Reports

Sale

Global Barley Market Size, Share, Trends, Growth, Forecast: By Application: Food, Seed, Industrial, Feed; Regional Analysis; Market Dynamics: SWOT Analysis, Porter’s Five Forces Analysis, Key Indicators for Demand, Key Indicators for Price; Trade Data Analysis; Competitive Landscape; Key Trends and Developments in the Market; 2024-2032

Global Barley Market Size

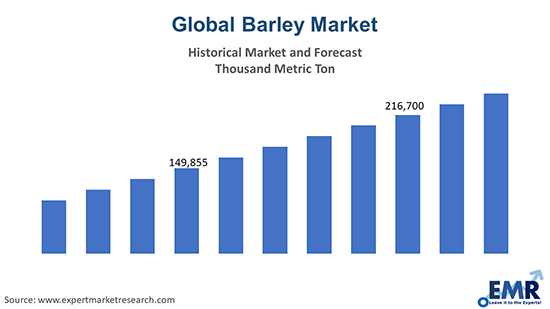

The global barley market reached a consumption volume of nearly 1,80,139.69 thousand metric tons in 2023. The consumption volume is projected to grow at a CAGR of 6.30% between 2024 and 2032.

Barley Market Outlook

- Malt barley is the most common type of grain used in the brewing sector to make beer.

- Organic and sustainable farming practices are witnessing an upward trend in the barley market.

- The major barley-consuming regions are the European Union, Russia, Saudi Arabia, and China.

Barley Market Growth Rate

Barley is a grain of cereal that can be used for making bread, beverages, stews, and other food products and being a whole grain, it provides a wide range of nutrients like fibre, vitamins, and other minerals. Barley comes in several forms, including hulled, pearled, and flaked, each differing in the degree of processing and nutritional content.

The expanding awareness about the health benefits of barley leading to its rising consumption among the health-conscious population is one of the major driving factors of barley market growth. Barley is a rich source of dietary fibre and has many beneficial nutrients, which play a critical role in improving digestion, promoting weight loss, lowering cholesterol levels, and supporting a healthier heart. It also has a mild nutty flavour and chewy texture, thereby increasing its use in the preparation of various dishes. The global market is further being driven by the growing demand from Middle Eastern countries such as Saudi Arabia, Jordan, and Kuwait where barley is widely being used for feed purposes.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Key Trends and Developments

Ethanol fuel production; introduction of new varieties of barley; genetic evolution of barley; and research activities to explore the potential applications of barley are the major trends impacting the barley market expansion

November 29th, 2023

Lavie Bio announced that Yalos™, its microbiome-based product will now include durum and barley to improve crop yield.

November 7th, 2023

Nile Breweries announced the launch of a state-of-the-art facility for cleaning and drying barley in Kween District, Uganda.

July 11th, 2023

Beneo announced that it is planning to launch Orafti ß-Fit, a whole-grain barley flour which consists of about 20% beta-glucans.

May 5th, 2022

The Molson Coors Beverage Co. announced the launch of Golden Wing Barley Milk to venture into the plant-based milk sector.

Ethanol fuel production

Ethanol fuel production from barley involves converting the starches in barley grains into sugars, which are then fermented and distilled into ethanol, a renewable fuel.

Introduction of new varieties of barley

One of the primary reasons for developing new barley varieties is to improve crop yields and enhance resistance to diseases and pests which helps in securing the food supply.

Sustainable and organic farming of barley

This trend is encouraging farmers to adopt more sustainable farming practices, such as crop rotation, reduced use of chemical fertilisers and pesticides, and conservation tillage.

Research activities to explore the potential applications of barley

The scope of research ranges from enhancing barley's agronomic traits and environmental resilience to discovering novel uses in food, feed, health, and bioenergy.

