Navigating Sustainable, Profitable Growth in a Rapidly Changing World

North America holds a significant market share due to the easy availability of personal loans and high consumer awareness about financial literacy. As the USA is the largest economy globally, the region has the presence of leading financial companies, banks, and fin-tech startups.

In the U.S., 77% of adults own at least one credit card that helps to maintain their CIBIL score, on the basis of which they can easily apply for personal loans. In 2022, U.S. consumers used their credit cards to complete 31 per cent of transactions. The growing number of people moving to smart urban areas like New York, California, and Miami, the rising amount of money needed to support lifestyles, and the growing accumulation of materialistic goods are supporting the personal loan market growth.

The increasing launches of innovative personal loan plans are further aiding the market. For instance, in November 2022, Wells Fargo & Company (NYSE: WFC) launched the Flex Loan to meet short-term liquidity demands. Flex Loan is a small-dollar, digital-only loan offering qualified consumers easy access to money at a reasonable price just when they need it and the flexibility to manage their daily finances.

The advantages, such as its assurance of approval for qualified clients, the ease with which cash can be obtained in a matter of minutes, and the transparency with which costs associated with expenses such as holiday gifts, vacation, and car expenses are likely to be beneficial for consumers, Eligible clients can apply for a Flex Loan in the amounts of USD 250 or USD 500 for a one-time cost of USD 12 or USD 20, respectively. The offer will be visible to qualified clients in their mobile app. The money is transferred into a customer's Wells Fargo account instantaneously when they accept the loan and arrange for repayment. This enables them to utilise their Wells Fargo debit card for instant purchases or payments.

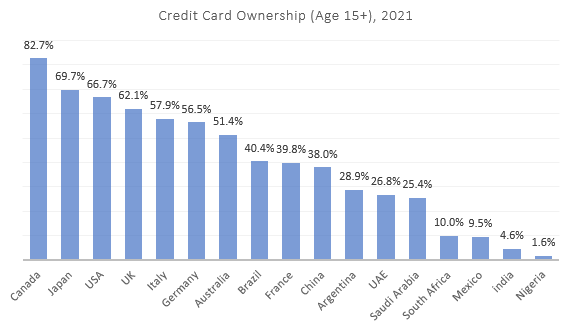

Table: Country wise Representation of Credit Card Ownership (age 15+) w.r.t. % of Population, 2021

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Analysis by Type, Age, Marital Status, Employment Status, and Region:

- The market, on the basis of type, can be divided into P2P marketplace lending and balance sheet lending.

- On the basis of age, the market can be divided into less than 30 years, 30-50 years, and more than 50 years.

- Based on marital status, the market can be divided into married and single.

- The different employment status for personal loan include salaried and business.

- The major regional markets for personal loan include North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

Key Findings of the Report:

- Personal loans can be used to pay off various credit card bills with a single, more affordable monthly payment as they usually offer lower interest rates than credit cards.

- Consumers in developing countries like China, India, Indonesia, and others require personal loans to improve their standard of living and sometimes for emergency purposes.

- The incorporation of digital technologies such as IoT, artificial intelligence (AI) and machine learning (ML) is simplifying the process of authorising personal loans. The improved accessibility of loans expands the personal loan market size.

- With the evolving needs of consumers, easy eligibility and affordable interest rates further create opportunities for the market for personal loan.

Key Offerings of the Report:

- The EMR report gives an overview of the global personal loan market for the periods (2019-2025) and (2026-2035).

- The report also offers the historical (2019-2025) and forecast (2026-2035) markets for the types, ages, marital status, employment status, and major regions of personal loan.

- The report analyses the market dynamics, covering the key demand and price indicators in the market, along with an assessment of the SWOT and Porter’s Five Forces models.

Top Players:

The major players in the global personal loan market are:

- American Express Company

- Avant, LLC.

- DBS Bank Limited

- The Goldman Sachs Group, Inc.

- LendingClub Bank, N.A.

- Prosper Funding LLC.

- SoFi Lending Corp.

- Truist Financial Corporation

- Wells Fargo & Company

- Industrial and Commercial Bank of China Limited

- Others

The comprehensive report by EMR looks into the market share, capacity, and latest developments like mergers and acquisitions, plant turnarounds, and capacity expansions of the major players.

