Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global amaranth market size is assessed to grow in the forecast period of 2026-2035 at a CAGR of 11.10%. The market growth is being driven by the thriving food and beverage industry and increasing use of natural ingredients in personal care products.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

11.1%

2026-2035

*this image is indicative*

Amaranth products have a number of health advantages that are beneficial to ageing people. As a result, the amaranth market demand is anticipated to grow over the projected period due to the increasing elderly population as well as the rising popularity of vegan food. In the coming years, the market for amaranth is expected to expand due to rising consumer interest in leading a healthy lifestyle and increasing use of essential oils in the beauty industry.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Organic products are becoming more popular as a result of changing consumer preferences, growing environmental awareness, and increasing knowledge of harmful effects of chemicals. The rising popularity of organic products is anticipated to surge the demand for organic amaranth in the forecast period.

Amaranth grain is a pseudocereal, essentially a seed, rich in protein containing all nine essential amino acids, manganese, magnesium, phosphorus, vitamins A and C, iron, fibre and antioxidants. While amaranth is native to Mesoamerica, it is also cultivated in India, China, and in countries in Southeast Asia, West Africa and the Caribbean. Amaranth has been associated with several health benefits, such as decreased inflammation, lower cholesterol levels, improved weight loss, and enhanced brain function.

Celiac disease, a widely known, serious autoimmune illness, affects genetically predisposed individuals. In people suffering from this ailment, gluten ingestion causes damage to the small intestine. Nearly 1% of all people are affected by Celiac disease across the globe. Amaranth seed, being gluten-free, may be a nutritious alternative for individuals suffering from this kind of food allergy. Amaranth flour is used to make bread, cakes, muffins, pancakes, cookies, dumplings, crepes, noodles, pastas, and crackers. The amaranth market is expected to be driven by health-conscious consumers looking for healthier, nutritious and gluten-free food alternatives. North America, Europe and the Asia Pacific are expected to be key markets for amaranth.

With squalene and omega-3, -6 and -9 fatty acids, amaranth oil is believed to give antioxidant, anti-inflammatory and anti-ageing benefits. Its application to the skin is considered beneficial. Greater demand for amaranth oil is likely to arise from the personal care sector, for the production of natural ingredient based cosmetic products.

The versatility of amaranth, which can be used as a grain as well as vegetable, is augmenting the growth of the amaranth market. Amaranth leaves, freshly picked, are generally consumed in salads or blanched, steamed, boiled, fried, and mixed with meat, fish, cucurbit seeds, groundnut, or palm oil. Cooked amaranth green leaves may be consumed as a side dish or added to soups. Both amaranth seeds and leaves are also used to prepare recipes for babies and toddlers. As a snack, amaranth seed is popular in Mexico; it is at times mixed with puffed rice or chocolate. Such snacks are gaining popularity in regions of North America and Europe.

Amaranth is very adaptable to hostile growing conditions, is drought and heat resistant, not normally infested by disease, and one of the easiest crops to grow in limited areas. It holds substantial potential as a cash crop and can be exported or sold in domestic markets, which is further bolstering the amaranth market.

In southern parts of India, such as Kerala and regions of Tamil Nadu, Andhra Pradesh and Karnataka, amaranth is well-consumed, and people appreciate its nutritional value of the vegetable. In such regions, it may be easier to sell the produce. If sale of produce is locally assured, amaranth farming could offer farmers a decent income.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Amaranth refers to a variety of short-lived species of plants cultivated chiefly as pseudocereals and leafy vegetables. It is a native species of South America's Andean region, which includes Argentina, Peru, and Bolivia. The plant's leaves are widely utilised in countries all over Africa and the Caribbean as well as in India and China. In India, amaranth grains are commonly called Rajgira, Rajagra or Ramdana. In the southern parts of India, amaranth leaves are commonly consumed as leafy green vegetables. These leaves are high in iron and calcium and contain trace minerals.

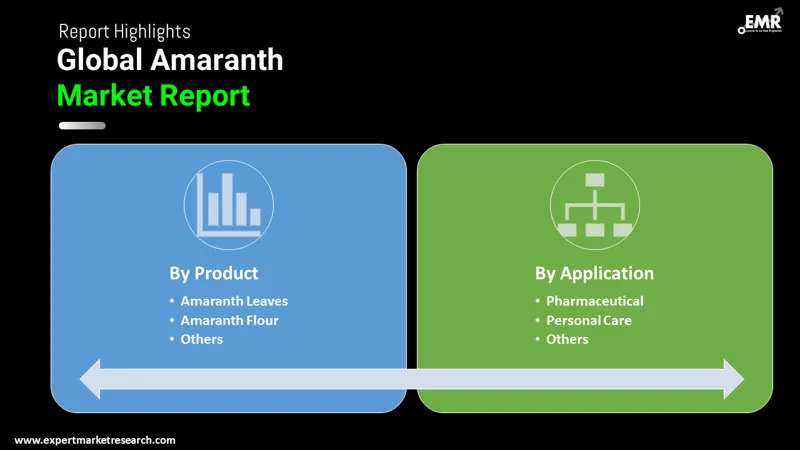

By product, the market is segmented into:

By application, the market is classified into:

By region, the market is categorised into:

The report presents a detailed analysis of the following key players in the market, looking into their capacity, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:

The EMR report gives an in-depth insight into the market by providing a SWOT analysis as well as an analysis of Porter’s Five Forces model.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global amaranth market forecast indicates a promising growth rate at a CAGR of 11.10% between 2026 and 2035.

The major drivers of the market include the growing expansion of the food and beverage industry, increasing demand for healthy food alternatives, rising demand for amaranth in personal care products, and increasing population.

The key global amaranth market trends include increasing shift of small farmers towards amaranth cultivation, improvements in supply chain, and rising demand for organic products.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The various products of amaranth in the market are amaranth seeds, amaranth oil, amaranth leaves, and amaranth flour.

the different applications of amaranth are food and beverage, pharmaceutical, and personal care, among others.

Associated health benefits of consuming amaranth include lower cholesterol, reduced inflammation, and aid in weight loss.

The major players in the market, according to the report, are Flaveko Trade spol. s.r.o., Nature Bio-Foods Ltd, A.G.Industries, Hometown Food Company, Rusoliva, DK MASS sro, FLAVEX Naturextrakte GmbH, Proderna Biotech Pvt Ltd, Kilaru Naturals Private Limited, and Organic Products India, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share