Green hydrogen, also known as renewable hydrogen, is produced by electrolysis using renewable energy sources such as wind, solar, and hydropower, making it a zero-carbon alternative to traditional hydrogen production methods. It is increasingly utilised in applications including energy storage, fuel cells for transportation, industrial feedstock, and power generation. According to Expert Market Research, the global green hydrogen market was valued at USD 2.43 Billion in 2025 and is projected to expand at a CAGR of 48.40% through 2035. The market is further expected to reach USD 125.88 Billion by 2035.

The market's expansion is driven by green hydrogen's potential to decarbonise various sectors, including heavy industries and transportation. Key factors fuelling this growth include rising government initiatives and investments in renewable energy infrastructure, increasing adoption of hydrogen-powered fuel cells, and the growing focus on achieving net-zero emissions globally.

Green Hydrogen: Production Pathways, Raw Materials, and Energy Sources

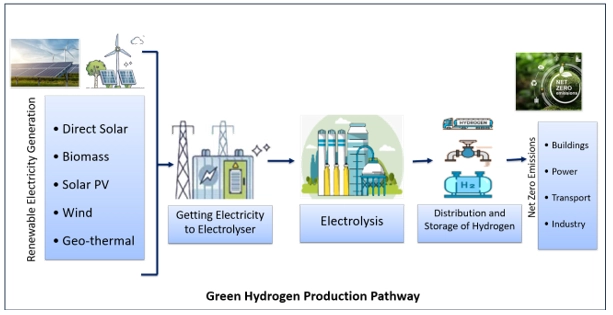

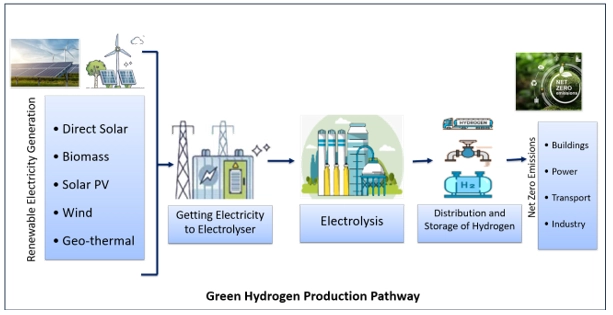

Green hydrogen is generated through electrolysis, a process that utilises renewable electricity to split water into hydrogen and oxygen. This emission-free technology takes place in an electrolyser, a device comprising an anode, cathode, and an electrolyte. Electrolysers vary in scale, ranging from small, distributed units for localised production to large industrial facilities linked to renewable energy sources like wind or solar power. The system also incorporates essential components such as pumps, gas separators, and storage tanks. Water acts as the primary raw material, while renewable energy drives the process, ensuring sustainability. The only by-product of this clean process is oxygen, making green hydrogen a vital solution for advancing global energy transitions.

Ongoing advancements in electrolyser technologies and the declining costs of renewable energy have further accelerated the market's development. According to Expert Market Research, the global hydrogen electrolyzer market was valued at USD 2.84 billion in 2025 and is projected to grow at a CAGR of 28.70% during the forecast period from 2026 to 2035, reaching approximately USD 35.41 billion by 2035. According to the International Energy Agency, as of 2023, the global installed electrolysis capacity by technology includes Alkaline (1,152 MW), Polymer electrolyte membrane (921 MW), and other technologies (811 MW), amounting to a total installed capacity of 2,884 MW. The increasing demand for sustainable energy solutions, coupled with international efforts to reduce greenhouse gas emissions, underscores the promising trajectory of the green hydrogen market.

Market Growth of Green Hydrogen

The green hydrogen market has witnessed substantial growth over the past decade, driven by advancements in electrolyser technologies and renewable energy integration. According to Energy Institute data, Asia-Pacific emerged as the market leader, capturing 63.4% of the global share in 2023, assisted by large-scale deployment of PEM and alkaline electrolysers.

