Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Uttar Pradesh dairy market size was valued at INR 2096.79 Billion in 2025. The industry is expected to grow at a CAGR of 14.10% during the forecast period of 2026-2035 to reach a value of INR 7841.72 Billion by 2035. The industry is increasingly leveraging advanced technologies and global partnerships to boost productivity and milk quality.

Farmers and companies are increasingly choosing innovation and modern farming methods to enhance flavor, quality, productivity, and sustainability in Uttar Pradesh dairy industry. To promote this specific trend, BL Kamdhenu Farms signed an MoU in September 2024 with DeLaval, a Sweden-based manufacturer specializing in zero-waste cattle breeding, farm operations, and cow comfort, with an investment of INR 1,500 crore. By linking stakeholder organizations to the farming value chain, we expect waste to be balanced between inputs and outputs, to create a circular economy and improve efficiencies, while positively increasing the benefits associated with sustainable farming to the environment.

Similarly, Ananda Dairy established a strategic partnership in November 2023 with the Brazilian organization Ameria Pajora and BH Embryos, to promote advanced animal nutrition, intensively exercisable cattle breeding, embryo development, and genetically superior breeding stock.

These developments illustrate the transformation in Uttar Pradesh's dairy sector, whereby leveraging technology-based solutions, sustainable farming, and collaboration with international organizations, are enabling local farmers and communities to increase efficiencies, facilitate production optimization and offer several growth opportunities in the Uttar Pradesh dairy market.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

14.1%

Value in INR Billion

2026-2035

*this image is indicative*

The Uttar Pradesh dairy market is witnessing growing interest from leading cooperatives and private players seeking to tap into rising demand for high-quality milk and value-added products. In March 2025, Karnataka Milk Federation (KMF) entered the state by launching its popular ‘Nandini’ milk, curd, and buttermilk range in Hathras, targeting a scale-up from 30,000 litres per day to 100,000 litres within six months. This expansion reflects a broader trend of dairy companies extending procurement and distribution networks beyond their traditional territories. By strengthening farmer linkages and increasing brand penetration, such initiatives are enhancing milk supply efficiency, improving local livelihoods, and supporting the overall market growth.

Uttar Pradesh continues to attract large-scale investments aimed at boosting milk processing efficiency and empowering rural dairy networks. In January 2024, Amul announced an investment of INR 900 crore to establish a modern milk processing facility in Baghpat, marking one of the state’s largest dairy infrastructure projects. Of this, INR 800 crore is dedicated to building a greenfield plant with an 8-lakh-litre daily capacity. The initiative is set to create nearly 4,000 indirect jobs while improving milk collection, enhancing cooperative competitiveness, and expanding the western Uttar Pradesh dairy market scope.

The ready-to-drink dairy beverages market in Uttar Pradesh is gaining strong momentum, supported by rising consumer preference for on-the-go, nutritious drink options. In March 2024, Varun Beverages Ltd. undertook a major expansion of its value-added dairy production capacity across northern India, including Uttar Pradesh, to meet this growing demand. The company doubled its dairy processing capability while investing in chilling infrastructure and rural distribution networks. By introducing hybrid dairy-juice lines, it is strengthening its foothold in underpenetrated markets and advancing the state’s shift toward functional, convenience-driven consumption of dairy across Uttar Pradesh.

Value-added and convenient dairy products are witnessing high demand in the Uttar Pradesh dairy market driven by changing consumer preferences, rising disposable incomes, and urbanization. In this context, Godrej Agrovet’s strategic acquisition of Hyderabad-based Creamline Dairy Products in March 2025, valued at INR 930 crore, has significantly strengthened its control over the Godrej Jersey brand. This move enables the company to expand its product portfolio in northern states, including Uttar Pradesh, with offerings such as INR 10 milk shots and badam milk. By streamlining supply chains and enhancing distribution networks, the acquisition supports the state’s growing shift toward premium, innovative, and tech-enabled dairy products.

The shift toward tech-enabled operations and value-added products have emerged as the rising trends in the Uttar Pradesh dairy market to meet growing consumer demand. Heritage Foods has actively expanded its footprint in the state, launching flavored curds, ice creams, and fortified milk variants in fiscal 2023–24. The company also introduced the Heritage VET+ app to provide real-time veterinary guidance and improve livestock health management for milk suppliers. By integrating farmers with village-level milk collection networks and digital systems, Heritage Foods is enhancing supply chain efficiency, product quality, and farmer empowerment, reflecting the broader trend of modern, technology-driven growth in Uttar Pradesh’s dairy industry.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Uttar Pradesh Dairy Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

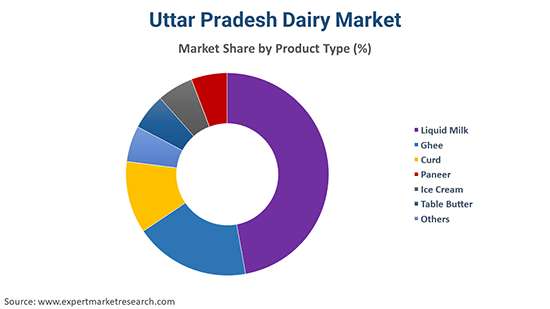

Market Breakup by Product Type

Key Insights: Liquid milk continues to lead consumption patterns in the Uttar Pradesh dairy market share, driven by consistent daily demand across urban and rural households. Traditional dairy staples such as ghee, curd, and paneer retain deep cultural relevance and contribute substantially to the overall market value.

Alongside these, emerging and value-added products, including frozen and flavored yogurt, UHT milk, flavored milk, cheese, and lassi, are experiencing notable growth, reflecting consumers’ increasing inclination toward convenience, enhanced nutrition, and premium dairy experiences; for instance, in June 2025, France’s Yogurt Factory entered India through a partnership with FranGlobal, highlighting the rising demand for 0% fat, gourmet frozen yogurt and customizable desserts in urban centers like Lucknow, Kanpur, and Noida.

