Reports

Sale

Global Charcoal Briquette Market Size, Share, Analysis: By Type: Wood Type, Others; By Application: Metallurgical Industry, Barbecue, Others; By Grade (Charcoal & Molasses Ratio): Grade A, Grade B, Grade C, Others; By Distribution Channel: Direct, Indirect; Regional Analysis; Market Dynamics: SWOT Analysis; Competitive Landscape; 2024-2032

Global Charcoal Briquette Market Size

The global charcoal briquette market reached a value of USD 2,500.55 million in 2023. The market is further estimated to grow at a CAGR of 8.1% during 2024-2032 to reach a value of USD 5,005.83 million by 2032.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Charcoal Briquette Market Outlook

- About 80% of the African households depend on charcoal as the major energy source.

- Some of the top coconut briquette manufacturers are India, Philippines, and Sri Lanka.

- The major producers of wood charcoal are Brazil, India, China, Nigeria, and Ethiopia.

Charcoal Briquette Market Growth Rate

Charcoal briquettes offer multiple advantages over lumpy charcoal, such as high combustion value, longer burning time, cost-effectiveness, and easy transportation. The governments in developing countries, such as India, have taken initiatives to produce charcoal to offer livelihood to rural communities and women by making use of the abundant agricultural waste to produce charcoal briquettes and meet the market demand.

Charcoal briquettes burn slower with more heat output than other fuels and last longer, making them cost-effective and increasing their consumption.

Manufacturers of charcoal briquettes are increasing their production capacities to fulfil the demand for an efficient and cheap source of fuel.

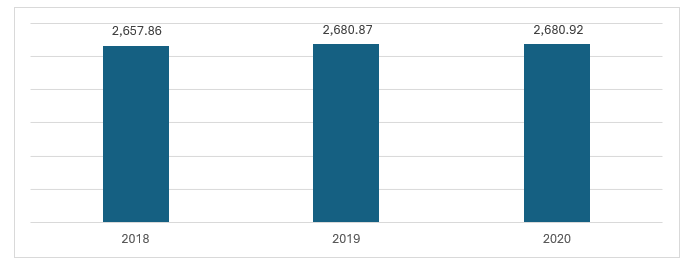

Figure: World Charcoal Production 2018-2020 (10,000 tons)

Key Trends and Developments

Adoption of charcoal briquette as an eco-friendly alternative to fossil fuels; growing e-commerce sector; rising trend of green barbecue; and expansion of area under agriculture are impacting the charcoal briquette market growth

Mar 4, 2024

The Good Charcoal Company announced the launch of Super Briquettes in 15.4lb bags at several Lowe's locations across the United States.

Sep 7, 2022

The Good Charcoal Company launched Pure Acacia Hardwood Lump Charcoal in all-new 8lb bag on HomeDepot.com.

Mar 22, 2022

Kingsford® introduced Kingsford® Signature Flavours, an innovative line of flavour boosters, which find their application in charcoal grills and pellets. These flavours are produced with 100% real spices and are ready-to-use for an easy-to-customise flavour experience.

Charcoal briquettes are an eco-friendly alternative to fossil fuels

Charcoal briquettes produce lower GHG emissions, less ash and dust during the combustion process, and are renewable, making them eco-friendly alternatives to traditional fuels.

Expansion of E-commerce

The rapid expansion of the online marketplace globally has increased the ease with which consumers can obtain and consume charcoal briquettes.

Trend of greener barbecue

The use of briquettes made from eco-friendly raw materials, such as coconut shells, is gaining traction. Organic materials, such as rice husk, sawdust, and bagasse, are also being used to meet the changing demand of customers.

Growing area under agriculture

As the agricultural sector is flourishing across the world, residuals from agricultural activities act as a profitable feedstock for making charcoal briquette. The agriculture and cultivation sources include coconut, cotton stalks, and bagasse among others.

Charcoal Briquette Market Trends

There is a growing demand for charcoal briquette as a biodegradable alternative to coal and oil and gas to reduce emissions and limit climate change, amid the surging eco-consciousness among the population. Also, the emerging need to reduce the dependency on fossil fuels, such as coal is leading to the increasing production of charcoal briquette.

The expanding availability and use of agricultural wastes to produce charcoal briquettes are contributing to the market development. This helps in reducing deforestation by lowering wood fuel consumption, further supporting waste management in the agricultural sector. Moreover, the availability of charcoal briquettes at low cost is leading to their wider adoption by developing nations.

