Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global acrylic acid market size attained a volume of approximately 8.87 MMT in 2025. The market is further expected to grow in the forecast period of 2026-2035 at a CAGR of 5.10%, reaching a volume of around 14.59 MMT by 2035.

The market is growing as the demand of acrylic acid rises from different sectors wherein the acid is a crucial raw material for super absorbent polymers (SAPs) that are used primarily in personal care products such as diapers, sanitary napkins, and incontinence products. The usage of paints, coatings, adhesives and sealants also contributes to the market growth, especially in construction and infrastructure.

The strength of the market is also complemented by the wide usage of acrylic acid in personal hygiene products. As SAPs gain traction in the marketplace, the acrylic acid industry is expected to undergo dynamic growth, fueled by continuous innovations in material formulations and a wider range of commercial applications.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5.1%

Value in MMT

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

| Global Acrylic Acid Market Report Summary | Description | Value |

| Base Year | MMT | 2025 |

| Historical Period | MMT | 2019-2025 |

| Forecast Period | MMT | 2026-2035 |

| Market Size 2025 | MMT | 8.87 |

| Market Size 2035 | MMT | 14.59 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 5.10% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 5.6% |

| CAGR 2026-2035 - Market by Country | India | 6.4% |

| CAGR 2026-2035 - Market by Country | China | 5.6% |

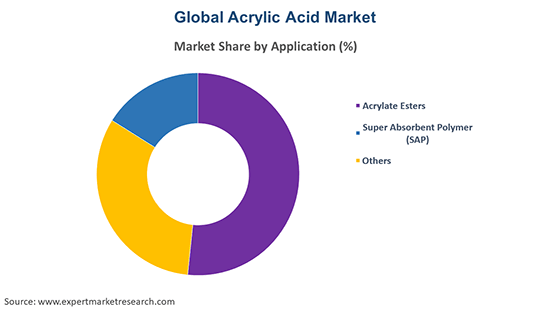

| CAGR 2026-2035 - Market by Application | Super Absorbent Polymer (SAP) | 5.7% |

| CAGR 2026-2035 - Market by Application | Acrylate Esters | 5.4% |

| Market Share by Country 2025 | UK | 3.5% |

Acrylic acid is a colorless organic compound with distinctive acrylics that have a high degree of polymerization. The acid is increasingly being used in paints and coatings to ensure a long-lasting, high-performance finish in construction, which in turn, is driving the market. Moreover, it is extensively utilized in the manufacturing of acrylate esters which plays a vital role in adhesives and sealants. Acrylic acid is used by the textile industry as well, for fabric treatments and finishes, making it another key ingredient of this product. High-quality personal care products are thriving, contributing to the overall growth of the acrylic acid market. The acid is also a key ingredient for specialized applications in packaging, automotive, and consumer goods industries.

Acrylic acid is a compound which is used in the production of super absorbent polymers, that is extensively used in the manufacturing of diapers and incontinence products. Market innovations include acrylic acid-based manufacturing processes, primarily for personal care products. Industrialization and urbanization, particularly in emerging economies, are boosting acrylic acid demand in different industries. For example, more than 90% of polyacrylic acid is used in SAP. The potential for market growth increases significantly as these regions develop. In addition, new acrylic acid production technologies keep improving efficiency, thereby favoring the expansion of the market, as well as opening new avenues in consumer goods and industrial markets.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The acrylic acid market is growing at a noteworthy pace because of the acid’s wide usage across several industries, particularly from the Super Absorbent Polymers (SAP) application. Acrylic acid’s high absorption capability makes them widely used in SAP products like diapers, sanitary napkins, and incontinence products. The consumption of personal hygiene products, particularly in the developing economies, continues to boost the sales for SAPs which in turn drive the growth of acrylic acid market.

Acrylic acid has comparable applications for the acrylate esters, which are polymerized as key constituents of paints, coatings, adhesives and sealants. Depending on the molecular weight of the acrylic acid, acrylate esters provide better performance, which comprises strength and elasticity, which are predominantly utilized in different sectors. Additionally, glacial acrylic acid (pure acrylic acid) is extensively utilized to produce water treatment chemicals, detergents, and more applications for industrial use.

Acrylic acid is used in a wide variety of end-use industries, with surfactants and surface coatings being the most significant among the different end-use segments of the global acrylic acid market. It is utilized in manufacturing surfactants with a high-performance level for cleaning products and surface coatings with great wetting and durability characteristics. It contributes significantly to organic chemicals production as it is used in creating a whole range of high-value chemicals used in various manufacturing processes. This versatility adds demand in various industries which is consequently boosting the market growth cyclically.

Acrylic acid is also crucial in the production of adhesives and sealants that improve the strength of bonds, flexibility, and protection against various environmental factors. In the textile sector, it also strikes a balance with water-repellent finishes, which maximize durability and wearability of fabrics. Acrylic acid derivatives are used in the water treatment industry to remove impurities and enhance the purity of water. Acrylic acid also plays a significant role in personal care products, being a crucial ingredient in the production of superabsorbent polymers used in diapers, sanitary napkins, and other hygiene products, providing enhanced absorbency and comfort. These applications reflect the wide use and growing market demand of acrylic acid.

North America Acrylic Acid Market Trends

The North America acrylic acid market is boosted by the increased demand for superabsorbent polymers (SAPs) that are gaining popularity in the personal care industry. Acrylic acid derivatives such as adhesives, coatings, and sealants in construction and automotive end-use industries are also indirect drivers for this market. In addition, the region is also focusing strongly on the technological advancements in the production processes, which are helping the efficiency in the production of grades of acrylic acid.

