Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global chamomile extract market attained a value of USD 662.63 Million in 2025 and is projected to expand at a CAGR of 7.10% through 2035. The market is further projected to achieve USD 1315.73 Million by 2035. The demand for calming, multifunctional botanicals in beauty, nutraceuticals, and functional beverages is constantly surging. This has pushed manufacturers to supply high-purity, low-allergen chamomile extracts with validated bioactive potency and advanced formulation compatibility.

One of the most notable developments reshaping the trends in the global market is the steady expansion of Givaudan Active Beauty’s botanical ingredient line, announced in September 2024, where the company has been scaling high-purity floral extracts designed for sensitive-skin formulations. Their recent work on bioactive plant fractions, including enhanced apigenin stabilization, is being closely monitored across the ingredient ecosystem. This chamomile extract market trend aligns with broader category momentum, as demand for natural skin-soothing active ingredients continues to rise.

Further, the market today is finding scope for application in dermo-cosmetic serums, high-performance nutraceuticals, premium herbal teas, and functional beverages. For example, in March 2023, Kimirica launched their Under Eye Serum which is a high-performance gel-creme formula infused with a revolutionary multi-Algae complex and chamomile extracts. Major suppliers are rethinking process design, investing in gentler extraction technologies such as low-temperature CO₂ methods. These can preserve volatile compounds while meeting stricter clean-label expectations, accelerating the overall chamomile extract market value.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

7.1%

Value in USD Million

2026-2035

*this image is indicative*

The industry enjoys strong traction as global skincare brands shift toward natural calming active ingredients that reduce irritation and support barrier recovery. Companies such as Givaudan, Symrise, and BASF are capitalizing on high-purity Matricaria and Roman chamomile extracts standardized for apigenin and bisabolol, which, in turn, propels the demand in the chamomile extract market. In August 2025, researchers reported in ACS Applied Materials & Interfaces the development of a two-stage pimple patch featuring tiny micro-spikes that attach directly to blemishes and deliver antibacterial and anti-inflammatory ingredients for faster healing. Such innovations are supported by the United States FDA and EU SCCS initiatives as well.

Players in the functional beverage market are increasingly using chamomile extract in the development of calming, sleep-supporting, and relaxation-oriented drinks that resonate with health-conscious consumers. Brands in the United States and Europe are launching RTD teas, sparkling herb infusions, and botanical shots that use chamomile as a familiar ingredient, thus accelerating the growth of the chamomile extract market. In January 2025, Biologic Pharmamedical unveiled new functional beverages with chamomile extracts for health, longevity, and performance. Also, updates within the USDA Organic program and the EU organic regulation have provided suppliers with an avenue to command premium prices for certified extracts.

Chamomile extract is drawing deeper pharmaceutical interest as companies explore its anti-inflammatory, antispasmodic, and mild sedative properties. Ingredients that meet European pharmacopeia standards find applications in OTC formulations for digestive discomfort and anxiety-related symptoms, thus unfolding new chamomile extract market opportunities. In August 2025, Vitanergy Health US Inc., a women-led dietary supplement company based in the United States, announced the launch of 4-in-1 Skin Glow Capsule that features chamomile extracts. Nutraceutical firms are also adopting chamomile in sleep gummies, stress capsules, and gut-health blends.

Sustainability initiatives are reshaping procurement strategies within the chamomile extract value chain. Large ingredient companies are partnering with agricultural cooperatives across Egypt, India, and Eastern Europe to implement regenerative growing practices, bio-input substitution, and water-efficient farming. In January 2022, Finlay Botanicals launched four new products including chamomile and fermented blackberry leaf, directly impacting growth in the chamomile extract market. European Green Deal incentives and USDA Climate-Smart Agriculture funding are motivating transition away from conventional farming of chamomile toward traceable, low-impact production models. Buyers in cosmetics and nutraceuticals also require QR-based sourcing transparency and third-party certifications.

Rapid upgrades in the extraction and fractionation technologies designed to preserve the volatile compounds and boost the bioactive potency are driving the chamomile extract market growth. Low-temperature CO₂ extraction, membrane filtration, and soft vacuum-evaporation systems are being installed to safeguard the critical molecules such as chamazulene and apigenin. In October 2025, happly, under Organigram Global, debuted with innovative FAST nanoemulsion gummies. These incorporate functional ingredients like caffeine, L-theanine, and chamomile extract to deliver on different mood states.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Chamomile Extract Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Source

Key Insight: All the sources included in the chamomile extract market report are driven by sourcing choices, product formats, and end-use requirements. Conventional bulk supply underpins industrial volume for beverages and supplements, while the organic category is scaling rapidly thanks to sustainability targets and premium pricing. Growth in this category is supported further by clean-label branding, farm-to-ingredient traceability programs, and evolving retailer preferences that prioritize botanical authenticity across wellness and personal care portfolios.

