Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global vehicle telematics market size was valued at USD 10.42 Billion in 2025. The industry is expected to grow at a CAGR of 7.75% during the forecast period of 2026-2035 to reach a value of USD 21.98 Billion by 2035. The market growth is significantly influenced by the deepening collaboration between telematics platform providers and OEMs to deliver cloud-native, intelligence-driven vehicle data ecosystems.

As fleets demand real, time diagnostics, predictive maintenance, and scalable analytics, those playing in the market are going beyond simple tracking solutions to integrated platforms that combine vehicle, engine, and cloud data. These collaborations give telematics suppliers the opportunity to install sophisticated health monitoring features directly in OEM and powertrain systems, thereby enhancing data accuracy and operational efficiency while also cutting down on hardware use.

A major example of this trend was the announcement made in March 2025 regarding the collaboration between Platform Science and Cummins Inc. to launch Vehicle Health Intelligence on Platform Science's Virtual Vehicle Marketplace. The product links the engine diagnostics of a connected device Cummins with the cloud, native telematics platform of Platform Science turning the telematics platform into an interface through which the fleet can readily get engine performance data, fault codes, and remote insights. This innovation demonstrates how OEM, aligned, cloud, based telematics architectures are leading the rapid adoption of commercial fleets by facilitating the conversion of raw vehicle data into usable intelligence on a large scale.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

7.75%

Value in USD Billion

2026-2035

*this image is indicative*

One of the main drivers leading to a rapidly expanding global vehicle telematics market is the integration of providers with OEM, embedded telematics systems. This integration results in a situation where no hardware installation is necessary. The change enables fleets to turn on connected services in an instant, and they get more accurate and scalable data as a result. Teletrac Navman, in line with this movement, introduced OEM Telematics in July 2025, thus allowing its TN360 platform to connect directly to the vehicle systems that are factory, installed by the leading manufacturers. The announcement of such milestones demonstrates how embedded connectivity strategies are a main factor in the reduction of deployment friction hence the faster enterprise, level adoption of telematics solutions worldwide is visible in different parts of the globe.

Product innovation is still one of the leading factors which contribute to the growth of the market as the telematics vendors introduce next, generation platforms that combine connectivity, infotainment, and vehicle data processing. Electronic integration is the preferred way by automakers for solutions that enable multiple connected services to be supported through a single unified architecture. In April 2024, Marelli came up with its ProConnect integrated cockpit and telematics platform, as a leading example combining 5G connectivity and infotainment capabilities on a single system, on, chip. The launch affirms in what way advanced telematics hardware innovation is facilitating the in-vehicle experience to become more immersive and hence, the OEM demand for a scalable future-ready telematics platform is getting stronger.

One of the main factors behind the growth of telematics is cross, industry partnerships which help to open up new use cases of connected vehicle data for adjacent industries such as insurance and vehicle protection. These collaborations increase the value proposition of telematics by combining real, time tracking with financial and risk, mitigation services. In May 2025, Roadzen collaborated with a world, leading telematics provider to introduce a connected vehicle protection and GAP insurance solution in the United Kingdom. These types of collaborations illustrate how telematics platforms are evolving to become not only the core of fleet operations but also the backbone of the broader mobility and automotive service ecosystems.

Market players are deepening their regional presence through partnerships with resellers and channels that localize the deployment of telematics in both emerging and developed markets. These partnerships enable global telematics platforms to combine regional expertise with a faster scaling of industry verticals. In February 2025, TransTRACK made public its collaboration with Geotab as an authorized reseller in Southeast Asia, thus facilitating the access of advanced telematics solutions to logistics, mining, and public sector fleets. The role of such expansion, driven partnerships in the acceleration of the telematics usage in different geographical areas cannot be overemphasized.

