Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Canada diabetes market was valued at USD 4.90 Billion in 2025, driven by the increasing prevalence of the disease and the rising initiatives to improve diabetes management in the region. The market is expected to grow at a CAGR of 8.46% during the forecast period of 2026-2035, with the value likely to rise from USD 4.91 Billion in 2026 to USD 11.04 Billion by 2035.

Base Year

Historical Period

Forecast Period

The market is influenced by the rising innovations in diabetes care technology and increased awareness campaigns on diabetes management.

One of the major market trends is the growing investment in diabetes research to develop more effective treatments and prevent the complications associated with this chronic disease.

Leading companies in the market are increasingly forming strategic partnerships, investing in startups, and advancing innovative therapies to address unmet needs and strengthen their competitive positioning.

Compound Annual Growth Rate

8.46%

Value in USD Billion

2026-2035

*this image is indicative*

Diabetes is a chronic disease characterized by the inability of the body to produce sufficient insulin or when the body cannot respond to the effects of insulin effectively, leading to high blood glucose levels. Type 2 diabetes is the most common type of diabetes where the body doesn’t make enough insulin or shows insulin resistance.

Rising Diabetes Cases to Drive Market Expansion

The growing prevalence of diabetes, fuelled by sedentary lifestyles and ageing populations, coupled with the high burden of diabetes-related complications, are key drivers shaping Canada’s diabetes market. A national analysis in 2024 reported 5.8 million Canadians living with diabetes, a figure expected to rise to over 7.3 million by 2034, representing 16% of the population. Additionally, diabetes contributes significantly to cardiovascular disease, kidney failure, and amputations. This alarming trend will amplify the demand for advanced diagnostic tools, innovative therapies, and public health initiatives, accelerating market growth throughout the forecast period.

Government Healthcare Initiatives to Boost Canada Diabetes Market Development

Expanding access to diabetes care through government support is a critical driver for market development. In February 2024, Canada introduced Bill C-64, the Pharmacare Act, covering diabetes medications and devices. Concurrently, the government announced a Device Fund to subsidise essential supplies, including insulin pumps and glucose monitoring devices. A USD 1 million grant was allocated in June 2023 to Diabetes Canada which further supports the strategic implementation of the national diabetes framework. These initiatives will enhance accessibility and affordability of care, driving the adoption of advanced treatment options and significantly contributing to market growth in the coming years.

Adoption of Innovative Therapies to Meet the Increasing Canada Diabetes Market Demand

Rising demand for convenient and patient-friendly therapies continues to drive innovation in diabetes treatment. In June 2024, Novo Nordisk introduced Awiqli® (insulin icodec), the world’s first once-weekly basal insulin, in Canada following Health Canada approval in March 2024. This groundbreaking therapy, designed to improve glycaemic control with reduced injection frequency, addresses adherence challenges in diabetes management. With Canada leading the global launch of Awiqli®, the treatment is expected to revolutionise insulin therapy standards. Its adoption will boost patient outcomes, foster technological advancements, and position Canada as a leader in diabetes care, driving significant market growth.

The market is witnessing several trends and developments to improve the current scenario. Some of the notable trends are as follows:

Rising Prevalence of Type 2 Diabetes Fuels Market Development

Type 2 diabetes prevalence in Canada is increasing due to sedentary lifestyles, ageing populations, and unhealthy dietary patterns. As estimated by Diabetes Canada, the prevalence of diagnosed type I and type II diabetes is likely to increase by nearly 32% during 2024-2034. This surge is boosting demand for innovative treatment options, including combination therapies and novel drug classes. Efforts by public health organisations to enhance diabetes awareness and screening are contributing to early diagnoses and treatment adoption. Additionally, pharmaceutical companies are collaborating with healthcare providers to address gaps in care. This trend signifies robust market development as stakeholders focus on mitigating the disease burden and improving patient quality of life.

