Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global weight loss and weight management diet market was valued at USD 206.15 Billion in 2025 and is expected to grow at a CAGR of 8.30%, reaching USD 457.58 Billion by 2035. The market growth is driven by increasing awareness of obesity-related health risks and growing demand for personalized nutrition and clean-label products. The rising adoption of plant-based diets, digital health tools, and meal replacements is expected to support market value during the forecast period, alongside the expansion of e-commerce channels and wellness-focused consumer behavior.

Base Year

Historical Period

Forecast Period

In November 2023, a Br J Nutr study revealed that individuals actively adopt strategies like increased vegetable intake and reduced high-fat/sugar foods during weight loss efforts. Such a behavioral shift is driving growth in the market by boosting demand for healthier, low-calorie, and nutrient-focused products.

One of the major market trends includes growing public health initiatives targeting obesity through lifestyle interventions. For instance, in 2023, the CDC launched a 5-year High Obesity Program, funding 16 universities to promote diet and activity changes.

Rising obesity rates and growing health awareness are driving demand for weight management diets, with key players advancing product innovation and strategic partnerships, significantly accelerating market growth across diverse consumer segments.

Compound Annual Growth Rate

8.3%

Value in USD Billion

2026-2035

*this image is indicative*

Weight loss and weight management diets emphasize structured nutritional strategies that promote healthy living and reduce the risk of chronic conditions. The global market is expanding due to increased health awareness, sedentary lifestyles, and the growing burden of obesity. Consumers are shifting toward meal replacements, low-calorie foods, and functional beverages supported by personalized nutrition plans and digital tracking tools. Companies are also focusing on clean-label and plant-based offerings. The market was valued at USD 206.15 Billion in 2025 and is expected to continue growing steadily in the coming years.

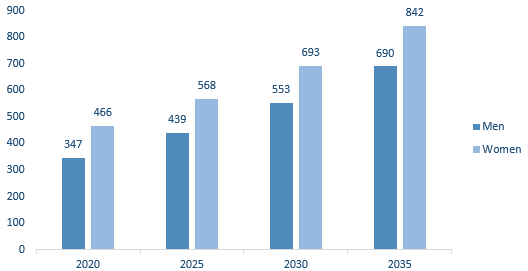

Rising Global Obesity Rates to Drive Significant Growth in the Market

The escalating global prevalence of obesity is a major driver fueling the growth of the weight loss and weight management diet market. According to a March 2024 news release by the World Health Organization, over 1 billion individuals worldwide were living with obesity in 2022, as reported by The Lancet. Obesity among adults has more than doubled since 1990, while rates among children and adolescents have quadrupled. This alarming trend underscores the urgent need for effective dietary interventions and wellness solutions, significantly boosting market demand.

GLOBAL OBESITY TRENDS FOR ADULTS BY GENDER 2020–2035, IN MILLIONS

Some of the notable trends in the market include the integration of AI-driven diet planning and the growing adoption of hormonal therapies for obesity management.

AI-Driven Diet Planning Emerges as a Transformative Trend in Weight Management, Boosting Market Value

The integration of artificial intelligence in personalized nutrition planning is becoming a pivotal trend in the global weight loss and weight management diet market. As AI platforms evolve, tools like ChatGPT-4o are being explored for their capability to generate tailored diet plans based on body mass index and physical activity levels. In July 2025, a study published in Food Science & Nutrition demonstrated how ChatGPT-4o generated 54 menus using ketogenic, intermittent fasting, and general dietary models for individuals with varying obesity levels. While results highlighted nutritional variability and inconsistencies, the study underlined AI’s growing potential in developing scalable, personalized diet strategies. This trend signifies increasing reliance on intelligent digital tools for weight management solutions, suggesting robust market growth in AI-integrated nutrition technologies over the coming years.

