanding electronics sector.

The key trends of the market include the growing demand for green contract packaging solutions, the advent of smart contract packaging technology, and the increased adoption of automation services by market players to boost their productivity.

The key regional markets for contract packaging are New England, Mideast, Great Lakes, Plains, Southeast, Southwest, Rocky Mountain, and Far West.

The packaging types include primary, secondary, and tertiary.

The key players in the market include Silgan Holdings Inc., Sonic Packaging Industries, Inc., Mattpak Inc., Bell-Carter Packaging, LLC, Reed-Lane, Inc., Multi-Pack Solutions LLC, Aaron Thomas Company, Inc., Sharp Services, LLC, Pharma Tech Industries, and Summit Packaging Solutions, among others.

The materials include plastic, glass, paper and paperboard, and metal.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Packaging Type |

|

| Breakup by Material |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share