With the increasing vehicle connectivity, cybersecurity has become one of the very basic requirements for telematics systems, hence the investments in secure data transmission and intrusion protection. Telematics vendors are incorporating the security solutions in order to provide the most updated connected fleets with the least of the possible threat. To demonstrate this commitment, VicOne and MediaTek presented advanced automotive telematics cybersecurity solutions at CES 2025 in January 2025, emphasizing security for telematics and V2X communications. Such consolidations renew the confidence of the users of connected vehicle ecosystems and pave the way for sustainable telematics adoption by commercial and enterprise fleet operator.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

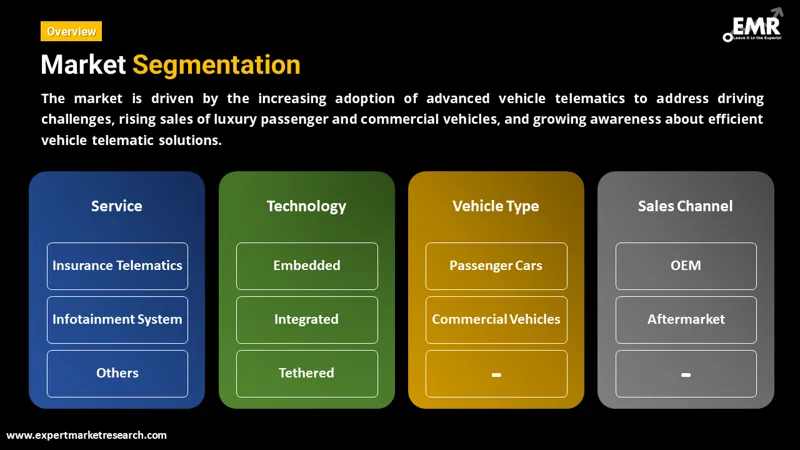

The EMR’s report titled “Global Vehicle Telematics Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Service

Key Insights: The service landscape covers safety and security, fleet/asset management, information and navigation, insurance telematics, infotainment systems, and others, with the most significant adoption being fleet optimization and safety. To achieve measurable efficiency gains, companies are broadening software, led telematics portfolios. In line with this, HERE Technologies introduced its Fleet Optimization software bundle in June 2024, providing AI, powered routing, tour planning, and location APIs for logistics fleets.

Market Breakup by Technology

Key Insights: Telematics deployment covers Embedded, Integrated, and Tethered technologies, with most of the growth in embedded solutions due to their higher reliability and direct OEM data access. To remove hardware dependencies, telematics providers are focusing on factory, fitted connectivity as their main priority. In July 2025, Teletrac Navman introduced OEM Telematics connectivity for its TN360 platform, thus enabling direct integration with vehicle manufacturer telematics systems.

Market Breakup by Vehicle Type

Key Insights: The need for telematics in passenger cars and commercial vehicles has operations as a distinct focus. Passenger cars have become more dependent on embedded connectivity that is generally used for safety, navigation, and infotainment, while commercial vehicles mostly use it for uptime, diagnostics, and compliance. Platform Science, in order to meet the needs of the commercial fleet, partnered with Cummins in March 2025 to launch Vehicle Health Intelligence on its Virtual Vehicle Marketplace. The product helps to connect the engine diagnostics with the cloud telematics, thus, making it easy for fleet operations to be data, driven and supporting the deployment of large, scale commercial vehicles.

Market Breakup by Sales Channel

Key Insights: There are OEM and Aftermarket sales channels for telematics, each providing different adoption routes. Factory, embedded systems are the main advantage of OEM channels, whereas aftermarket solutions are the only option for the fleets that are already in existence and need quick retrofits. In February 2025, TransTRACK made an announcement of its official reseller partnership with Geotab, thus, facilitating the access to Geotabs telematics hardware and fleet management software in the whole Southeast Asia region. This, by strengthening the aftermarket penetration, is also a great way of complementing the OEM, installed solutions through the local distribution and service support.

Market Breakup by Region

Key Insights: Regional adoption of telematics has different shades in various parts of the world, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Local regulations, fleet digitization, and the readiness of the infrastructure have been some of the factors influencing this trend. At CES 2025 in January 2025, VicOne and MediaTek unveiled leading-edge automotive telematics cybersecurity solutions aimed at ensuring data protection throughout the global connected vehicle markets. Those kinds of technologies are becoming increasingly necessary, especially in the areas of the United States and Europe, while developing regions are embracing scalable and secure telematics platforms for the further expansion of commercial fleets.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

By service, Information and Navigation witnesses robust growth

Information and navigation telematics solutions are continually changing as fleets require more intelligent routing, safety alerts, and operational visibility. Providers are coming up with integrated tools that combine mapping and predictive analytics to help logistics planning and driver guidance. As a result of the collaboration with Volkswagen Group Info Services AG, Cartrack is able to provide easy access to OEM vehicle diagnostics and routing data across six brands which enhances decision making for fleet managers. The partnership between these two companies is a perfect example of how navigation data integration can be used to improve telematics services.

