Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Latin America pet food market was valued at USD 12.84 Billion in 2025. The industry is expected to grow at a CAGR of 3.70% during the forecast period of 2026-2035 to reach a value of USD 18.47 Billion by 2035.

The pet food market in Latin America is experiencing a transformative shift owing to rising pet humanisation and premiumisation trends. Brazil alone contributes nearly 60% to the region's pet food sales. Notably, the region is now seeing rapid growth beyond urban hubs, with mid-income households increasingly purchasing formulated and nutritionally balanced food for pets.

Government programmes are playing a crucial role in Latin America pet food market structuring. For instance, Mexico’s “Plan Nacional de Desarrollo 2023–2024” includes provisions for animal welfare that indirectly foster demand for quality pet nutrition. Similarly, Argentina has begun enforcing stricter labelling norms, prompting brands toward transparency and higher formulation standards. There is also a visible rise in functional pet food solutions, supported by local R&D grants in Colombia for novel plant-based formulations.

Multinationals and domestic players in the Latin America pet food market are turning towards advanced manufacturing, using extrusion technology and AI-powered feeding analysis to formulate breed- and age-specific products. Innovation hubs in São Paulo and Guadalajara are fast emerging as developmental powerhouses for pet food innovation, with brands launching customisable food plans based on pet DNA and gut microbiome data.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

3.7%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Pet ownership is increasingly growing across Latin America, especially in Chile, where over 75% of households own pets. This cultural shift is driving demand for premium, human-grade pet food. Brands like Gran Plus and Equilibrio are introducing gourmet and tailor-made diets, often mimicking human food trends like keto or vegan, boosting further development in the Latin America pet food market. This premium food surge is further supported by retailers offering in-store nutrition consultations.

Argentina's recent legislation mandating nutrient-specific labelling on pet food packaging is becoming a key trend in the Latin America pet food market. For example, “Ley de Alimentos para Mascotas” requires clear, evidence-based nutrient disclosure and allergen details. This is compelling companies to adopt digital labelling tools, including QR-code-linked product traceability. These changes are pushing local players to integrate supply chain tracking technology while attracting global companies seeking regulatory-aligned expansion.

In Colombia, start-ups like MascotaLab are pioneering custom-mix pet food tailored through genetic testing and gut health screening, accelerating the Latin America pet food market opportunities. There has also been a growing momentum around functional formulations including skin health, digestive support, and joint care, crafted using natural botanicals and fermented ingredients. Even mid-tier brands are launching SKUs with probiotics, collagen, or CBD oil for stress relief. This evolution is turning functional food from niche to norm, especially for ageing pets and those with breed-specific health sensitivities.

Pet food e-commerce is becoming less about convenience and more about smart service. Mexico-based PetNGo and Brazil’s Zee.Dog have launched subscription-based models integrated with AI for reorder prediction. These platforms offer real-time inventory sync and dietary adjustment features. Online sales in Latin America reached nearly USD 180 million in 2024, as per Latin America pet food market analysis. Governments are also enabling digital commerce. For example, Brazil’s Digital Market Acts simplifies cross-border pet food e-commerce. This has led to increased investments in digital CX, cold-chain last-mile delivery, and even drone-based fulfilment trials in São Paulo.

Eco-conscious production is gaining traction in the Latin America pet food market. For example, Jiminy launched the region’s first insect-protein-based dog food, using black soldier fly larvae sourced from waste processing facilities. Packaging is evolving with fully compostable bags and refill stations in Bogotá and Buenos Aires. Companies incorporating carbon-labelling and low-emission logistics are now perceived as forward-thinking, adding ESG value to product lines.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

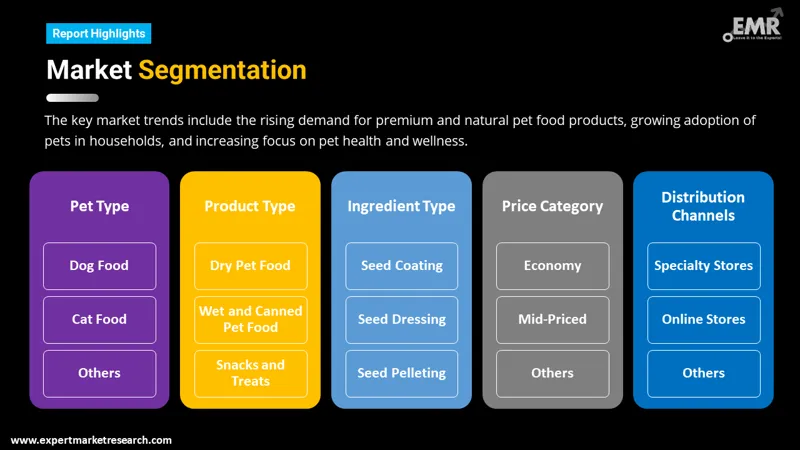

The EMR’s report titled “Latin America Pet Food Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Pet Type