Barley Market Trends

Ethanol fuel, a biofuel alternative to gasoline, is primarily produced from agricultural feedstocks. While corn is the dominant crop used for ethanol production in countries like the United States, barley offers an alternative feedstock, especially in regions where it is more economically viable or environmentally suitable to grow. Barley can grow in cooler climates and less fertile soils than many other crops, making it a viable option for ethanol production in regions that are not suitable for corn or sugarcane. It can also be part of sustainable crop rotation systems, reducing the need for chemical fertilisers and pesticides, and improving soil health which makes barley an attractive option for regions focusing on sustainable or organic farming practices.

Companies are developing high-end production facilities to enhance the quality of the barley. Nile Breweries announced the inauguration of a UGX 4 billion state-of-the-art barley cleaning and drying plant in Cheminy, Kween District, Uganda in November 2023. This facility is strategically located in the Sebei region and is poised to significantly enhance the quality and sustainability of barley production in the area.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Barley Industry Segmentation

“Barley Market Report and Forecast 2024-2032” offers a detailed analysis of the market based on the following segments:

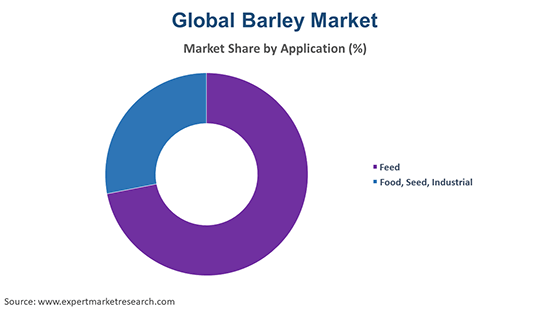

Market Breakup by Application

- Food, Seed, Industrial

- Feed

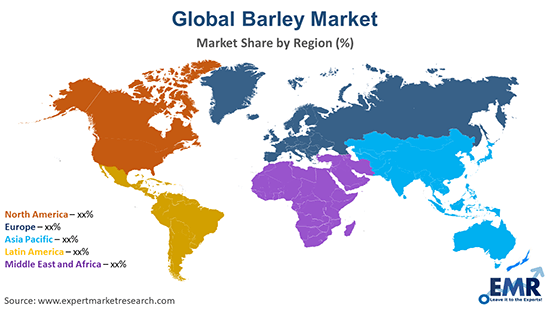

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Barley Market Share

The feed sector is expected to increase due to barley’s nutrition-rich profile and cost-effectiveness

The feed sector holds the major market share. Barley is a nutritious grain that provides a valuable source of energy, protein, and fibre for livestock. It's particularly beneficial for ruminants (such as cattle and sheep) but is also used for pigs, poultry, and horses. The grain's high fibre content is excellent for rumen health in cattle, supporting digestion and nutrient absorption.

For many farmers, growing barley for animal feed is economically viable due to its adaptability to different climates and soil types, which can result in lower input costs compared to other feed grains like corn. Barley can produce reliable yields even in conditions where other crops might not thrive as well, making it a resilient choice for feed production. The growing demand for feed across the region, especially in the United States as well as the rising import of barley in nations like Saudi Arabia supports the segment growth.

The food sector is expected to gain robust growth in the barley market in the coming years. There is a growing trend towards consuming whole grains as part of a healthy diet, influenced by dietary guidelines and health recommendations from organisations around the world. Barley, as a whole grain, fits well into this trend, contributing to its significance in the food market.

Barley's versatility in the kitchen enhances its appeal in the food segment. It can be used in a wide range of dishes, including soups, stews, salads, bread, and breakfast cereals. Hulled barley, pearl barley, barley flakes, and barley flour offer different textures and flavours, expanding their use in culinary applications.

Leading Providers or Barley in the Market

The market players are focusing on expanding their presence in both existing and emerging markets through strategic partnerships and acquisitions to gain a competitive edge in the barley market

Soufflet Group, founded in 1900 and headquartered in Lyon, France, operates in the barley, wheat, rice, and pulses sectors. Additionally, they offer advisory services and supplies to vine growers and winemakers.

Malteurop Groupe, established in 1961 and based in Reims, France, specializes in the production of malt.

GrainCorp Limited, founded in 1917 in Sydney, Australia, focuses on the storage of grain and related commodities, as well as logistics and marketing within these sectors.

