Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Base Year

Historical Period

Forecast Period

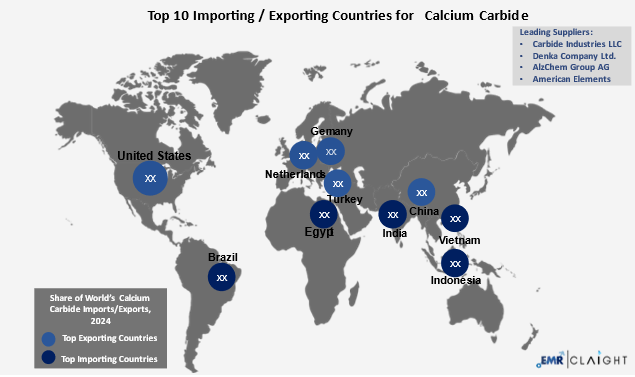

The EMR pricing report on Calcium Carbide provides insights into the top 10 leading trading countries and regions.

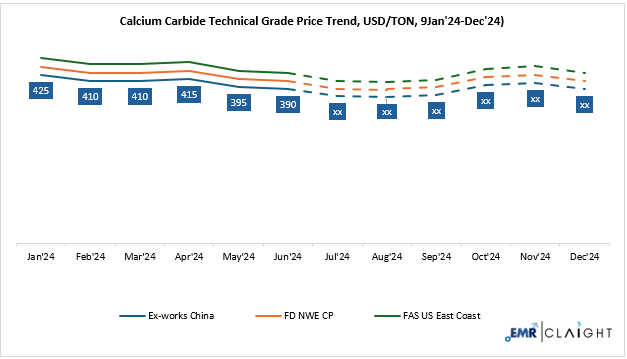

Calcium carbide price trends in the final quarter of 2024 and early 2025 reflected varied regional trends due to shifting demand and supply dynamics. In Q4, prices declined in many regions, driven by weak demand and increased competition from low-cost Asian suppliers. During early 2025, Asia continued to experience downward pressure due to oversupply and subdued activity in downstream sectors like PVC and acetylene. North America followed a different trajectory, with prices initially rising due to higher feedstock costs, dipping with weather-affected construction demand, and then rebounding as conditions improved. Europe and the Middle East faced ongoing softness, influenced by fluctuating demand and cost-related challenges.

| Calcium Carbide Technical Grade Trade Price (USD/TON) YoY Change, Ex-works China | ||||

| Month | 2023 Price | 2024 Price | YoY Change | Expert Market Research Price Prediction for 2025 |

| October | 405 USD/TON | 400 USD/TON | - 1% | Prices stabilised in early 2025 after late 2024 volatility, but Asia and Europe remain weak on oversupply. |

| November | 400 USD/TON | 405 USD/TON | + 1% | |

| December | 415 USD/TON | 390 USD/TON | - 6% | |

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

Overall, while late 2024 was marked by price volatility and weak consumption, early 2025 brought a modest recovery in some markets. Going forward, the calcium carbide price trends outlook remains broadly stable, with minor fluctuations expected based on agricultural demand cycles, inventory movements, and evolving supply-side conditions.

During the year 2024, calcium carbide price trends in Asia, particularly China and India, surged due to heightened demand from downstream sectors like PVC and acetylene manufacturing, compounded by tightening feedstock coke supplies. The U.S. market mirrored this trend by July, supported by increased exports, robust demand, and higher coke prices. However, by October, pricing momentum slowed as construction activity dipped, monsoon-related disruptions affected Indian supply chains, and global logistics challenges persisted. While November showed some stability due to balanced raw material costs, overall demand remained weak, leading to a significant price decline by December amid high inventories and reduced PVC output. Adding to this downward pressure, the Food Safety and Standards Authority of India (FSSAI) reaffirmed its ban on the use of calcium carbide for fruit ripening, particularly in mangoes, citing severe health risks from toxic acetylene gas emissions. With stricter enforcement by Indian authorities and increased awareness about the health hazards of carbide-ripened fruits, industrial usage could face regulatory headwinds in 2025. As a result, calcium carbide price trends are likely to remain under pressure in early 2025, weighed down by muted downstream demand, ample supply, and growing regulatory constraints in key consuming markets like India.

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

| Leading Exporting Countries | Leading Importing Countries | Major Suppliers |

| China | India | Carbide Industries LLC |

| United States | Indonesia | Denka Company Limited |

| Netherlands | Vietnam | AlzChem Group AG |

| Turkey | Brazil | Inner Mongolia Baiyanhu Chemical Co., Ltd |

| Germany | Egypt | MCB Industries Sdn. Bhd. |

| India | Thailand | Ovivo India Pvt. Ltd. |

| Spain | Turkey | American Elements |

| Singapore | Bangladesh | Panchanan International |

In 2024, global trade and supply chains for calcium carbide faced disruptions due to export restrictions, high energy costs, and logistics challenges. China, the leading producer, limited exports amid environmental checks and strong domestic demand, impacting supply to regions like India, Southeast Asia, and Latin America. Europe saw rising import costs and reduced local output, with countries like Germany increasing reliance on Asian and Middle Eastern suppliers, thus affecting the calcium carbide price trends. In North America, port congestion and container shortages led to shipment delays and inventory build-ups, prompting buyers to alternate between domestic and imported sourcing. These factors highlighted the need for more resilient and diversified procurement strategies globally.

In March 2025, calcium carbide price trends in Asia maintained a downward slope due to weak PVC demand, surplus inventory, and cheap feedstock. In China, plant maintenance and sluggish downstream activity further reduced buying interest. In contrast, U.S. prices rose slightly with increased construction and housing activity, despite labour shortages and import tariffs. Europe also saw modest price gains driven by high energy costs; even as industrial demand stayed weak.