Europe, benefiting from advancements in hydrogen storage and renewable energy infrastructure, accounted for 21.4% of the green hydrogen production market in 2023. North America, focusing on fuel cell technologies and decarbonisation of industries represents 13.2% of the global market. South and Central America, though holding a smaller share of 0.8%, saw significant growth of 309.3% from 2022 to 2023. This rapid expansion underscores the role of innovation in green hydrogen production and global decarbonisation efforts.

Insights on Green Hydrogen: Latest News and Developments

- In January 2025, Hygen Energy’s green hydrogen production in Birmingham received significant financial backing from HSBC UK. The multi-million-pound investment aims to expand Hygen’s hydrogen supply capabilities and support decarbonisation efforts among major companies.

- In January 2025, Japanese technology company Asahi Kasei secured government funding to expand its green hydrogen equipment production as part of Japan's goal to achieve carbon neutrality by 2050. The company plans to build new manufacturing facilities at its Kawasaki plant, aiming to produce 2 GW of electrolyser components annually by 2028. The expansion is supported by a USD 74 million subsidy under Japan’s Green Transformation (GX) strategy, as part of a larger USD 224 million investment.

- In January 2025, Swiss-based green energy company H2 Global Energy signed an MOU with the Tunisian government to develop a USD 6 billion green hydrogen and green ammonia project.

- In January 2025, Indian power electronics firm Ador Powertron unveiled a new 500 MW manufacturing plant for green hydrogen power solutions in Pune, Maharashtra. The plant will produce megawatt-scale transformers and rectifiers using insulated-gate bipolar transistor (IGBT), silicon carbide (SiC), and thyristor technologies.

- In January 2025, Copenhagen Infrastructure Partners (CIP) teamed up with Friesen Elektra Green Energy AG to launch Project Anker, a green hydrogen production facility in Sande, Lower Saxony, Germany. The project will begin with an electrolysis capacity of 400 megawatts (MW), with plans to expand to 800 MW in the future, producing up to 80,000 tonnes of green hydrogen annually.

- In January 2025, SunHydrogen unveiled its 1m² green hydrogen panel technology, marking a significant milestone in clean energy solutions. The demonstration, held at their laboratory in Coralville, Iowa, showcased the company's progress in renewable hydrogen production.

- In September 2024, BP and Iberdrola announced the final investment decision for their 25 MW green hydrogen project in Spain, developed through a 50:50 joint venture. The green hydrogen produced will help decarbonize BP's refinery operations in Castellón, and it is expected to be completed in 2026. The project is expected to prevent the emission of 23,000 tons of CO2 annually.

- In August 2024, Linde Engineering signed an agreement with Shell Deutschland GmbH to build a 100 megawatt (MW) renewable hydrogen plant for the REFHYNE II project at the Shell Energy and Chemicals Park Rheinland in Wesseling, Germany.

- In July 2024, 3M made a strategic investment in Ohmium International, a company specializing in electrolyzer systems for green hydrogen production. This investment is part of 3M's ongoing efforts to expand into emerging climate technologies, supporting the transition to a low-carbon economy.

- In June 2024, TotalEnergies and Air Products signed a 15-year agreement to supply 70,000 tons of green hydrogen annually in Europe, starting in 2030. This first long-term deal follows TotalEnergies’ tender for the supply of 500,000 tons per year of green hydrogen to decarbonize its European refineries.

Key Applications of Green Hydrogen in Decarbonising Industries and Transportation

Oil Production, Petrochemical Refining, and Ammonia Production

Green hydrogen can help reduce emissions in oil production, petrochemical refining, and ammonia production, which are all major sources of pollution. In 2024, the global refining industry contributed 4% of global emissions, but using hydrogen as a feedstock could cut emissions by 25% by 2050.