Cargill, Incorporated, originating in 1865 in Minnesota, United States, operates across various sectors, including trading, purchasing, and distributing grain and other agricultural commodities.

Players such as Boortmalt Group in the barley market are engaging in various strategies to meet the evolving demands and challenges. These strategies include investing in research and development to introduce new and improved barley varieties with enhanced yield, disease resistance, and climate adaptability.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Barley Market Analysis by Region

Europe, being the largest producer and consumer of barley, consumes up to 90% of malting barley to produce beer. The major producers of barley within the European Union include France and Germany, with the majority of their output utilised in making beer. The malting barley varieties are specifically cultivated for their ability to produce a high-quality malt that meets the stringent requirements of brewers and distillers. This sector's demand for high-grade malting barley significantly influences the market in Europe.

The barley market in North America is anticipated to gain a significant share as a major global consumer of barley is Canada, which consumes the majority of its barley for feed purposes. The demand for industrial consumption is also growing in the region, accounting for 20% of the barley consumption. The major barley-producing regions in Canada are Alberta as well as Saskatchewan, together accounting for 70% of the country’s total output. The rest of the share is produced in British Colombia and Manitoba. The region also exports majorly to the United States and China as well as imports high volumes of barley from Japan to Canada for brewing purposes.

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Snapshot

6.1 Global

6.2 Regional

7 Opportunities and Challenges in the Market

8 Global Barley Market Analysis

8.1 Key Industry Highlights

8.2 Global Barley Historical Market (2018-2023)

8.3 Global Barley Market Forecast (2024-2032)

8.4 Global Barley Market by Application

8.4.1 Food, Seed, Industrial

8.4.1.1 Historical Trend (2018-2023)

8.4.1.2 Forecast Trend (2024-2032)

8.4.2 Feed

8.4.2.1 Historical Trend (2018-2023)

8.4.2.2 Forecast Trend (2024-2032)

8.5 Global Barley Market by Region

8.5.1 North America

8.5.1.1 Historical Trend (2018-2023)

8.5.1.2 Forecast Trend (2024-2032)

8.5.2 Europe

8.5.2.1 Historical Trend (2018-2023)

8.5.2.2 Forecast Trend (2024-2032)

8.5.3 Asia Pacific

8.5.3.1 Historical Trend (2018-2023)

8.5.3.2 Forecast Trend (2024-2032)

8.5.4 Latin America

8.5.4.1 Historical Trend (2018-2023)

8.5.4.2 Forecast Trend (2024-2032)

8.5.5 Middle East and Africa

8.5.5.1 Historical Trend (2018-2023)

8.5.5.2 Forecast Trend (2024-2032)

9 North America Barley Market Analysis

9.1 United States of America

9.1.1 Historical Trend (2018-2023)

9.1.2 Forecast Trend (2024-2032)

9.2 Canada

9.2.1 Historical Trend (2018-2023)

9.2.2 Forecast Trend (2024-2032)

10 Europe Barley Market Analysis

10.1 United Kingdom

10.1.1 Historical Trend (2018-2023)

10.1.2 Forecast Trend (2024-2032)

10.2 Germany

10.2.1 Historical Trend (2018-2023)

10.2.2 Forecast Trend (2024-2032)

10.3 France

10.3.1 Historical Trend (2018-2023)

10.3.2 Forecast Trend (2024-2032)

10.4 Italy

10.4.1 Historical Trend (2018-2023)

10.4.2 Forecast Trend (2024-2032)

10.5 Others

11 Asia Pacific Barley Market Analysis

11.1 China

11.1.1 Historical Trend (2018-2023)

11.1.2 Forecast Trend (2024-2032)

11.2 Japan

11.2.1 Historical Trend (2018-2023)

11.2.2 Forecast Trend (2024-2032)

11.3 India

11.3.1 Historical Trend (2018-2023)

11.3.2 Forecast Trend (2024-2032)

11.4 ASEAN

11.4.1 Historical Trend (2018-2023)

11.4.2 Forecast Trend (2024-2032)