Key Insight: The Latin American pet food market, segmented by pet type, is dominated by dog food due to its broad consumer base. Cat food is the fastest-growing segment, influenced by changing lifestyle preferences and apartment-based living. Niche segments like bird and rodent food are seeing growth, driven by exotic pet trends and urban farming influences. However, the strategic focus remains on dogs and cats, where veterinary partnerships, personalised offerings, and subscription models are creating new monetisation pathways for both traditional and digital-first players.

Market Breakup by Product Type

Key Insight: Across product types, dry pet food dominates the Latin America pet food market in volume and availability, offering reliable value. Wet and canned food holds strong in premium categories, often linked to veterinary diets. Snacks and treats, however, are outpacing others in growth rate due to emotional purchasing and health-functional innovations. Segment strategies differ. For example, dry food leans on cost and consistency, wet food banks on palatability and therapy, while treats serve both health and indulgence.

Market Breakup by Ingredient Type

Key Insight: Ingredient selection in Latin America’s pet food industry is increasingly becoming a branding move. Animal-derived ingredients dominate the market due to tradition, availability, and taste. However, plant-derived formulations are becoming trendy, particularly for specialised diets among sustainability-conscious buyers. The blend of traditional protein sources with superfoods, botanicals, and novel fermentation inputs indicates a progressive feild for innovation.

Market Breakup by Price Category

Key Insight: The mid-priced category dominates the Latin America pet food market revenue due to their mass appeal. Premium is surging, driven by rising disposable income and human-grade expectations. Economy products cater to rural and lower-income markets, focusing on calorie density over formulation nuance. Therapeutic options are expanding under vet guidance, while non-therapeutic remains the default choice for most households.

Market Breakup by Distribution Channels

Key Insight: Distribution in the Latin American pet food market is diversifying rapidly. Supermarkets dominate the market due to reach and trust, ideal for bulk and mid-range buyers. Specialty stores provide expert guidance and premium selections. Online platforms, however, are redefining convenience and loyalty, especially among urban millennials. Emerging channels like vet clinics and subscription-based delivery are growing, adding a service to traditional retail.

Market Breakup by Region

Key Insight: Across Latin America, Brazil dominates in terms of pet food consumption by scale and infrastructure, while Mexico is emerging as the region’s innovation lab. Argentina and Colombia are gaining traction through niche offerings and sustainability-led production. Chile’s regulatory discipline is pushing transparency, and Peru is becoming a contender in plant-based innovation. Factors like rising disposable income, tech-enabled retail, and a more emotionally invested pet culture are powering unified demand across the continent.

By Pet Type, Dog Food Registers the Larger Share of the Market

Dog food continues to dominate Latin America's pet food market, particularly in Brazil and Mexico. Recent growth has been driven by value-added product lines including grain-free, breed-specific, and immunity-boosting diets. Premiumisation in the dog segment is closely tied to rising middle-class income and urban lifestyles. In 2023, São Paulo-based Petlove launched a dog food range with AI-personalised nutrient profiles based on age, breed, and activity level. This segment is benefiting from stronger veterinary alliances and new diagnostic tools that push demand for therapeutic canine diets, cementing its dominance in both retail and e-commerce channels.

Cat food has recorded the fastest CAGR in the Latin America pet food market, boosted by countries like Argentina and Chile, where feline ownership is surging among urban millennials. Compared to dogs, cats demand higher protein and taurine-based diets, leading to innovation in fish- and liver-based wet foods. Chile’s emerging pet food brands like Felinia Canino are introducing raw, freeze-dried blends with gut flora-balancing prebiotics. This segment's growth is also driven by apartment-friendly living trends and smaller household sizes.

By Product Type, Dry Pet Food Secures the Majority of the Market Share

Dry pet food demand in Latin America is growing mainly due to its affordability, convenience, and long shelf life, which are critical in countries with limited cold-chain infrastructure. Brands like Affinity and Nutrience are upgrading dry formulas with enhanced palatability and fortification. Symrise Pet Food, inaugurated a plant-based pet food production facility in Brazil, in Chapéco (SC), in late August 2023, that also integrates high-pressure processing to boost nutrient retention in dry kibbles. Furthermore, extruded kibble formats embedded with probiotics and oral health agents are gaining preference. With supermarkets dominating the distribution of dry food, companies are leveraging high-volume sales with bundling products.

