Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The United States HIV drugs market was valued at USD 13.04 Billion in 2025 and is expected to grow at a CAGR of 4.30%, reaching USD 19.87 Billion by 2035. The market growth is driven by rising HIV prevalence, introduction of novel antiretroviral therapies, and government support for HIV/AIDS programs.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4.3%

Value in USD Billion

2026-2035

*this image is indicative*

United States and many other countries in other regions witness large number of cases of HIV infection. Unites States noted a major spike in the number of new cases according to most recent data, with the southern states taking the highest numbers among all. It was followed by the West, North-East and Midwest parts of the United States. The demand for drugs for the same will be greater to cater to new and existing cases collectively.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

More testing centers will also help in early detection of HIV positives and, accordingly, people can start with prescribed medicines to protect themselves from very serious harm. Innovation will also help in rising in the market, like creating more multidimensional medicines such that the burden of consuming different pills is minimized, or lesser dosage is required in a particular time.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

HIV, human immunodeficiency virus, infection is a condition which attacks and weakens the immune system of people. There are three stages of the infection, acute, chronic and the final and most severe acquired immunodeficiency disease (AIDS). HIV medicines can help in viral suppression, by decreasing the viral load which can protect the immune system and prevent transmission too. Some medicines do this by blocking or altering the enzymes that help the virus multiply. Some refrain the virus from decreasing the CD4 cell count, which fight the pathogens or infections.

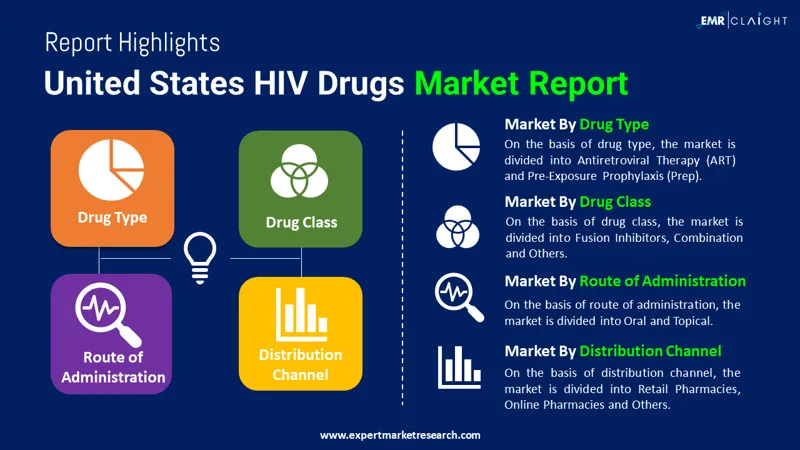

Market Breakup by Drug Type

Market Breakup by Drug Class

Market Breakup by Route of Administration

Market Breakup by Distribution Channel

The rising density of HIV-infected people in the population has helped in the production and implementation of HIV drugs. The market is affected by rising government initiatives and campaigns to raise public consciousness about the causes, symptoms, and treatments of HIV. Furthermore, the launch of generic drugs, which are less expensive and chemically similar to branded drugs, is another factor adding to the demand for HIV drugs. Several international organizations provide funds to research institutes for R&D activities in order to develop innovative, accessible, secure, and reliable medicines for successful therapeutic solutions. The aforementioned factors are expected to drive up demand for HIV drugs over the forecast period.

The report presents a detailed analysis of the following key players in the HIV drugs market of United States, looking into their capacity, market shares, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is estimated to grow at a CAGR of 4.30% between 2026 and 2035.

The major drivers of the industry include rising population, growing disposable incomes, demand for prevention of infection, and the rising availability of affordable and innovative drugs.

The increasing government initiatives and campaigns to raise public consciousness awareness about the disease is an important industry trend.

The HIV drug types include antiretroviral therapy (ART) and pre-exposure prophylaxis (Prep).

The various classes of HIV drugs are nucleoside reverse transcriptase inhibitors, multi-class combination products, protease inhibitors, HIV integrase strand transfer inhibitors, non-nucleoside reverse transcriptase inhibitors, entry inhibitors — CCR5 co-receptor antagonist, fusion inhibitors, and combination, among others.

Oral and topical forms of drug are available.

Different distribution channels involve hospital pharmacies, retail pharmacies, and online pharmacies, among others.

The leading players in the market are Gilead Sciences, Inc, Janssen Global Services, LLC (Johnson & Johnson, ViiV Healthcare group of companies (GSK), Merck Sharp & Dohme Corp (Merck & Co), among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Drug Type |

|

| Breakup by Drug Class |

|

| Breakup by Route of Administration |

|

| Breakup by Distribution Channel |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 1,999

USD 1,799

tax inclusive*

Single User License

One User

USD 3,099

USD 2,789

tax inclusive*

Five User License

Five User

USD 4,599

USD 3,909

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share