Natural Gas Power Plants

Green hydrogen can play a crucial role in greening natural gas production in power plants while reducing its carbon intensity. Under the Inflation Reduction Act, using green hydrogen as a feedstock in gas power plants can qualify operators for financial incentives. According to ICF International, this could make green hydrogen more cost-effective than the current natural gas used in combined-cycle gas turbines by 2030.

Green Hydrogen in Heavy Industry

Green hydrogen holds significant potential for decarbonising heavy industries, which contribute about 25% of global carbon emissions, according to the IEA. Industries like steelmaking, glassmaking, concrete production, and electronics manufacturing have few viable energy alternatives. Concrete production alone is responsible for 9% of global emissions, with increasing levels annually over the past 50 years. Green hydrogen offers a sustainable solution to reduce emissions in these highly polluting sectors, addressing the urgent need for decarbonisation in heavy industrial processes.

Green Hydrogen for Energy Storage and Production

Green hydrogen offers long-term energy storage, unlike batteries, which have limited durations. It can store energy for months, useful during emergencies. Hydrogen can also be converted into methane through the Sabatier reaction, providing a sustainable fuel alternative. This ability is essential for decarbonising hard-to-electrify sectors like aviation and heavy transport, showcasing hydrogen’s role in energy storage and fuel production.

Green Hydrogen as a Transportation Fuel

Green hydrogen is gaining traction in transportation, especially for long-haul trucking, where it offers faster refuelling compared to electric vehicles. At the end of 2022, IEA data demonstrates that there were around 75,000 fuel cell vehicles globally, with significant adoption in South Korea (41%) and the U.S. (21%). Hydrogen-powered trucks, buses, and trains are expanding, with companies like Nikola Motors and Hyundai leading the charge. Hydrogen’s quick refuelling capability makes it a promising fuel for long-distance travel.

Outlook and Opportunities

The global green hydrogen industry is growing, with IRENA forecasting in December 2024 that hydrogen and its derivatives will meet 14% of global energy demand by 2050. The IEA predicts green hydrogen production will reach 43 million tons by 2030. Key players in the market include Saudi Arabia, Australia, China, India, and the European Union, which are leading the development of large-scale green hydrogen plants. In 2023, 1,418 green hydrogen projects were launched worldwide. This indicates a significant push towards advancing green hydrogen technologies and scaling up production efficiently.

Top 7 Green Hydrogen Projects in the World (Ranked based on hydrogen production capacity):

| Project Name |

Capacity (GW/MW) |

Hydrogen Capacity (tons/year) |

Developer |

Year of Commission |

Country |

| Western Green Energy Hub |

50 GW |

3.5 million |

InterContinental Energy, CWP Global, Mirning Green Energy Ltd |

2030 |

Australia |

| BrintØ Green Hydrogen Island |

10 GW |

1 million |

Copenhagen Infrastructure Partners (CIP) |

2030 |

Denmark |

| Aqua Ventus |

10 GW |

1 million |

RWE Renewables, Aqua Ventus Forderverein |

2030 |

Germany |

| NEOM Green Hydrogen Project |

4 GW |

219 KMT |

NEOM, Acwa Power, Air Products |

2026 |

Saudi Arabia |

| Ningxia Baofeng Energy Group |

200 MW |

27 KMT |

Ningxia Baofeng Energy Group |

2021 |

China |

| Xinjiang Green Hydrogen Plant |

260 MW |

20 KMT |

Sinopec |

2023 |

China |

| Project Nour |

1.6 GW |

150 KMT |

Chariot Green Hydorgen & TE H2 |

2030 |

Africa |

Green Hydrogen: Pathways to Progress

Green hydrogen represents a critical pathway for decarbonising heavy industries, offering a renewable alternative to fossil fuels for high-temperature processes and chemical feedstocks. While challenges such as infrastructure and cost competitiveness remain, sustained investments, technological innovations, and supportive policies are paving the way for a green hydrogen revolution. As the global economy transitions towards sustainability, green hydrogen’s role will undoubtedly become more prominent, reshaping industries and driving a cleaner, greener future.

Share