Growing Adoption of Digital Health Tools in Diabetes Management to Meet Increasing Canada Diabetes Market Demand

Digital health technologies, including mobile apps, continuous glucose monitoring (CGM) systems, and telemedicine, are becoming integral in diabetes care across Canada. These tools empower patients to monitor blood sugar levels in real-time and enable healthcare providers to offer personalised treatment plans remotely. With rising smartphone penetration and improved healthcare infrastructure, the market is witnessing increased investments in digital solutions. This trend highlights a shift towards technology-driven care, driven by patient demand for convenience and accuracy, alongside healthcare professionals' focus on enhanced outcomes.

Expanding Portfolio of Advanced Insulin Delivery Systems

The Canadian diabetes market is experiencing significant advancements in insulin delivery systems, including wearable insulin pumps and smart pens. These innovations improve patient compliance and ensure precise dosage administration. The growing awareness of diabetes complications and government efforts to subsidise innovative treatment devices are driving market growth. Manufacturers are also focusing on integrating AI and connectivity features to offer data-driven solutions. This trend underlines the evolving focus on convenience and efficiency in diabetes management, making insulin delivery more accessible and effective for patients across Canada.

Surge in Demand for Personalised Diabetes Treatments to Boost Canada Diabetes Market Value

The market is witnessing increased demand for personalised therapies tailored to individual needs. Advances in genetic research, artificial intelligence, and patient data analysis are enabling customised treatment plans, including specific drug combinations and lifestyle recommendations. This approach enhances treatment effectiveness and minimises side effects, making it a preferred choice for healthcare providers and patients alike. Pharmaceutical companies are investing in precision medicine to meet this growing demand. The shift towards personalised care signifies a transformative trend, reflecting patient-centric innovation and improved healthcare outcomes in diabetes management across Canada.

The market report offers a detailed analysis of the market based on the following segments:

Market Breakup by Diabetes Type

Market Breakup by Drugs

Market Breakup by Route of Administration

Market Breakup by Region

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Type II Diabetes to Lead the Diabetes Type Segment

Type II diabetes is expected a large market share based on diabetes type, driven by its growing prevalence due to sedentary lifestyles, unhealthy diets, and an ageing population. Its management requires a wide range of treatments, from oral medications to insulin therapies, creating substantial demand. Increased public awareness, early diagnosis programmes, and government healthcare initiatives further fuel growth. As per the analysis by Expert Market Research, the type 2 diabetes market is expected to grow at a CAGR of 8.4% during the forecast period of 2025-2034. Innovations in combination therapies and personalised treatments are poised to expand the segment's dominance in the forecast period, ensuring sustained market growth and improved patient outcomes.

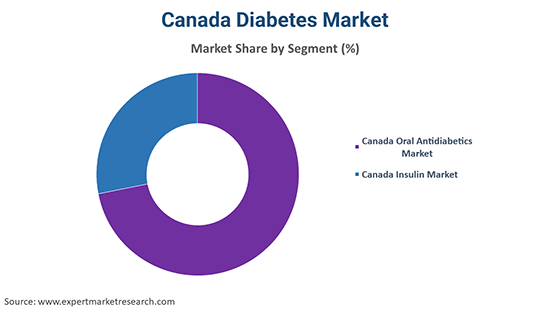

Market Share Based on Drugs to Witness Substantial Growth in the Canada Diabetes Market

The oral anti-diabetic drugs segment is predicted to lead the market due to their convenience, cost-effectiveness, and extensive use in managing type 2 diabetes. Among these, DPP-4 inhibitors and SGLT2 inhibitors are experiencing significant growth due to their dual benefits in glucose control and cardiovascular health. Rising healthcare awareness and a shift towards minimally invasive options are market drivers. With continuous advancements in oral drug formulations and increasing adoption, this segment is expected to maintain its leadership and support future market expansion.

Canada Diabetes Market Share Based on Route of Administration to Hold a Significant Value

Subcutaneous administration leads the diabetes market in Canada due to its critical role in delivering insulin and non-insulin injectables like GLP-1 receptor agonists. Its efficiency in ensuring precise drug delivery and bioavailability makes it a preferred choice for patients and healthcare providers. Technological innovations in auto-injectors and insulin pumps further enhance its appeal. As personalised treatments and advanced delivery systems gain traction, subcutaneous administration is set to drive market growth in the forecast period, ensuring effective diabetes management.

