Industrial Hose Applications Across Key North American Industries

The industrial hose market in North America is currently growing because hoses are being widely demanded for application in tougher environments, with far less tolerance for failure. In industries such as oil & gas, food processing, chemicals, mining, and heavy manufacturing, industrial hoses have become essential engineered components that directly affect uptime and safety. Major manufacturers are no longer selling hoses by diameter and length only. They are offering complete application-specific solutions designed around pressure limits, temperature fluctuations, regulatory exposure, and fluid compatibility. This shift in how hoses are specified and procured is now gradually reshaping demand patterns across the region.

Oil and Gas Operations Drive High-Spec Hose Development

The oil and gas industry largely contributes to the demand for industrial hoses in North America. Upstream drilling sites, midstream terminals, and downstream refineries all rely on hoses for crude transfer, frac fluid movement, vapor recovery, and loading operations as the expectation around durability and safety margins is gradually evolving.

Manufacturers such as Gates Industrial, Eaton, and Continental have expanded their portfolios of high-pressure composite hoses and flexible metallic alternatives aimed at shale basins like the Permian and Bakken. These regions operate under extreme pressure cycles and aggressive chemicals. Product development efforts are increasingly focused on burst resistance, electrostatic dissipation, and longer inspection intervals.

Food and Beverage Processing Pushes Compliance-Centric Designs

In food and beverage manufacturing, industrial hose applications are governed less by pressure and more by compliance and hygiene. North American processors face strict FDA and USDA standards, which has compelled hose suppliers to rethink material selection and surface finishes.

Companies like Trelleborg and Parker Hannifin have invested heavily in food-grade silicone and thermoplastic hose lines that support dairy, beverage, and prepared food production. These hoses are designed to withstand frequent washdowns and temperature fluctuations without cracking or leaching. This has driven demand for more flexible constructions that maintain flow rates even under repeated bending. For B2B buyers, supplier track record with audits and documentation is now as important as product performance itself.

Chemical Transfer Applications Demand Precision and Customization

Chemical processing facilities represent one of the fastest evolving application segments for industrial hoses. The diversity of chemicals such as acids, solvents, and specialty compounds, handled across North America, makes standardization difficult. Consequently, hose manufacturers are increasingly offering customized assemblies rather than off-the-shelf products.

Saint-Gobain and Alfagomma have both expanded chemical hose ranges that feature multi-layer liners and advanced reinforcement to handle permeation risks. These products are marketed heavily toward specialty chemical producers in the Gulf Coast and Midwest. Site assessments and material compatibility analysis are becoming part of the commercial process. This helps suppliers lock in long-term supply agreements while reducing failure-related liabilities for plant operators.

Mining and Slurry Handling Favor Abrasion-Resistant Solutions

Mining continues to be a smaller volume market compared to oil and gas, but it has a major influence on hose design innovation. Slurry handling, tailings transfer, and dewatering operations place extreme abrasion stress on hoses. North American mining operators, particularly in Canada and the western United States, are demanding longer service life to reduce maintenance labor in remote locations.

Manufacturers such as Weir Minerals and Bridgestone Industrial have introduced reinforced rubber hoses with thicker inner linings and embedded wear indicators. These features allow operators to plan replacements more accurately. From a B2B perspective, fewer shutdowns and safer working conditions justify higher upfront costs. Mining applications often become test beds for durability features that later migrate into other industrial sectors.

Manufacturing Facilities Embrace Application-Specific Hose Systems

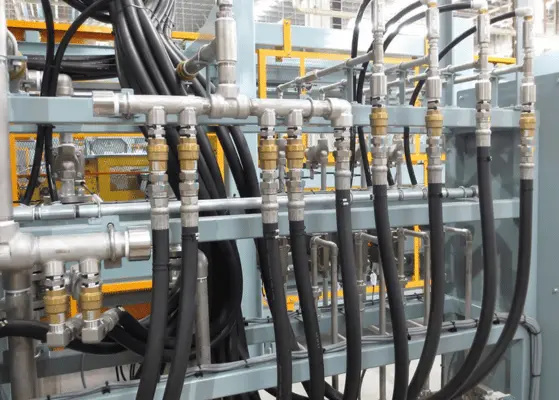

General manufacturing is where industrial hose applications show the most variation. Automotive plants, metal fabrication shops, and plastics processors all rely on hoses for air, coolant, lubrication, and material transfer, however, the only change that has occurred is the level of system integration.

Large manufacturers like Sumitomo Riko and Kuriyama are positioning hoses as part of broader fluid handling systems that include couplings, clamps, and monitoring components. Some suppliers are piloting sensor-enabled hose assemblies that track pressure cycles and temperature exposure. While this development is still in its nascent stage, it reflects how industrial buyers are thinking beyond replacement cycles and toward performance optimization. In North America’s reshoring-driven manufacturing expansion, suppliers that can scale these systems quickly are gaining preferred vendor status.

For deeper insights into supplier strategies, product positioning & demand drivers, explore the North America Industrial Hose Market

Application-Driven Demand Will Define the Next Growth Phase

Industrial hose demand in North America is no longer driven by broad industrial growth alone. It is shaped by how hoses are used, where failures occur, and what risks buyers are trying to eliminate. From oil fields to food plants, applications dictate material choices, design priorities, and supplier relationships. Manufacturers that invest in application engineering, compliance expertise, and durability-focused innovation are expected to capture more traction in the market, over the coming years.

Share