Insurance telematics is one of the main factors that contribute to the growth of the market. Furthermore, the tools that deliver usage, based data and risk, based insights are the ones that give the most significant opportunities for the introduction of tailored premiums. To name one instance, Lytx revealed the coming of two new safety recognition features in February 2025, such as the Safe Driving Report and Safe Driving Trend Dashboard, which allow fleet managers to identify the best performers and encourage the safer driving practice. These tools constitute a support system for both insurers and fleets in the process of setting premiums based on actual driver behavior and enhancing long, term risk outcomes.

By technology, embedded telematics shows significant uptake

Embedded telematics systems that have a direct link with the vehicle mechanisms are leading the way for deeper operational understanding and lesser installation complexities. One of the powerful instances is the partnership of Cartrack with Volkswagen Group Info Services AG in November 2025, which made it possible for the real, time OEM vehicle data like warning light indicators and mileage to be transferred into Cartracks fleet management platform without the need for additional hardware. This access to embedded data significantly elevates maintenance scheduling and predictive diagnostics in the different vehicle fleet environments.

Fully integrated telematics technologies that combine video, data, and analytics are the future of fleet safety and management. As an instance, Lytx presented Lytx+ with Geotab at the 2025 Protect Conference, which is a single solution for video, powdered fleet safety and telematics combining best, in, class video, AI, and telematics insights in one interface. Such an integration greatly speeds up data, driven decision, making that also improves safety, compliance, and operational efficiency of commercial fleets.

By vehicle type, passenger cars category witnesses high demand

Telematics in passenger vehicles are getting more advanced with the integration of various data that support diagnostics, connectivity, and predictive servicing. One of the best examples is the partnership between Cartrack and Volkswagen Group Info Services AG in November 2025, which facilitates direct OEM data delivery from various brands. As a result of this project, fleets of passenger cars are able to obtain the health of the vehicles as well as usage data in real time, and what is more, this can be done without the installation of any aftermarket hardware. This makes it possible for both consumers and those involved in the mobility sector to have better maintenance scheduling and increased fleet utilization.

The use of telematics in commercial vehicles is expanding fast due to the presence of integrated safety and analytics tools that not only improve the performance but also ensure compliance. One case is the launch by Lytx of the Surfsight AI 14 dash cam in 2025, which was equipped with advanced machine vision and AI to provide real, time risk detection, driver alerts, and analytics, thereby enhancing both safety and operational efficiency. This new generation unit is a clear indication of how commercial telematics is embracing the combination of hardware and software to address the needs of enterprises in the area of risk mitigation.

By Sales Channel, OEM generates notable growth

OEM telematics channels are expanding as car makers install factory direct connectivity platforms, thereby making data access easier and fleet performance metrics more accurate. A good example is the collaboration between Cartrack and Volkswagen Group Info Services AG in November 2025, which gives the direct access to the embedded data of six Volkswagen Group brands for fleet planning, diagnostics, and performance insights. This move spreads the use of OEM telematics and encourages the integration of more hardware, free operational intelligence.

Aftermarket telematics solutions are the answer to existing fleets that want to add advanced tracking, analytics, and safety features and cannot wait for OEM built, in systems. For example, Lytx's introduction of two new safety and driver recognition features in February 2025 is an excellent example that enhances the telematics value proposition in the aftermarket by incentivizing safe behavior and providing intervention, ready insights to lower risk. The resulting effect is increased telematics adoption in mixed fleets and aftersales through the respective enhancements.

By Region, North America shows emerges as a lucrative market destination

North America is still a major telematics market owing to the strong data, driven safety and analytics requirements. An excellent example is Lytx's introduction of new innovations at the 2025 Protect Conference, among which is the Lytx+ integrated fleet solution that merges video and telematics for in, depth safety and performance analytics. This product launch centered on North America demonstrates how integrated solutions not only help operational efficiency but also support driver risk reduction strategies.

