Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global aramid fibre market is expected to grow at a CAGR of 8.50% during the period 2026-2035.

Base Year

Historical Period

Forecast Period

Expansion of the aerospace space sector has a direct influence on the demand of aramid fibres.

Sales over the period from 2016 to 2035 will be valued at approximately USD 6.3 trillion with strong growth and good demand expected across all aircraft categories.

Narrow-body aircraft would hold the greatest share in the value part of deliveries, comprising about USD 2.50 trillion out of this general sum, positively impacting the growth of aramid fibre market.

Compound Annual Growth Rate

8.5%

2026-2035

*this image is indicative*

| Global Aramid Fibre Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | XX |

| Market Size 2035 | USD Million | XX |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 8.50% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 9.8% |

| CAGR 2026-2035 - Market by Country | Germany | 11.0% |

| CAGR 2026-2035 - Market by Country | India | 10.8% |

| CAGR 2026-2035 - Market by Application | Security and Protection | 9.7% |

| CAGR 2026-2035 - Market by Type | Meta-Aramid Fibre | 9.4% |

| Market Share by Country 2025 | USA | XX% |

The global market for aramid fibres is expected to be driven by uses in multiple sectors including defence, automotive, aerospace, personal protection, etc. North America, Europe and Asia are projected to be key markets. “Aramid” stands for “aromatic polyamide”. Aromatic polyamides were first commercialised as meta-aramid fibres in the early 1960s; para-aramid fibres saw development in the 1960s and 1970s. Aramid fibres exhibit significant flexibility, strength and abrasion tolerance due to their chemical structure wherein the bonds within the chain molecules align along the fibre axis. The robust bond between comparatively short molecules offers the fibre increased strength.

Superior heat resistance, low inflammability, and superior resistance to organic solvents are other properties of aramid fibres, accelerating the aramid fibre demand growth. These properties enable several applications of aramid fibres, including air cargo containers, aquaculture nets, aramid honeycombs, armoured vehicles, ballistic protective vests, brakes, civil engineering products, composites, conveyor belts, cut-protection products, elastomer reinforcements, engineering plastics, flexible flowlines and umbilicals, friction paper, heat- and flame-resistant garments, helmets, mooring lines, optical fibre cables, parachute cords, ropes and cables, sealing materials, thermoplastic pipes, fireproof suits, tyres, etc. Major markets include aerospace, automotive, personal protection equipment, consumer products, mining, fibre optics, life protection, and ropes and cables. Common trade names for aramid fibres include Nomex and Kevlar by Dupont, and Twaron by Teijin.

Offering durability and strength, usage in aircraft parts manufacturing and various usage in automobiles are few factors shaping the aramid fibre market dynamics and trends.

A key trend in the aramid fibre market is that aramid fibres offer durability, lightweight strength, stiffness, and thermal and fire protection in aircraft composites, enabling enhanced fuel efficiency and decreased operating and maintenance costs. Aircraft cabin floors, overhead bins and bulkheads developed with aramid fibre honeycomb cores help in reducing weight for aircraft manufacturers. Honeycomb also exhibits low electrical conductivity and high fire resistance, helping in adhering to set safety standards. Superior thermal and sound insulation also lead to better passenger comfort.

Aramid fibres are also used in landing gear doors, wing boxes and control surfaces, filament-wound pressure bottles, engine nacelles, engine containment rings, aircraft tyres, rotor blades, and spacecraft.

Aramid fibres are increasingly being used in automotive components, including filters, belts, gaskets, battery separators, etc. In NASCAR race car bodies, aramid fibre is replacing fibreglass-reinforced plastic. It is also used in the HANS Device that helps support the driver’s head and neck. Further, aramid fibre offers tyres better dimensional stability, even at higher temperatures and speeds, and superior puncture, abrasion and tear resistance, opening up new aramid fibre market opportunities.

Aramid fibre plays an important role in personal protection equipment (PPE) solutions. Front line workers across applications prefer aramid fibre garments as these offers better protection, are lightweight and comfortable. Aramid fibre garments are commonly found in law enforcement, emergency response and industrial manufacturing environments, propelling the aramid fibre industry growth.

Lightweight armour solutions for vehicles offer protection against ballistic attacks. Aramid fibres offer strength to motorcycle gear, workout equipment and luggage. In the mining industry, aramid fibres are used to build lighter, stronger and longer-lasting conveyor belts. Aramid fibres offer enhanced strength to fibre optic cables, and ropes, lines and cables.

The Expansion of the Aerospace Sector aids the Market for Aramid Fibre.

The United States ranks among one of the largest and the world's best manufacturers in aerospace. During 2023, sales revenue to the U.S. aerospace and defence industry was $952 billion. During that period, sales revenue increased by 6.7 percent relative to that of the prior year. The increase shows that the industry has been performing well and that its market is registering improvement. For every million dollars of end-use sales, four employees are supported, either at the manufacturing sector or the whole chain of production sectors, therefore immersing the very aspect of job creation and economic sustainment in the general economy.

Sales breakdown: it would be 56% of the overall revenue and equal to 537 billion dollars provided by the direct industry output, which is simply saying that the products available for end use have a high demand. The remaining 44% totaling USD 415 billion was evident of the contribution of the supply chain, which in simple terms means the high value it offers to the powerful industry. This represented an integrated supply chain that was essential for overall industry productivity and sustainability and carved a significant trend of the aramid fibre market.

Aerospace and Defense rose 4.4% to record 104.8 USD billion in 2022 from 2021. In other words, there has been an increase in the export value of United States aerospace and defence equipment. The leading export destinations this year, 2022, make up the following critical international markets: France, Canada, Brazil, the United Kingdom, and Germany. The sustained interest being shown by these nations in U.S. exports of aerospace and defence is not only ample evidence of the US products' dependability.