Calcium carbide production costs were largely influenced by fluctuations in key feedstocks, coke, electricity, and, to a lesser extent, limestone. Coke prices rose mid-2024, particularly in China, due to coal mining restrictions and environmental inspections, but eased toward year-end as coal output stabilised and downstream demand weakened. This downward trend continued into early 2025, especially in Asia, contributing to softer calcium carbide price trends. Electricity, another major cost component, remained elevated in Europe due to volatile gas prices and carbon costs, limiting production margins and affecting export competitiveness. In contrast, electricity prices in China and Southeast Asia were more stable, helping improve producer profitability in those regions. Limestone availability stayed consistent throughout the period, although rising transportation and fuel costs added minor inflationary pressure. Overall, while late 2024 saw elevated production costs, early to mid-2025 benefited from easing coke and power costs, especially in Asia, leading to reduced input costs and downward pricing pressure in an already oversupplied market.

Consumption of calcium carbide remained steady in its core applications: acetylene production, PVC manufacturing, steel desulfurization, and welding. In Asia, specifically China and India, the 2024 demand slowed due to sluggish construction and a saturated downstream PVC market. Southeast Asia saw only moderate demand levels, particularly during the monsoon and holiday seasons. In contrast, North America experienced more robust activity, buoyed by infrastructure and industrial projects, while European demand weakened under pressure from high energy prices and reduced industrial output, thus pushing the calcium carbide price trends higher.

On the supply side, global capacity was ample in 2024, with oversupply in Asia contributing to downward price pressure. This imbalance played a significant role in shaping calcium carbide price trends, particularly in China, where excessive stock and subdued demand led to sustained price weakness. Periodic production curbs in China due to environmental inspections and export restrictions led to temporary tightness. Meanwhile, several European producers scaled back or halted output in response to steep energy and feedstock costs, further influencing regional calcium carbide price trends. As of early 2025, Asia’s market remained oversupplied, while North America and Europe saw slight inventory tightening due to cautious restocking and subdued downstream demand. Looking ahead, demand is expected to gradually recover in H2 2025, contingent on improved construction and acetylene sector activity. However, prevailing oversupply in Asia may continue to exert downward price pressure unless there are deliberate production cutbacks or a meaningful rebound in global demand.

| Report Features | Coverage - Detail Report Annual Subscription |

| Product Name | Calcium Carbide |

| Report Coverage | Price Forecasting and Historical Analysis: Monthly historical prices (2021-2024), short- and long-term price forecasts (2025-2026), scenario forecasts (most probable, optimistic, pessimistic) |

| Regional and Grade-wise Market Breakdown: The top 10 countries in terms of production, consumption, export, and import, regional insights (USA, North West Europe, China, India, South East Asia, Brazil, Mexico, South Africa, Nigeria, GCC, Japan, South Korea, etc.). | |

| Grade Wise Price Trends with Incoterms: Variation in price by product grade and specifications, and Incoterms. | |

| Price Drivers and Cost Structure: Feedstock correlations, production costs, market competition, government policies, economic factors | |

| Supply and Demand Analysis: Regional supply-demand analysis (North America, Europe, Asia Pacific, etc.), company-level and grade-level supply-demand, plant shutdown, expansion, force majeure, details | |

| Trade Balance Analysis: Historical deficit and surplus countries, net importers and exporters, Product movement, Supply Chain, Freight, Duties and Taxes | |

| Production Cost Breakdown: Direct and indirect cost breakdowns: raw material, labour, processing, packaging, overhead, R&D, taxes | |

| Profitability Assessment: Profit margin evaluations | |

| Industry News and Macroeconomic Context: Geopolitical events, policy updates, GDP, inflation, exchange rates, and their impact on coal prices | |

| Data Overview: Macroeconomic Impact, Supply-Demand, Government/Industry Inputs, Custom Insights | |

| Currency | USD (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customised based on the requirements of the customer |

| Post-Sale Analyst Support | Till the end of the subscription |

| Data Access | Lifetime Access, Visualisation |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Gain a competitive edge with EMR's comprehensive price forecasting reports. Dive deep into the latest market dynamics and price outlook for your specific materials, ensuring you stay ahead of the curve with actionable insights and strategic foresight.

Our reports cover a wide range of commodities, including chemicals (including speciality chemicals), metals, agricultural ingredients, and energy. Each report focuses on a specific commodity to provide detailed insights.

Our reports are updated monthly to provide the most current data and insights. Users can also subscribe to quarterly or semi-annual updates based on their needs.

We source our data through primary interviews with our supplier and trader network, government websites, industry bodies, and world trade data, ensuring accuracy and reliability.

Yes, we offer custom reports tailored to your specific needs. Please contact our support team for more information.

Our reports provide critical insights that help you anticipate market trends, optimize procurement strategies, and make informed investment decisions. This leads to better negotiation and timing in purchases, thereby reducing the impact of price volatility.

Clients can receive analyst support to answer specific questions related to the reports. Additionally, we offer services like risk management, category intelligence, should-cost models, and trade data analytics as part of our extended suite of offerings.

Basic Report -

One Time

Basic Report -

Annual Subscription

Detailed Report -

One Time

Detailed Report -

Annual Subscription

Basic Report -

One Time

USD 799

tax inclusive*

Basic Report -

Annual Subscription

USD 3,499

tax inclusive*

Detailed Report -

One Time

USD 4,299

tax inclusive*

Detailed Report -

Annual Subscription

USD 7,999

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City,1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

United States

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

United States (Head Office)

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City, 1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

Share