Rising Adoption of Hormonal Therapies for Obesity Management to Strengthen the Weight Loss and Weight Management Diet Market Demand

The integration of advanced hormonal therapies into chronic weight management programs is reshaping the market. In November 2023, the U.S. Food and Drug Administration approved Eli Lilly’s Zepbound (tirzepatide), a once-weekly injectable for adults with obesity or overweight linked to weight-related conditions. Used in addition to a reduced-calorie diet and increased physical activity, Zepbound demonstrated up to an 18% weight reduction in clinical trials. This approval highlights a significant trend toward combined medical and lifestyle-based approaches, accelerating global market expansion.

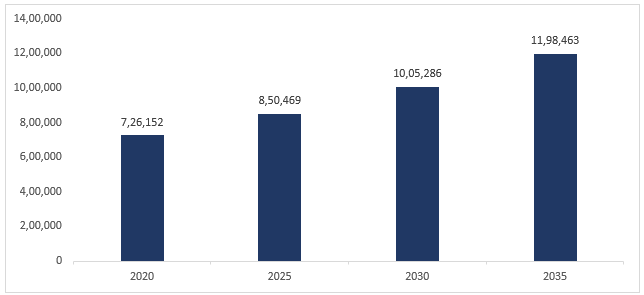

TOTAL ECONOMIC IMPACT OF BMI≥25KG/M2, US$ MILLION, 2020-2035

Weight Loss Supplements Expected to Lead the Market by Product Type

The market, segmented by product type, includes meals, weight loss supplements, and beverages. Among these, weight loss supplements are expected to lead the market due to rising demand for convenient, science-backed solutions for managing weight and metabolic health. For instance, in July 2025, Herbalife Ltd. launched MultiBurn™, a next-generation weight loss supplement. Formulated with clinically studied botanicals like Morosil™, Metabolaid®, and Capsifen™, the product supports fat reduction, metabolic health, and energy expenditure. Such innovation reflects a broader market shift toward clean-label, evidence-based supplements, reinforcing the segment’s dominant position.

The regions included in the report are North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Among these, North America is expected to lead the market, driven by growing health awareness, high obesity rates, and increased use of weight management solutions. In support, in May 2024, Nestlé introduced “Vital Pursuit”, a new food line tailored for GLP-1 medication users and individuals focused on weight management in the United States. This launch reflects rising demand for portion-controlled, nutrient-rich, and accessible diet products.

The key features of the market report include strategic initiatives by the leading players. The major companies in the market are as follows:

Cargill plays a vital role in the market through its advanced research in nutrition and digestive health. Leveraging cutting-edge molecular biology and genomics, the company develops feed additives and solutions that enhance gut health, boost animal performance, and optimize weight outcomes. Products like Proviox® contribute to healthier dietary profiles, reflecting Cargill’s commitment to improving global nutrition systems.

Ingredion Inc., a global ingredient solutions provider headquartered in the United States. It introduced WEIGHTAIN, a clinically supported whole grain-based satiety ingredient. Designed for the weight loss and weight management diet market, WEIGHTAIN helps suppress hunger and reduce calorie intake by 50 to 100 calories per day. The gluten-free solution is ideal for use in low-moisture baked goods, soups, and smoothies, enabling food manufacturers to develop on-trend products targeting calorie control and sustained fullness.

Kellogg Co., a prominent player in the weight loss and weight management diet market, offers ready-to-eat cereals that promote healthy eating habits. The company supports research emphasizing the benefits of cereal-based breakfasts in family-based obesity treatment, improved nutrient intake, and weight control, particularly among children and adolescents. Kellogg's focus on whole grains, breakfast consumption, and dietary fiber highlights its contribution to managing body weight and enhancing overall diet quality.

Herbalife International, Inc. is a global leader in nutrition and wellness, actively engaged in the market. The company offers a wide range of products focused on healthy weight, including protein shakes, meal replacements, and dietary supplements. Herbalife’s commitment to promoting balanced nutrition and active lifestyles strengthen its position in the global market.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market are The Kraft Heinz Company, Almased USA, Inc., Nutrisystem Inc., General Mills Inc., and Now Health Group, Inc., among others.

"Weight Loss and Weight Management Diet Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Market Breakup by Distribution Channels

Market Breakup by Region

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Distribution Channels |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share