Products like ice cream, fresh cream, table butter, and sweetened condensed milk are demonstrating steady growth of the Uttar Pradesh dairy market benefiting from rising disposable incomes, urbanization, and lifestyle-driven consumption trends, particularly among younger demographics. In line with this trend, in September 2025, the entry of global dessert brand Carvel, known for soft-serve ice cream and specialty frozen desserts, highlights growing consumer interest in premium frozen treats, reflecting opportunities for similar products in urban markets of the state.

Niche categories such as infant food and malt-based beverages are gaining traction due to heightened awareness of child nutrition and wellness. Skimmed milk powder and dairy whitener continue to see steady demand from both households and institutional buyers.

By product type, liquid milk continues to lead the market growth

The liquid milk segment in Uttar Pradesh is witnessing steady growth in the Uttar Pradesh dairy industry, driven by rising daily consumption, increasing health awareness, and a growing preference for nutrient-rich dairy. Amidst this trend, in January 2024, Mother Dairy launched a buffalo milk variant, featuring 6.5% fat, 9% SNF, and A2 protein, appealing to consumers seeking a richer taste and creamier texture. Sourced from Uttar Pradesh and Gujarat, the variant is projected to achieve two lakh liters per day and grow 10% year-on-year. Overall, such initiatives reflect a broader shift toward specialized, high-quality milk offerings, supporting premium consumption and market expansion in the state.

Uttar Pradesh’s yogurt segment is experiencing rapid expansion as consumers increasingly seek healthier, protein-rich, and ready-to-eat dairy alternatives. This shift is fueled by rising urban incomes and growing awareness of nutritional and probiotic benefits. Reflecting this market evolution, Parag Milk Foods announced an INR 400 crore investment in June 2025, to strengthen its premium dairy portfolio, with a focus on high-protein and Greek yogurt offerings under its Pride of Cows brand. By scaling distribution across modern retail and quick commerce channels, the company aims to capture the growing appetite for indulgent yet functional yogurt products across the state.

The top Uttar Pradesh dairy market players are increasingly leveraging technology-driven initiatives to enhance milk production and supply chain efficiency. Investments in modern processing plants, chilling infrastructure, and digital milk collection systems are enabling consistent quality and traceability. Companies are also focusing on value-added products such as flavored milk, yogurt, paneer, and fortified dairy items to cater to evolving consumer preferences, while simultaneously providing farmers with training, veterinary support, and fair pricing mechanisms to boost productivity and livelihoods.

To strengthen their presence in the state, many dairy companies across Uttar Pradesh are adopting strategies like expanding rural outreach, setting up cooperative networks, and forging strategic partnerships for animal nutrition and breeding. Initiatives include implementing sustainable practices, improving herd health, and integrating farm-to-fork solutions. These efforts not only ensure a reliable milk supply for growing urban and rural demand but also drive long-term growth, operational efficiency, and farmer empowerment across Uttar Pradesh’s dairy ecosystem.

Founded in 2001 and headquartered in Lucknow, C P Milk and Food Products Pvt. Ltd., the force behind Gyan Dairy, has redefined how North India enjoys freshness. From farm to table, its strong network of local farmers and cutting-edge facilities ensures every drop of milk reflects purity, quality, and trust.

Established in 1986 and headquartered in Delhi NCR, VRS Foods Limited, known for its beloved Paras brand, blends tradition with technology to craft dairy goodness. With a diverse portfolio spanning milk, cheese, and butter, the company continues to nourish millions with uncompromising quality and wholesome taste.

Incorporated in 1992 and based in Mumbai, Parag Milk Foods Ltd. stands as a symbol of innovation in India’s dairy landscape, especially in the Uttar Pradesh dairy market. Home to iconic brands like Gowardhan, Go, Avvatar, and Pride of Cows, it champions premium, protein-rich, and wellness-oriented dairy crafted for modern consumers.

Born in 1989 and headquartered in Bulandshahr, Ananda Dairy Ltd. embodies the spirit of rural India with a modern twist. Its wide range, from farm-fresh milk to indulgent paneer and flavored lassi, celebrates purity, nutrition, and the joy of everyday dairy moments.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Explore the latest trends shaping the Uttar Pradesh Dairy Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Get a free sample report or contact our team for customized consultation on Uttar Pradesh dairy market trends 2026.

Northern India Protein Rich Food Demand

India Fresh Milk Supply Networks

North India Value-Added Dairy Products

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of INR 2096.79 Billion.

The market is projected to grow at a CAGR of 14.10% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach around INR 7841.72 Billion by 2035.

Key strategies driving the market include expanding rural milk collection networks, adopting technology-driven farming and processing solutions, investing in value-added dairy products, strengthening supply chain efficiency, and forming strategic collaborations with domestic and international partners.

The key trends guiding the growth of the market are the increasing popularity of organic dairy products and rapid technological advancements in the region, aiding the growth of the production capacity.

The significant products types in the market include liquid milk, ghee, curd, paneer, ice-cream, table butter, skimmed milk powder, frozen/flavoured yoghurt, fresh cream, lassi, butter milk, cheese, flavoured milk, UHT milk, dairy whitener, sweet condensed milk, infant food, and malt based beverages.

The key players in the market include C P Milk and Food Products Pvt. Ltd.,VRS Foods Limited, Parag Milk Foods Ltd, Ananda Dairy Ltd., and several other market players.

Liquid milk continues to witness the highest demand in the Uttar Pradesh dairy market due to its consistent daily consumption across urban and rural households.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment

|

| Breakup by Product Type |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share