Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Base Year

Historical Period

Forecast Period

The Expert Market Research pricing report on Tin Plate provides insights into the top 10 leading trading countries and regions.

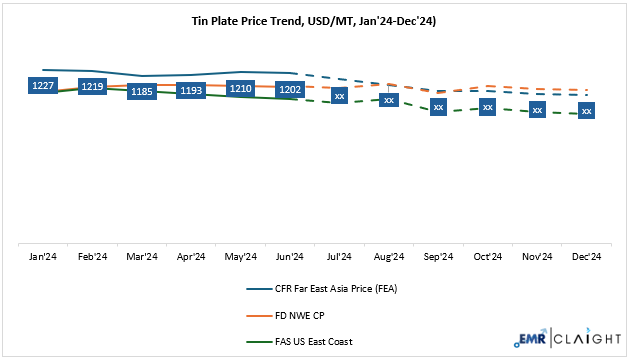

Tin plate prices have seen various fluctuations throughout 2024. The price of tin plates is impacted by factors such as the raw materials market, energy costs, changes in demand and supply, and regulatory and government policies. With China responsible for the highest global tin production, fluctuations in the availability and cost of raw materials like tin and steel also influence the market price. In Q1 2025, tinplate prices trended upward due to rising tin costs and global supply constraints. Disruptions in key producing countries and increased imports by China tightened inventories. However, weak demand from sectors like electronics has limited sharper price hikes, with a potential easing expected in the next quarter.

| Tin Plate (Thickness -0.17) Price (USD/MT) YoY Change, CFR Far Global | ||||

| Month | 2023 Price | 2024 Price | YoY Change | Expert Market Research Price Prediction for 2025 |

| October | 1378 USD/MT | 1076 USD/MT | - 22% | Prices rose in Q1 2025 due to supply constraints and higher tin costs, though weak demand capped the increase. |

| November | 1268 USD/MT | 1059 USD/MT | - 17% | |

| December | 1244 USD/MT | 1051 USD/MT | - 16% | |

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

Globally, the prices of tin have shown a consistent downward trend, with a notable 10% decrease observed in the last quarter of 2024. Tin prices may fluctuate due to limited production sources and changing demand in the electronics and packaging industries. In addition, the weight and thickness of the tin coating also have a great impact on the price.

The graph illustrates the hydroquinone price trends from October 2024 to June 2025 across various countries, including China, India, the USA, the UAE, and Australia. The price lines show notable fluctuations, with prices slightly decreasing & increasing compared with different countries.

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

The tinplate manufacturing process is energy-intensive and requires a large amount of electricity and fuel. For example, tinplate is subjected to batch annealing or continuous annealing as needed, depending on the annealing method. Changes in the cost of energy, such as oil, natural gas, and electricity, directly affect production costs. For example, rising energy prices may lead to higher production costs and thus higher tinplate prices.

The demand for tinplate is closely related to the packaging industry, especially the food packaging and beverage packaging industries. Economic conditions in major markets such as the United States, Europe, and Asia affect tinplate demand. For example, increased demand for packaged foods during periods of economic growth may drive up tinplate prices.

| Leading Exporting Countries | Leading Importing Countries | Major Suppliers |

| China | United States | Baosteel (China) |

| Thailand | Turkey | Nippon Steel (Japan) |

| Taiwan | Italy | POSCO (South Korea) |

| Japan | Indonesia | Tata Steel (India) |

| Netherlands | South Korea | JSW Steel (India) |

| Belgium | Bangladesh | US Steel (USA) |

| Brazil | Poland | JFE Steel (Japan) |

| United Kingdom | Switzerland | ArcelorMittal (Luxembourg) |

Events such as natural disasters, political instability, or logistical challenges can severely disrupt global supply chains, impacting both the availability and cost of raw materials and finished goods. In the context of the tinplate market, such disruptions can cause production delays, increased transportation costs, and reduced inventory levels, ultimately leading to price volatility. A recent and notable example of policy-driven disruption is the European Commission's decision to impose provisional anti-dumping duties of up to 62.6% on tinplate imports from China.

This move is intended to protect domestic producers from what is perceived as unfair pricing by Chinese exporters. However, since China is a major supplier of tinplate to Europe, these duties are expected to significantly raise import costs. As a result, the European market is likely to experience a notable increase in tinplate prices. In addition to raising costs for manufacturers who rely on imported tinplate, this policy may lead to supply shortages or the need to source from more expensive or less competitive alternatives, further straining downstream industries such as food packaging, automotive components, and electronics manufacturing.

