Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global automotive usage based insurance market is expected to grow at a CAGR of 21.40% during the period 2026-2035. North America and Europe are expected to be key markets.

Base Year

Historical Period

Forecast Period

The use of blackbox technology is expected to increase by 24.4% in the forecast period.

The market for automotive usage based insurance in Germany accounted for 4.6% of the global market share in 2023.

The European market is also experiencing significant growth with countries such as UK and Germany exhibiting CAGR of 24.7% and 22.2%.

Compound Annual Growth Rate

21.4%

2026-2035

*this image is indicative*

| Global Automotive Usage Based Insurance Market Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | XX |

| Market Size 2035 | USD Million | XX |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 21.40% |

| CAGR 2026-2035 - Market by Region | North America | 24.8% |

| CAGR 2026-2035 - Market by Country | India | 25.3% |

| CAGR 2026-2035 - Market by Country | UK | 24.7% |

| CAGR 2026-2035 - Market by Package | Pay-As-You-Drive (PAYD) | 24.0% |

| CAGR 2026-2035 - Market by Technology | Black Box | 24.4% |

| Market Share by Country 2025 | Germany | 4.6% |

The increasing popularity of smartphones has provided insurance providers access to means to enhance and strengthen their relationships with clients. Today, insurance providers can leverage mobile telematics apps to offer unique incentives to drivers who exhibit safe on-road habits. Gestures such as congratulating a driver through a smartphone message on completing a long road trip safely and efficiently, or offering a bonus, rebate or reward for a demonstrating an on-road skillset are likely to strengthen company-client relationship, which can boost the automotive usage based insurance demand.

Benefits of usage based insurance (UBI) include improved driving, possibly lower premiums (safer and better driving would lead to lower premiums), possible reduction in road accidents, enhanced road safety, and better insurance products (with the help of the right kind of data, insurance companies may devise novel, improved, and beneficial need-based insurance policies).

Usage based insurance (UBI) is a type of insurance where the premium payable is directly linked to the use of the insured product or service. In the automotive insurance industry, usage based insurance is also known as Telematics insurance. Usage based insurance is quite prevalent for vehicles in developed countries. In a usage based insurance program, the automobile insurance company would keep a track of the way one drives; if the driving gets a good score, then it could lead to lower rates of car insurance. Usage based insurance programs usually assess acceleration, speeding and harsh braking, and also consider mileage and the time of day of the drive, which can contribute to the growth of the automotive usage based insurance market.

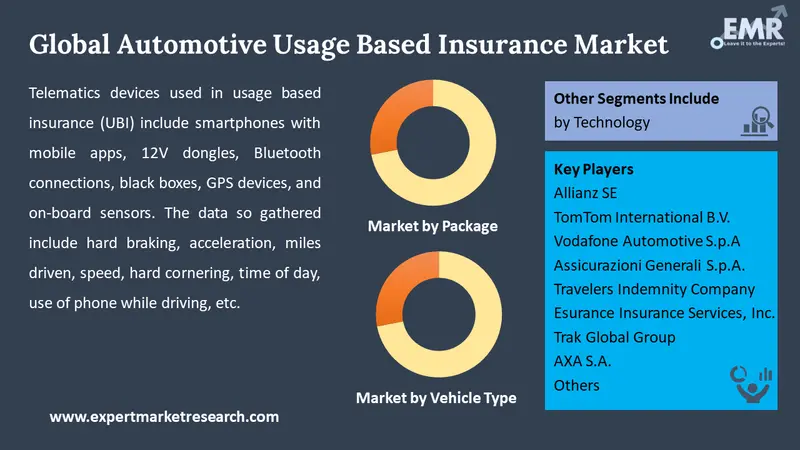

Driving is scored, and the driver is also given tips to better the score. The better the driving, the better the auto insurance rates. Usage based insurance programs gather vehicle telematics data with the help of cellular, GPS or other technologies. Telematics devices used in usage based insurance (UBI) include smartphones with mobile apps, 12V dongles, Bluetooth connections, black boxes, GPS devices, and on-board sensors. The data so gathered include hard braking, acceleration, miles driven, speed, hard cornering, time of day, use of phone while driving, etc. Usage based insurance is gaining recognition and acceptance, with a significant percentage of drivers choosing a telematics option when offered.

The different types of usage based insurance for automobiles include:

Pay as You Drive (PAYD) – Insurance premium is charged on the basis of the amount of driving done, influencing automotive usage based insurance market dynamics and trends.

Pay How You Drive (PHYD) – Insurance premium is charged on the basis of the driving skills of the driver. Parameters include acceleration, hard braking, hard turning, etc.

Pay as You Go (PAYG) – This method warrants the installation of a Telematics device, and could a combination of the aforementioned points.

Distance-based Insurance – Based on the number of miles travelled by the automobile during the policy period.

Leading companies are coming together to offer usage based insurance to new vehicle owners. For example, in 2023, State Farm® and Ford announced the launch of Drive Safe & Save™ Connected Car for customers with eligible connected Ford or Lincoln vehicles, to benefit from usage based insurance that can aid the automotive usage based insurance demand.