About Us

Expert Market Research (EMR) is a leading market research and business intelligence company, ensuring its clients remain at the vanguard of their industries by providing them with exhaustive and actionable market data through its syndicated and custom market reports, covering over 15 major industry domains. The company's expansive and ever-growing database of reports, which are constantly updated, includes reports from industry verticals like chemicals and materials, food and beverages, energy and mining, technology and media, consumer goods, pharmaceuticals, agriculture, and packaging.

EMR leverages its state-of-the-art technological and analytical tools, along with the expertise of its highly skilled team of over a 100 analysts and more than 3000 consultants, to help its clients, ranging from Fortune 1000 companies to small and medium sized enterprises, easily grasp the expansive industry data and help them in formulating market and business strategies, which ensure that they remain ahead of the curve.

Contact Us

Expert Market Research

Website: www.expertmarketresearch.com

Email: [email protected]

US & Canada Phone no: +1-415-325-5166

UK Phone no: +44-702-402-5790

Report Summary

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Age |

|

| Breakup by Marital Status |

|

| Breakup by Employment Status |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

How To Order

Our step-by-step guide will help you select, purchase, and access your reports swiftly, ensuring you get the information that drives your decisions, right when you need it.

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Single User License

USD 3,999

USD 3,599

tax inclusive*

- All Segments

- Printing Restrictions

- PDF Delivered via Email

- Custom Report Layout

- Post Sales Analysts Support

- Periodic Updates

- Unlimited Prints

Datasheet

USD 2,499

USD 2,249

tax inclusive*

- Selected Segments

- Printing Restrictions

- Excel Spreadsheet Delivered via Email

- Full Report

- Periodic Updates

- Post Sales Analysts Support

- Unlimited Prints

Five User License

USD 4,999

USD 4,249

tax inclusive*

- All Segments

- Five Prints Available

- PDF Delivered via Email

- Limited Free Customization

- Post Sales Analyst Support

- Custom Report Layout

- Periodic Updates

- Unlimited Prints

Corporate License

USD 5,999

USD 5,099

tax inclusive*

- All Segments

- Unlimited Prints Available

- PDF & Excel Delivery via Email

- Limited Free Customization

- Post Sales Analysts Support

- Discount On Next Update

- Custom Report Layout

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

- Life Time Access

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours

- Complimentary Free 1 Month Subscription to Trade Data Base

- Complimentary One Month Subscription to Price Database (Chemicals only)

- Complimentary PPT Version of the Report

- Complimentary License Upgrade

- Complimentary Power BI Dashboards

- Life Time Access

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 50 Hours

- Complimentary Free 1 Month Subscription to Trade Data Base

- Complimentary One Month Subscription to Price Database (Chemicals only)

- Complimentary PPT Version of the Report

- Complimentary License Upgrade

- Complimentary Power BI Dashboards

- Life Time Access

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 80 Hours

- Complimentary Free 1 Month Subscription to Trade Data Base

- Complimentary One Month Subscription to Price Database (Chemicals only)

- Complimentary PPT Version of the Report

- Complimentary License Upgrade

- Complimentary Power BI Dashboards

- Life Time Access

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 100 Hours

- Complimentary Free 1 Month Subscription to Trade Data Base

- Complimentary One Month Subscription to Price Database (Chemicals only)

- Complimentary PPT Version of the Report

- Complimentary License Upgrade

- Complimentary Power BI Dashboards

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

- 3 Reports Included

- Life Time Acess

- Analyst Support Related to Report

- PDF Version of the Report

- Free 1 Month Subscription to Trade Data Base

- 1 Month Subscription to Price Database (Chemicals only)

- Complimentary Excel Data Set

- PPT Version of the Report

- Power BI Dashboards

- License Upgrade

- Free Analyst Hours

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

- 5 Reports Included

- Life Time Acess

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 50 Hours

- Free 1 Month Subscription to Trade Data Base

- 1 Month Subscription to Price Database (Chemicals only)

- Complimentary Excel Data Set

- PPT Version of the Report

- Power BI Dashboards

- License Upgrade

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

- 8 Reports Included

- Life Time Acess

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 50 Hours

- Free 1 Month Subscription to Trade Data Base

- 1 Month Subscription to Price Database (Chemicals only)

- License Upgrade

- Free Analyst Hours - 80 Hours

- Power BI Dashboards

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

- 10 Reports Included

- Life Time Acess

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 50 Hours

- Free 1 Month Subscription to Trade Data Base

- 1 Month Subscription to Price Database (Chemicals only)

- License Upgrade

- Power BI Dashboards

- Free Analyst Hours - 100 Hours