Central Canada is projected to hold a substantial market share due to its dense population and well-established healthcare infrastructure. The provinces of Ontario and Quebec, which make up this region, account for a significant portion of the country's diabetes cases. Urbanisation and lifestyle-related factors contribute to the higher prevalence of Type II diabetes, driving demand for advanced treatments and management solutions. Central Canada benefits from robust research initiatives, healthcare funding, and partnerships between public and private sectors, which facilitate early diagnosis and access to innovative therapies. The region's focus on adopting digital health tools and cutting-edge treatments further strengthens its market leadership. With continued investments in healthcare innovation and increasing public awareness, Central Canada is well-positioned to sustain its dominance and drive overall market growth in the coming years.

The key features of the market report comprise patent analysis, clinical trials analysis, grants analysis, funding and investment analysis, and strategic initiatives by the leading players. The major companies in the market are as follows:

Founded in 1876 and headquartered in Indianapolis, Eli Lilly and Company is a global leader in diabetes care, renowned for its innovative treatments like Trulicity and Humalog. In December 2024, Eli Lilly Canada announced groundbreaking results from the SURMOUNT-5 Phase 3b clinical trial, showing tirzepatide achieved a 47% greater relative weight loss compared to Wegovy® (semaglutide), with an average 20.2% weight loss over 72 weeks. This superior efficacy highlights Eli Lilly’s commitment to addressing obesity, a key diabetes comorbidity, which will drive market growth by offering highly effective treatment options and strengthening its leadership in Canada’s healthcare sector.

AstraZeneca, headquartered in Cambridge, UK, is a global biopharmaceutical leader focusing on innovative treatments across therapeutic areas, including cardiovascular, renal, and metabolic diseases. In August 2021, AstraZeneca Canada achieved a significant milestone with Health Canada’s approval of Forxiga® (dapagliflozin), an SGLT2 inhibitor. This therapy reduces the risk of kidney function decline, end-stage kidney disease, and cardiovascular or renal death in adults with chronic kidney disease. The approval, supported by the DAPA-CKD Phase III trial, highlights AstraZeneca's commitment to advancing patient care. This breakthrough strengthens its portfolio and significantly impacts Canada's diabetes market by addressing critical comorbidities, improving patient outcomes, and driving demand for advanced, multifaceted therapies.

Sanofi, a global healthcare leader headquartered in Paris, France, has a significant presence in the diabetes market, offering a diverse portfolio of insulin products, GLP-1 receptor agonists, and cutting-edge diabetes therapies. For instance, in November 2024, Sanofi made a strategic investment in Zucara Therapeutics Inc., participating in its USD 20 million Series B financing. This partnership includes an exclusive right of first negotiation for Sanofi, showcasing its commitment to innovation. By supporting Zucara’s development of ZT-01, a once-daily therapeutic to prevent hypoglycaemia, Sanofi aims to address unmet needs in diabetes care, enhancing its market influence and driving long-term growth through pioneering treatment solutions.

Founded in 1891 and headquartered in Kenilworth, New Jersey, it plays a notable role in Canada’s diabetes market. The company is known for its DPP-4 inhibitors, including Januvia (sitagliptin), which helps regulate blood sugar levels in type 2 diabetes patients. Merck is dedicated to advancing diabetes care through research, education initiatives, and partnerships. Its focus on innovative solutions highlights a commitment to improving the quality of life for those living with diabetes across Canada.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Novartis AG, Boehringer Ingelheim International GmbH, and Novo Nordisk A/S.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Diabetes Type |

|

| Breakup by Drugs |

|

| Breakup by Route of Administration |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 1,999

USD 1,799

tax inclusive*

Single User License

One User

USD 3,099

USD 2,789

tax inclusive*

Five User License

Five User

USD 4,599

USD 3,909

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share