Europe Acrylic Acid Market Trends

The market for acrylic acid in Europe is significant, boosted by the region's well-established industrial base and robust demand for acrylic acid-based products in paints and coatings, and adhesives. Since the focus of the European Union is on environmental regulations, the industry has changed toward “greener” and bio-based acrylic acid processes. The automotive and construction industries are the key drivers as acrylic acid derivatives are used in total applications such as sealants and protective coatings.

Asia Pacific Acrylic Acid Market Trends

Asia Pacific is the largest and fastest growing region as per the acrylic acid market analysis. The market growth can be attributed to rapid industrialization and the burgeoning population in emerging economies such as China and India. For example, in 2023, India imported 23,048 tones of acrylic acid from Saudi Arabia. One of the prominent drivers for the growth of this market across the region is the SAP in diapers and personal care products. Acrylic acid is consumed in coatings, adhesives, and sealants; hence the growth of the construction and automotive industries directly impacts the regional market. Furthermore, the movement toward sustainable production practices and further investments in innovations are likely to contribute to the growth the market in Asia Pacific.

Latin America Acrylic Acid Market Trends

The Latin America acrylic acid market is expected to grow moderately over the next few years, driven primarily by urbanization and industrialization. So, the growing living standards and consumer base is causing the growth of personal care products such as superabsorbent diapers market. Acrylic acid is used in the construction industry for adhesives, coatings, and sealants in infrastructure projects, which makes that another primary driver.

Middle East and Africa Acrylic Acid Market Trends

The growth of the construction and automotive industries has a significant impact on the MEA acrylic acid market. Extensive application of acrylic acid derivatives in adhesives, coatings, and sealants have been the primary components of infrastructure development and automobile industry in the region. Furthermore, the growing population is anticipated to fuel the demand for personal care products, which in turn is likely to drive the market growth. Besides, the country's infrastructure development and water treatment market not only contribute to water treatment but also promote sustainable production in the region.

| CAGR 2026-2035 - Market by | Country |

| India | 6.4% |

| China | 5.6% |

| UK | 4.7% |

| USA | 4.5% |

| Italy | 3.6% |

| Canada | XX% |

| Germany | XX% |

| France | XX% |

| Japan | 3.5% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Key market participants in the acrylic acid sector are focused on enhancing production capacities, sustainability, and adopting advanced technologies to cater to rising demand. These are developed through advanced production processes and implemented to improve efficiency by opening up new avenues in diverse applications in personal care, construction, textiles and coatings.

Sustainable production methods and innovation are the major aspects of BASF SE, the largest producer of acrylic acid, to concentrate on. The high-quality acrylic acid it produces has a range of applications from adhesives to personal care products, and the company is helping industries around the world through its ground-breaking technologies.

Nippon Shokubai Co. Ltd. has a portfolio of a broad range products from superabsorbent polymers to acrylates. The company has a core focus on environmental sustainability and works across diverse sectors like hygiene products, water treatment, and automotive coatings, among many others.

Acrylic acid is offered by the Dow Chemical Company for high-performance paints, adhesives and other personal care manufacturing. Dow focuses on innovation in manufacturing processes, enhancing efficiency, and addressing the growing worldwide demand for high-performance acrylic acid-based products.

Specializing in acrylic acid and its derivatives, Arkema Group serves customers in the coatings, adhesives, and construction sectors. Its eco-friendly product portfolio adds to the growth of the acrylic acid market, as the company is focused on sustaining practices and leaning forward in technology.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

The study on the acrylic acid market delivers detailed analysis on region-level perspective depending on specific contemporary industry trends. It considers various segments, such as application and end use. By assessing all these segments, this report presents a thorough discussion of market drivers, regulations, and emerging opportunities observed in the market.

Application Outlook (Revenue, MMT, 2026-2035)

End Use Outlook (Revenue, MMT, 2026-2035)

Region Outlook (Revenue, MMT, 2026-2035)

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global market for acrylic acid market attained a volume of approximately 8.87 MMT.

The market is projected to grow at a CAGR of 5.10% between 2026 and 2035.

The market is estimated to reach a volume of around 14.59 MMT by 2035.

The major drivers of the market include rising disposable incomes, growth of construction, superabsorbent polymers, and automobile industries, and increasing population.

The key acrylic acid market trends include the rising demand for water treatment and detergent co-builders, improvements in production, and increasing usage of diapers.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading applications of acrylic acid in the market are acrylate esters, and super absorbent polymer (SAP), and glacial acrylic acid.

The major players in the market, according to the report, are BASF SE, Nippon Shokubai Co. Ltd., The Dow Chemical Company, Arkema Group, LG Chem. Ltd., Shanghai Huayi Acrylic Acid Co., Ltd, Evonik Industries AG, Mitsubishi Chemical Corporation, SIBUR International GmbH, Satellite Chemical Co.,Ltd., Wanhua Petrochemical (Yantai) Co., Ltd., Toagosei Co., Ltd, China Petroleum & Chemical Corporation, Vigon International, LLC., SMC, Sinopec, Formosa Plastics Corporation, and Sasol, among others.

The major challenge in the acrylic acid market is raw material price volatility and supply chain disruptions.

High production costs, environmental concerns, and raw material supply instability are some of the key challenges that the market faces.

Growing demand for superabsorbent polymers in hygiene and agricultural applications is a key opportunity for companies in the acrylic acid market.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share