Challenges and Opportunities for Indian PCB Startups and SMEs

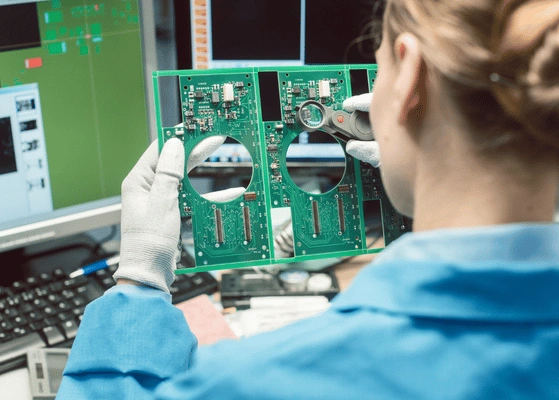

The printed circuit board (PCB) industry in India is rapidly evolving, offering significant potential for startups and small and medium enterprises (SMEs). These players are vital to innovation, agility, and diversification within the Indian PCB ecosystem. However, the journey for new and smaller PCB manufacturers is fraught with challenges, including high capital requirements, technology gaps, and intense competition.

At the same time, government initiatives, rising domestic demand, and increasing industry collaboration provide a conducive environment for startups and SMEs to thrive. This blog explores the unique challenges faced by Indian PCB startups and SMEs and highlights the opportunities that can help them carve a successful niche in the growing electronics manufacturing landscape.

Capital Intensity and Technology Barriers

One of the biggest challenges for PCB startups and SMEs in India is the high capital investment required to establish modern manufacturing facilities. Advanced PCB production involves sophisticated equipment such as CNC drilling machines, laser direct imaging systems, and automated inspection tools. These machines require substantial upfront expenditure, which can be prohibitive for smaller firms with limited access to finance.

Moreover, acquiring technical know-how and skilled manpower to operate such advanced equipment is a steep hurdle. Many startups struggle to bridge the technology gap needed to manufacture complex multilayer, HDI, and flexible PCBs, which are increasingly demanded by key end-use sectors.

Competition from Established Players and Imports

Indian PCB startups and SMEs operate in a competitive landscape dominated by well-established domestic manufacturers and inexpensive imports, primarily from China and Taiwan. Price pressures from these global suppliers challenge smaller Indian firms on both cost and scale. Many startups focus on niche segments or customized PCB solutions to differentiate themselves. However, competing against large-scale operations with economies of scale and global sourcing remains a constant struggle.

Furthermore, buyers in segments such as consumer electronics and automotive often require stringent quality certifications and long-term supplier relationships, which startups may find difficult to establish early on.

Opportunities: Government Support and Incentive Programs

The Indian government’s growing emphasis on electronics manufacturing presents substantial opportunities for PCB startups and SMEs. Schemes like the Production Linked Incentive (PLI) provide financial incentives to manufacturers investing in new capacity and technology upgrades. Electronics manufacturing clusters and Special Economic Zones (SEZs) offer startups access to improved infrastructure, supply chains, and power reliability, lowering operational risks. Additionally, initiatives promoting Make in India aim to reduce import dependence and encourage domestic production, expanding the potential customer base for startups.

Innovation and Niche Market Focus

Startups and SMEs have a distinct advantage in agility and innovation. Many are leveraging emerging technologies such as flexible and rigid-flex PCBs, high-frequency materials, and miniaturized designs to meet specialized demands in wearables, medical devices, and IoT.

By targeting niche applications where customization and rapid prototyping are valued, startups can build a competitive edge over larger players focused on volume production. Collaborations with research institutions and participation in industry consortia facilitate technology access and knowledge sharing.

Building Skilled Workforce and Quality Standards

To scale sustainably, startups and SMEs must invest in building a skilled workforce adept in modern PCB manufacturing and quality control. Training programs, skill development partnerships, and collaboration with technical institutes help bridge the talent gap.

Achieving certifications such as ISO 9001, IPC standards, and RoHS compliance is essential to gain customer trust and enter global supply chains. While certification processes can be resource-intensive, they unlock higher-value contracts and export potential.

Focus on quality from the outset helps startups build a reputation for reliability, which is critical in industries like automotive and medical electronics where failure rates must be minimized.

Collaborative Ecosystem and Future Outlook

A collaborative ecosystem involving government bodies, industry associations, academic institutions, and private enterprises is vital for fostering growth among PCB startups and SMEs. Shared facilities, testing centers, and technology parks can lower barriers to entry by providing access to expensive equipment and expert guidance.

As India’s electronics manufacturing base expands, demand for specialized and customized PCBs will grow, offering ample opportunities for innovative startups. Supportive policies, coupled with increasing investor interest in hardware startups, signal a positive future.

For in-depth market insights and strategic analysis, visit our India Printed Circuit Board (PCB) Market

Building a Strong Future for Startups and SMEs

The journey for Indian PCB startups and SMEs is challenging but filled with promise. With the right mix of innovation, government support, and strategic collaboration, these agile players can overcome barriers and play a pivotal role in strengthening India’s electronics manufacturing ecosystem. Their success will not only boost domestic capabilities but also enhance India’s competitiveness in the global PCB market.

Share