Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global aerosol cans market size reached nearly USD 15.34 Billion in 2025. The market is assessed to grow at a CAGR of 3.60% between 2026 and 2035 to reach around USD 21.85 Billion by 2035.

Base Year

Historical Period

Forecast Period

There is a rising demand for aerosol cans amid growing customer preferences for efficiency, convenience, and effectiveness in sectors such as household products, personal care, food and beverage, and automotive, among others. As per the International Organisation of Aluminum Aerosol Container Manufacturers (AEROBAL), in H1 2024, the deliveries of its members rose by 4.4% to over 3.4 billion units. With the increasing adoption of aerosol cans, manufacturers are actively investing in technologies that can improve the appeal and performance of aerosol-based products.

Advancements in nanotechnology enabling the development of aerosol formulations that deliver active ingredients like cosmetic ingredients, medications, and cleaning agents more effectively are shaping the aerosol cans market dynamics. This is also creating opportunities for product innovations, enabling manufacturers to develop new types of aerosol products with unique properties like improved stability, better skin penetration, and more controlled release of active ingredients.

Annually, Australians consume more than 250 million cans of aerosol. With the increasing demand for aerosol cans in different sectors, manufacturers are expanding their production capabilities and distribution networks. For instance, in January 2021, Ball Metalpack announced it plans to launch a new high-speed aerosol can line at its DeForest, Wisconsin, can manufacturing plant to support strong customer growth in categories such as household cleaning products and spray paint, among others.

Compound Annual Growth Rate

3.6%

Value in USD Billion

2026-2035

*this image is indicative*

Rising use of aerosol cans in personal care applications; growing focus on sustainability; increasing trend of personalisation and customisation; and technological advancements and innovations are driving the aerosol cans market expansion.

In the personal care industry, aerosol cans are widely used in products such as dry shampoos, deodorants, and hairsprays as they are portable, convenient, and fast-acting. Aerosol cans also ensure that products like body sprays, deodorants, and hair sprays are applied evenly, hence offering consistent application and minimising waste.

With the growing shift towards sustainability, there is a rising preference for aluminum and steel in aerosol can production as they are highly recyclable. Key players are attempting to use recycled content in their cans to improve their sustainability profile. Moreover, there is an increasing shift from traditional propellants such as hydrocarbons and hydrofluorocarbons (HFCs) to natural or gas-based propellants to cater to the evolving demands of the environmentally conscious consumer base.

The increasing trend of customisation and personalisation is creating lucrative aerosol cans market opportunities. Custom-sized and designed aerosol cans can accommodate different product types and are ideal for several purposes, such as corporate gifting, marketing campaigns, giveaways, or loyalty programmes. Moreover, advancements in 3D printing technologies are encouraging manufacturers to explore on-demand production of aerosol cans, opening up possibilities for mass customisation.

Advancements in material sciences enabling the development of stronger and more lightweight materials for use in aerosol can manufacturing are propelling the market. Furthermore, the integration of advanced technologies such as the Internet of things (IoT) and augmented reality (AR) in aerosol cans to provide product information, special offers, or personalised recommendations to customers is expected to fuel the market in the coming years.

The Expert Market Research’s report titled “Aerosol Cans Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Material Type

Market Breakup by End-Use

Market Breakup by Region

The comprehensive EMR report provides an in-depth assessment of the market based on Porter's five forces model, along with a SWOT analysis. The report gives a detailed analysis of the following key players in the global aerosol cans market, covering their competitive landscape and latest developments like mergers, acquisitions, investments, and expansion plans.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

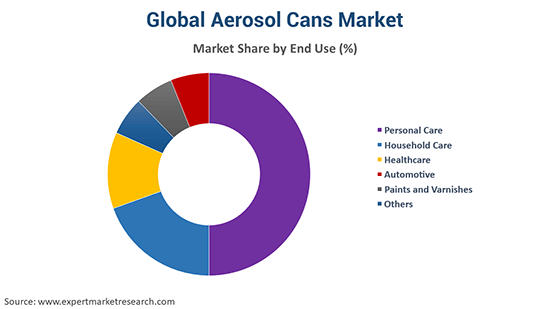

Personal care accounts for a significant market share due to rising disposable incomes, increasing hygiene consciousness, and evolving customer lifestyles. The customisable benefits of aerosol cans also make them ideal for use in the packaging of different personal care products, such as deodorants, sprays, dry shampoos, and shower gels, among others.

