Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The barley market attained a volume of 150.29 MMT in 2025. The market is expected to grow at a CAGR of 2.10% during the forecast period of 2026-2035. By 2035, the market is expected to reach 185.01 MMT.

Rising beer consumption is driving the barley market, particularly due to the essential role of malted barley in brewing. With the growing global beer demand, especially in emerging markets, such as China, India, and Southeast Asia, the need for high-quality malting barley is also surging. According to industry reports, the worldwide beer consumption touched 187.9 million kilolitres in 2023, significantly increasing the demand for specialty malts and consequently driving the barley market growth.

Breweries are further entering long-term contracts and investing in sustainable sourcing with barley farmers for ensuring consistent supply in beer production. In March 2025, Soufflet Malt and HEINEKEN Beverages announced a EUR 100 million partnership to establish a state-of-the-art malting facility beside HEINEKEN’s Sedibeng Brewery in Johannesburg, South Africa. Furthermore, farmers are also leveraging GPS-guided equipment, drones, and remote sensing to enhance barley yield and efficiency.

Innovations in production are significantly impacting the barley market outlook for improving yield, quality, and sustainability. In May 2025, Scientists at GB Pant University of Agriculture and Technology developed UPB 1106, a high-yielding six-row barley variety offering improved yields, disease resistance, and nutritional value. These advances are helping to meet the rising demand from brewing, feed, and food industries by ensuring consistent, high-quality barley production across diverse growing regions worldwide.

Base Year

Historical Period

Forecast Period

Malt barley is the most common type of grain used in the brewing sector to make beer.

Organic and sustainable farming practices are witnessing an upward trend in the barley market.

The major barley-consuming regions are the European Union, Russia, Saudi Arabia, and China.

Compound Annual Growth Rate

2.1%

Value in MMT

2026-2035

*this image is indicative*

Rising meat consumption in emerging countries, such as China, India, and the Middle East is propelling feed trade, adding to the barley market expansion. Supporting with industry reports, exports of Australian barley for feed from 2020–21 to 2022–23 reached an annual average of USD 2.5 billion. With rising incomes and shifting dietary preferences toward protein-rich foods, meat consumption is expected to favour the market growth.

The barley market value is growing due to its dietary fibre and beta-glucans content, making it increasingly popular in functional foods. Health-aware consumers are largely seeking barley-enriched foods for digestive health and reduced cholesterol, further spurring product launches. In November 2022, Salalah Mills launched a nutritious barley flour, rich in vitamins, minerals, and dietary fibre for healthier bread options. Rising incorporation into cereals, bakery items, and plant-based products is adding to the industry growth.

The global shift towards organic food is boosting the barley market development with increasing focus on organic production. For instance, in March 2025, BASF partnered with Boortmalt to produce Europe’s first net-zero barley, cutting 90% carbon emissions via certified carbon farming practices in Ireland. With farmers earning premium prices, consumers are increasingly choosing organic barley for perceived health and environmental benefits. This is creating strong incentives for continued expansion in certified barley cultivation worldwide.

The rapid growth of precision agriculture is influencing the barley industry to enable farmers to optimize inputs like water, fertilizers, and pesticides. Growers are largely adopting technologies to achieve higher yields and better crop quality while reducing environmental impacts. For instance, in April 2025, the OzBarley Initiative was introduced to integrate genetic and trait data to accelerate barley breeding while boosting climate resilience and food security in Australia. Such practices are also enhancing soil health and aligning with sustainability goals, further driving the appeal of barley as a climate-smart crop.

The surge in government initiatives for backing production with research funding and crop insurance is adding to the barley market revenue. Catering to this trend, in June 2024, the Canadian government spent USD 5.2 million to aid barley research for creating more sustainable, resistant crop types while promoting long-term profitability and environmental gains for Canadian producers. Climate risk protection and subsidies are also stabilizing barley markets while promoting sustainable production.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Barley Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

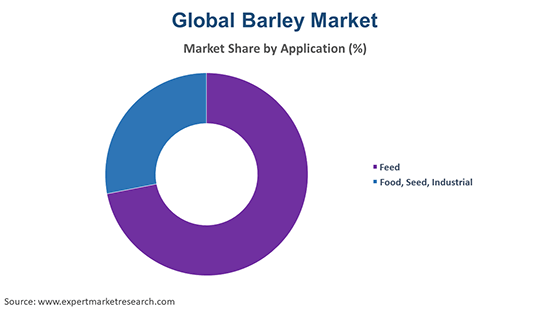

Market Breakup by Application

Key Insight: The feed segment is dominating the global barley market, backed by widespread usage in livestock and poultry nutrition given its high fibre and energy content. Australia is exporting large quantities of feed barley to Asia and the Middle East for supporting intensive animal farming industries. With growing meat consumption worldwide, the demand for animal feed continues to rise. According to industry reports, Global meat consumption is expected to touch about 453 million tonnes in 2025, further reinforcing barley’s key role in this segment.

