Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global vehicle electrification market reached a value of nearly USD 138.76 Billion in 2025. The market is assessed to grow at a CAGR of 12.10% during the forecast period of 2026-2035 to attain a value of around USD 434.83 Billion by 2035. The market growth can be attributed to the increasing focus on sustainability, the rising adoption of electric vehicles, advancements in battery technology, expanding electric vehicle charging infrastructure, the integration of autonomous and connected technologies, and technological advancements and innovations.

Base Year

Historical Period

Forecast Period

The adoption of electric vehicles is significantly increasing amid the rising environmental consciousness and the introduction of stringent emission regulations. The reduced maintenance needs and lower operating costs of EVs further boost their appeal among customers. As per the International Energy Agency, EV share has increased from 4% in 2020 to 18% in 2023. With the increasing EV adoption, the demand for key components such as batteries, electric motors, charging infrastructure, and other electrified systems is surging. Moreover, the rise in EVs boosts the expansion of charging infrastructure, such as home charging stations and fast chargers.

There is a growing adoption of electric vehicles in both developed and developing countries amid the rising awareness regarding the economic and environmental benefits of EVs. Governments are also offering tax benefits and subsidies for customers as well as incentives for manufacturers to develop electric vehicles. As per the data from the Federation of Automobile Dealers Associations (Fada), in September 2024, around 5,874 EVs were sold in India, indicating a shift towards vehicle electrification. This suggests a rising shift towards viable EV options, prompting automakers to produce longer-range and more affordable EVs with features appealing to the mass market.

Advancements in battery technology and the increasing energy density of batteries are increasing the vehicle electrification market value. Key players are exploring the use of lithium-sulphur batteries and solid-state batteries with higher energy density to reduce range anxiety of customers. For instance, Toyota intends to introduce solid-state batteries in 2027 that are suitable for fast charging and discharging, delivering more power in a smaller form.

Compound Annual Growth Rate

12.1%

Value in USD Billion

2026-2035

*this image is indicative*

The increasing sales of electric vehicles owing to the rising disposable income, rising number of options, growing efforts to reduce the dependence of customers on fossil fuels, and stringent government regulations aimed at reducing carbon emission levels are driving the demand of the vehicle electrification market.

The increasing inclination of the private transportation sector towards vehicle electrification due to economic and climate concerns is anticipated to bolster the market in the forecast period. Moreover, the rising demand for 48 V systems owing to their ability to enhance the power transmission to components is likely to be a key driving factor in the industry growth.

Subsidies, tax incentives, and regulatory support enhance market adoption and lower the financial impact on consumers, driving up vehicle electrification demand. The UK provides a range of incentives, such as grants for the purchase of electric vehicles and the installation of home charging stations. Furthermore, under the Zero Emission Bus Program, the UK government is allocating GBP 129 million (around USD 160 million) to enhance electric bus infrastructure and facilitate the introduction of zero-emission buses.

Increasing consumer interest and demand for clean energy solutions also present significant growth opportunities in the market. As per the European Automobile Manufacturers Association, in 2023, the European Union had 632,423 public charging points, including 153,027 new installations within the year, reflecting rapid expansion efforts. Germany and France emerged as leaders, with 120,625 (19.1%) and 119,255 (18.9%) charging points respectively. This robust growth in infrastructure development supporting clean energy solutions is driving the market growth.

Expansion of electric vehicle charging infrastructure; integration of autonomous and connected technologies; technological advancements and innovations; and the growing emphasis on sustainability are favouring the vehicle electrification market expansion.

The expansion of electric vehicle charging infrastructure and an increasing number of fast-charging stations are boosting the vehicle electrification market value. Governments globally are also increasingly investing to expand EV charging infrastructure by offering tax credits, subsidies, and incentives to build charging stations in highways, urban areas, and rural zones. In August 2024, the US government announced USD 521 million in grants to build electric vehicle (EV) charging and alternative-fuelling infrastructure by deploying over 9,200 EV charging ports. Moreover, innovations in charging technologies, including the development of charging stations powered by renewable energy sources like wind or solar, are expected to further enhance the attractiveness, reliability, and convenience of electric vehicles in the forecast period.