Charcoal Briquette Industry Segmentation

“Global Charcoal Briquette Market Report and Forecast 2024-2032” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

- Wood Type

- Others

Market Breakup by Application

- Metallurgical Industry

- Barbecue

- Others

Market Breakup by Grade (Charcoal & Molasses Ratio)

- Grade A

- Grade B

- Grade C

- Others

Market Breakup by Distribution Channel

- Direct

- Indirect

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Charcoal Briquette Market Share

Based on application, barbecue accounts for a significant share of the market

Charcoal briquettes are among the most popular barbecue fuels as they are easy to ignite and have a uniform shape that delivers heat evenly. 100% natural charcoal briquettes that use corn starch binders are available in the market that deliver natural wood flavour to cooked food and can be used as a fuel in different grills.

Based on distribution channel, indirect channels lead the global charcoal briquette market

Manufacturers of charcoal briquette adopt external sales channels to benefit from the third party’s infrastructure and salesforce and avoid the complexities associated with managing distribution logistics.

Charcoal Briquette Market Leaders

The market players are focused on providing high quality and innovative charcoal briquettes, meeting the changing demands of consumers

The Clorox Company

The Clorox Company, based in the United States, offers its product line for health, wellness, household, lifestyle sectors. The company is listed on New York Stock Exchange under the symbol CLX.

Weber Inc.

Founded in 1952, the company provides charcoal briquettes, lump charcoal, pellets, wood chips and chunks, grills, gas grills, charcoal grills, electric grills, smokers, and pellet grills.

Coco Energy

Headquartered in India, Coco Energy is engaged in the manufacture of premium quality coconut shell charcoal briquettes.

Otago Pte. Ltd.

Otago Pte. Ltd., founded in 2018 is primarily engaged in manufacturing high-quality and sustainable char-briquettes, made from coconut shell charcoal and recycled wood charcoal residues/dust.

PT. Coconut Charcoal Briquettes Factory

It is primarily engaged in manufacturing coconut shell charcoal for shisha and hookah in Indonesia. The company has three charcoal briquettes production lines with a daily capacity of ten tones of coconut charcoal briquettes for hookah.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Charcoal Briquette Market Analysis by Region

North America is one of the key regional markets due to increased focus of policy makers and citizens to promote sustainability

In North America, charcoal briquette producers are adopting sustainability in their production processes and are restraining from using protected species of trees. Charcoal briquettes produce evenly grilled food with a natural, smoky taste and are environmentally friendly owing to their characteristic property of low smoke during combustion.

Rural Africa is presenting considerable opportunities for establishing briquette production facilities due to its high demand for it as a cooking and heating fuel. In developing countries, such as Rwanda, the government is promoting the utilisation of charcoal briquettes as a substitute for wood and charcoal for cooking purposes to reduce the country’s dependence on charcoal to 42% of the population by 2024 and reduce deforestation.