Market Breakup by Region

Key Insight: North America records a significant share of the barley market, driven by the expanding agricultural sectors in the United States and Canada. The region is a leading producer of malting barley, essential for the thriving brewing industry. Supporting with industry reports, producers in the United States harvested 1.875 million acres of barley to reach a total production of 143.8 million bushels in 2024. Innovations, such as sustainable farming practices and precision agriculture are helping to enhance yield and quality. The growing demand for barley in animal feed and health foods is also supporting the market expansion.

Barley to Record Huge Popularity in Food, Seed, Industrial Applications

The food, seed, and industrial segment in the barley market is gaining traction due to the rising awareness of functional foods. Barley is increasingly used in health-conscious food products for its beta-glucan content to aid in cholesterol reduction and digestive health. For instance, in February 2025, Otsuka Foods launched Mannan Gohan with barley and brown rice for offering five times more fiber. In the seed market, high-yield and disease-resistant barley varieties are in demand for sustainable farming. Industrially, barley is used in biofuels and cosmetics. This segment is growing steadily, especially with the environmental benefits of barley-based industrial applications.

Thriving Barley Industry in Europe & Asia Pacific

Europe barley market share is growing with surging rate of production in France, Germany, and the United Kingdom, especially for malting to cater to beer brewing applications. The region is benefitting from advanced farming technologies and the strong governmental support for sustainable agriculture. Europe has a well-developed barley processing industry that serves the food, feed, and brewing sectors. The increasing consumer preference for organic and non-GMO barley products is also driving market growth opportunities.

Asia Pacific represents a growing segment of the barley market, with increasing awareness of its nutritional benefits and hefty investments in sustainable agriculture. The region’s barley production is largely supporting by the animal feed and brewing industries. The rising rate of Australia exports of significant quantities of malting barley, especially to Asian markets, is also influencing the regional product uptake. As per industry reports, Australia exported 679,112 tonnes of barley in December 2024, with China accounting for the maximum amount.

Key players in the barley market are deploying strategies to reinforce their market position whilst capitalizing on growth opportunities. With product diversification, companies are proliferating their barley varieties as well as related offerings to cater to different end-use sectors including animal feed, brewing, and food processing. This is helping in serving the evolving consumer preferences and regulatory requirements. Geographic expansion is compelling firms to target emerging markets and regions with thriving barley demand to boost their global footprint. Involvement in high-tech agricultural technologies and sustainable agriculture is playing an influential role with companies emphasizing increasing crop yields and reducing environmental footprints for optimizing productivity and sustainability requirements. Additionally, industry players are focusing on vertical integration by owning multiple levels of the barley value chain from cultivation and processing to distribution to achieve quality control and cost saving. Strategic research and development activities are also facilitating innovations in barley cultivation and processing technologies to facilitate differentiated product offerings.

Founded in 1932, Soufflet Group is headquartered in France and specializes in grain collection, malting, and agri-food services. The company provides comprehensive solutions across the agricultural value chain, including grain trading, malt production, and logistics for serving customers worldwide with robust focus on quality and innovation.

Founded in 1934 and headquartered in France, Malteurop Groupe is a leading producer of high-quality malt for the brewing and distilling industries, supported by a global network of malting plants. The group focuses on sustainable practices and delivering tailored solutions to meet the growing customer needs.

GrainCorp Limited, headquartered in Australia, was founded in 1917 and operates as an agribusiness company for offering grain storage, handling, marketing, and processing services. GrainCorp plays a vital role in the agricultural supply chain by connecting growers and customers with an emphasis on operational efficiency and market responsiveness.

Boortmalt Group, founded in 2003 and headquartered in Belgium, is a prominent malt producer with operations across Europe. The company provides malt for brewing and distilling by focusing on quality, sustainability, and customer collaboration. Boortmalt’s integrated approach also ensures reliable supply and innovation in the malting industry.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the barley market are Cargill, Incorporated, among others.

Download your free sample report to explore the latest barley market trends 2026. Discover key growth drivers, competitive landscape, and emerging opportunities shaping the barley industry. Leverage Expert Market Research’s detailed analysis and forecasts for informed investment and strategic decisions in the evolving barley market.

Barley Malt Extract Manufacturing Plant Project Report

Barley Water Manufacturing Plant Project Report

Barley Procurement Intelligence Report

Barley Malt Syrup Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate volume of 150.29 MMT.

The market is projected to grow at a CAGR of 2.10% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about a volume of around 185.01 MMT by 2035.

Key strategies driving the market include expanding malting barley production for brewing, adopting sustainable farming practices, enhancing seed quality through R&D, and strengthening supply chains via digital tools. Additionally, partnerships with local farmers and growing demand for health-based barley foods support market growth across both developed and emerging regions.

The key trends guiding the growth of the market include the increase in consumption of soy and corn in feed and biofuel industries and rapidly growing beer industry.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The feed segment dominates the market, backed by widespread usage in livestock and poultry nutrition.

The key players in the market report include Soufflet Group, Malteurop Groupe, GrainCorp Limited, Boortmalt Group, and Cargill, Incorporated, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share