Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global airless tyres market is expected to grow at a CAGR of 5.00% in the forecast period of 2026-2035.

Base Year

Historical Period

Forecast Period

According to the International Organization of Motor Vehicle Manufacturers, China continues to be the global leader with a staggering production total of more than 30 million vehicles, including about 26 million cars and 4 million commercial vehicles, thus making an increase of 12%.

The United States follows with an outturn of over 10.6 million vehicles, driven primarily by a healthy commercial vehicle sector that churned out nearly 8.9 million units to reflect 6% growth.

Next comes Japan, strong with nearly 9 million vehicles, including about 7.8 million cars, achieving a growth of 4%, boosting the airless tyres demand growth.

Compound Annual Growth Rate

5%

2026-2035

*this image is indicative*

| Global Airless Tyres Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | XX |

| Market Size 2035 | USD Billion | XX |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 5.00% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 5.7% |

| CAGR 2026-2035 - Market by Country | India | 6.5% |

| CAGR 2026-2035 - Market by Country | China | 5.4% |

| CAGR 2026-2035 - Market by Type | Radial | 5.6% |

| CAGR 2026-2035 - Market by Sales Channel | OEM | 5.8% |

| Market Share by Country 2025 | Germany | 4.8% |

The commercial vehicles segment is expected to see lucrative profits in the forecast period as a result of the ongoing efforts of industry players to introduce airless/non-pneumatic tyres (NPT) for commercial vehicles. For example, in January 2020, Bridgestone, one of the leading industry players, announced the launch of airless tyres for commercial vehicles. These offer higher durability and less wear and tear compared to regular tyres. Thus, the rising demand for tyres to sustain through tough road conditions in heavy-duty vehicles will support the market growth. In addition, the increasing focus of tyre manufacturers such as Goodyear and Michelin to build tyres for commercial vehicles and catalyse upon its increasing demand is anticipated to further strengthen the growth of airless tyres market.

Focus on sustainability, advancements in material technology, and integration of smart technology are a few factors shaping up the airless tyres market dynamics and trends.

A key trend in the airless tyres market is the greater emphasis is put on the creation of green airless tyres, increasing recyclable content, and reducing the environment's impact. It delivers innovations further pushing the needle on sustainability through a reduction in waste and tyre life elongation that will help in accomplishing wider industry objectives of reducing carbon footprints.

This assembly is highly supported by the fact that there has been a high rise in new and better materials used in the airless tyre, such as advanced composites and improved polymers. These are toward enhancing durability, flexibility, and performance features related to prior weaknesses of the no-air tyres, hence opening other areas of application.

Airless tyres are increasingly being integrated with smart technologies, such as sensors and monitoring systems. Such technologies monitor in real-time performance, wearing, and maintenance needs of the tyres, offering improved safety, efficiency, and comfort to consumers and fleet operators alike, opening up new airless tyres market opportunities.

Growing Number of Benefits of Airless Tyres Over Pneumatic Tyres to Bolster the Growth of the Airless Tyres Industry

Airless tyres provide improved load-bearing capability, driving performance, and good environmental compatibility. Moreover, consumers are using these tyres to eliminate the need for spare tyres, as well as for high productivity in applications involving the manufacturing, farming, construction, and mining sectors. Apart from these benefits, airless tyres also have a low environmental impact. These tyres can reduce carbon emissions due to the elimination of energy loss in tyre resistance. In addition, the use of recyclable materials to produce these tyres and the efficient use of resources will drive the airless tyres industry growth. Also, the increase in the need for maintenance-free tyres, especially in military, utility, terrain, and commercial vehicles will continue to positively affect the market size of airless tyres.

Over the forecast period, the growing attention towards the agricultural sector is expected to be a key driver for the market, owing to the rising demand for agricultural machinery. Further, the growing technological advancements and the increasing R&D activities will also boost the industry growth.

The Growth in Rubber Production and Its Crucial Application in the Automotive Industry Drive the Growth of the Market.

Rubber is viewed as one of the critical raw materials in tyre production. Thailand tops the list of the world's rubber producers, accounting for 4,850,000 metric tons. This reflects a high level of development of the country's rubber industry, which is further enhanced by suitable climatic conditions and extensive areas covered by rubber plantations. Indonesia is the second-largest producer, with a share of 3,550,000 metric tons.

Vietnam comes third with 1,190,000 metric tons, thanks to its ever-expanding rubber plantation areas and investment in rubber processing technologies. India produced 911,000 metric tons, while China's production was 831,000 metric tons. Other huge suppliers of the commodity, these countries have large agricultural sectors and rising industrial demands that act as the driving force behind their capabilities for rubber production. This becomes a significant trend of the airless tyres market.