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

|

Breakup by Grade (Charcoal & Molasses Ratio) |

|

|

Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Market Snapshot

6.1 Global

6.2 Regional

7 Opportunities and Challenges in the Market

8 Global Charcoal Briquette Market Analysis

8.1 Key Industry Highlights

8.2 Global Charcoal Briquette Historical Market By Value and Volume (2018-2023)

8.3 Global Charcoal Briquette Market Forecast By Value and Volume (2024-2032)

8.4 Global Charcoal Briquette Market by Type

8.4.1 Wood Type

8.4.1.1 Historical Trend (2018-2023)

8.4.1.2 Forecast Trend (2024-2032)

8.4.2 Others

8.5 Global Charcoal Briquette Market by Application

8.5.1 Metallurgical Industry

8.5.1.1 Historical Trend (2018-2023)

8.5.1.2 Forecast Trend (2024-2032)

8.5.2 Barbecue

8.5.2.1 Historical Trend (2018-2023)

8.5.2.2 Forecast Trend (2024-2032)

8.5.3 Others

8.6 Global Charcoal Briquette Market by Grade (Charcoal & Molasses Ratio)

8.6.1 Grade A

8.6.1.1 Historical Trend (2018-2023)

8.6.1.2 Forecast Trend (2024-2032)

8.6.2 Grade B

8.6.2.1 Historical Trend (2018-2023)

8.6.2.2 Forecast Trend (2024-2032)

8.6.2 Grade C

8.6.2.1 Historical Trend (2018-2023)

8.6.2.2 Forecast Trend (2024-2032)

8.6.3 Others

8.7 Global Charcoal Briquette Market by Distribution Channel

8.7.1 Direct

8.7.1.1 Historical Trend (2018-2023)

8.7.1.2 Forecast Trend (2024-2032)

8.7.2 Indirect

8.7.2.1 Historical Trend (2018-2023)

8.7.2.2 Forecast Trend (2024-2032)

8.8 Global Charcoal Briquette Market by Region

8.8.1 North America

8.8.1.1 Historical Trend (2018-2023)

8.8.1.2 Forecast Trend (2024-2032)

8.8.2 Europe

8.8.2.1 Historical Trend (2018-2023)

8.8.2.2 Forecast Trend (2024-2032)

8.8.3 Asia Pacific

8.8.3.1 Historical Trend (2018-2023)

8.8.3.2 Forecast Trend (2024-2032)

8.8.4 Latin America

8.8.4.1 Historical Trend (2018-2023)

8.8.4.2 Forecast Trend (2024-2032)

8.8.5 Middle East and Africa

8.8.5.1 Historical Trend (2018-2023)

8.8.5.2 Forecast Trend (2024-2032)

9 North America Charcoal Briquette Market Analysis

9.1 United States of America

9.1.1 Historical Trend (2018-2023)

9.1.2 Forecast Trend (2024-2032)

9.2 Canada

9.2.1 Historical Trend (2018-2023)

9.2.2 Forecast Trend (2024-2032)

10 Europe Charcoal Briquette Market Analysis

10.1 United Kingdom

10.1.1 Historical Trend (2018-2023)

10.1.2 Forecast Trend (2024-2032)

10.2 Germany

10.2.1 Historical Trend (2018-2023)

10.2.2 Forecast Trend (2024-2032)

10.3 France

10.3.1 Historical Trend (2018-2023)

10.3.2 Forecast Trend (2024-2032)

10.4 Italy

10.4.1 Historical Trend (2018-2023)

10.4.2 Forecast Trend (2024-2032)

10.5 Spain

10.5.1 Historical Trend (2018-2023)

10.5.2 Forecast Trend (2024-2032)

10.6 Others

11 Asia Pacific Charcoal Briquette Market Analysis

11.1 China

11.1.1 Historical Trend (2018-2023)

11.1.2 Forecast Trend (2024-2032)

11.2 Japan

11.2.1 Historical Trend (2018-2023)

11.2.2 Forecast Trend (2024-2032)

11.3 India

11.3.1 Historical Trend (2018-2023)

11.3.2 Forecast Trend (2024-2032)

11.4 ASEAN

11.4.1 Historical Trend (2018-2023)

11.4.2 Forecast Trend (2024-2032)

11.5 Australia

11.5.1 Historical Trend (2018-2023)

11.5.2 Forecast Trend (2024-2032)

11.6 South Korea

11.6.1 Historical Trend (2018-2023)

11.6.2 Forecast Trend (2024-2032)

11.7 Others

12 Latin America Charcoal Briquette Market Analysis

12.1 Brazil

12.1.1 Historical Trend (2018-2023)

12.1.2 Forecast Trend (2024-2032)

12.2 Argentina

12.2.1 Historical Trend (2018-2023)

12.2.2 Forecast Trend (2024-2032)

12.3 Mexico

12.3.1 Historical Trend (2018-2023)

12.3.2 Forecast Trend (2024-2032)

12.4 Others

13 Middle East and Africa Charcoal Briquette Market Analysis

13.1 Saudi Arabia

13.1.1 Historical Trend (2018-2023)

13.1.2 Forecast Trend (2024-2032)

13.2 United Arab Emirates

13.2.1 Historical Trend (2018-2023)

13.2.2 Forecast Trend (2024-2032)

13.3 Egypt

13.3.1 Historical Trend (2018-2023)

13.3.2 Forecast Trend (2024-2032)

13.4 South Africa

13.4.1 Historical Trend (2018-2023)

13.4.2 Forecast Trend (2024-2032)

13.5 Turkey

13.5.1 Historical Trend (2018-2023)

13.5.2 Forecast Trend (2024-2032)

13.6 Others

14 Market Dynamics

14.1 SWOT Analysis

14.1.1 Strengths

14.1.2 Weaknesses

14.1.3 Opportunities

14.1.4 Threats

14.2 Porter’s Five Forces Analysis

14.2.1 Supplier’s Power

14.2.2 Buyer’s Power

14.2.3 Threat of New Entrants

14.2.4 Degree of Rivalry

14.2.5 Threat of Substitutes

14.3 Key Indicators for Demand

14.4 Key Indicators for Price

15 Price Analysis

15.1 North America Historical Price Trends (2018-2023) and Forecast (2024-2032)