In 2024, tin prices experienced a spike, driven by regional supply-demand dynamics and feedstock cost variations. The World Bank Commodity Outlook reported that Myanmar introduced a 30% in-kind tax in February on all grades of tin concentrate exports, following the closure of several mines last year for conservation and pollution-reduction purposes. This move is expected to tighten the global supply of tin, as Myanmar is a significant exporter of tin concentrate. The reduction in available supply, combined with the increased tax, is likely to drive up tin prices. As tin becomes scarcer in the market, manufacturers and buyers may face higher costs, which will lead to an overall increase in tin prices globally.

The demand for tinplate is expected to grow due to its critical applications in several industries, including electronics, automotive, and packaging. Tin is widely used in the electronics industry for soldering components on circuit boards, ensuring the functionality and reliability of electronic devices. The strong demand forecast for tin plate highlights its importance in the automotive sector, where tin is crucial for producing components like connectors and bearings. Furthermore, tin is a vital material in the packaging industry, particularly in food packaging, as it helps prevent corrosion and provides a protective coating. With economic growth driving increased production and packaging of processed foods, the demand for tinplate is anticipated to rise. This surge in demand, combined with European antidumping duties on Chinese imports, could lead to higher tinplate prices, further impacting the market. Econometric market analysis also suggests that continued volatility in upstream raw materials and policy variables will remain key influencers of tin plate pricing through 2025.

| Report Features | Coverage - Detail Report Annual Subscription |

| Product Name | Tin Plates |

| Report Coverage | Price Forecasting and Historical Analysis: Monthly historical prices (2021-2024), short- and long-term price forecasts (2025-2026), scenario forecasts (most probable, optimistic, pessimistic) |

| Regional and Grade-wise Market Breakdown: The top 10 countries in terms of production, consumption, export, and import, regional insights (USA, North West Europe, China, India, South East Asia, Brazil, Mexico, South Africa, Nigeria, GCC, Japan, South Korea, etc.). | |

| Grade Wise Price Trends with Incoterms: Variation in price by product grade and specifications, and Incoterms. | |

| Price Drivers and Cost Structure: Feedstock correlations, production costs, market competition, government policies, economic factors | |

| Supply and Demand Analysis: Regional supply-demand analysis (North America, Europe, Asia Pacific, etc.), company-level and grade-level supply-demand, plant shutdown, expansion, force majeure, details | |

| Trade Balance Analysis: Historical deficit and surplus countries, net importers and exporters, Product movement, Supply Chain, Freight, Duties and Taxes | |

| Production Cost Breakdown: Direct and indirect cost breakdowns: raw material, labour, processing, packaging, overhead, R&D, taxes | |

| Profitability Assessment: Profit margin evaluations | |

| Industry News and Macroeconomic Context: Geopolitical events, policy updates, GDP, inflation, exchange rates, and their impact on coal prices | |

| Data Overview: Macroeconomic Impact, Supply-Demand, Government/Industry Inputs, Custom Insights | |

| Currency | USD (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customised based on the requirements of the customer |

| Post-Sale Analyst Support | Till the end of the subscription |

| Data Access | Lifetime Access, Visualisation |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Gain a competitive edge with Expert Market Research's comprehensive price forecasting reports. Dive deep into the latest market dynamics and price outlook for your specific materials, ensuring you stay ahead of the curve with actionable insights and strategic foresight.

Our market research reports cover a wide range of commodities, including chemicals (including speciality chemicals), metals, agricultural ingredients, and energy. Each report focuses on a specific commodity to provide detailed insights.

Our reports are updated monthly to provide the most current data and insights. Users can also subscribe to the next quarter market outlook or semi-annual updates based on their needs.

We source our data through primary interviews with our supplier and trader network, government websites, industry bodies, and world trade data, ensuring accuracy and reliability.

Yes, we offer custom reports tailored to your specific needs. Please contact our support team for more information.

Our reports provide critical insights that help you anticipate market trends, optimise procurement strategies, and make informed investment decisions. This leads to better negotiation and timing in purchases, thereby reducing the impact of price volatility.

Clients can receive analyst support to answer specific questions related to the reports. Additionally, we offer services like risk management, category intelligence, should-cost models, and trade data analytics as part of our extended suite of offerings.

Basic Report -

One Time

Basic Report -

Annual Subscription

Detailed Report -

One Time

Detailed Report -

Annual Subscription

Basic Report -

One Time

USD 799

tax inclusive*

Basic Report -

Annual Subscription

USD 3,499

tax inclusive*

Detailed Report -

One Time

USD 4,299

tax inclusive*

Detailed Report -

Annual Subscription

USD 7,999

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City,1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

United States

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

United States (Head Office)

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City, 1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

Share