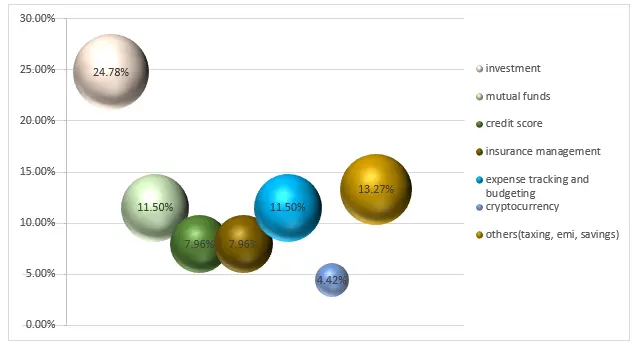

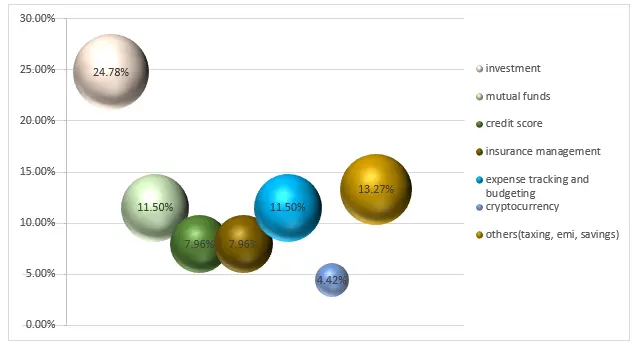

In a recent survey conducted by the Expert market research to study the most used types of apps in the fintech industry, it was noted that 24.78% of the respondents use Investment apps, followed by 11.50% who use mutual funds investing apps. This signifies the rapid increase of FinTech app users, with increased awareness of investments and trading.

With digitalization at its peak, and in the era of cashless payments, managing personal finances has become more accessible and convenient than ever before. These apps are rapidly growing in the Fintech industry, gaining significant market share by offering users the facility to control their financial health within a few taps. There is a wide variety of fintech apps to solve many of the concerns of users namely investment, mutual funds, insurances, etc.

To study which type of personal finance apps consumers are using the most, a study was conducted by expert market research across the tier 1 cities which revealed some interesting insights.

Most-Used-Fintech-Apps

Based on the findings of this study, it was observed that Investment apps such as Groww, Zerodha are the most used personal financing apps amongst users, being the preference of 24.78% of the total respondents. Following this is Mutual funds investment apps such at ETMONEY, Paytm money, with a share of 11.50%. Credit score and insurance management apps like Paisa bazaar, policy bazaar, are being used by 7.96% of the respondents each.

Another 11.50% of the respondents usually use expense tracking and budgeting apps like Monefy, Moneyview and MINT. About 4.42% of the respondents also use cryptocurrency apps such as COINDCX while the remaining opt for apps in Taxation, EMI tracking and savings apps.

Investment apps amongst the most popular used fintech apps

Ahead of the pandemic, fintech investing apps noticed a sharp rise with younger investors showing keen interest in stock trading and other means of investing. The genz took advantage of the market volatility and lower stock prices which accelerated the adoption of investment apps as they became more aware of it. Investment apps have also lowered their barriers to entry of investing along with the at-home convenience they offer, attracting a large traders base, some of whom might not have considered the traditional investment routes.

These budding investors have also shown interest in mutual funds investing apps which offer the ability to diversify your investments, thus lowering down your risk, beneficial for the ones hesitant to invest. With the government’s efforts of cross linkage UPI payments has further improved India's inclusion in the fintech industry.

Understanding these trends is necessary for the fintech industry to better navigate through the competition. Our study further explores how by analyzing consumer behavior for the fintech apps, this industry can modify these apps as per trader’s likings.

Share