As per a survey conducted by Expert Market Research, 27.63% of respondents use personal finance apps frequently for audit and tax planning majorly which forms a share of 11.84% of respondents.

The use of fintech applications has become very popular because of the increased awareness on financial management. They have simplified our daily financial tasks, from payments to booking a hotel, it caters to all our necessities. According to a comprehensive survey conducted by Expert Market Research, across top tier 1 and 2 cities, covering over 50,000 respondents, the outcomes delve deep into the scenarios where personal finance apps are widely used.

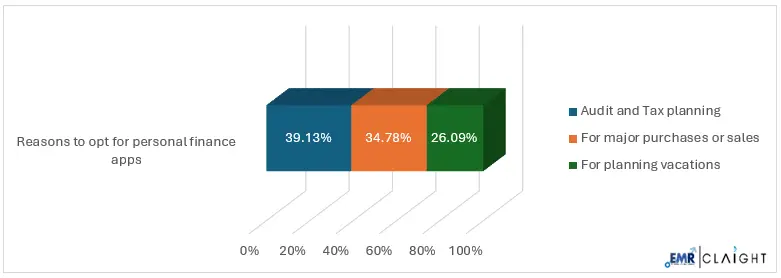

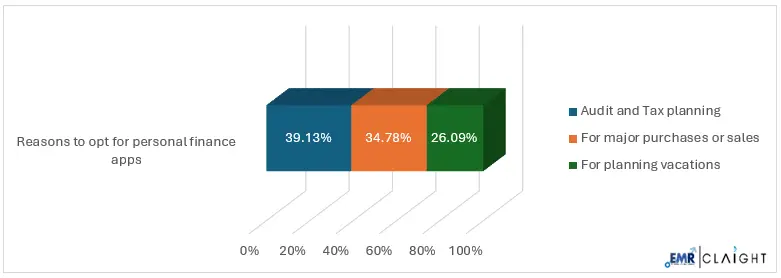

Reasons To Opt For Personal Finance Apps

The results from the survey indicate that most of the respondents i.e. 39.13% prefer to use personal finance apps for audit and tax planning while 34.78% and 26.09% use them for major purchases or vacations respectively. This study aims to analyze the scenarios where individuals prefer to use personal finance apps and consequently the most preferred one. The top reasons emerge to be tax planning and for major purchases which collectively forms a share of approximately 74%, as being chosen by the majority, followed by those who prefer to use such apps for planning vacations.

Since fintech apps help to keep our financials organized and facilitate budget and expenditure tracking, their usage and adoption has shown significant growth over the past few years. As per trends, personal finance apps are now integrating automation, machine learning and natural language processing (NLC) to facilitate and streamline tax filing process by sourcing information from bank accounts and suggesting possible deductions. Payments which include considerable amount have now become easier and simplified. As there is an emerging trend of saving down for a down payment, fintech applications facilitate users to allocate and track their investments and help them manage their significant financial goals.

Offers And Cash Backs On Personal Finance Apps

After analyzing varied reasons of users towards the adoption of personal finance apps, it is concluded that individuals prefer to use such apps for tax planning and major purchases primarily. Although most of the population is known to personal finance apps and use it for various benefits, still there lies a need to bridge the gap of financial inclusion. This can be solved by providing educational content within such apps to spread awareness. Still, there’s significant share that utilize personal finance apps solely for investing and not for facilitating major purchases such as saving for a new house or buying gold. Older adults are generally more cautious about using personal finance apps for auditing or tax planning, as these tasks were traditionally handled by professionals. Taking them online and making them adapt to new technology creates hassle among such individuals.

Share