Key players are offering aerosol cans with decorative effects and innovative sizes and shapes, due to which end-users are preferring them to differentiate their brands and gain a competitive edge. Moreover, aerosol cans are increasingly utilised in food and beverage applications to provide enhanced flexibility and protection, reduce food wastage, and extend the shelf life of packaged products.

According to the aerosol cans market research, Europe represents a considerable share in the market, as the United Kingdom, Italy, France, and Germany are some of the significant producers and exporters of the product. Due to the surging emphasis on decreasing packaging waste, the demand for aerosol cans, due to their high recyclability, is projected to grow. Furthermore, the cost-effectiveness and extended shelf life of the product are likely to propel its appeal for use in diverse applications.

Key aerosol cans market players are focusing on the use of sustainable and recyclable materials, particularly steel and aluminium, to meet evolving customer expectations. They are also attempting to develop lightweight aerosol cans that reduce the use of materials such as metal while contributing to better performance and lower shipping costs.

Trivium Packaging B.V., founded in 2019 and headquartered in the Netherlands, is a company that is engaged in producing and supplying metal packaging for a variety of applications and industries. Its product portfolio includes aerosols, three-piece cans, and threaded bottles, among others.

Ardagh Group, founded in 1932 and headquartered in Luxembourg, is a global supplier of infinitely recyclable and sustainable metal and glass packaging. It operates around 60 metal and glass production facilities in 16 countries while employing nearly 19,000 individuals. The company also holds a 42% interest in Trivium Packaging.

Mauser Packaging Solutions, headquartered in Illinois, United States, and founded in 2018, has established its position as a global leader in solutions and services across the lifecycle of packaging. It offers large and small plastic, metal, hybrid, and fibre packaging worldwide to companies in different sectors, including personal care, food, beverage, petrochemicals, pharmaceuticals, and agrochemicals, among others.

Graham Packaging, founded in 1970 and headquartered in Pennsylvania, United States, is a prominent designer, manufacturer, and seller of value-added, custom, and sustainable food, beverage, automotive, and household containers. Its facilities across Europe, North America, and South America produce over 16 billion container units per year.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the aerosol cans market include CPMC HOLDINGS LIMITED, Colep Packaging Portugal, S.A, SGD Pharma, Toyo Aerosol Industry Co., Ltd, Euro Asia Packaging Co. Ltd, TUBEX Holding GmbH, SWAN Industries (Thailand) Company Limited, DAIWA CAN COMPANY, Bharat Containers Pvt. Ltd., Kian Joo Can Factory Berhad, and DS Containers.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market attained a value of approximately USD 15.34 Billion.

The market is projected to grow at a CAGR of 3.60% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 21.85 Billion by 2035.

The major drivers of the market are rising disposable incomes, increasing population, escalating cleanliness awareness, growing use of products like air fresheners and deodorants, and rising urbanisation.

The availability of lightweight products, recyclability of bottles, and use of recycled materials are the key trends of the market.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Tin plate and aluminium are the leading material types of aerosol cans in the global market.

Personal care, household care, healthcare, automotive, and paints and varnishes, among others, are the significant end-uses of aerosol cans in the market.

The major players in the market are Trivium Packaging B.V., Ardagh Group, Graham Packaging, Mauser Packaging Solutions, CPMC HOLDINGS LIMITED, Colep Packaging Portugal, S.A, SGD Pharma , Toyo Aerosol Industry Co., Ltd, Euro Asia Packaging Co. Ltd., TUBEX Holding GmbH, SWAN Industries (Thailand) Company Limited, DAIWA CAN COMPANY, Bharat Containers Pvt. Ltd., Kian Joo Can Factory Berhad, DS Containers, Others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Material Type |

|

| Breakup by End-Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share