11.5 Australia

11.5.1 Historical Trend (2018-2023)

11.5.2 Forecast Trend (2024-2032)

11.6 Others

12 Latin America Barley Market Analysis

12.1 Brazil

12.1.1 Historical Trend (2018-2023)

12.1.2 Forecast Trend (2024-2032)

12.2 Argentina

12.2.1 Historical Trend (2018-2023)

12.2.2 Forecast Trend (2024-2032)

12.3 Mexico

12.3.1 Historical Trend (2018-2023)

12.3.2 Forecast Trend (2024-2032)

12.4 Others

13 Middle East and Africa Barley Market Analysis

13.1 Saudi Arabia

13.1.1 Historical Trend (2018-2023)

13.1.2 Forecast Trend (2024-2032)

13.2 United Arab Emirates

13.2.1 Historical Trend (2018-2023)

13.2.2 Forecast Trend (2024-2032)

13.3 Nigeria

13.3.1 Historical Trend (2018-2023)

13.3.2 Forecast Trend (2024-2032)

13.4 South Africa

13.4.1 Historical Trend (2018-2023)

13.4.2 Forecast Trend (2024-2032)

13.5 Others

14 Market Dynamics

14.1 SWOT Analysis

14.1.1 Strengths

14.1.2 Weaknesses

14.1.3 Opportunities

14.1.4 Threats

14.2 Porter’s Five Forces Analysis

14.2.1 Supplier’s Power

14.2.2 Buyer’s Power

14.2.3 Threat of New Entrants

14.2.4 Degree of Rivalry

14.2.5 Threat of Substitutes

14.3 Key Indicators for Demand

14.4 Key Indicators for Price

15 Value Chain Analysis

16 Trade Data Analysis (HS Code – 1003)

16.1 Major Exporting Countries

16.1.1 By Value

16.1.2 By Volume

16.2 Major Importing Countries

16.2.1 By Value

16.2.2 By Volume

17 Price Analysis

17.1 North America Historical Price Trends (2018-2023) and Forecast (2024-2032)

17.2 Europe Historical Price Trends (2018-2023) and Forecast (2024-2032)

17.3 Asia Pacific Historical Price Trends (2018-2023) and Forecast (2024-2032)

17.4 Latin America Historical Price Trends (2018-2023) and Forecast (2024-2032)

17.5 Middle East and Africa Historical Price Trends (2018-2023) and Forecast (2024-2032)

18 Competitive Landscape

18.1 Market Structure

18.2 Company Profiles

18.2.1 Soufflet Group

18.2.1.1 Company Overview

18.2.1.2 Product Portfolio

18.2.1.3 Demographic Reach and Achievements

18.2.1.4 Certifications

18.2.2 Malteurop Groupe

18.2.2.1 Company Overview

18.2.2.2 Product Portfolio

18.2.2.3 Demographic Reach and Achievements

18.2.2.4 Certifications

18.2.3 GrainCorp Limited

18.2.3.1 Company Overview

18.2.3.2 Product Portfolio

18.2.3.3 Demographic Reach and Achievements

18.2.3.4 Certifications

18.2.4 Boortmalt Group

18.2.4.1 Company Overview

18.2.4.2 Product Portfolio

18.2.4.3 Demographic Reach and Achievements

18.2.4.4 Certifications

18.2.5 Cargill, Incorporated

18.2.5.1 Company Overview

18.2.5.2 Product Portfolio

18.2.5.3 Demographic Reach and Achievements

18.2.5.4 Certifications

18.2.6 Others

19 Key Trends and Developments in the Market

Additional Customisations Available

1 Manufacturing Process

1.1 Overview

1.2 Detailed Process Flow

1.3 Operation Involved

2 Project Requirement and Cost Analysis

2.1 Land, Location and Site Development

2.2 Construction

2.3 Plant Machinery

2.4 Cost of Raw Material

2.5 Packaging

2.6 Transportation

2.7 Utilities

2.8 Manpower

2.9 Other Capital Investment

List of Key Figures and Tables

1. Global Barley Market: Key Industry Highlights, 2018 and 2032

2. Global Barley Historical Market: Breakup by Application (Thousand Metric Tons), 2018-2023

3. Global Barley Market Forecast: Breakup by Application (Thousand Metric Tons), 2024-2032

4. Global Barley Historical Market: Breakup by Region (Thousand Metric Tons), 2018-2023

5. Global Barley Market Forecast: Breakup by Region (Thousand Metric Tons), 2024-2032

6. North America Barley Historical Market: Breakup by Country (Thousand Metric Tons), 2018-2023

7. North America Barley Market Forecast: Breakup by Country (Thousand Metric Tons), 2024-2032

8. Europe Barley Historical Market: Breakup by Country (Thousand Metric Tons), 2018-2023