The growing integration of connected and autonomous technologies aimed at enhancing the appeal, efficiency, and functionality of electric vehicles (EVs) is creating lucrative vehicle electrification market opportunities. Key players are attempting to develop autonomous EVs with self-driving capabilities to optimise speed, braking, and route selection while maximising battery range and range. In October 2024, Hyundai announced a strategic partnership with Waymo to integrate autonomous driving technology into the former’s all-electric IONIQ 5 SUV. Moreover, the growing prominence of connected technologies, including vehicle-to-everything (V2X) communication, to enable EVs to communicate with infrastructure and other vehicles for reducing energy consumption and improving traffic flow is driving the market. In the forecast period, the increasing development of smart cities is expected to surge the adoption of connected and autonomous EVs to optimise traffic flow, improve air quality, and reduce congestion.

Advancements in battery technology and electric drivetrains drive efficiency and performance, making electric vehicles (EVs) more attractive. The Federal Chamber of Automotive Industries reported that in the first quarter of 2023, the total sales of electric vehicles in Australia were estimated at 34,958 units. The figure surged to 63,899 units in the first quarter of 2024, driving up the vehicle electrification market revenue, as advances in battery technology and electric drivetrains improve EV efficiency, performance, and range, making them more attractive to consumers. According to the Open Government Data Platform India, 2,877 EV chargers have been sanctioned across various states and union territories in India by Sept 2023, with Maharashtra and Tamil Nadu leading with 317 and 281 EV chargers sanctioned. These high-capacity chargers are expected to offer fast charging services, aiding the growth of EV vehicles.

EVs offer reduced emissions and better fuel efficiency, aligning with global sustainability goals and attracting environmentally conscious consumers. Several government initiatives across the world are readily supporting the deployment of EVs and eventually contributing to sustainability goals and boosting the growth of the vehicle electrification market. For instance, the federal government in the United States offers tax credits of up to USD 7,500 for people buying electric vehicles and, in some states, like California, the state government provide additional rebates to reduce the total cost further. Several EU countries, including Germany and France, on the other hand, offer subsidies and tax incentives for electric vehicle buyers. In Germany, for instance, buyers can receive subsidies of up to €6,000. The Chinese government is offering financial assistance for electric vehicle purchases and has extended tax exemptions on EV sales through initiatives like the New Energy Vehicle (NEV) program.

The vehicle electrification market is growing due to several key factors. The expansion of EV infrastructure, supported by government investments, tax credits, and fast-charging stations, is increasing EV adoption. Technological innovations, such as advancements in battery and charging technology, are improving EV efficiency and range. The integration of autonomous and connected technologies is enhancing EV appeal by optimising performance and reducing energy consumption. Additionally, the rising trend of sustainability, with government incentives promoting eco-friendly EVs, is driving market growth. These factors, combined with global support for clean energy, are accelerating the transition to electric vehicles.

Innovations in fast charging and wireless charging can enhance convenience and drive adoption. According to the China Passenger Car Association, in the first quarter of 2024, global electric car sales substantially increased, with sales nearing 3.5 million units, Notably, China retained its leading position, selling nearly 1.9 million electric cars from January to March, signifying a 35% surge compared to the same period in 2023.

As per the vehicle electrification market dynamics and trends, as per the China Passenger Car Association, in Europe, EV sales increased from 0.65 million units in Q1 2022 to approximately 1.2 million units in Q1 2024. In the United States, sales rose to approximately 0.75 million units in Q1 2024 from 0.35 million units in Q1 2022. This surge in the production of EVs has fuelled the necessity of fast-charging equipment that can supplement the rising demand for EVs, leading manufacturers to come up with innovative equipment to stay ahead of their competitors.