Market Breakup by Form

Key Insight: While liquid extracts are preferred where solubility, immediate blending, and batch scalability matter, especially for beverages and emulsified cosmetics, powders are gaining popularity as they enable shelf stability, microencapsulation, and dry-mix integration for supplements and powdered beverages, supporting the chamomile extract market expansion. Hydrosols and glycerin or glycol-based liquid grades have become important where aroma and rapid incorporation are critical. Spray-dried and freeze-dried powders are chosen for automated dosing and reduced cold-chain costs.

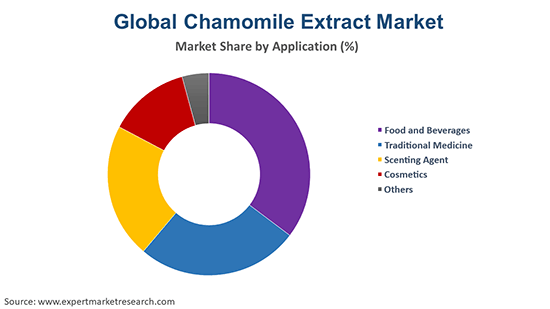

Market Breakup by Application

Key Insight: Chamomile extract firms are finding huge demand across diverse applications driven by specific performance needs. Cosmetics require standardized, low-allergen fractions for validated calming claims, while food and beverage brands are seeking heat-stable concentrates and organic provenance for functional drinks, propelling growth in the chamomile extract market. Traditional medicine uses pharmacopeial-grade extracts in OTC remedies, and scenting agents demand precise volatile profiles for perfumery.

Market Breakup by Region

Key Insight: Regional chamomile extract market dynamics are variable as per demand patterns. Europe leads the market with the demand for premium cosmetics, stringent regulation, and traceable sourcing that reward certified suppliers. North America remains strong in nutraceuticals and functional beverages demanding clinical substantiation and organic grades. Asia Pacific is expanding rapidly with manufacturing scalability and cost-competitive production. Latin America provides agricultural capacity and lower-cost raw chamomile, while the Middle East and Africa are emerging as key cultivation hubs for export-grade ingredients.

Conventional source currently leads the market revenue growth owing to bulk extract volumes for industrial users

Conventional chamomile sourcing remains the dominant channel in the market, supplying bulk extract volumes for industrial users who prioritize consistent availability and cost-efficiency. Large processors in Egypt, China, and Eastern Europe are optimizing harvest schedules and solvent-based extraction lines to meet volume contracts with beverage manufacturers and OTC supplement formulators. Commodity buyers are valuing predictable sensory profiles and standardization to apigenin benchmarks, enabling formulation stability across SKUs.

Organic chamomile is also gaining rapid momentum in the chamomile extract industry dynamics as brands seek certified, residue-free ingredients. Extract suppliers are scaling up organic acreage in controlled regions, offering USDA Organic, EU Organic, and Fair For Life certification that unlocks premium pricing with multinational cosmetics and specialty beverage buyers. In April 2022, Lubrizol Life Science unveiled baby care ingredients for shampoo, skincare and diaper rash cream with their Actismart SW organic chamomile extract that is also known for its soothing and anti-inflammatory ingredients on skin. Processors are investing in solventless CO2 and steam distillation lines to preserve bioactive potency while meeting organic processing rules.

By form, liquid formulations retain market dominance owing to better solubility and processability advantages

Liquid chamomile extracts, including hydrosols and concentrated tinctures, dominate industrial sourcing due to their ease of incorporation into liquid formulations and minimal downstream processing. Beverage manufacturers and beverage co-packers require water-soluble, heat-stable liquid concentrates with consistent organoleptic profiles, hence extractors are offering clarified concentrates with standardized apigenin and chamazulene ranges.

Powdered chamomile extracts, produced via spray-drying or freeze-drying with carriers, are expanding their contribution in the chamomile extract market revenue share because they enable longer shelf life, easier dosing, and incorporation into dry blends. In October 2023, Modicare launched the Well Freedom range, with chamomile as a key ingredient, tailored to support Period Care, providing a comprehensive solution for menstrual discomfort. Manufacturers of nutraceutical tablets and powdered beverage mixes are also preferring microencapsulated powders that mask bitterness and protect volatile terpenes during processing.