9. Europe Barley Market Forecast: Breakup by Country (Thousand Metric Tons), 2024-2032

10. Asia Pacific Barley Historical Market: Breakup by Country (Thousand Metric Tons), 2018-2023

11. Asia Pacific Barley Market Forecast: Breakup by Country (Thousand Metric Tons), 2024-2032

12. Latin America Barley Historical Market: Breakup by Country (Thousand Metric Tons), 2018-2023

13. Latin America Barley Market Forecast: Breakup by Country (Thousand Metric Tons), 2024-2032

14. Middle East and Africa Barley Historical Market: Breakup by Country (Thousand Metric Tons), 2018-2023

15. Middle East and Africa Barley Market Forecast: Breakup by Country (Thousand Metric Tons), 2024-2032

16. Major Exporting Countries by Value

17. Major Importing Countries by Value

18. Major Exporting Countries by Volume

19. Major Importing Countries by Volume

20. North America Historical Price Trends and Forecast 2018-2032

21. Europe Historical Price Trends and Forecast 2018-2032

22. Asia Pacific Historical Price Trends and Forecast 2018-2032

23. Latin America Historical Price Trends and Forecast 2018-2032

24. Middle East and Africa Historical Price Trends and Forecast 2018-2032

25. Global Barley Market Structure

In 2023, the market attained a volume of approximately 1,80,139.69 thousand metric tonnes.

The market is projected to grow at a CAGR of 6.30% between 2024 and 2032.

The market is estimated to witness a healthy growth in the forecast period of 2024-2032 to reach about a volume of around 3,12,182.67 thousand metric tons by 2032.

The major drivers of the market are rising disposable incomes, increasing population, and growing barley demand in many countries.

The key trends guiding the growth of the market include the increase in consumption of soy and corn in feed and biofuel industries and rapidly growing beer industry.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Food, seed, industrial and feed are the leading applications of barley in the market.

The major players in the market are Soufflet Group, Malteurop Groupe, GrainCorp Limited, Boortmalt Group, and Cargill, Incorporated, among others.

The global barley market attained a volume of nearly 1,80,139.69 thousand metric tons in 2023, driven by the rapidly growing beer industry. Aided by technological advancements, the market is expected to witness a further growth in the forecast period of 2024-2032, growing at a CAGR of 6.30%. The market is projected to reach a volume of around 3,12,182.67 thousand metric tons by 2032.

EMR’s meticulous research methodology delves deep into the market, covering the macro and micro aspects of the industry. Based on applications, the market can be segmented into Food, seed, industrial and feed. The major regional markets for the product are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa, with Europe accounting for the largest share of the market. The key players in the above market include Soufflet Group, Malteurop Groupe, GrainCorp Limited, Boortmalt Group, and Cargill, Incorporated, among others.

EMR’s research methodology uses a combination of cutting-edge analytical tools and the expertise of their highly accomplished team, thus, providing their customers with market insights that are accurate, actionable, and help them remain ahead of their competition. is the feed sector. The increasing demand for feed is, thus, supporting the demand growth for barley. The growing demand for feed across the region, especially the United States, is supporting the global barley market. The growing demand for the product among consumers in Europe is aiding the overall demand growth as well as exports. Nations like Saudi Arabia import huge volumes of the product for feed purposes only.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.