Of this total forecast value, widebody aircraft are likely to contribute USD 2.80 trillion. This epitomises the fact that long-distance travel and cargo transport across international boundaries depend much upon widebody aircraft. Business jets are going to contribute USD 0.55 trillion owing to an upsurge in the demand for private and corporate aviation. This category is promoted by growth in high-net-worth individuals and higher demands for business travel in an efficient manner. Helicopters, valued at USD 0.17 trillion, address the medical services, oil and gas, and urban air mobility industries. Regional and turboprop aircraft, at USD 0.15 trillion, remain highly relevant to short-haul and regional connectivity. Commercial unmanned aircraft represent a relatively new market of significantly attractive growth rates, valued at approximately USD 0.06 trillion.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Global Aramid Fibre Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

By product type, the market is segmented into:

By end-user industry, the market is divided into:

By region, the market is classified into:

| CAGR 2026-2035 - Market by | Type |

| Meta-Aramid Fibre | 9.4% |

| Para-Aramid Fibre | XX% |

| CAGR 2026-2035 - Market by | Application |

| Security and Protection | 9.7% |

| Frictional Materials | 9.1% |

| Optical Fibres | XX% |

| Others | XX% |

| Industrial Filtration | XX% |

| Tyre Reinforcement | XX% |

| CAGR 2026-2035 - Market by | Region |

| Asia Pacific | 9.8% |

| Europe | 9.4% |

| North America | XX% |

| Latin America | XX% |

| Middle East and Africa | XX% |

| CAGR 2026-2035 - Market by | Country |

| Germany | 11.0% |

| India | 10.8% |

| China | 10.3% |

| UK | 9.8% |

| France | 8.4% |

| Japan | 8.3% |

| Italy | 6.1% |

| USA | XX% |

| Canada | XX% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Para-Aramid Segment To Gain Popularity Due To Its Strength To Weight Ratio

As per aramid fibre market analysis, the segment of Para-aramid is likely to pick tremendous momentum on account of exceptional strength-to-weight ratio, while the durability or strength is high. The fibres of para-aramid consist of aramids of Kevlar have been leading in such industries that require high performance at higher temperatures, including aerospace, military, and automotive industries. Materials used in protective gear include the demand for bulletproof vests to state-of-the-art composites intended for light weight and with high strength. The growth of the para-aramid market segment will continue to grow as more industries have increasing requirements for advanced safety and performance materials.

| Market Share by | Country |

| USA | XX% |

| Canada | XX% |

| UK | XX% |

The aramid fibres industry in Asia Pacific is getting a huge development opportunity from various countries owing to rapid industrialization, increased manufacturing activities, and expanding automotive and aerospace sectors, mainly from countries like China and India. Demand for high-performance materials from this region, which is more inclined toward advanced infrastructure and cohesive technological advancement, is growing. The increasing focus on the safety sector and the protective gear in industries of construction and defence are some other factors contributing to the increase in demand for aramid fibres in the Asia-Pacific region.

Leading firms in the aramid fibre market are engaged in continual R&D to come up with superior products to offer lighter, stronger and longer-lasting solutions to address the needs of the industry. Novel, enhanced solutions offering better protection from chemical, thermal, electric, and mechanical hazards are expected to stimulate market growth.

Bluestar, a Beijing, China, based company with a foundation in 1984, through the subsidiary China National BlueStar (Group) Co., Ltd. produces para-aramid fibres for such applications as protective garments and industrial reinforcement under the trade name Newstar para-aramid fibres.

The other well-known Kevlar para-aramid fibres are made by DuPont, founded in 1802 and located in Wilmington Delaware, USA. Most of the usage of Kevlar is utilised for ballistic vests, aerospace applications, and high-performance tires since the material is able to bear strong forces.

Hebei Silicon Valley Chemical Co. Ltd., founded in 2009 and headquartered in Shijiazhuang, China, produces para-aramid fibres available under the Huanghe brand name. Products manufactured by this firm can be used in protection gear, automobiles, and other applications requiring strength and resistance to high temperatures.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the aramid fibre market report are Huvis, HYOSUNG, KERMEL, and Kolon Industries Inc., among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 8.50% between 2026 and 2035.

The major market drivers include the increasing applications of aramid fibre to prepare personal protective equipment and the surging utilisation of aramid fibre in various end-use sectors, including automotive, aerospace, defence, and construction.

The key trends propelling the market growth are the growing investments in R&D activities by key players and the increasing applications of aramid fibres in the optical fibre sector.

The major regions in the aramid fibre market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The significant aramid fibre types are meta-aramid fibre and para-aramid fibre.

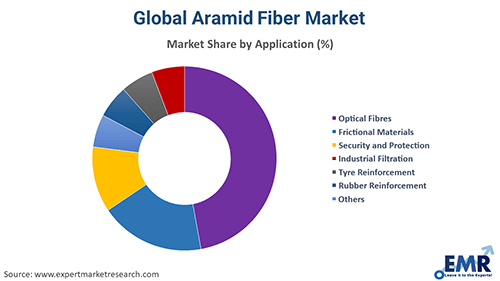

The various applications of aramid fibre include optical fibres, frictional materials, security and protection, industrial filtration, tyre reinforcement, and rubber reinforcement, among others.

The major players in the market are Teijin Limited, DuPont de Nemours, Inc., Huvis Corporation, Shenma Industrial Co., Ltd., Kolon Industries, Inc. and Kermel, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share