15.2 Europe Historical Price Trends (2018-2023) and Forecast (2024-2032)

15.3 Asia Pacific Historical Price Trends (2018-2023) and Forecast (2024-2032)

15.4 Latin America Historical Price Trends (2018-2023) and Forecast (2024-2032)

15.5 Middle East and Africa Price Trends (2018-2023) and Forecast (2024-2032)

16 Competitive Landscape

16.1 Market Structure

16.2 Company Profiles

16.2.1 The Clorox Company

16.2.1.1 Company Overview

16.2.1.2 Product Portfolio

16.2.1.3 Demographic Reach and Achievements

16.2.1.4 Certifications

16.2.2 Weber Inc.

16.2.2.1 Company Overview

16.2.2.2 Product Portfolio

16.2.2.3 Demographic Reach and Achievements

16.2.2.4 Certifications

16.2.3 Coco Energy

16.2.3.1 Company Overview

16.2.3.2 Product Portfolio

16.2.3.3 Demographic Reach and Achievements

16.2.3.4 Certifications

16.2.4 Otago Pte. Ltd.

16.2.4.1 Company Overview

16.2.4.2 Product Portfolio

16.2.4.3 Demographic Reach and Achievements

16.2.4.4 Certifications

16.2.5 PT. Coconut Charcoal Briquettes Factory

16.2.5.1 Company Overview

16.2.5.2 Product Portfolio

16.2.5.3 Demographic Reach and Achievements

16.2.5.4 Certifications

16.2.6 Others

17 Key Trends and Developments in the Market

List of Key Figures and Tables

1. Global Charcoal Briquette Market: Key Industry Highlights, 2018 and 2032

2. Global Charcoal Briquette Historical Market: Breakup by Type (USD Million), 2018-2023

3. Global Charcoal Briquette Market Forecast: Breakup by Type (USD Million), 2024-2032

4. Global Charcoal Briquette Historical Market: Breakup by Application (USD Million), 2018-2023

5. Global Charcoal Briquette Market Forecast: Breakup by Application (USD Million), 2024-2032

6. Global Charcoal Briquette Historical Market: Breakup by Grade (USD Million), 2018-2023

7. Global Charcoal Briquette Market Forecast: Breakup by Grade (USD Million), 2024-2032

8. Global Charcoal Briquette Historical Market: Breakup by Distribution Channel (USD Million), 2018-2023

9. Global Charcoal Briquette Market Forecast: Breakup by Distribution Channel (USD Million), 2024-2032

10. Global Charcoal Briquette Historical Market: Breakup by Region (USD Million), 2018-2023

11. Global Charcoal Briquette Market Forecast: Breakup by Region (USD Million), 2024-2032

12. North America Charcoal Briquette Historical Market: Breakup by Country (USD Million), 2018-2023

13. North America Charcoal Briquette Market Forecast: Breakup by Country (USD Million), 2024-2032

14. Europe Charcoal Briquette Historical Market: Breakup by Country (USD Million), 2018-2023

15. Europe Charcoal Briquette Market Forecast: Breakup by Country (USD Million), 2024-2032

16. Asia Pacific Charcoal Briquette Historical Market: Breakup by Country (USD Million), 2018-2023

17. Asia Pacific Charcoal Briquette Market Forecast: Breakup by Country (USD Million), 2024-2032

18. Latin America Charcoal Briquette Historical Market: Breakup by Country (USD Million), 2018-2023

19. Latin America Charcoal Briquette Market Forecast: Breakup by Country (USD Million), 2024-2032

20. Middle East and Africa Charcoal Briquette Historical Market: Breakup by Country (USD Million), 2018-2023

21. Middle East and Africa Charcoal Briquette Market Forecast: Breakup by Country (USD Million), 2024-2032

22. North America Historical Price Trends (2018-2023) and Forecast (2024-2032)

23. Europe Historical Price Trends (2018-2023) and Forecast (2024-2032)

24. Asia Pacific Historical Price Trends (2018-2023) and Forecast (2024-2032)

25. Latin America Historical Price Trends (2018-2023) and Forecast (2024-2032)

26. Middle East and Africa Historical Price Trends (2018-2023) and Forecast (2024-2032)

27. Global Charcoal Briquette Market Structure

The market reached a value of USD 2,500.55 million in 2023.

The market is further estimated to grow at a CAGR of 8.1% during 2024-2032.

The market is estimated to witness a healthy growth in the forecast period of 2024-2032 to reach a value of USD 5,005.83 million by 2032.

The different grades of charcoal briquette are grade A, grade B, grade C, and others.

The key regional markets for charcoal briquette are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The market is being driven by the growing trend of barbecue, research and development for eco-friendly charcoal briquette production technologies, and the rising demand for sustainable energy.

The applications include the metallurgical industry, barbecue, and others.

The key players in the market include The Clorox Company, Weber Inc., Coco Energy, Otago Pte. Ltd., and PT. Coconut Charcoal Briquettes Factory, among others.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.