Is Managed Service ATM Deployment Becoming a Cost Saving Strategy for Indian Banks?

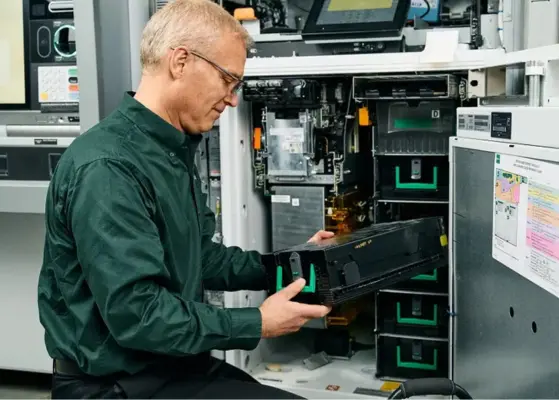

Banks in India are trying to lower their operational costs at the same time they have to expand their network of ATMs. The in-house model of owning and managing ATMs has become costly with the increased demand for cash withdrawals and maintenance of machines. Therefore, banks are moving to the managed service model for ATM deployment, where a third-party service provider takes care of installation, monitoring, cash replenishment, and maintenance.

By using managed service models, banks can lessen their monetary burden and provide customers with higher uptime. Banks can concentrate on core banking services by giving the responsibility of daily ATM operations to a specialized company, thus they do not need to invest heavily in machines, logistics, hardware repairs, and manpower. This method is used by large and mid-sized banks that want to optimize their costs without compromising customer service and is becoming increasingly popular.

How Managed Service Providers Reduce Costs for Banks?

Managed service companies are an excellent solution for banks to reduce the operating costs that may appear throughout the bank’s activities, especially by the implementation of efficiencies.

First, they oversee the purchasing and the deployment of the product on a large scale. Owing to the fact that they are responsible for thousands of installations, they are in a position to acquire machines, security systems, and spares at the most competitive prices. Banks gain from these efficiencies without the need to invest directly.

Secondly, replenishing cash and logistics is their responsibility. By working with cash in transit teams, scheduling fills, and ensuring the secure movement of currency can prove to be very costly for banks if they decide to manage them internally. By giving this work away to someone else, operations become more efficient, and the number of cashouts decreases.

Thirdly, managed service providers have centralized monitoring as their offer. They resort to command centers dedicated to tracking ATM functioning, recognizing breakdowns, and dispatching technicians. In this way, bank uptime is improved and there is the prevention of loss of money due to ATM downtime.

Company Example Showing the Impact of Managed Services

One of the leading managed service companies in India that frequently collaborates with several private and public sector banks is a perfect example of how this model brings benefits to the industry. The company is responsible for thousands of ATMs that are located in metros, tier-2 cities, and villages. Additionally, it offers services from deployment to monitoring and cash management.

Banks that engage with such providers have experienced a drastic reduction in their costs. They pay a certain service fee instead of paying for various repairs, security upgrades, or network issues individually. This lowers the risk and makes budgeting more efficient. The providers are also able to increase the device uptime as a result of the shorter repair cycles and the more accurate forecasting of technical issues.

Cooperative and regional banks are other examples. A lot of such banks have chosen managed service ATMs as a tool to grow their presence while they are still able to keep the heavy infrastructure investments at bay. Through these companies, the banks have been able to install ATMs in far-flung areas, keep the uptime at a high level and thus make the customers' access to cash easier.

These examples indicate how the outsourcing of ATM operations facilitates the reduction of bank expenses as well as the shifting of their focus towards core financial services.

Why Does the Model Support Future Ready ATM Networks?

Managed service ATMs are a big part of how India is changing its ATM infrastructure to be more modern. They enable a faster implementation of new technologies like cardless withdrawals via UPI, biometric authentication, and cash recycler machines. Banks can launch these upgrades without a complete network redesign.

The model is also aligned with enhanced security. Providers equip themselves with state-of-the-art monitoring instruments, better surveillance, and quick response teams to ensure the security of the machines. Banks get the advantage of higher safety standards without the full implementation cost coming from their side.

What This Means for the ATM Market in India?

As banks search for cost-efficient and scalable solutions, managed service ATMs will be present in more locations all over India. The model allows banks to increase their reach, lower their operating costs, and provide excellent service to customers. In addition, it is beneficial for ATM operators and service companies who can increase their market share and make technological advancements.

For insights into ATM deployment models, cost structures, and service strategies in India, refer to the India ATM Market

Looking Ahead

Banks that aim at cutting down their expenses and enhancing their productivity will likely adopt managed service ATM deployment as a standard practice. With the ongoing trend in India where digital payments are complemented by a robust cash usage, this approach will facilitate the establishment of reliable and up-to-date ATM networks nationwide.

Share