In 2023, Otonomo and Audi AG came together to focus on innovative, data-driven services. Audi would provide Otonomo with GDPR-compliant access to Audi car data, quickening the development of advanced mobility solutions, from pay-as-you-drive (data could be used for usage based insurance; elements included mileage readings and parking time) and insurance services to general vehicle status, first notification of loss, accident reporting, etc.

Rising Vehicle Ownership Globally Presents an Opportunity for Automotive Usage Based Insurance Market.

According to OICA data, the analysis of global vehicle ownership per capita reveals significant regional variations, which can impact the adoption and growth of automotive usage-based insurance (UBI). As per the automotive usage based insurance industry analysis, according to February 2024 data, in North America, the United States leads with 860 vehicles per 1,000 people, indicating a mature automotive market with high penetration rates. Canada follows with 707 vehicles per 1,000 people. The high vehicle density in these regions presents a favourable environment for UBI adoption, as insurers can leverage extensive telematics data to offer personalized premiums based on driving behavior.

Europe shows diverse trends, with Poland experiencing rapid growth, reaching 761 vehicles per 1,000 people, nearly tripling its vehicle count since 2000. This rapid motorization can drive demand for UBI as consumers seek cost-effective insurance solutions tailored to their specific driving habits, boosting the growth of the automotive usage based insurance industry. In contrast, countries like Bulgaria and Ukraine have low or negative motorization growth rates, suggesting slower UBI market potential due to lower vehicle ownership.

In Asia, New Zealand leads with 869 vehicles per 1,000 people, followed by Australia with 737 vehicles. Japan, Malaysia, and South Korea also show significant vehicle ownership, indicating a strong market for UBI, especially as these countries are technologically advanced and have high consumer awareness. China, with 223 vehicles per 1,000 people, demonstrates a fast-growing market.

In Central and South America, Argentina leads with 311 vehicles per 1,000 people, but economic challenges like high inflation could hinder growth in vehicle ownership and UBI adoption, impacting automotive usage based insurance industry revenue. In Africa, Libya has the highest vehicle ownership at 490 per 1,000 people, while other countries like Morocco and South Africa have much lower rates. The automotive markets in these regions are still developing, presenting long-term opportunities for UBI as vehicle ownership increases.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Automotive Usage Based Insurance Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

By package, the market is segmented into:

By vehicle type, the market is divided into:

By technology, the market is classified into:

By region, the market is segmented into:

The demand for Pay-As-You-Drive (PAYD)is expected to grow at a CAGR of 24.0% in the forecast period. This model calculates premiums based on the actual distance a vehicle travels, offering a personalised approach to auto insurance. Individuals who drive less can benefit from lower premiums, making PAYD an attractive option for those seeking cost-effective insurance solutions which can increase automotive usage based insurance market opportunities.

Moreover, the integration of telematics and data analytics enables accurate tracking of vehicle usage, facilitating the implementation of PAYD models.

The report presents a detailed analysis of the following key players in the market, looking into their capacity, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:

North America accounts for a substantial automotive usage based insurance market share and is expected to grow at a CAGR of 24.8% in the forecast period. The US market is expected to grow at a CAGR of 24.4% between 2026 and 2035. The growth is propelled by the widespread acceptance of connected vehicle technology and high car ownership rates. Collaborations between telematics providers, insurance companies, and Original Equipment Manufacturers (OEMs) further fuel this expansion.

| CAGR 2026-2035 - Market by | Country |

| India | 25.3% |

| UK | 24.7% |

| USA | 24.4% |

| Germany | 22.2% |

| China | 21.1% |

| Canada | XX% |

| France | XX% |

| Italy | XX% |

| Japan | 13.2% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Asia-Pacific is anticipated to exhibit high growth rate during the forecast period. The markets in India, China, and Japan are anticipated to grow at a CAGR of 25.3%, 21.1%, and 13.2% between 2026 and 2035. Factors such as the proliferation of mobile connectivity, smartphone technology, and increasing sales of telematics-equipped vehicles drive this growth.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global automotive usage-based insurance market is projected to grow at a CAGR of 21.40% between 2026 and 2035.

The major drivers of the market include the data-driven services, advancement of IoT, increasing production and sales of automobiles, changing demographic trend, changing driving habits and increasing number of affluent middle-class population.

The increasing popularity of smartphones and the benefits of usage-based insurance (UBI) are the key industry trends propelling the market's growth.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Based on package, the market is divided into Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD).

The different types of vehicles are passenger vehicles, light commercial vehicle, and heavy commercial vehicle.

The various technologies are black box, smartphone, embedded telematics, and on-board diagnostics (OBD), among others.

The major players in the industry are Allianz SE, TomTom International B.V., Vodafone Automotive S.p.A, Assicurazioni Generali S.p.A., Travelers Indemnity Company, Esurance Insurance Services, Inc., Trak Global Group, and AXA S.A., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Package |

|

| Breakup by Vehicle Type |

|

| Breakup by Technology |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share