The rapidly growing market attracts numerous competitors, potentially leading to price wars and reduced profit margins. For instance, in 2024, Tesla introduced substantial price cuts for its electric vehicle lineup, including the Model Y, Model S, and Model X, leading to intense price competition in the industry. This approach, aimed at strengthening its market position, has forced other automakers to adopt similar measures, impacting their profit margins as they strive to maintain competitive pricing, which can impact the vehicle electrification demand forecast.

Supply chain issues and shortages of critical battery materials can impact production and cost. Disruptions in the supply chain, particularly concerning crucial battery materials such as lithium and nickel, have posed considerable challenges. For example, recent shortages of cobalt have resulted in higher costs, influencing both the production and pricing of electric vehicles (EVs). This instability in supply may affect overall production levels and pricing structures within the EV sector, which depends significantly on a reliable supply of these key materials.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Global Vehicle Electrification Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Market Breakup by Sales Channel

Market Breakup by Vehicle Type

Market Breakup by Region

By Product Type Insights

Electric oil pumps boost engine efficiency by maintaining optimal oil pressure at different speeds, enhancing performance, fuel economy, and reducing noise, while also allowing precise oil flow control for greater engine reliability. Alternators deliver a consistent power supply for vehicle systems and recharge the battery, which prolongs battery life and supports advanced electrical accessories, thereby driving the vehicle electrification demand growth.

More efficient than conventional systems, they reduce engine load and emissions, thus optimising vehicle performance. Together, these components contribute to smoother operation, improved fuel efficiency, and quieter, more dependable vehicle performance, driving growth in the vehicle electrification market.

Electric car motors are essential components of PHEVs and BEVs. Innovations in electric motor technology, the shift towards energy-efficient vehicles, and technological advancements in motor design are driving the segment growth. Meanwhile, electric water pumps play a crucial role in EVs to circulate coolant throughout the system and maintain the optimal temperature of the electric motor and battery. Such pumps are also essential to enhance the durability and efficiency of EV powertrains. Hence, the growing adoption of EVs is aiding the segment.

Electric fuel pumps are used in hybrid vehicles for supplying fuel to the internal combustion engine. The growing adoption of plug-in hybrid and hybrid vehicles combining traditional and electric engines is boosting the demand for electric fuel pumps. Conversely, actuators are critical in various vehicle electrification systems like braking systems, throttle control, and HVAC systems. The rising focus to improving the safety, fuel efficiency, and performance of vehicles is driving the utilisation of actuators, hence fuelling the vehicle electrification market expansion.

Electric power steering (EPS) systems reduce the weight of a vehicle, provide better control and handling, and improve fuel efficiency. While an electric vacuum pump generates the vacuum required for braking and other systems in hybrid and electric vehicles, the start/stop system reduces emissions and improves the fuel efficiency of vehicles. The growing adoption of hybrid and electric vehicles and the introduction of stringent government initiatives combating emissions are driving the market.

By Sales Channel Insights

OEMs account for a significant vehicle electrification market share as they are heavily investing in electrification to produce fully electric vehicles (BEVs) and plug-in hybrids (PHEVs) across various vehicle categories. Companies like Ford, General Motors, and Volkswagen are not only expanding their EV model lineups but are also developing proprietary electrification technologies, such as battery systems, in-house to reduce costs and secure their supply chains. Additionally, many OEMs are forming strategic partnerships with suppliers to innovate in areas like thermal management and high-voltage inverters, which are critical for the efficiency and performance of EVs.

With the growing adoption of electric vehicles (EVs), the demand for aftermarket services such as battery maintenance, charging stations, and EV-specific parts and services is increasing. The growing focus on extending the durability of EVs and the rising demand for home charging stations are driving the vehicle electrification market development.