In Europe and Asia Pacific, the utilization of telematics is deepening through collaborations that enable OEM data integration and provision of localized services to fleets. As an illustration, the partnership between Cartrack and Volkswagen Group Info Services AG in November 2025, allows fleets in these areas to receive real, time OEM diagnostic and usage data without the need for hardware installation, thus removing the obstacles to telematics, facilitating compliance, and providing more profound operational insights in the international markets.

Market players in the global vehicle telematics market continue to be aggressive in their strategies as they work towards expanding OEM partnerships, improving embedded telematics features, and making heavy investments in AI, driven analytics that will help them deliver real-time insights. These companies are also elevating the performance of their cloud-based platforms to be able to provide scalable fleet management, safety monitoring, and predictive maintenance services. The strategic collaborations and regional expansions have allowed the providers to be able to meet the different regulatory requirements and at the same time increase data accessibility and operational efficiency for fleet operators all over the world.

One of the major goals leading telematics providers have set for themselves is product innovation achieved through advanced connectivity solutions, integrated video telematics, and software-defined platforms. The investments in automation, machine learning, and data harmonization are the major reasons for the success of the companies, and they can now improve driver safety, asset utilization, and cost optimization with ease. In addition, the market players are now making it easier for different vehicle types and technologies to be interoperable. Thus, telematics services can be integrated seamlessly across passenger and commercial vehicle fleets.

Samsara Inc. is a leading software company which offers IoT technology to various end, use sectors including transportation, food and beverage, and government, among others. The company was established in 2015 and is headquartered in California, United States.

MiX Telematics International (Pty) Ltd. is a global provider of fleet and mobile asset management solutions. Established in 1996 and currently headquartered in Stellenbosch, South Africa, the product portfolio of this company includes enterprise and small fleets.

Trimble Inc., established in 1978 and headquartered in Colorado in the United States, is a prominent provider of software, hardware, and technology services. The company offers transformative solutions to various end users, helping them thrive.

Verizon Connect is a global provider of fleet management and vehicle telematics solutions, offering GPS tracking, driver behavior monitoring, compliance tools, and data-driven fleet insights for commercial operators. Established in 2016, the company is headquartered in Atlanta, Georgia, and operates as a part of Verizon Business, serving fleets across multiple regions with scalable connected vehicle technologies.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other market players include Zonar Systems, Inc., Octo Group S.p.A, HARMAN International, Visteon Corporation, Aplicom Oy, and Scorpion Automotive Ltd, among others.

Explore the latest trends shaping the Global Vehicle Telematics Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on Global vehicle telematics market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 7.75% between 2026 and 2035.

Key strategies driving the market include expanding OEM-embedded telematics partnerships, launching AI-enabled fleet management and safety solutions, increasing investments in cloud and data analytics platforms, and strengthening regional expansion through strategic collaborations and acquisitions.

The key trends in the market include the rising demand for quick cab services, growing expansion of freight transportation services, increasing dependence of the urban population on delivery services, and growing adoption of portable smart devices.

Safety and security, fleet/asset management, information and navigation, insurance telematics, and infotainment system, among others, are the different services of vehicle telematics in the market.

Embedded, integrated, and tethered are the major technologies of vehicle telematics in the market.

North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa are the major regions in the market.

The primary sales channels for vehicle telematics are OEM and aftermarket.

The key players in the market include Samsara Inc., MiX Telematics International (Pty) Ltd., Trimble Inc., Verizon Connect, Zonar Systems, Inc., Octo Group S.p.A, HARMAN International, Visteon Corporation, Aplicom Oy, Scorpion Automotive Ltd., among others.

In 2025, the global vehicle telematics market reached an approximate value of USD 10.42 Billion.

Top challenges that the market faces include high implementation and integration costs, data privacy and cybersecurity concerns, interoperability issues across vehicle brands and platforms, and regulatory complexity across different regions.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Service |

|

| Breakup by Technology |

|

| Breakup by Vehicle Type |

|

| Breakup by Sales Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share