Pet snacks and treats are experiencing exponential growth, especially among Gen Z and millennial pet parents across Mexico and Colombia, as per the Latin America pet food market report. Functional treats including CBD chews, dental sticks, and skin-nourishing nibbles are becoming mainstream. This segment benefits from impulse buying, often driven by emotional connections rather than nutritional profiles. E-commerce platforms are pushing bundled treat packs with subscriptions and loyalty programmes.

By Ingredient Type, the Animal Derived Segment Occupies a Significant Share of the Market

Animal-derived ingredients remain the cornerstone of Latin American pet food market, valued for high protein content and palatability. Beef, chicken, and fish derivatives dominate both dry and wet formulations. Brazil, with its vast meat processing industry, has become a key supplier of by-products like organ meats and bone meal for local pet food makers. With traceability and welfare concerns rising, many brands are opting for hormone-free, pasture-raised proteins. Furthermore, cold-chain logistics are being upgraded to maintain integrity in high-value animal-based ingredients. New technology like plasma protein inclusion is also gaining ground, enhancing amino acid absorption for senior pets.

Plant-derived pet food ingredients are on the rise, driven by the sustainability trends and increasing pet allergies to meat proteins. Soy, pea protein, lentils, sweet potato, and even tropical fruits are being explored. Companies in the Latin America pet food market like BioPet are investing in fermentation technology to improve bioavailability of plant nutrients. In Chile, quinoa and chia are being incorporated into dog food formulas for omega enrichment.

By Price Category, the Mid-Priced Segment Clock in the Major Share of the Market

Mid-priced pet food has recorded the largest share of the Latin America pet food market owing to affordability and quality, especially in emerging economies like Peru, Ecuador, and Paraguay. Brands such as DogChow and Whiskas have optimised formulations using local protein sources while incorporating some premium features like added vitamins and prebiotics. This category has the broadest consumer base, encompassing middle-class families prioritising value without compromising on pet health. Growth is supported by mass retailers, offering bulk deals.

Premium pet food is seeing robust growth in the Latin America pet food market, especially in affluent areas of Brazil, Chile, and Panama. Products in this segment boast high protein content, zero fillers, and often include exotic ingredients like duck, venison, or quinoa. Personalisation has become a key area of concern as brands are offering custom-blended bags based on pet health data. Subscription services with vet consultations, free trials, and delivery perks are driving customer retention.

By Distribution Channel, Supermarkets and Hypermarkets Continue to Dominate the Industry

Supermarkets and hypermarkets remain the primary retail channel boosting the pet food market revenue in Latin America. Chains like Grupo Éxito, Cencosud, and Carrefour have ramped up pet care aisles with private-label brands and specialised SKUs. Retailers are integrating QR-code labelling for on-shelf info and hosting in-store vet check-up events to build engagement. Bulk promotions, loyalty cards, and bundled offers are common strategies to boost frequency of purchase. With well-established cold chain infrastructure and distribution hubs, supermarkets have become pivotal for driving volume, especially for dry food and mid-priced categories.

Online pet food retail is the fastest-growing segment in the pet food industry of Latin America, underpinned by urbanisation, smartphone penetration, and digital payment adoption. Startups like Puppis and Tiendanimal are redefining user experience with personalised recommendations, loyalty programmes, and subscription models. Live chat with pet nutritionists, AR tools for packaging previews, and mobile reorder reminders are propelling customer retention. Logistics players are offering scheduled deliveries with cold-chain compliance for wet food and treats.

By Region, Brazil Holds the Leading Position in the Market

Brazil leads the Latin American pet food market, supported by strong domestic manufacturing and one of the world’s highest pet ownership rates. The market thrives on product innovation and robust distribution. São Paulo and Rio de Janeiro are hubs for premiumisation and digital retail adoption. Brands are also leveraging Brazil’s agricultural abundance to develop farm-to-bowl solutions.

The Mexico pet food market is accelerating swiftly, powered by rising middle-class income and digitisation. Government programmes such as "Bienestar Animal" are indirectly stimulating the industry by raising awareness around pet nutrition. Startups like Nupec and Petzone are disrupting the market with science-backed products, subscription models, and community-led branding. Retailers are integrating AI recommendation engines and click-and-collect services.

