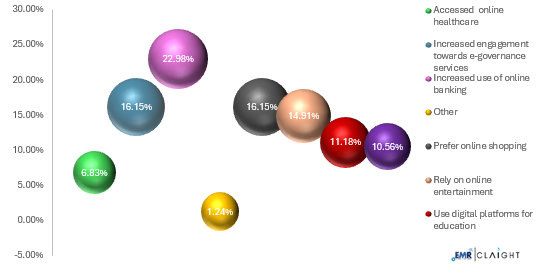

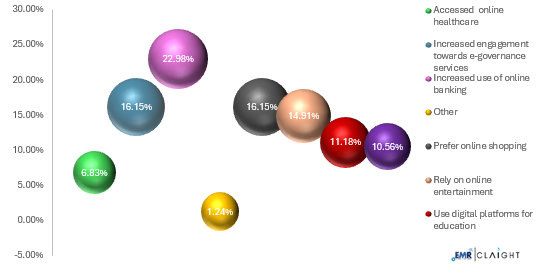

As per a survey conducted by Expert Market Research, 22.98% of the respondents have experienced an increase in use of e-banking services followed by 16.15% who noticed a surge in online shopping and increased engagement towards e-governance services each.

Digital India was launched with vision to transform the definition of routine tasks and transition online. Through digital India, accessibility towards schemes and initiatives which are timely introduced by Indian government for public has improved. As per a comprehensive survey conducted by Expert Market Research, across top tier 1 and 2 cities, covering over 60,000 respondents, the results delve deep into the impact of Digital India towards the use of e-services.

Services Offered Through Digital India

The results from the survey indicate that 22.98% of respondents has observed an increase in the use of online banking services while an equivalent percentage of respondents i.e. 16.15% has observed their increased engagement towards e-governance services and online shopping respectively. This study aims to analyze impact of digital India towards the use of digital services and which service has been mostly impacted. It’s evident that a major share of the population, i.e. 22.98%, has noticed an increase in their use of e-banking services which include digital payments and integration of bank accounts. This trend is followed by increased engagement towards e-governance services and a preference towards online shopping with an equal share.

Impact On Use Of E Services After Digital India

Payments or transactions through e-banking or electronic banking are convenient, secure and safe. It not only records them but provides an authenticity check before you indulge in any fraud or fake transaction. Adoption of e-banking through digital India has significantly reduced the corruption practices and contributed towards a robust financial sector. Initiatives launched by NPCI (National Payments Corporation of India) in the sector of e-banking are numerous and significant. One such example is the BHIM mobile app to facilitate quick and convenient transactions using UPI. Apart from the government, mobile apps such as Paytm and Google Pay, launched by private companies have gained importance under the initiative Digital India because of the increased awareness among the public.

After analyzing varied behaviors of respondents towards the usage of digital services after the introduction of digital India, it can be concluded that consumer buying behavior has significantly changed. Use of technology for payments, education, work or shopping, digital India has taken country’s economy to a cashless and paperless economy. Earlier, government-launched initiatives were not able to reach the beneficiaries or to the granular level, but today, the public can utilize these initiatives for improving their lives. But on the other hand, retail shops have experienced a decline in their sales as more people now prefer to shop online rather than through traditional methods and thus a significant growth was noticed in e-commerce websites after the launch of Digital India.

Share