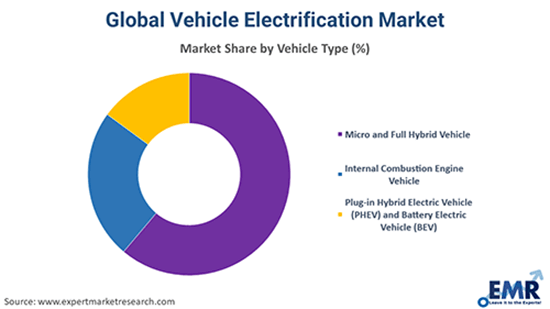

By Vehicle Type Insights

Micro and full hybrid vehicles are anticipated to witness high demand in the forecast period and are likely to take-over the conventional fossil fuel-driven vehicles. This can be attributed to the significant advantages offered by micro and full hybrid vehicles, which include affordability, environment-friendliness, regenerative braking system, lightweight, automatic start and stop systems, and higher resale value, among others. These benefits are expected to aid the market growth industry in the forecast period.

There is a gradual transition from ICE vehicles to electric vehicles amid the rising focus to reduce emissions. The hybridisation of ICE engines, the rising focus on fuel efficiency, and the development of electric drivetrains are positively impacting the vehicle electrification market.

Meanwhile, plug-in electric hybrid vehicles (PHEVs) offer a middle ground between electric vehicles (EVs) and traditional ICE vehicles. They serve as a transactional option and play a crucial role in increasing EV adoption by offering a lower entry barrier to customers. Battery electric vehicles (BEVs) entirely rely on battery power for propulsion. Favourable government initiatives, advancements in battery technology, and the rising customer inclination towards sustainable transportation options are expected to fuel the segment’s growth in the forecast period.

North America Vehicle Electrification Market Dynamics

North America, especially the United States, is experiencing rapid advancements in vehicle electrification, driven by federal tax credits, state incentives, and substantial investments in charging infrastructure. As per the vehicle electrification industry analysis, in 2023, electric vehicle sales surged to 1.4 million units, representing a 40% increase from 2022, largely supported by incentives from the Inflation Reduction Act. Major automotive manufacturers, including General Motors, are making significant investments and aim to launch 30 new electric vehicle models by 2025. This region is expected to enhance its charging networks and sustain its incentive programs, further encouraging the adoption of electric vehicles.

Europe Vehicle Electrification Market Outlook

Europe accounts for a significant market share due to stringent emissions regulations and the growth of sustainable infrastructure. In 2023, electric car registrations in Europe reached 3.2 million, reflecting a 20% increase from the previous year, which increased the vehicle electrification industry revenue. Countries like Germany, France, and the Netherlands show notable sales figures for electric vehicles (EVs), with around 25-30% of newly sold cars being electric. Additionally, policies in some nations aimed at banning internal combustion engines (ICE) by 2035 are further aiding the market growth. The European Union is also making significant investments in public charging networks, aiming to establish one million charging points by 2025.

Asia Pacific Vehicle Electrification Market Drivers

Asia Pacific boosts the vehicle electrification market opportunities, with China and India leading the market growth. For instance, India's FAME II initiative provides financial incentives to encourage the purchase of electric vehicles, particularly two- and three-wheelers that are commonly used for transportation. The government has committed to improving EV infrastructure, with a goal of deploying 50,000 electric buses by 2027. Additionally, tax benefits are offered for loans used to buy electric vehicles, and reduced import duties help make EV ownership more affordable for consumers.

Latin America Vehicle Electrification Market Trends

Latin America is expected to occupy a substantial share of the market due to government initiatives and investments in charging infrastructure. Brazil and Mexico lead the region in electric vehicle sales, supported by policies that encourage cleaner transportation alternatives, boosting the vehicle electrification market value. The market for electric buses and commercial vehicles is seeing significant growth, thanks to local subsidies and initiatives aimed at reducing urban air pollution. Furthermore, Chile and Colombia are actively developing policies that promote electric vehicles, especially in public transportation.