By application, command the maximum share of the market due to formulation versatility and derma recommendations

Cosmetics represent the dominant application for chamomile extracts, where formulators are prioritizing anti-inflammatory, calming, and skin-repair claims. Ingredient houses are supplying high-purity matricaria fractions standardized to apigenin and bisabolol, enabling measurable claim substantiation in serums, moisturizers, and post-procedure kits. Cosmetic chemists are favoring fractionated hydrophilic extracts that preserve chamazulene for visible soothing without imparting strong color, broadening the chamomile extract industry scope.

Food and beverage applications are emerging as the fastest-growing use case for chamomile extracts as consumer interest in calming, functional drinks surges. Manufacturers of RTD teas, adaptogenic tonics, and sleep-support beverages are partnering with extractors to secure water-dispersible, heat-stable concentrates optimized for canning and pasteurization. They prioritize preserving volatile aromatics while meeting microbial standards.

Europe secures the dominant position through regulatory alignment and premium consumer demand

Europe, driven by high-value cosmetic demand, strong botanical regulation, and established herbal supply chains, sustains its dominant position in the market. German and French formulators are sourcing pharmacopeial-grade matricaria extracts for premium skincare and OTC herbal remedies, creating steady institutional demand. European Green Deal goals and COSMOS organic standards are encouraging traceable, low-residue sourcing, which benefits certified extract suppliers.

The chamomile extract industry in Asia Pacific is growing with a steady momentum due to expanding cosmetic manufacturing, growing specialty beverage industries, and increased cultivation investments in India and China. Manufacturers are scaling local extraction facilities to serve domestic formulators and regional exporters, focusing on cost-competitive organic supplies and custom chemotypes suited for regional flavor preferences.

Chamomile extract companies are prioritizing vertically integrated sourcing, micro-batch extraction, and solvent-free technologies to secure potency while meeting regulatory and clean-label requirements. Demand for pharmacopeial-grade apigenin fractions is open up new opportunities in dermatology, sleep-support beverages, and functional nutrition, encouraging suppliers to expand analytical capabilities and offer co-development programs with formulators.

Strategic partnerships with growers remain essential as climate risks affect yield stability, pushing chamomile extract market players to lock multi-year contracts and invest in regenerative farming initiatives. Digital traceability and sustainability reporting are becoming commercial levers, enabling suppliers to win procurement bids with major nutraceutical, cosmetic, and beverage manufacturers.

Mountain Rose Herbs, founded in 1987 and based in Oregon, United States, supports the chamomile extract market with a portfolio of certified organic botanicals, CO2 extracts, and glycerites that appeal to wellness and clean-beauty brands. The company works closely with growers through a vertically integrated sourcing model, handles extraction in-house, and runs detailed quality checks.

NOW Health Group, established in 1968 and headquartered in Illinois, United States, caters to the market with nutraceutical-grade powders and liquid concentrates used in supplements, calming blends, and functional beverages. The company relies on strong in-house analytical capabilities, including HPTLC identity testing and rigorous contaminant screening, enabling brands to build formulations backed by pharmacopeial-level quality assurance and consistent performance across high-volume production runs.

Herbo Nutra, founded in 2013 and headquartered in New Delhi, India, delivers chamomile extracts designed for cosmetic, nutraceutical, and herbal applications, with a focus on high-apigenin profiles and flexible solvent systems. Its GMP-certified facility produces both spray-dried and liquid extracts and offers microencapsulation and customized assay standardization, helping global clients match purity, potency, and compliance requirements while maintaining competitive sourcing options.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Unlock the latest insights with our chamomile extract market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 7.10% between 2026 and 2035.

Key strategies driving the market include strengthening grower partnerships, expanding solvent-free capacity, co-developing customized actives, investing in digital traceability, and offering application-specific formulations to support brand differentiation, regulatory compliance, and faster commercialization across wellness, beverage, and cosmetic verticals.

The key trends guiding the market growth include the surging shift towards organic and clean-labelled cosmetic products, the increasing popularity of herbal tea, and the surging prevalence of sleep disorders.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading sources of chamomile extract in the market are organic and conventional.

The significant forms of chamomile extract in the market are liquid and powder.

The various applications of chamomile extract are food and beverages, traditional medicine, scenting agent, and cosmetics, among others.

The key players in the market include Mountain Rose Herbs, NOW Health Group, Inc., and Herbo Nutra, among others.

In 2025, the market reached an approximate value of USD 662.63 Million.

Companies face volatile crop yields, rising organic certification costs, stricter residue-limit regulations, and increasing demand for batch-level traceability. Delivering standardized apigenin content while maintaining competitive pricing adds additional operational and sourcing pressure.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Source |

|

| Breakup by Form |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share