Malaysia—one of the world's greatest producers of rubber throughout its history—now produces 730,000 metric tons, a continued strong position within world production despite increased competition from other Asian producers. Next on the list come Sri Lanka, Côte d'Ivoire, the Philippines, and Cameroon, which have outputs of 88,000, 77,000, 74,000, and 72,000 metric tons respectively. Such countries have smaller volumes of production but hold important regional positions and contribute to global supply chains.

Airless tyres play an important role in the automotive sector since they provide durability and long life. This growth in the automotive sector is likely to act as a booster for the market. Germany, a major player in the automotive industry, churned out more than 4.1 million vehicles, up 18%. South Korea turned in a total output of nearly 4.2 million units with a growth of 13%, helped by manufacturing nearly 3.9 million cars. The automotive sector performed well and the output came to over 4 million vehicles; within that, more than 3 million commercial vehicles were manufactured representing a growth of 14%. Factors as these are anticipated to boost the demand of airless tyres market.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Global Airless Tyres Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Material

Market Breakup by Sales Channel

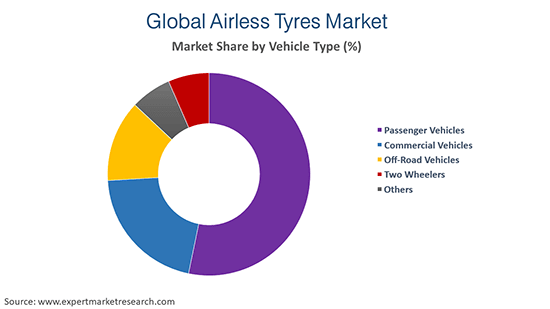

Market Breakup by Vehicle Type

Market Breakup by Region

Radial Tire Segment Is Likely To Gain Traction For Its Excellent Performance Features

As per airless tyres market analysis, the radial tyre segment is expected to gain ground due to excellent performance characteristics over bias tyres. The demand for radial tyres will grow in the forecast period as they have better fuel efficiency and handling with improved durability, finding application in passenger and commercial vehicles. Their construction provides better road contact and a smoother ride, which enhances safety and comfort. Moreover, improvements to radial tyre technology through better raw materials and new manufacturing processes are a constant driver for their uses in a wide range of automotive applications and, hence, commanding a growing market share.

North America to Provide Enhanced Growth Opportunities to the Airless Tyres Industry

The airless tyres industry in North America is expected to drive the market demand in the forecast period owing to the roll-out of these tyres in military operations and operational vehicles across the region. Moreover, industrial players in the region remain focused on providing the product for military and defence purposes. For example, Resilient Technologies and Michelin provide these wheels to the United States military so that they can travel in uneven and difficult terrain.

| CAGR 2026-2035 - Market by | Country |

| India | 6.5% |

| China | 5.4% |

| UK | 4.5% |

| USA | 4.3% |

| Australia | 3.8% |

| Canada | XX% |

| Germany | XX% |

| France | XX% |

| Italy | 3.4% |

| Japan | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

The key players in the airless tyres market emphasise developing durable, maintenance-free, sustainable solutions. Their focus is on improving performance and safety, but also reducing the constraints linked with traditional tyres.

The Goodyear Tire & Rubber Company, founded in 1898 and based in Akron, Ohio, is developing airless tyre technology under its "Urban Terrain" concept. The tyres would be both durable and high-performance without having to worry about air pressure or any other type of maintenance.

Founded in 1931 and based in Tokyo, Japan, Bridgestone Corporation has airless tyre solutions in the "Airless Tire" and "Non-Pneumatic Tire" concepts. Their designs improve safety and reliability without the risk of punctures and reduce maintenance.

Based in Greenville, South Carolina, Michelin North America, Inc. was founded in 1968 and today is known for its "Michelin Uptis." The Unique Puncture-proof Tire System is an airless tyre technology developed to bring a durable improvement in performance without punctures or loss of pressure for many vehicle categories.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the airless tyres market report include Toyo Tire Corporation and Continental AG, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 5.00% between 2026 and 2035.

The major drivers pushing the market include various technological advancements and the need for the same in end use sectors, and the increase in research and development activities.

The key trends driving the growth of the market include the rising demand from agricultural machinery industry and the increasing need for maintenance-free tyres, especially in military, utility, terrain, and commercial vehicles.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Radial and bias are the two dominant types of airless tyres in the market.

The materials in the market include rubber and plastic.

The major sales channels are OEM and aftermarket.

The significant vehicle types in the market are passenger vehicles, commercial vehicles, off-road vehicles and two wheelers, among others.

The key players in the global airless tyres market are The Goodyear Tyre & Rubber Company, Bridgestone Corporation, Michelin North America, Inc., Toyo tyre Corporation, and Continental AG, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Material |

|

| Breakup by Sales Channel |

|

| Breakup by Vehicle Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share