Leading Latin America pet food market players including Mars, Nestlé, Biofresh, Nutrire, and Nupec continue to dominate owing to brand recognition and R&D investments, while the regional players that are excelling in localisation, agility, and consumer engagement. These companies are leveraging a deep understanding of local dietary preferences, ingredient availability, and pricing sensitivities to tailor offerings more precisely. Functional food innovation is a core strategy as many are introducing breed-specific, age-specific, or condition-focused diets backed by scientific formulations.

AI-driven recommendation systems are also being integrated into online retail platforms to offer smart buying suggestions. Partnerships with veterinary clinics are enabling Latin America pet food companies to co-create therapeutic diets, giving credibility through medical endorsement. Meanwhile, digital-first models, especially via mobile apps and subscription services, are capturing tech-savvy urban consumers. Sustainable sourcing, eco-friendly packaging, and plant-based options are becoming competitive differentiators.

Founded in 1911 and based in Washington, United States, Mars Inc. is a global company that offers various products within the pet care, confectionery, and food segments. With above 140,000 employees, the company boasts of its wide presence in about 80 countries. To support pet care and health, it offers aims to advance personalised pet healthcare to enhance the quality of life of pets.

Nestlé SA is the leading food and beverage company that strives to increase the accessibility and affordability of beverages, food, as well as nutritional health products. The company was formed in 1866 and is headquartered in Switzerland. With 276,000 employees and a wide presence in 186 countries, the company attained net sales of CHF 87.1 billion in 2021.

Established in the year 1902, Archer Daniels Midland Company is a leading global nutrition player, which serves in animal nutrition, human nutrition, services, and industrial biosolutions segments. The company is focusing on innovation to target its next milestone from $6.00 to $7.00 per share by 2025.

Headquartered in Buenos Aires, Petfood Saladillo SA is a company that develops and markets balanced pet food. Its processes are vertically integrated, through which it ensures total control of its production chain. With 65 product presentations and 5000 tonnes of finished product storage, the company has a production capacity of 8000 tonnes.

Metrive SA, based in Salto, Buenos Aires, Argentina, is dedicated to the cleaning, classification, and purchase-sale of cereals for bird feeding applications. The company boasts of a pet food factory, oil factory, balanced feed factory, grain silo and storage plant, as well as a comprehensive distribution centre.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market are Petfood Saladillo S.A., and PremieRpet, among others.

Explore the latest trends shaping the Latin America Pet Food Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on Latin America Pet Food Market Trends 2026.

North America Pet Food Market

United States Pet Food Market

Saudi Arabia Pet Food Market

South Korea Pet Food Market

Asia Pacific Pet Food Market

Argentina Pet Food Market

Vietnam Pet Food Market

Organic Pet Food Market

Canada Pet Food Market

Pet Food Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the Latin America pet food market reached an approximate value of USD 12.84 Billion.

The market is projected to grow at a CAGR of 3.70% between 2026 and 2035.

Pet food is crucial to ensure the overall wellbeing of pets, repair damaged cells, and maintain bone and joint health. Moreover, it boosts the immunity of pets while reducing the risk of preventable diseases.

The major product types in the market are dry pet food, wet and canned pet food, and snacks and treats, among others.

Key strategies driving the market include investing in R&D, local sourcing, digital retail, subscription models, and veterinary partnerships to differentiate products, strengthen supply chains, and meet rising demand for transparency, sustainability, and personalisation.

Dogs are the most popular domesticated animals in Latin America, with Argentina, Mexico, and Brazil being the countries with the highest dog population in the region. In addition, the growing middle-class population and the rising adoption of pets as substitutes for children are likely to boost the adoption of dogs.

The significant price categories in the market include economy, mid-priced, premium, therapeutic, and non-therapeutic.

The Latin America market for pet food is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 18.47 Billion by 2035.

The major regions in the market are Brazil, Argentina, and Mexico.

The several distribution channels in the market are speciality stores, supermarkets and hypermarkets, and online stores, among others.

The market is expected to be aided by the increasing R&D activities, the growing demand for pet food through online channels, and the surging demand for pet food with excellent flavour and nutrition profiles.

The major players in the market are Mars Inc., Nestlé SA, Archer Daniels Midland Company, BRF SA., Metrive S.A., Petfood Saladillo S.A., and PremieRpet, among others.

The key challenges are high raw material costs, inconsistent supply chains, weak regulatory harmonisation, and limited pet food education in rural markets.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Pet Type |

|

| Breakup by Product Type |

|

| Breakup by Ingredient Type |

|

| Breakup by Price Category |

|

| Breakup by Distribution Channels |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Trade Data Analysis |

|

| Price Analysis |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share