Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Argentina pet food market size attained a value of USD 1263.74 Million in 2025. The market is expected to grow at a CAGR of 4.20% between 2026 and 2035, reaching almost USD 1906.93 Million by 2035.

Base Year

Historical Period

Forecast Period

Argentina is a self-sufficient producer of corn and meat, the key raw materials for pet food production.

In 2021, Argentina produced about 764,000 tons of pet food.

Increasing trend of pet humanisation is supporting the adoption of high-quality products.

Compound Annual Growth Rate

4.2%

Value in USD Million

2026-2035

*this image is indicative*

| Argentina Pet Food Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical Period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | 1263.74 |

| Market Size 2035 | USD Million | 1906.93 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.20 |

| CAGR 2026-2035 - Market by Price Category | Mid-Priced Products | 4.5% |

| CAGR 2026-2035 - Market by Distribution Channel | Online Stores | 7.6% |

| 2025 Market Share by Distribution Channel | Online Stores | 10.8% |

Pet food is available in a variety of forms, including canned, dehydrated, and frozen, enriched with different ingredients to meet the varied nutritional requirements and healthcare needs of animals.

Argentina has the presence of 40 pet food manufacturers, majorly concentrated in 3 states (Buenos Aires, Cordoba, and Santa Fe).

Pet owners are becoming more demanding in search for adequate food for their companion animals as a result of rising concern for pet’s welfare, health, and comfort. Pet food manufacturers are working to create formulas that not only taste good to animals but also improve their quality of life.

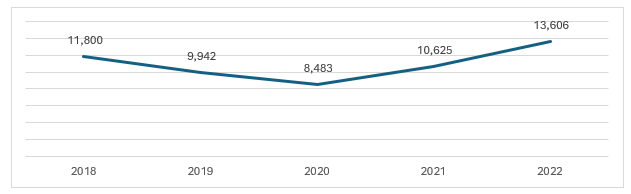

Further, the rising disposable income of the population has increased the sales of pet food. The increasing consumer demand for organic pet foods are contributing to the growth of the premium category.

Figure: Argentina GDP Per Capita (2018-2022)

The rising pet population in Argentina; increasing awareness regarding the importance of pet health; expansion of e-commerce channels; and rising corn production are impacting the Argentina pet food market growth

The expanding cat and dog pet population in Argentinean households are increasing the purchase of highly functional pet food, value-added treats, and vegan products to ensure the optimum nourishment of pets.

Rising pet adoption and the trend of pet humanisation among Argentinians are leading to an increased focus on pet health. Owners are choosing highly nutritious pet foods with high protein content to lower the occurrences of long-term ailments and boost their immunity.

Consumer preferences for online shopping are extending to pet food, with an increasing number of pet owners opting for e-commerce channels to purchase pet food due to the variety and convenience offered.

Argentina is a significant producer and exporter of wheat and corn, which provides the country with an advantage for pet food production. Favourable environmental conditions in various parts of the country are surging the production of corn.

Argentina has a significant rate of pet ownership in Latin America. There is a growing demand for exotic pets among pet owners in cities like Córdoba, Buenos Aries, and Rosario. This, coupled with the trend of pet humanisation is surging the demand for innovative and functional pet food products that can meet the nutritional requirements of their pets.

According to the Argentina pet food market analysis, owners are increasingly purchasing wet food products, value-added treats, and vegan alternatives to improve their pet’s quality of life.

Producers of pet food are investing in research to develop innovative pet food formulations and gain an advantage in the competitive pet food market.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Argentina Pet Food Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Pet Type

Market Breakup by Product Type

Market Breakup by Price Category

Market Breakup by Distribution Channel

| CAGR 2026-2035 - Market by | Price Category |

| Mid-Priced Products | 4.5% |

| Economy Products | XX% |

| Premium Products | XX% |

| CAGR 2026-2035 - Market by | Distribution Channel |

| Online Stores | 7.6% |

| Supermarkets and Hypermarkets | 4.3% |

| Convenience Stores | XX% |

| Veterinary Clinics | XX% |

| Speciality Stores | XX% |

Based on product type, dry pet food accounts for a significant share of the Argentina pet food market

Dry food is convenient to use and available at comparatively lower costs. Additionally, dry food stimulates chewing, which helps dogs avoid tartar buildup and subsequent dental diseases.

However, wet food is growing in popularity among pet parents due to the health benefits its offers, including enhanced hydration. Owners are also investing in treats for their dogs to maintain their health and to effortlessly train them. Additionally, Argentinean producers of pet food offer good quality products at competitive prices.

Based on pet type, dogs dominate the Argentina pet food market share as a result of the increasing dog ownership

Argentina has the presence of about 6.5 million pet dogs. Dogs are the most popular kind of pet in Argentina, with about 78% of households owning at least one dog. The ingredients in dog food are selected to ensure that the body of the dog can easily absorb the necessary nutrients. Digestibility is crucial to the dog's ability to utilise all the nutrients in the meal and quickly eliminate waste from its body. Dog food is rich in vitamins and minerals that work together to strengthen its immune system and metabolism.

| 2025 Market Share by | Distribution Channel |

| Online Stores | 10.8% |

| Convenience Stores | XX% |

| Veterinary Clinics | XX% |

| Supermarkets and Hypermarkets | XX% |

| Speciality Stores | XX% |

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The market players are deploying several strategies to increase sales retention rates, upscale packaging, and increase innovations

Headquartered in the United States, Mars is a family-owned global company primarily engaged in the manufacturing of confectionery, food, and pet care products and services. The company also provides pet health services including AniCura, Banfield Pet Hospitals™, BluePearl®, Linnaeus, Pet Partners™, and VCA™.

Founded in 1866, Nestlé S.A. is a global leader in the food and beverages industry and deals in seven product categories including coffee, pet care, and ready-to-eat items.

Founded in 1906, it provides a wide range of pet products for dogs, cats, birds, and small animals and also manufactures products for hardware and home improvement, home and garden and home and personal care.

A publicly listed company headquartered in Brazil, BRF is one of the largest food companies in the world and a leader in exporting animal protein products. The company offers a portfolio of products that is focused on health, animal nutrition, and food ingredients.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the Argentina pet food market are Petfood Saladillo SA, Agroindustrias Baires S.A., Petfood Saladillo SA, Agroindustrias Baires S.A., Nelsoni Ranch and Others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The Argentina pet food market reached a value of USD 1263.74 Million in 2025.

The market is projected to grow at a CAGR of 4.20% between 2026 and 2035.

The factors supporting the market growth include increasing pet humanisation, rising disposable incomes, increasing awareness regarding pet health, and the demand for premium pet foods.

The different pet types are dog, cat, fish, bird, and others.

The product types include dry pet food, wet pet food, and snacks and treats.

The price categories include economy products, mid-priced products, and premium products.

Pet foods are mostly prepared using meat by-products, cereals, vitamins, minerals, and grains.

The key players in the market include Mars, Incorporated, Nestlé S.A, Spectrum Brands Holdings Inc., BRF S.A., Petfood Saladillo SA, Agroindustrias Baires S.A., Petfood Saladillo SA, Agroindustrias Baires S.A., Nelsoni Ranch and Others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Pet Type |

|

| Breakup by Product Type |

|

| Breakup by Price Category |

|

| Breakup by Distribution Channel |

|

| Market Dynamics |

|

| Trade Data Analysis |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share