Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global ventilators market was valued at USD 4.47 Billion in 2025, driven by the increasing geriatric population and increasing prevalence of respiratory diseases across the globe. The market is expected to grow at a CAGR of 6.80% during the forecast period of 2026-2035, with the values likely to reach USD 8.63 Billion by 2035.

Base Year

Historical Period

Forecast Period

Rising healthcare expenditure and improved healthcare infrastructure in developing regions are contributing to the growth of the market. Government initiatives to improve healthcare access and quality, along with private sector investments support market expansion.

The global aging population is more susceptible to respiratory diseases and complications, driving the need for ventilators. As the proportion of elderly individuals increases, the demand for ventilatory support in hospitals, long-term care facilities, and homecare settings is also on the rise.

The standalone type segment is experiencing significant growth driven by the continuous advancements in ventilators, such as advanced sensors, improved user interfaces, and enhanced connectivity contributing to market growth.

Compound Annual Growth Rate

6.8%

Value in USD Billion

2026-2035

*this image is indicative*

Ventilators are mechanical devices designed to assist or replace spontaneous breathing by providing respiratory support to patients who are unable to breathe adequately on their own. They deliver a controlled flow of oxygen-enriched air into the lungs and help remove carbon dioxide, ensuring proper ventilation and oxygenation. Ventilators are used in various medical settings, including hospitals, intensive care units (ICUs), emergency rooms, surgical suites, and home care environments.

The growing number of surgical procedures, including complex surgeries that require postoperative respiratory support is driving the demand for ventilators. Increased surgical volumes, particularly in developing countries are boosting the demand for durable ventilators in the region. The trend is expected to continue, owing to the growing trend towards homecare ventilation due to the comfort and convenience it offers to patients. Advances in portable and easy-to-use ventilators make it feasible for patients with chronic respiratory conditions to receive care at home.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Technological Advancements Augmenting the Market Growth

Continuous innovation in ventilator technology, such as the development of portable and non-invasive ventilators, has expanded their use. For Instance, in January 2023, Getinge launched the Servo-c ventilator, designed for both pediatric and adult patients, featuring CO2 monitoring and Servo Compass technology for optimal respiratory management.

The rise in research and development activities has resulted in the improvement of ventilator technology. The rapid advancement in the medical ventilator system has become one of the key drivers for boosting the ventilators market value. In September 2023, 42 Technology was appointed to design and develop the Exovent negative pressure ventilator (NPV) system and bring it to the market by a United Kingdom-based company called Portsmouth Aviation. Unlike traditional ventilators, the Exovent NPV system covers the patient’s torso and allows them to drink, eat, and talk normally even while being ventilated.

Increasing Government Initiatives and Funding

Government initiatives to boost healthcare infrastructure and pandemic preparedness have led to increased procurement and stockpiling of ventilators. These initiatives are particularly prominent in regions like North America and Asia-Pacific. For instance, in August 2023, Medline partnered with Flight Medical to offer the Flight 60 transportable ventilator. This device seamlessly transitions between invasive and non-invasive modes, catering to a wide range of patient needs.

The market is witnessing several trends and developments to improve the current global scenario. Some of the notable trends are as follows:

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

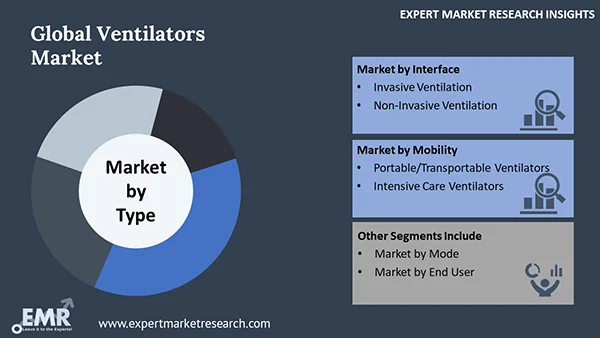

The EMR’s report titled “Ventilators Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Age Group

Market Breakup by Interface

Market Breakup by Region

Market Segmentation Based on Age Group is Anticipated to Witness Substantial Growth

By age group, the market is segmented into neonatal/infant and adult. Ventilators are increasingly employed in the healthcare sector for patients with respiratory diseases who require quality medical assistance for patient care. The adult segment is experiencing significant growth driven by the proportion of elderly individuals increases, leading to the demand for ventilatory support in hospitals, long-term care facilities, and homecare settings. The increasing number of ICU admissions due to various health conditions has led to a higher demand for ICU ventilators. Hospitals and healthcare facilities are expanding their ICU capabilities to manage the growing patient load, further driving the ventilator market.

Based on the region, the market report covers North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America is dominating the market share due to the rising burden of chronic diseases, the growing aging population, and the presence of advanced healthcare infrastructure. Further, the increasing technological advancements in ventilators, heightened awareness, and the surge in the adoption of ventilators for better results are some of the factors supporting the market growth.

Europe also holds a high ventilators market value driven by increasing investments in healthcare technologies and greater access to advanced medical devices. Additionally, Asia Pacific is expected to witness substantial market growth fueled by the growing patient pool and the increasing recognition of ventilator benefits. Increased government initiatives to improve healthcare services and rising disposable income are poised to boost the region’s market share.

The key features of the market report include patent analysis, funding and investment analysis, and strategic initiatives by the leading key players. The major companies in the market are as follows:

Koninklijke Philips N.V., commonly known as Philips, is a global leader in health technology, focusing on improving people's health and enabling better outcomes across the health continuum. Philips is renowned for its advanced medical devices, including a range of ventilators that cater to various clinical needs, from critical care to home use. The company's ventilators are designed with advanced features for precise and efficient respiratory support, incorporating cutting-edge technology to enhance patient care and clinical workflow.

Medtronic plc is a global leader in medical technology, services, and solutions, known for its innovative medical devices. The company offers a comprehensive range of ventilators designed to provide critical respiratory support in various healthcare settings. Their ventilators feature advanced technology for invasive and non-invasive ventilation, ensuring precise and effective respiratory care for patients with critical needs.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include ResMed Inc., Drägerwerk AG & Co. KGaA, Nihon Kohden Corporation, Getinge AB, L’AIR LIQUIDE S.A., Vyaire Medical, Inc., Shenzhen Mindray Bio-Medical Electronics Co Ltd, and Hamilton Medical among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Age Group |

|

| Breakup by Interface |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share