Middle East and Africa Vehicle Electrification Market Growth

The Middle East and Africa are experiencing a rise in vehicle electrification, driven by a growing commitment to sustainable alternatives that reduce dependence on oil. For instance, the UAE has introduced initiatives like free charging for electric vehicles and aims to convert 20% of its government fleet to electric by 2030, which can boost the growth of the vehicle electrification industry. Similarly, South Africa is creating incentives to boost electric vehicle adoption and is increasingly interested in local assembly of EVs to meet regional demand. The region is focusing on building infrastructure to attract more investments in electric vehicles and promote cleaner transportation options.

As electric vehicle (EV) adoption continues to rise, startups are making significant advancements in EV charging infrastructure to expand their market reach. For instance, they are developing extensive open networks for EV charging as well as offering mobile charging solutions that incorporate battery storage. This innovation enables flexible charging options that can be deployed in diverse locations without the need for extensive infrastructure.

Rivian

Rivian, headquartered in Michigan, specialises in all-electric trucks and SUVs designed for outdoor and adventure enthusiasts. The R1T pickup and R1S SUV from Rivian provide impressive range capabilities and are engineered to run on tough terrains. The company has gained major backing from major investors, including Ford and Amazon, which has led them to develop a fleet of electric delivery vans.

Arrival

Arrival, established in the United Kingdom, is dedicated to manufacturing electric commercial vehicles, including delivery vans and buses, specifically designed for urban environments. By using modular electric vehicles produced in small, decentralised micro factories, Arrival effectively lowers costs and enhances production adaptability. This strategy also facilitates localised manufacturing, which can help minimise emissions related to logistics. Arrival has attracted investments from firms such as BlackRock and Hyundai and has formed partnerships with companies like UPS to develop future electric delivery vehicle fleets.

The companies specialise in advanced motion subsystems, such as electric motors and actuators, enhancing vehicle performance and efficiency. They focus on precision engineering and reliable solutions for various industries. Automakers in the vehicle electrification market are making significant investments in lithium iron phosphate (LFP) batteries, which are more cost-effective and do not depend on cobalt, a material that is both rare and expensive. This transition allows these market players to reduce production expenses and provide more affordable electric vehicles, thereby increasing accessibility to EVs for a wider customer base. The movement towards LFP and other economical battery technologies is anticipated to drive mass-adoption by enhancing the financial feasibility of EVs.

The company expanded its electric powertrain systems portfolio to meet the growing demand of the market. It has also launched advanced battery management systems to improve safety.

The company is focused on developing high-efficiency electric vehicle components. It has also introduced advanced energy management solutions to optimise performance.

The company has developed new drive units for ultra-small electric vehicles. It is also committed to supporting sustainable mobility to capture market opportunities.

The company has partnered with leading automotive companies and developed new components for electric vehicles.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other major vehicle electrification market players are Delphi Technologies, Robert Bosch GmbH, ZF Friedrichshafen AG, Johnson Electric Holdings Limited, and Magna International Inc., among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 12.10% between 2026 and 2035.

Based on region, the market is broken down into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

The major drivers of the industry, such as the thriving automotive industry in emerging economies, rapid technological advancements, and the stringent regulations by the government to reduce carbon emission levels, are expected to aid the market growth.

The key market trends guiding the growth of the industry include the growing R&D activities by the major automotive players to provide efficient electrification solutions.

The market is broken down into electric oil pump, alternator, electric car motors, electric water pumps, electric fuel pump, actuators, electric power steering, electric vacuum pump, and start/stop system.

Aftermarket and original equipment manufacturers (OEM) are the different sales channels of the product.

The market is broken down into micro and full hybrid vehicle, internal combustion engine vehicle, and plug-in hybrid electric vehicle (PHEV) and battery electric vehicle (BEV).

The competitive landscape consists of Continental AG, Hitachi Automotive Systems, Ltd., Aisin Seiki Co., Ltd., Denso Corporation, Delphi Technologies, Robert Bosch GmbH, ZF Friedrichshafen AG, Johnson Electric Holdings Limited, and Magna International Inc., among others.

In 2025, the market reached an approximate value of USD 138.76 Billion.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 434.83 Billion by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Sales Channel |

|

| Breakup by Vehicle Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share